I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

คำค้นหาที่แนะนำ

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

ข้อแนะนำในการค้นหา

- ตรวจสอบความถูกต้องของข้อความ

- ตรวจสอบภาษาที่ใช้ในการพิมพ์

- เปลี่ยนคำใหม่ กรณีไม่พบผลการค้นหา

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Protect My Family

- Five things you need to know about health insurance

- Personal Banking

- ...

- Five things you need to know about health insurance

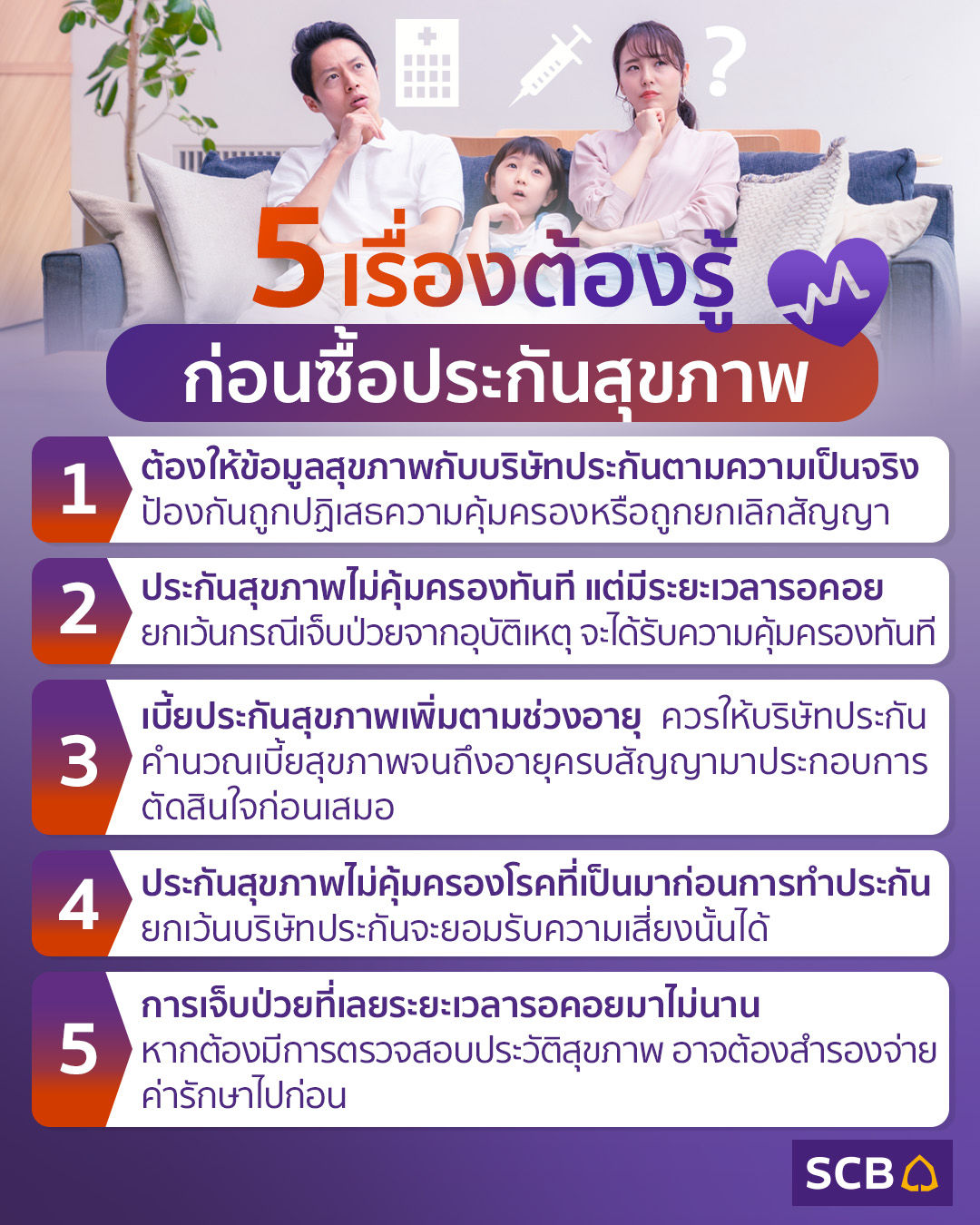

Five things you need to know about health insurance

13-08-2021

The food we eat, the environment we live in, our lifestyles, the recent pandemic, and many more factors all impact our health. Meanwhile, medical expenses continue to rise and medical expenses can cost you a lot of money if you do not have a good health insurance plan. Therefore, health insurance is indispensable to cover the risks of various diseases. Before buying a health insurance plan, you must carefully study coverage conditions so that you will be properly protected and be able to file claims accordingly. Some important conditions are as follows:

1. Declare your health condition

A health declaration is a statement by the insured person disclosing their truthful health information to insurers, such as congenital disease (if any) or medical history so that insurance companies can assess their health risk. Truthful health declarations are therefore the most important condition when applying for insurance, whether for life or health. If we don’t tell the truth, insurance companies have the right to terminate and revoke policies with retrospective effect. However,

if we disclose our true health information, they are not able to deny their liabilities or terminate the policy under any circumstance once they accept our application. It is therefore important to strictly follow the conditions set forth in the policy.

2. Waiting period for health insurance policies

Many people suffer from the misconception that their health insurance will be valid instantly once they pay their first premium. In fact, coverage for various illnesses will take effect after a waiting period. Despite having to provide truthful health statements, insurers still have risks that some insured do not provide accurate health statements or intend to hide their health records to obtain protection. This makes it necessary for insurers to set a waiting period appropriate for each level of disease coverage. These waiting periods can be between 3—120 days, depending on the severity of the disease.

For illnesses such as all types of hernias, pterygium, cataracts, tonsilitis and adenoidectomy, and endometriosis or chocolate cysts the waiting period will be 120 days. For critical illness coverage,

waiting periods could be between 30-90 days, depending on insurance schemes. Therefore, it is important to carefully study the details of a health insurance policy so you won’t run into any problems when making a claim.

There is no waiting period for conditions caused by accidents. The insured will receive protection immediately once the premium has been paid.

3. Health insurance premiums increase with age

Premiums for general health insurance grow higher with age. Some premiums may increase every five years, while others may increase every year. The reason for this is because as we age, our body and overall health deteriorate naturally, and the chances of getting sick increase, causing insurance companies to increase insurance premiums according to age.

People who don’t know this may incorrectly calculate their retirement planning and not have enough money to pay for higher health insurance premiums after retirement. Therefore, before buying health insurance you should ask your insurance agent or insurance company to submit a schedule of premiums covering the entire contract to make the proper decision for your financial planning.

4. Health insurance does not cover pre-existing diseases

Generally, insurance policies will not provide benefits for pre-existing health conditions unless the insured has made a declaration and the company accepts the risks for such coverage. Therefore, it is very important to declare your health conditions truthfully.

In some cases, insurance companies may take on risks for people with pre-existing health conditions. However, as the risk is higher, they may stipulate additional conditions. For example, they may increase insurance premiums, so you must consider whether the added conditions are acceptable to you or not. If you decline because of the added expense you need to realize that you will no longer have health insurance coverage as intended, meaning that you have to assume the risk of paying for medical treatment by yourself in the event you fall ill. In that case additional savings will be required, or you may consider taking advantage of the government’s basic social welfare or gold card universal coverage schemes.

5. Pay in advance

If you fall sick after the 30-day waiting period, but before the 90-day period after the policy is effective, you will not be able to file a claim because the insurer may doubt your illness or pre-existing health conditions. Insurance companies will want to investigate and request medical records from hospitals for review before approving the claim. The insurer may have concerns about whether or not the illness was a pre-existing condition, even if it occurs 90 days after the policy becomes effective. The company can reject a claim and you will have to advance medical expenses and make a claim later. Claim documents comprise claim forms, receipts, and medical certificates. If your health statement is true, you don't have to worry about not being able to file a successful claim.

In summary, these five conditions are something that everyone should be aware of, both before and after buying insurance, so that they can buy the health insurance plan that is right for them. Before deciding to purchase an insurance plan it is important to provide a truthful health declaration to avoid any future problems and fully enjoy the benefits of your health insurance plan. You must also study and understand the coverage details and conditions before making a purchase.

Nipaphan Poonsathiensap CFP®, ACC

Independent Financial Planner, writer, and speaker