- Product Detail

- Interest rates

- Promotions

- Conditions

- Document Required

-

My Home My Cash

- Apply Online

About My Home My Cash Loan

Turn your home into cash—whether for home repairs, renovations, emergency expenses, or making your dreams come true. Pledge your obligation-free property as collateral to apply for a loan, such as single houses, semi-detached houses, townhouses/townhomes, condominium units, commercial buildings, plots of vacant land (must not be abandoned and located in a residential community). You can also refinance your existing “Home for Cash” loan from another financial institution to SCB.

Loan Amount Up to THB 20 million

Loan approval depends on your income, collateral value, and SCB’s terms and conditions

Enjoy Repayment Periods of Up to 30 Years

The combined repayment period and borrower’s age must not exceed 65 years. (In case of joint borrowers, the youngest borrower’s age applies.)

Collateral

Eligible properties include single houses, semi-detached houses, townhouses/townhomes, condominium units, commercial buildings, and plots of vacant land (not abandoned and located in a residential area).

Quick Approval Within 1 Business Day

Get preliminary approval results within 1 business day after submitting complete documents. No guarantor required and no penalty in case of prepayment.

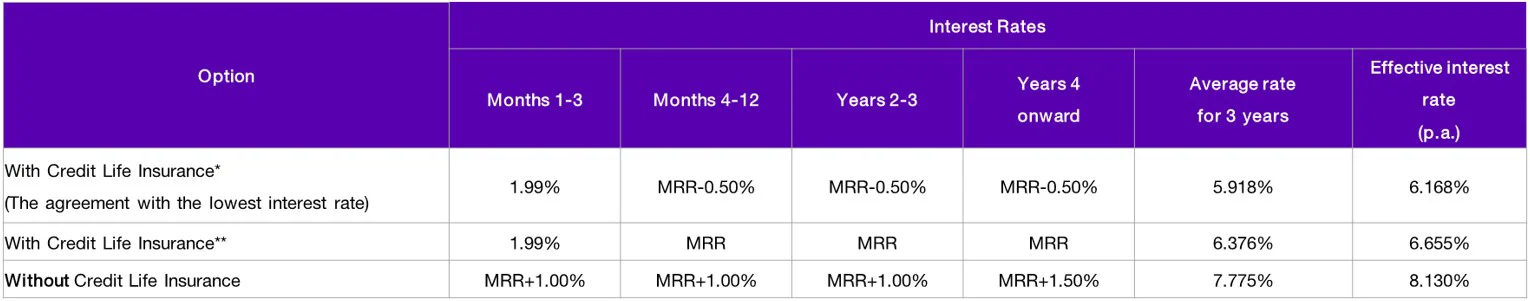

Interest Rates

Subject to SCB’s announcement

Borrow responsibly, within your repayment ability.

Effective interest rates are between from 6.168% – 13.775% p.a.

Current Minimum Retail Rate (MRR) is 6.775% p.a., effective August 15, 2025. This is a floating rate and subject to change according to SCB’s announcements.

Additional calculation details are available in the interest rate table upon loan approval under SCB’s terms and conditions.Note: These interest rates do not include special offers for SCB Payroll clients.

Interest Rates

1. Interest Rates for General Clients.

2. Interest Rates for Clients in Specialized Professions*

Specialized professions* include medical professions, dentists, veterinarians, alternative medicine practitioners (Thai traditional medicine, applied Thai traditional medicine, and Chinese medicine) with a valid professional license, pharmacists, university lecturers at Assistant Professor level (or equivalent) or higher, judges and prosecutors.

3. Interest Rates for Clients with the Following Income Levels

- Salaried employees with an average monthly income of THB 75,000 minimum, or

- Business owners with an average monthly income of THB 100,000 minimum

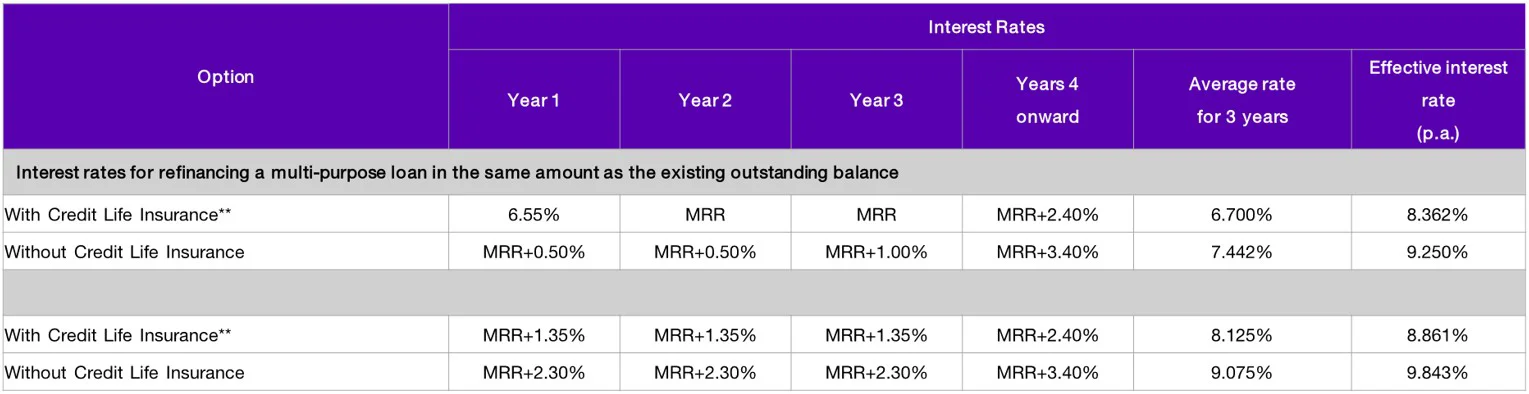

4. Interest Rates for Clients Refinancing a “Home for Cash” Loan from Another Financial Institution to SCB

Remarks :

- Minimum Retail Rate (MRR) is 6.775% per year, effective August 15, 2025. This is a floating rate, subject to change according to SCB’s announcements.

- Effective interest rates are calculated based on a loan amount of THB 1,000,000 with a 20-year term.

- The stated interest rates are valid from October 1, 2025 – December 31, 2025.

- Requirements for Credit Life Insurance Options

- *Credit Life 100%/100%: The sum insured must be at least 100% of the loan amount and an insurance period of 100% of the loan period.

- **Credit Life 70%/70%: The sum insured must be at least 70% of the loan amount and an insurance period of 70% of the loan period, with a minimum coverage period of 10 years. (If the loan period is less than 10 years, coverage period must equal the loan period.)

- For fire insurance on loan collateral, clients may, at their discretion, apply for a fire insurance top‑up, which will be included in the loan amount.

- Credit Life Insurance is subject to underwriting conditions of FWD Life Insurance Public Company Limited. Fire insurance is subject to underwriting conditions of Deves Insurance Public Company Limited.

- Clients should carefully review coverage details, conditions, and claim and benefit requirements before deciding to purchase an insurance policy.

- SCB acts solely as a broker, recommending or arranging insurance policies for clients’ consideration.

- Insurance approval is subject to the underwriting conditions of FWD Life Insurance (for Credit Life) and Deves Insurance (for fire insurance).

- Benefits, coverage, and conditions are as specified in the policy and by FWD Life Insurance.

- Credit Life Insurance Provider: FWD Life Insurance Public Company Limited For inquiries about coverage or claims, please contact FWD Customer Service at 1351 (8:00 AM – 8:00 PM daily) or visit fwd.co.th.

- Fire Insurance Provider: Deves Insurance Public Company Limited For inquiries about coverage or claims, please contact Deves Customer Service at 1291 (8:00 AM – 6:00 PM daily) or visit www.deves.co.th.

Rights Regarding Fire Insurance and Credit Life Insurance

- Credit Life Insurance is optional, entirely at the client’s discretion, and has no impact on SCB’s loan approval process.

- Fire insurance is mandatory for collateral protection. The sum insured must cover the property’s valuation. Clients may obtain fire insurance from the insurance company of their choice.

- Opting for fire insurance with Deves Insurance PCL does not affect eligibility for special interest rates or SCB’s loan approval process.

Promotions

1. Waiver of collateral valuation fees

Conditions for waiver of collateral valuation fees

Clients must complete the property valuation by December 31, 2025, and utilize the approved loan amount within 10 business days from December 31, 2025.

Collateral Eligible for Waiver of Collateral Valuation Fees

Obligation-free residential properties as follows: single houses, semi-detached houses, townhouses/townhomes, condominium units, and commercial buildings.

If the above conditions are not met, the standard valuation fee will apply.

Product Terms and Conditions

Collateral Valuation Fees

- Single houses, condominium units (60 sq.m. or larger), and vacant plots of land up to 3 rai: THB 5,000 per unit (excluding VAT)

- Semi-detached houses, townhouses, condominium units (under 60 sq.m.), and commercial buildings: THB 3,450 per unit (excluding VAT)

- If the above conditions are not met, the standard valuation fee will apply.

Front-End Fee

- Waived

Stamp Duty

- 0.05% of the loan amount, up to a maximum of THB 10,000

Mortgage Registration Fee

- 1% of the mortgage amount

Fire Insurance Premium

- Based on the insurance company’s rate

Qualification and Document Required

Qualification

Thai nationality

Has never had a non-performing loan at any financial institution

Age at least 20 years old, not more than 65.

Document Required

Identity Verification

- Only a copy of your ID card is required. It providing a copy of a government officer or state enterprise officer ID card with ID number and photo on the card, or passport (in the event that your spouse is a foreigner), please provide a copy of your house registration document.

- Copy of house registration

- Copy of marriage certificate (if applicable)

- Copy of certificate of name change (if applicable)

Collateral Document

- Copy of ownership document (copy of title deed, front and back)

- Collateral information disclosure (forms available at bank branch)

- Photos of the collateral

Income Document

Salaried employee

- Salary confirmation and pay slips

- Bank statements for past six months

Business owner

- Bank statements for past six months (personal account and business account)

- Four or five photos of the business premises and map showing location

- Copy of trade registration and company registration, including list of shareholders

- Tax submission documents for past year, showing income and expenditures as well as receipts for purchase and sale of goods

Self-employed

- Bank statements for past six months

- Professional license (doctor, engineer, lawyer architect)