RELATED LINKS

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Tips for You

- ‘Chatbot’ –Consumers’ Favourite Business Assistant

- Personal Banking

- ...

- ‘Chatbot’ –Consumers’ Favourite Business Assistant

‘Chatbot’ –Consumers’ Favourite Business Assistant

13-01-2020

As communication is ever-improving, nowadays, there are not only human that is able to communicate

There is also “Chatbot”, a short form of Chat Robot which is an automatic program that processes through the database, records questions and answers as well as detects keywords from the questions to process answers and send back to the customers (Rule-based Chatbot) by utilizing Natural Language Processing (NPL) and Natural Language Understanding (NLU). This is so that the program can improve the communication pattern as close to human communication as possible. Overall, this is called the development of AI. The more effective it is, the higher the cost of development.

Nowadays, the pattern of Chatbot can be classified into “Voice Chatbot” that is popularly used in the call centres by detecting keywords or important sentences of customers while “Text Chatbot” is popularly used via service provider application as well as various social media.

For the business industry, Chatbot is considered a popular tool for SMEs and medium to large businesses. It is used to aid customers in the age that e-commerce is striving. It answers customers promptly and that allows the business to win some space in the market and provide service better. This is because, in the customers’ perspective, long waiting time for call center might be boring and intolerable for many people while some are more comfortable with typing out their problems clearly before sending. If there is a program that can solve basic problems, customers’ mood will be tremendously lightened.

The development of Chatbot, thus, is the perfect answer for both entrepreneurs and customers. This is confirmed by the satisfaction survey of people who have used Chatbot from 4 research departments in the USA (Drift, SurveyMonkey Audience, Salesforce, and my clever). It stated that 64% of the survey group think that Chatbot’s strength is that it “provides service 24 hours” and what it can improve is “the response speed” such as emergency cases, complaints, and detailed information explanation.

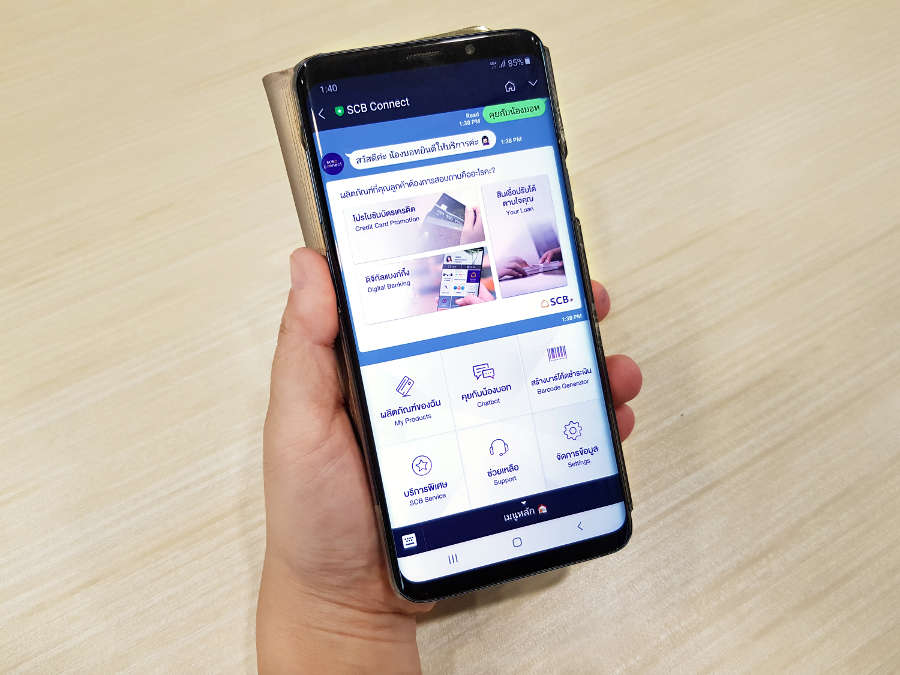

If mentioning about Chatbot in financial institutions, many people might be familiar with SCB Connect from SCB that is provided as a free service through LINE application under the main concept of “Remind-Respond-Report”:

- Remind · Respond to provide information on credit card as well as information on services that are provided in branches. The latest function is “Nong Bot”, the SCB Chatbot that will help customers to request for loans and advise on how to use.

on the pay date or notify when there are credit card spending and automatic financial transaction. - Respond to provide information on credit card as well as information on services that are provided in branches. The latest function is “Nong Bot”, the SCB Chatbot that will help customers to request for loans and advise on how to use.

- Report on promotions that suit customers’ lifestyle without customers having to wait for the newsletters.

These services that are the results of the highly updated Chatbot will help to provide convenience to customers. Customers do not have to wait long to be answered. Also, Chatbot pushes the service boundary and help to satisfy customers in this digital era. Try out “Nong Bot” at LINE SCB Connect. Click Add LINE SCB Connect at SCB Connect

References

https://www.drift.com/blog/chatbots-report/

https://www.g-able.com/digital-review/business-going-to-need-chatbots/