I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Grow Your Wealth

- The easy way to buy funds via SCB EASY application

- Personal Banking

- ...

- The easy way to buy funds via SCB EASY application

The easy way to buy funds via SCB EASY application

03-05-2020

Anyone wants to save money and invest to get more to win the annual increasing inflation rate. Investment in assets, funds markets such as index, private index, government bonds, money market, etc. both in domestic and international are the options for getting more return. However, each investment type has a different return and risk. For those who just started studying investment or do not have much experience, investment in a mutual fund is a basic choice for a better return on your own acceptable risk.

What is a mutual fund and how to invest?

Mutual funds are made up of a pool of money collected from many investors to invest in securities as indicated in the prospectus together with a high-experienced professional fund manager. The important thing is you can start an investment with only a thousand Baht. There are many fund types which are suited for everyone which are money market funds, fixed income funds, index funds, equity funds, mixed funds, international investment funds, real estate funds, RMF and the latest opening fund, The Social Security Fund (SSF) which is for tax reduction for later than 2020.

Return from mixed funds are dividend (for funds with dividend payment policy) and capital gain which is a value from a difference between selling high price and buying lower price. However, a good understanding of that investment from a fund fact sheet is needed before making any decision. (More information, click -Here-)

Start your investment with SCB EASY

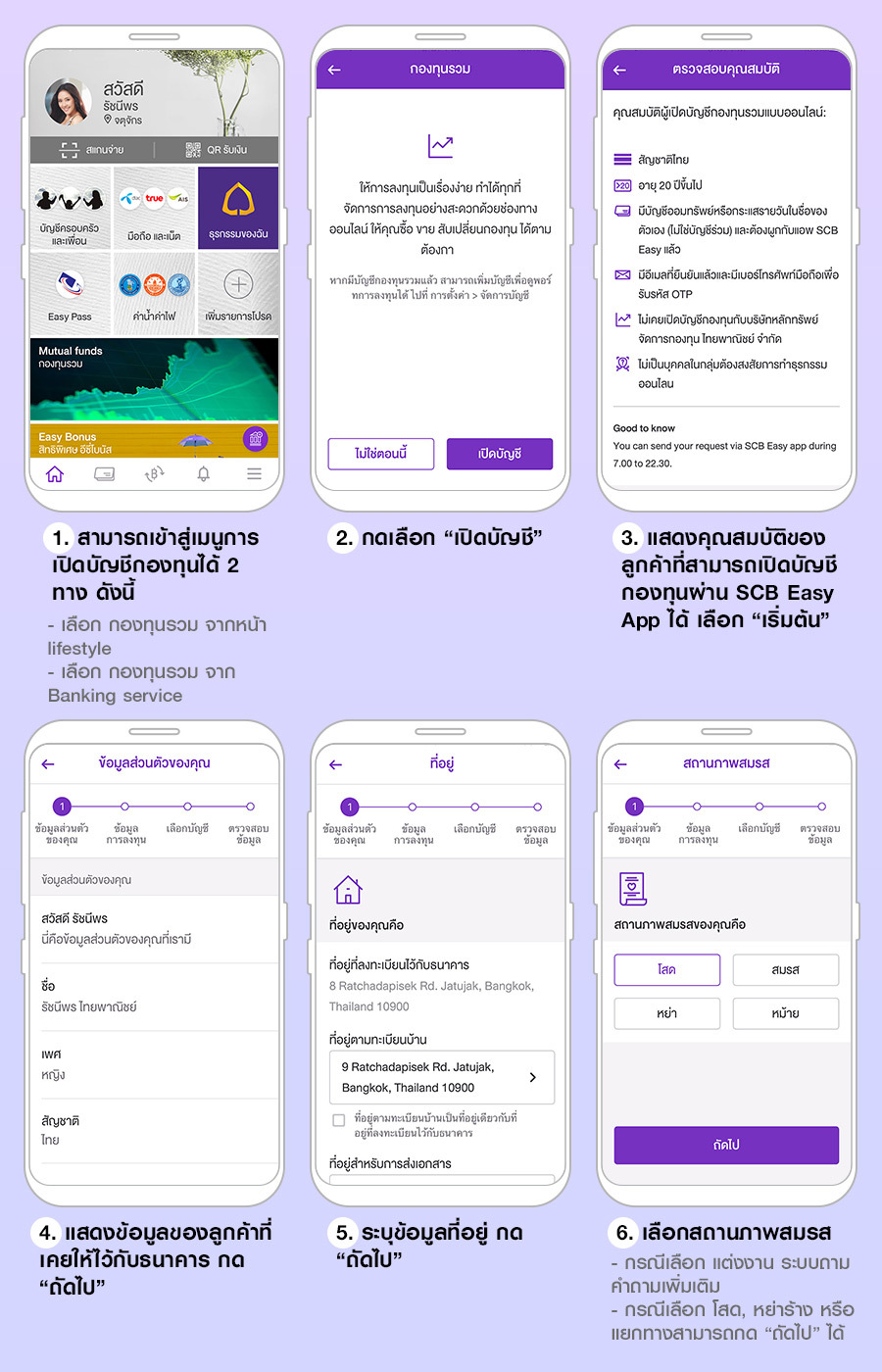

For a current customer who owns an SCB saving account, you can open an investment account via SCB EASY application and no need to go to the branch. Online open account menu can be found at “Investment”. In the first page, select open a mutual fund which you do not have to buy any fund right away after opening an account. You can buy a fund anytime from now on.

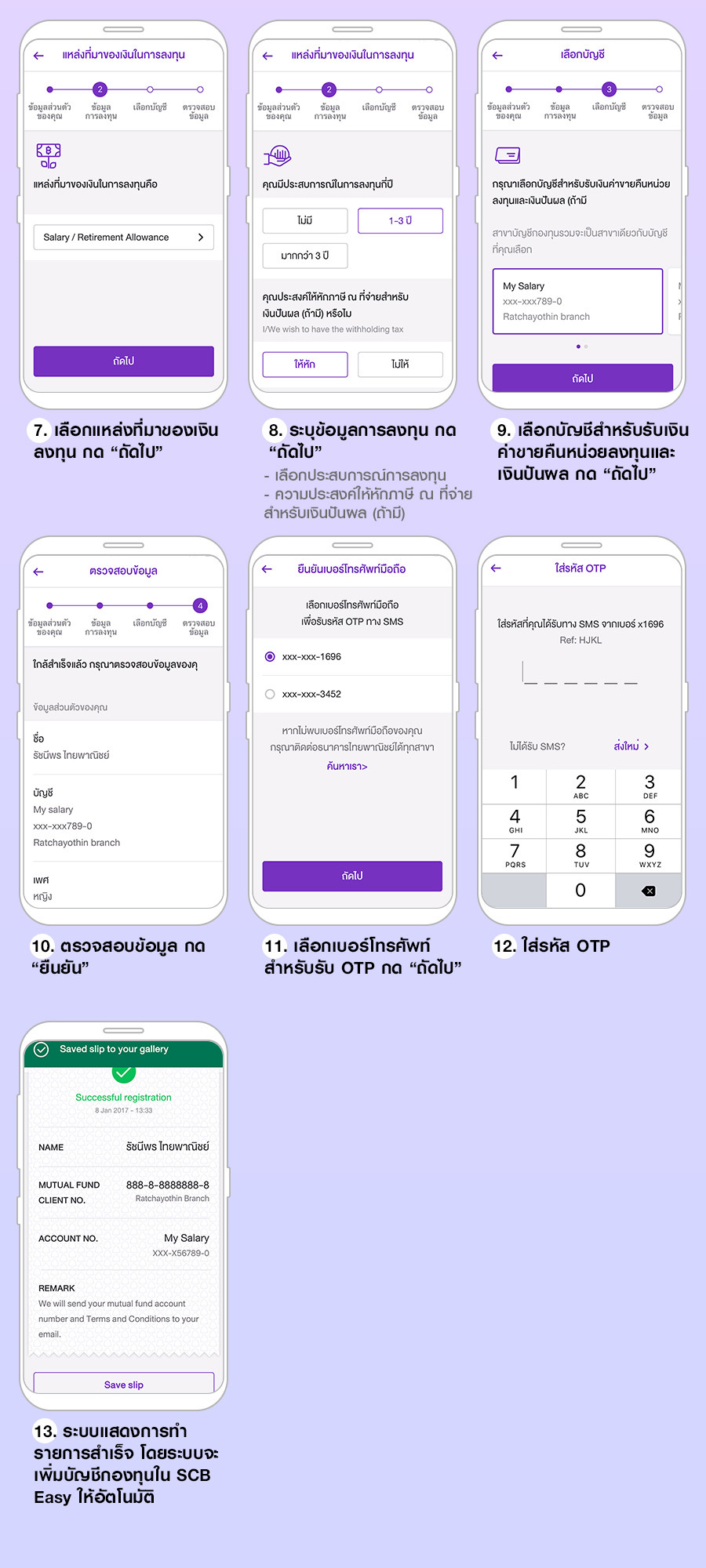

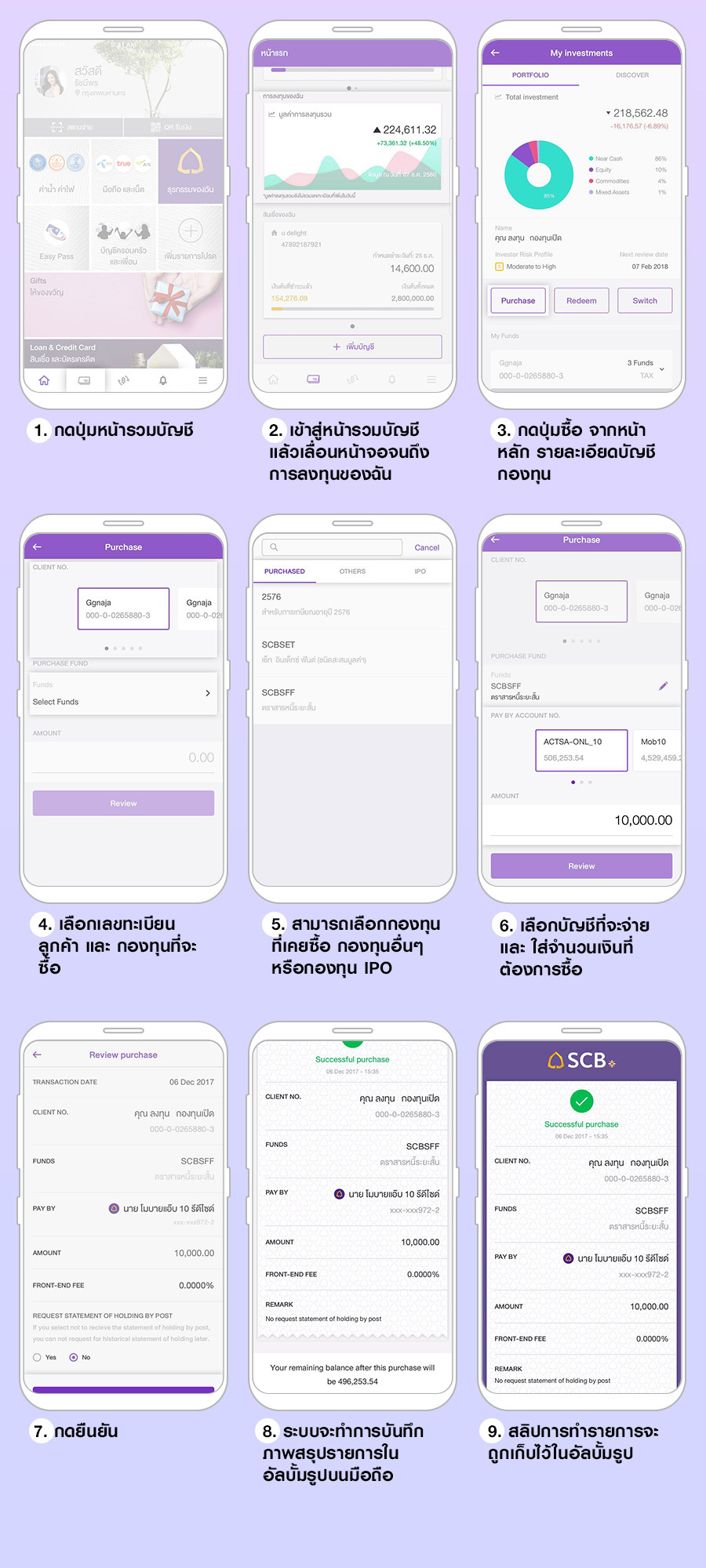

Inputting the 6-digit pin to get in the account summary page and go to “My investment”. You have to do the Investment Suitability Test Form at the first time then select the “Buy” button and the system will show a fund list from other funds, IPO funds or you can search by typing a fund name. Then select the payment account, input the money number, verify and confirm the transaction. The confirmation slip will be saved automatically in your smartphone.

In case you want to sell a fund, go to the summary account, input the 6-digit pin then “My investment” and select “sell”. You can choose your intended-to-sell fund and input the amount whether by money amount, or unit amount, or all amount. After that verify all information, then click confirm. The confirmation slip will also be saved automatically on your smartphone. The money from fund selling will be transferred to your saving account as indicated in the period as mentioned in the fund information.

Technology has helped us to invest easier and more conveniently these days and the investment fact can be found anywhere on the internet such as the SET website, many financial institute Facebook pages, and financial advisors. So, let’s start saving to get more return via SCB EASY application which is super easy. For more information click - Here -

Reference :

https://www.scbam.com/smartstart/get-to-know?section=know

https://www.set.or.th/education/th/begin/mutualfund_content01.pdf