I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

คำค้นหาที่แนะนำ

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

ข้อแนะนำในการค้นหา

- ตรวจสอบความถูกต้องของข้อความ

- ตรวจสอบภาษาที่ใช้ในการพิมพ์

- เปลี่ยนคำใหม่ กรณีไม่พบผลการค้นหา

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Protect My Family

- How to choose a high-limit health insurance package?

- Personal Banking

- ...

- How to choose a high-limit health insurance package?

How to choose a high-limit health insurance package?

10-09-2020

In retirement planning One of the costs we need to focus on and consider is health-related costs. Since health care to medical expenses because it will be a very large expense and will be more and more when getting older. This is because symptoms of disease or deterioration of the body are more pronounced. As we get older, healthcare costs also tend to become more expensive.

Therefore, planning for health insurance is very important and necessary. Because having health insurance can help alleviate the cost of medical treatment.

As already mentioned, Medical expenses in private hospitals today Have a relatively high price and keep rising It is almost every year. Make various insurance companies Issue a package of health insurance products Both the normal credit limit (1 - 8 million baht) and the high limit (10 - 120 million baht) out to buy. In which this article will talk about 'How to choose a high limit of health insurance?

Compulsory health insurance

Compulsory health insurance means having coverage per year. Making it possible to withdraw money for medical expenses continuously as you must pay with the maximum limit specified. But there will be some items that are still classified as room, doctor, medical fee and there is a maximum limit that can be withdrawn per day. Or per treatment time. Which part of the cost is calculated separately which part is in the package plan depends on the conditions of each company defined in the policy?

And of course, when it is a high-limit health package We will have a much higher coverage per year. And earn a higher room rate as well (Health insurance in lump sum payment of the normal limit will receive a thousand room fees While the health insurance package is a high limit Will get the cost of ten thousand main rooms, etc. In addition to having a higher coverage limit, There is still special coverage that general health insurance does not cover. Such as surgery, artificial organ transplantation, alternative medical treatment Psychiatric treatment, dialysis, chemotherapy, outpatient targeted therapy. Some forms cover the cost of pregnancy and provide medical examination, vaccination, and dental fees as well It can be said that there is both a high limit and offers more comprehensive coverage than traditional health insurance

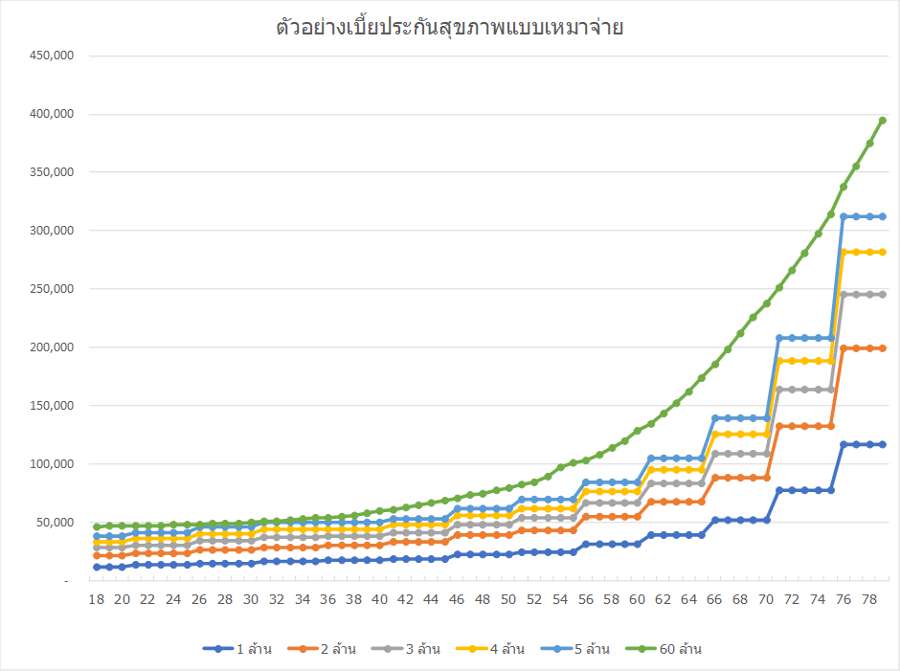

Let's look at the insurance premiums. Many people might think that the coverage limit is this high premium should be expensive. Answers are both yes and no. The young age Insurance premiums are not as expensive as you think. (Compared to the coverage obtained), however, when older Insurance premiums are quite expensive, as in the picture.

Remark: This is a comparison to illustrate between the lump sum paid health insurance premium and the high limit premium only. If interested, you need to study the details of the coverage of each policy type. And of each additional company because there may be subtleties that differ.

Mostly health insurance premium increases with age every 5 years. But an example of a high limit paid health insurance shown Is an additional premium according to age every year. It can be seen that the young age Insurance premiums still stick together but with age Insurance premiums start to differ significantly. Especially, the premiums paid for health insurance premiums will cost more rapidly. Must prepare the money to pay insurance premiums when you are old.

So, how should we choose to buy health insurance?

- Explore the expenses of the hospital that you think will use the service as having room and medical expenses in case of general illness. And how much are the cases of illness with serious illnesses in order to determine the amount of coverage that we should have.

- Explore available benefits if still working and that the company has group health insurance for you. Compare it with the expenses in item 1 that it is enough or not. If not enough, then add the rest parts.

- Compare coverage limits Coverage and insurance premiums of each insurance company. Because there are still subtleties that we need to consider, such as some pregnancy protection options If we need health insurance to use after retirement, Therefore, this coverage is not the answer. And should compare the coverage received with the premium paid as well that it is worthwhile or not.

- Finally, come back to see the ability to pay premiums. If you plan early, we may be able to prepare the money to pay for expensive health insurance premiums in time. By preparing money to pay future insurance premiums It means that more retirement funds need to be prepared. But if you think the insurance premium is too expensive, we may have to choose to save money. To take that risk on your own

Besides planning your health insurance, don't forget to plan to take care of yourself. Because when we get older our bodies are naturally deteriorating. Which health care must start planning early with enough sleep, exercise regularly, eating healthy food. Reduce and give up what is harmful to health and regular check-ups. Which good health care Will reduce the chance of illness and may cost us less medical care.

Nipapun Poonsateansup, CFP®, ACC

Independent Financial Planner Writer and speaker