I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Salary Man

- Lost revenue. How to continue fighting?

- Personal Banking

- ...

- Lost revenue. How to continue fighting?

Lost revenue. How to continue fighting?

01-06-2020

Does anyone know if our income will decrease in the future? Nowadays, everyone is at risk. Even if being a salaryman, salary may be reduced or released from work. Freelance or business, there will be periods of rising and fall. But when we see the overall economy worsening, Of course, everyone adapts to reduce expenses. People affected by the money crisis lost income, we have ways to cope with during the crisis below.

1. Conscious, allow, and accept the truth To find a solution. Looking around, not only we who are struggling in order to have more encouragement

2. Check income-expenses: How much money do we have now? How much money is left? Will this month be paid? Get a full month or half month or what percentage. When compiling your own financial information, began to plan the use of money each day. If still having income Don't forget to save money in an emergency. Because we can't make any predictions about how long this situation will last

3. Cut unnecessary expenses, to just the expenses that are necessary. If it is general expenses, reduce the amount of money spent. Prioritize expenditures in order to see that what must be reduced first? Like expenses are not necessary or expenditure on luxury, before used to driving, turned to use public transport, BTS or bus. That used to have to ride a motorcycle taxi into an alley, then turned to walk instead. If it is an expense arising from a loan with interest, it must be negotiated with the creditor. Because debt is a very big issue, income cannot be paid by installments, must hurry to negotiate for a waiver.

4. Find extra income, in this economic situation, it may sound difficult, but there may be something that still needs. But the first thing to do first is to not be shy and afraid that others see ourselves, an underdog. Must dare to present yourself to work. Must be optimistic that we work in good faith we do for survival not hurt anyone. Such as taking care of the elderly on holidays, be a nanny or take care of pets. If having other skills such as translation, make a cloth mask for sale, baking, or cooking for sale online or other skills that we have, it can increase our income.

5. Systematic revenue allocation. After cutting some unnecessary expenses, it's time to look back at your existing income. If you think that you are unable to control the money in your hands as you expect by yourself. We also need some additional help, such as determining how much money each day we should spend and do accordingly

6. Record income and expenses: Record of income - expenses. Is a very effective way of organizing expenses. Because we will see clear numbers of income and expenses for each month. And will know immediately if we spend too much money on anything. This is a good starting point to change during the period of falling revenue. And this will become a good financial habit in the future as well when income returns.

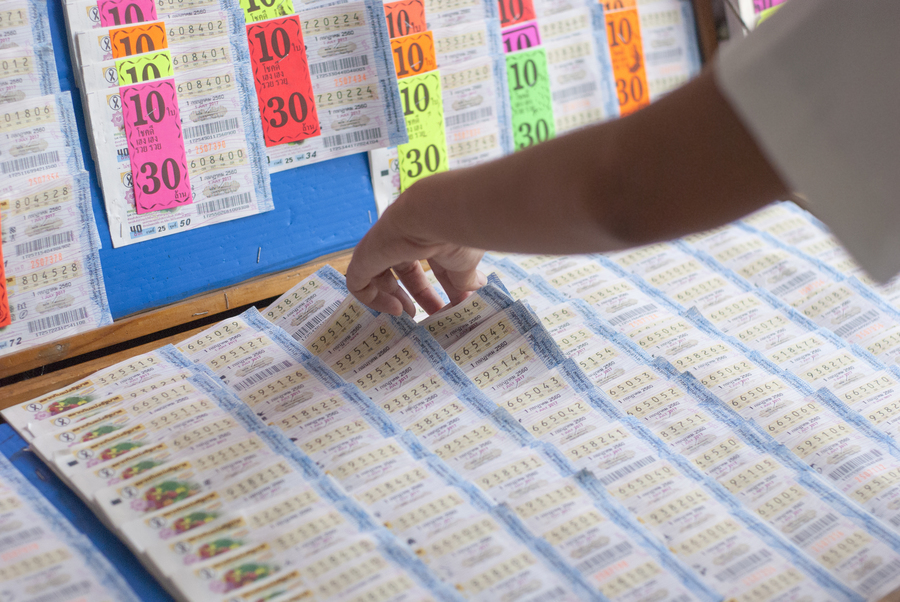

7. Stop depending on the financial future with luck. Whether lotteries, underground lotteries, or any kind of luck that is a small amount of money. But in this situation, every baht, every satang has value. 90-baht, 100 baht is the money that can be bought for two meals. Stop thinking about relying on the future with the fortune. Because our chance of luck is very low. Instead of throwing money into gambling Suggest that it is better to save those funds for use.

In situations like this, we're not the only ones who are in a bad situation. We are not the only ones with reduced incomes. Once the spending has been appropriately allocated Do not forget to divide a portion of the money as savings or investment. Recommend that at least not less than 10% of income. When the financial situation improves, it can increase the collection and investment funds. Saving or making money grow can take many forms, such as fixed deposits. Investing in various types of mutual funds. But if you want to benefit from tax deductions, choose either SSF or RMF, or if you want both savings and coverage at the same time, you can invest in cumulative life insurance. The SCB has a wide variety of products to choose from, according to your financial goals. Can learn more details at https://www.scb.co.th/th/personal-banking.html