I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

คำค้นหาที่แนะนำ

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

ข้อแนะนำในการค้นหา

- ตรวจสอบความถูกต้องของข้อความ

- ตรวจสอบภาษาที่ใช้ในการพิมพ์

- เปลี่ยนคำใหม่ กรณีไม่พบผลการค้นหา

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Protect My Family

- What's in a life insurance policy?

- Personal Banking

- ...

- What's in a life insurance policy?

What's in a life insurance policy?

25-08-2021

When we buy life insurance and health insurance. What we will receive is an 'insurance' as evidence. and so that we can study the details of various protections. The policy is a document that the insurance company gives to the insured. To confirm that the insured will be covered by the insurance company If an unexpected event occurs

What information is contained in a life insurance policy?

Important information in a life insurance policy is divided into 5 parts as follows:

1 .Life insurance policy summary

It will be on the first page of the policy with summary of important information as follows:

Name of life insurance Types of insurance and insurance companies

Contract start date contract expiration date and age of the insured at the beginning of the contract.

Contract coverage period, premiums, payment periods (e.g. monthly, quarterly, three-month, six-month, or annual) and premium payment periods.

Insured amount

Additional contracts (if any), such as additional health coverage health insurance premiums and period of payment of health insurance premiums the health coverage should be supplemented with a policy that provides continuous coverage until after retirement, the better.

2. Details of insurance benefits

This section describes the benefits in detail. that we will receive from the insurance that we buy both in case "Alive" or even "dead" such as periodic rebate Cash back at the end of the policy year and dividends if the contract expires, how much more? How much in case of death which such benefits It is set as a percentage of the sum assured.

If we have multiple policies Policy summary should be kept. so that we may know each policy How much will you get, in what year and at what age? and if there is health insurance that is attached to life insurance Summarizing the policy will let us know how much coverage each item is.

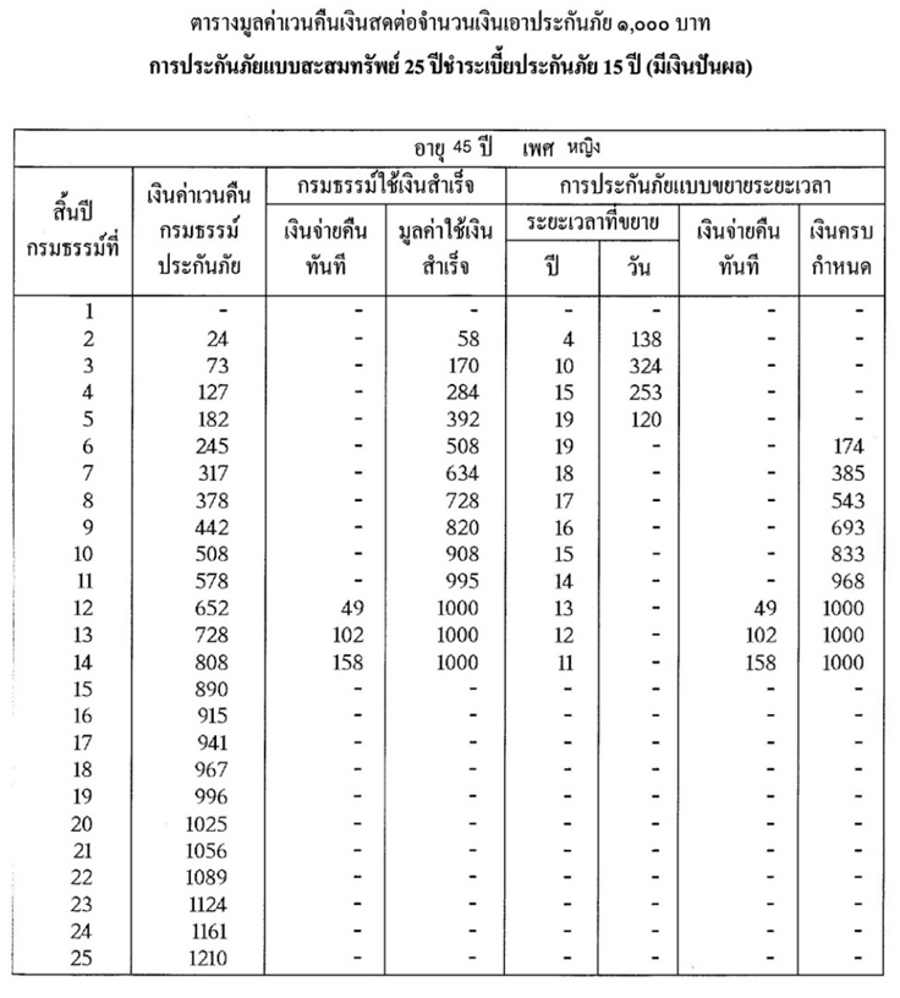

3.Policy value table

It is a table showing the value of the exercise of the right in the policy, namely the right to surrender the cash value. The right to convert the policy to a successful money-saving policy and the right to extend the protection period If we want to stop paying premiums In the table are numbers for every 1,000 baht insured, as shown in the example.

From the above table Female insured, aged 45 years, purchased 25-year savings insurance, paid premiums for 15 years, sum insured 200,000 baht. If the insured pays insurance premiums until the end of the 12th policy year (by the end of the policy year will be from the date of the insurance cycle does not mean the end of the calendar year) and wants to stop paying premiums The insured has the following options:

- If wanting to expropriate the policy, we will look at the table at the insurance policy surrender value column. and at the end of the 12th policy year line will get the number 652, which we will be able to calculate the refund equal to 652/1,000 x 200,000 = 130,400 baht.

- If you still want protection, we may choose to be a cash-successful policy, that is, request a reduction in coverage or a partial reduction of the sum insured. while the protection period remains the same from the table, we'll look at the paid policy column. which will be divided into 2 parts: instant cash back and the value of the money successfully If we pay the premium long enough. After that, there will be a portion of the cash back immediately returned as well. For example, at the end of the 12th policy year, the insured will immediately receive a cash back of 49/1,000 x 200,000 = 9,800 baht, and the coverage limit in case of death is 1,000/1,000 x 200,000 = 200,000 baht in the event that the contract is complete (that is, 25 years) will also receive a refund of 200,000 baht, but will not receive any other benefits such as repayment periodically or dividends anymore.

- But if we change to a successful payout policy at the end of the 11th policy year from the table, it will be seen that there will be no refund immediately. This means that we will not receive a lump sum when converting the policy. Will receive only money after 25 years of contract or death protection limit of 995/1,000 x 200,000 = 199,000 baht only

- In the case of changing to extended insurance is to stop paying insurance premiums but still receive the same protection where the protection period is reduced From the table, it can be seen that the benefits are the same as the money-successful policy. because the premium has been paid for a long period of time

- However, if you want to stop paying premiums at the end of the 5th policy year, you can see that the number in the extended insurance column will get the number of extended period is 19 years 120 days means The insured will receive the same coverage, which is 200,000 baht, but the protection period is only 19 years, 120 days and does not receive a refund upon maturity. While the policy has been paid successfully at the end of the 5th policy year, the resulting figure is 392, meaning that we will have a period of protection until the end of the contract. But the sum insured or the coverage limit in the event of death will be only 392/1,000 x 200,000 = 78,400 baht. If the contract is complete (that is, 25 years), you will receive a refund of 78,400 baht as well.

- If we must buy health insurance attached to life insurance. When we have converted one of the policies, we will not be able to purchase additional health insurance.

- The tables shown in this article are illustrative purposes only. Because each insurance type, each age and gender have a specific policy value table. The insured should study further by returning to read their own policy again. if in doubt You can ask for advice from an agent or company we are insured with.

4. Additional contract

In this section, the details are as follows:

- Definitions is a section that describes various definitions. in the additional contract

- Benefit describes the protection and benefits of additional contracts.

- claim for benefits It will tell you how to claim benefits and how to proceed. What relevant evidence is used, such as a claim, a medical certificate? and receipt and must be done within a few days.

- compensation payment Specifies who to pay compensation, for example, in the event of death, it will be paid to the beneficiary

- Termination of the additional contract It is to inform the insured that the coverage of the additional contract will be enforceable under any circumstances.

- Reinstatement of additional contracts will tell the condition that if this additional contract is terminated but the insured wants this coverage back. What should I do?

- An exception will indicate what circumstances this additional contract does not cover

In the additional contract There are quite a lot of details. Therefore, the insured should read and understand it carefully. so that there is no problem in claiming when unexpected events occur

5.life insurance application form

At the end of the policy is a life insurance application form. Or the life insurance application that we make with the agent itself. which will show the personal information of the insured Details of insurance and coverage beneficiary and health declaration of the insured.

The information in this section is very important. and considered part of the life insurance contract When the insured receives the policy The first thing you should do is look at the end of the book to check the information in the life insurance application again whether the information entered is correct or not. Various contact information Is the information correct or not, etc. If it is found that the information is incorrect, please notify the representative to change the information immediately.

In summary, life insurance policies It is an important document that we should read and study to understand. You may study on your own or seek further advice from an insurance agent. So that we can benefit from this life insurance and health insurance to the fullest. Worth the premium paid

By Nipaphan Poonsatiensub CFP®, ACC

independent financial planner writer and speaker