RELATED LINKS

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Loans

- Mortgages

- Corporate Welfare Home Loan

- Personal Banking

- ...

- Corporate Welfare Home Loan

Mortgages

Corporate Welfare Home Loan

Are you a corporate employee? Let SCB take care of all your home loan needs.

- Product Detail

- Interest Rates

- Conditions

- Qualification and Document Required

- Contact Us

-

Corporate Welfare...

- Apply Online

Product Detail

Enjoy exclusive benefits with Corporate Welfare Home Loans from SCB. We provide expert consultation and home financing solutions for:New Homes, Pre-owned Homes, Home Construction, Refinancing

All with special interest rate conditions exclusively for employees at companies partnered with SCB under corporate welfare programs.

- Fixed interest rates for the second year start at 2.65%* p.a.

- Interest discounts**

- A loan amount up to 100%*** of the collateral value

*Fixed interest rate of 2.65% per year for the Second year exclusively for Strategic Group clients with a minimum 70/70 Credit Life insurance coverage.

**Interest rate discount applies when Credit Life insurance is purchased as per specified conditions.

***A loan amount is up to 100% of the collateral value, based on either the collateral valuation or the purchase price stated in the Land Department’s sale contract, whichever is lower. (Effective May 1, 2025 – June 30, 2026)

Loan Amount

Enjoy a loan amount up to 100% of the collateral value, based on either the collateral valuation or the purchase price stated in the Land Department’s sale contract, whichever is lower.

Convenient service at your office

SCB's loan consultant specialists are at your service. You don't need to take time off work to visit a bank branch. We'll come to your office to collect the loan application from you or your human resources department

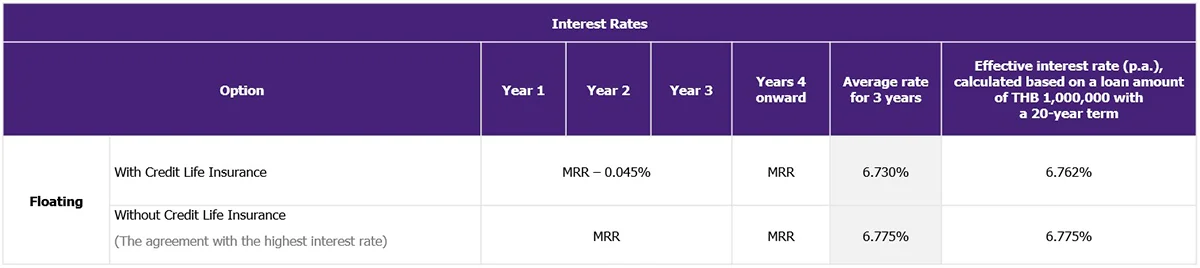

Interest rates

As announced by the bank.

Borrow responsibly, within your repayment ability.

Effective interest rates are between 4.20% - 6.675% p.a.

Current Minimum Retail Rate (MRR) is 6.675% p.a., effective December 23, 2025. This is a floating rate and subject to change according to SCB’s announcements.

Additional calculation details are available in the interest rate table.

Rates and Fees

Collateral Assessment and Appraisal Fee

- Unit in a project financed by SCB: 500 baht (excluding VAT)/unit

- For property developers who partner with SCB: 535 baht

- For other collateral such as a condominium unit larger than 60 sqm or a single detached house: 5,000 baht.

- For a condominium unit not larger than 60 sqm, a townhouse or a semi-detached house: 3,500 baht.

- Expenses may vary as announced by the bank.

Loan Consultation Service Fee

- Waived.

Stamp Duty

- 0.05% of loan limit, but not more than 10,000 baht.

Mortgage Fee

- 1% of credit limit

Fire Insurance Premium

- As charged by insurance company.

Good to know for home loan clients

Interest Rates

1. Interest Rates for Strategic Group* Clients (Employees at Companies Partnered with SCB under Corporate Welfare Programs)

2. Interest Rates for General Clients

Remarks :

- Minimum Retail Rate (MRR) is 6.675% per year, effective December 23, 2025. This is a floating rate, subject to change according to SCB’s announcements.

- Effective interest rates are calculated based on a loan amount of THB 1,000,000 with a 20-year term.

- The stated interest rates are valid from January 5, 2026 – March 31, 2026.

- Credit Life refers to life insurance that covers the outstanding loan amount. Requirements for interest rates with Credit Life Insurance Options are as follows:

- Credit Life 100%: The sum insured must be at least 100% of the loan amount and an insurance period of 100% of the loan period.

- Credit Life 70%: The sum insured must be at least 70% of the loan amount and an insurance period of 70% of the loan period, with a minimum coverage period of 10 years. (If the loan period is less than 10 years, coverage period must equal the loan period.)

- For fire insurance on loan collateral, clients may, at their discretion, apply for a fire insurance top‑up with SCB, which will be included in the loan amount.

- Credit Life Insurance is subject to underwriting conditions of FWD Life Insurance Public Company Limited. Fire insurance is subject to underwriting conditions of Deves Insurance Public Company Limited.

- Clients should carefully review coverage details, conditions, and claim and benefit requirements before deciding to purchase an insurance policy.

- SCB acts solely as a broker, recommending or arranging insurance policies for clients’ consideration. Insurance approval is subject to the underwriting conditions of FWD Life Insurance (for Credit Life) and Deves Insurance (for fire insurance).

- Benefits, coverage, and conditions are as specified in the policy and by FWD Life Insurance.

- Credit Life Insurance Provider: FWD Life Insurance Public Company Limited. For inquiries about coverage or claims, please contact FWD Customer Service at 1351 (8:00 AM – 8:00 PM daily) or visit fwd.co.th.

- Fire Insurance Provider: Deves Insurance Public Company Limited. For inquiries about coverage or claims, please contact Deves Customer Service at 1291 (8:00 AM – 6:00 PM daily) or visit www.deves.co.th.

Rights Regarding Fire Insurance and Credit Life Insurance

- Credit Life Insurance is optional, entirely at the client’s discretion, and has no impact on SCB’s loan approval process.

- Fire insurance is mandatory for collateral protection. The sum insured must cover the property’s valuation. Clients may obtain fire insurance from the insurance company of their choice.

- Opting for fire insurance with Deves Insurance PCL does not affect eligibility for special interest rates or SCB’s loan approval process.

Conditions

For customers receiving salary via an SCB ATS Payroll account. For inquiries, please contact your HR Department or the SCB Call Center at 0 2777 7777.

Conditions on special interest rates*

- For permanent employees with a minimum of 1 year of service.

- SCB ATS Payroll account customers must pay instalment amounts via their accounts on the same day as their pay day.

- In case of join-borrowers, at least one borrower must have an SCB ATS Payroll account from which instalment amounts will be paid. Instalment amounts shall not exceed the borrower’s salary available in their SCB ATS Payroll account.

Additional conditions**

- Borrower qualifications, approved loan amounts, loan periods, supporting documents, and loan approval are subject to requirements and conditions as specified by SCB.

- SCB has the right to amend conditions, terms, requirements, periods, and benefits, and may cancel this promotion with notification 7 days in advance of an effective date, unless there is a need whereby such advance notification is impossible. In case of any dispute, SCB's judgment is deemed final.

Qualification and Document Required

Qualification

Thai nationality

Has never had a non-performing loan at any financial institution

Age at least 20 years old, not more than 65.

Document Required

Identity Verification

- Only a copy of your ID card is required. It providing a copy of a government officer or state enterprise officer ID card with ID number and photo on the card, or passport (in the event that your spouse is a foreigner), please provide a copy of your house registration document.

- Copy of house registration

- Copy of marriage certificate (if applicable)

- Copy of certificate of name change (if applicable)

Collateral Document

If purchasing a new home or second-hand home:

- Copy of sale and purchase agreement

If refinancing:

- Copy of ownership document (copy of title deed, front and back)

- Loan agreement from the existing financial institution

- Copy of mortgage payment receipts from the existing financial institution