I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

คำค้นหาที่แนะนำ

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

ข้อแนะนำในการค้นหา

- ตรวจสอบความถูกต้องของข้อความ

- ตรวจสอบภาษาที่ใช้ในการพิมพ์

- เปลี่ยนคำใหม่ กรณีไม่พบผลการค้นหา

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Tips for You

- Debtors must read now! BOT adjusted the method of calculating interest in order to relief people’s burden

- Personal Banking

- ...

- Debtors must read now! BOT adjusted the method of calculating interest in order to relief people’s burden

STORIES & TIPS

Debtors must read now! BOT adjusted the method of calculating interest in order to relief people’s burden

Debtors must read now! BOT adjusted the method of calculating interest in order to relief people’s burden

07-01-2020

Bank of Thailand (BOT) issued the new measures - the financial institutions are to change the method of calculating interest and charge fees. This is in order to reduce the burden and increase fairness for the people and SMEs, by changing all 3 issues as follows - announced on 7 January 2020

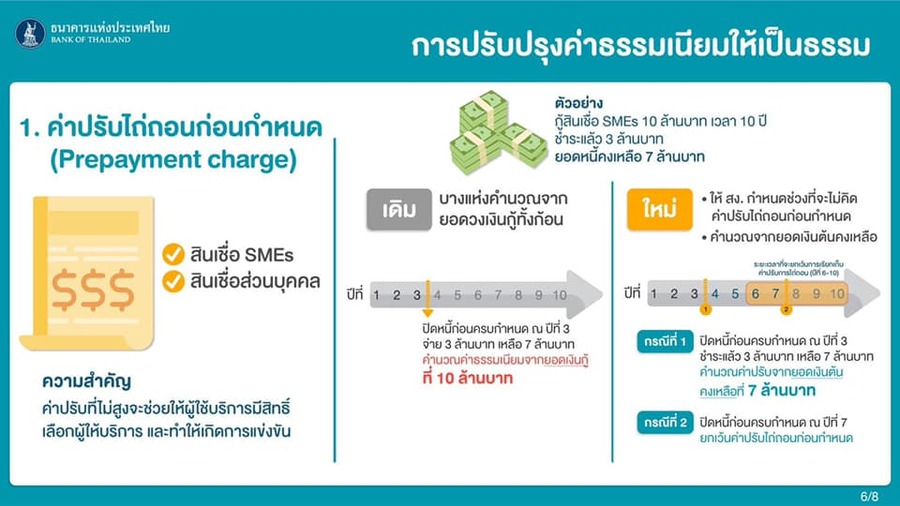

1.Early Credit Redemption Fines - to calculate the fine from the remaining principal (Original item calculated from whole principal amount)

Let’s see an example of the calculation – let’s say we borrow money from a bank to do a business of 10 million baht, which we have paid the debt regularly for 3 years to 3 million baht, resulting in a remaining debt of 7 million baht. Because the business runs well, so there is enough profit left to close the debt.

The old calculation for bank charges for an early credit line will calculate the penalty from the total loan amount, which is 10 million baht. If the early credit redemption penalty at 2% per year, we will have to pay a fine of 10,000,000 x 2% equal to 200,000 baht.

But the new measure from BOT, the bank is to charge a fine from the remaining principal. So, in this case, we have only 7 million baht of principal remaining, resulting in a fine of only 7,000,000 x 2% equal to 140,000 baht, or equal to 60,000 baht for early redemption (200,000 - 200,000,000).

Moreover, the financial institutions are to specify a period for exemption from the redemption of fines, such as the 10-year installment period. However, if closing the debt after year 3 or year 5 will not charge the early redemption credit

The importance of this matter is the lower fine will give people the right to choose the financial institution that offers the best deals and truly create competition in the market.

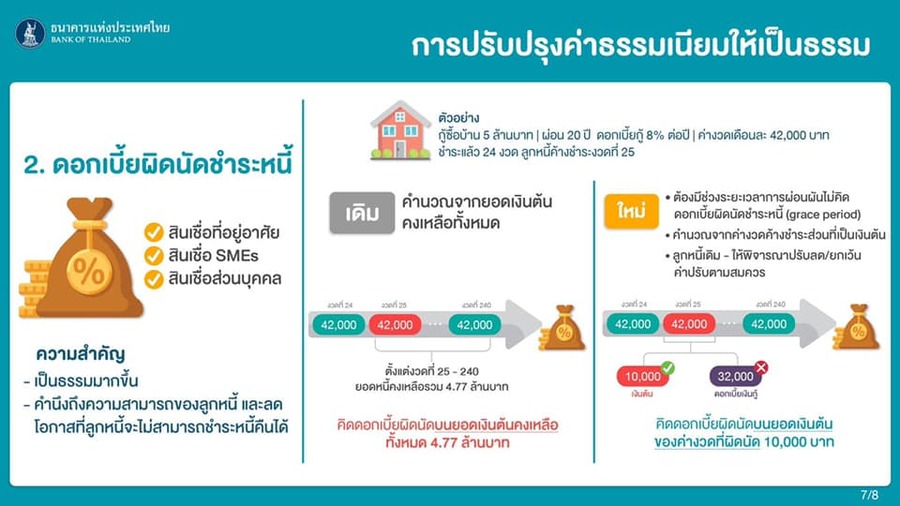

2. Defaulted interest payment - to calculate the interest from the principal defaulted payment (Formerly calculated from total remaining principal)

For example, get a home loan of 5 million baht, with 42,000-baht installment for 240 installments (20 years) with 8% interest per year. The payment has never been overdue. But there was a problem in the 25th installment due to insufficient money to pay. That causes installments that are not as required by the bank, delaying 30 days

From the picture, assuming the outstanding debt is 4.77 million baht. Originally, the bank will calculate the default interest from the outstanding balance. When there’s an overdue payment, the defaulted interest payment will be 4,770,000 x 8% per year x the number of 30 days of late payment is 31,364.38 baht.

But the new method is to calculate from "defaulted installment principal". If 42,000 baht per installment is paid in that installment 10,000 baht is interesting 32,000 baht (as in the picture above), which means that the new criteria will calculate the interest adjustment from the 10,000 baht principal, 10,000 x 8% per year x The amount of 30 days of late payment is 65.75 baht.

It is found that the new interest calculation can reduce the amount to 31,298.63 baht (31,364.38 - 65.75), considered to be very beneficial to the debtor. Especially for those who pay late, it probably means they are in trouble. This new criterion is useful and helps to alleviate the debtor quite a lot.

In addition, the financial institutions are to set a grace period for not paying interest in case the debtor may have trouble-causing them unable to pay as scheduled. Let debtors informed clearly of such as late payment, not more than 7 days, and to explain details of the outstanding debt, such as default interest Debt collection fee.

3. ATM card fees can be refunded (not refunded or refunded when customers request)

This is to require the bank to return an ATM or debit card fee. If users cancel the card usage by calculating according to the usage proportion.

Normally, banks will charge an annual card fee to users such as 300 baht per year. But if the cardholder uses only 90 days and then requests for cancellation, bank has to calculate the fee based on the proportion used according to new criteria. For this case, the usage period is 90 days - the proportion of 365 days is equal to 73.97 baht (90/365 x 300), which means that the bank will return the fee of 300 - 73.97 equal 226.03 baht. While there will be no fee refunded according to the old criteria, except when the user requests only.

In addition to the new criteria, there will be no fee for new cards or replacement card code issuance. Unless the card issuance or replacement code has a high cost, may consider collecting as appropriate.

These new criteria announced by the Bank of Thailand regarding fines of early credit redemption and fees for ATM and debit cards have been effective since January 8, 2020. The new default interest payment will be effective May 1, 2020, because it takes time to adjust the system to support all. The new criteria, especially the early redemption of fines and defaulted interest considered to be very useful and fair to the debtor

Niphan Phunsathiensup CFP®

Independent financial planners Writers and speakers