RELATED LINKS

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Tips for You

- Mobile Banking App: An Option for Those who wants to secretly take a Loan

- Personal Banking

- ...

- Mobile Banking App: An Option for Those who wants to secretly take a Loan

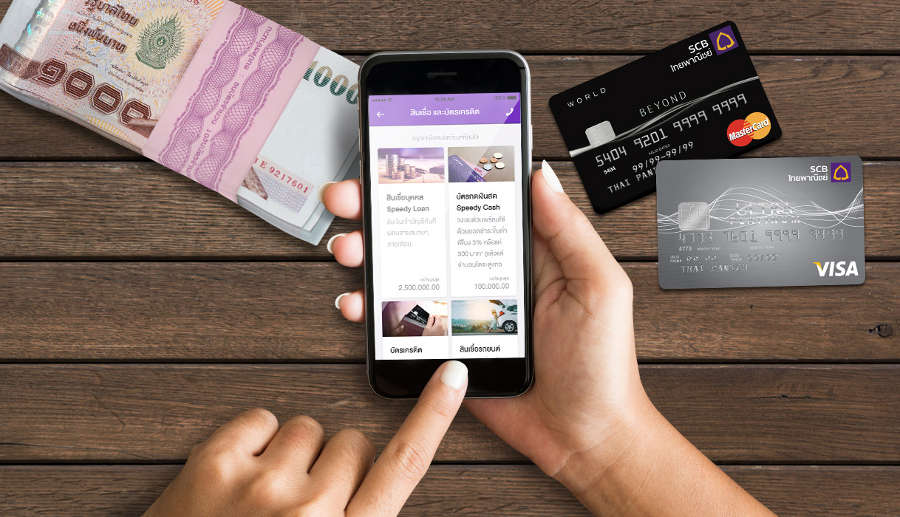

Mobile Banking App: An Option for Those who wants to secretly take a Loan

15-03-2020

Nobody wants to be in debt, but when life faces the situations that money is needed to make dreams come true, needed for the education of the younger generations or needed to build up a business, there is no time to waste.

Borrowing money from close friends would be embarrassing. Borrowing money from a loan shark is also terrifying. Eventually, we have no other choice, but to turn back to legal institutions. While carrying necessary documents and walking into the bank, we just accidentally bumped into our friends and so, they know that we are going to be in debt or we are just too tired to wait in a long queue at the bank and it totally ruins our mood.

Is there any way that we can quietly take on loans without anybody knowing?

Of course, there is! With the smartphone in our hands, taking a loan would not be known to anybody anymore. This is because money loaning can now be done through a phone application. With the aid of Artificial Intelligence (AI) to determine loaning capability and analyze customer data. Customers can estimate the probability and desired payment. There is a comparison between financial institutions to maximize options.

As for the application process, just start from the desired bank application with desired terms and conditions. There are many types of loans depend on the service provider, credit card, personal loan, car loan, or property loan.

After that, fill up personal detail, take a photo of the required document, and upload on the mobile application. When the bank received all the required documents through the application process, you will be contacted by bank staff to enquire more information and verify your identity. Then all you have to do is wait for the approval.

It is just so easy and simple from the very first step of application! The application can be done from anywhere. How convenient!

As for SCB, it is the very first bank that offers loans through mobile applications under the name “SBC EASY Digital Lending” on SCB EASY application that everybody is familiar with. The application has one more function which is “Loan and Credit Card” that users can choose the amount of money they want to loan and calculate installment payment, in which the system will calculate monthly installment. If the loan is approved, the loan money will be transferred to the debtor’s bank account immediately. It is really convenient.

For SCB account holders, you can immediately apply for a loan with a few simple steps as the bank already has your information. You do not have to send any additional document and the loan money will just be transferred to your account. As easy as that and there is a solution to a life that allows you to create opportunity without feeling ashamed. For new customers, you will have to send additional documents by just taking photos of the required document and upload. SCB will contact you back within an hour.

Apart from that, customer behavior is important information to introduce loans to customers through the Machine Learning system. This system allows SCB to present loan that matches customer’s need. For example, when there is a data that customer has been spending more than they normally do, SCB will introduce suitable loan for a customer through an application. Of course, the application of loan is solely based on customer’s consent only.

Therefore, let us emphasize once again that it is not a crime to take on a loan and there is nothing to be embarrassed about. Everybody has their own needs. But you should take careful consideration before taking on any loan. This is because taking loan means to spend the future money. If taking on a bank loan is your final decision, we recommend you make use of mobile technology and you will get to experience the convenience of achieving your goal via smartphone.