I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Home & Car

- Know tax and fee before buy and sell property

- Personal Banking

- ...

- Know tax and fee before buy and sell property

Know tax and fee before buy and sell property

02-09-2019

Properties investment is one of the interesting choices whether leasing or selling to get profit from its difference. However, there are tax, and other concerning fees regarding selling the property. This article is about what do general people who sell property must pay for.

- Fee th e the alienation registration fee which is 2% calculating from the higher price of either evaluating cost or selling price. An evaluating cost is from the government indicating the price for all properties in the country which will be the criteria for fee and tax selling calculation, and it is recalculated every 4 years. The Department of Lands will update all land prices in Thailand for general people to check out on the website http://property.treasury.go.th/pvmwebsite/index.asp This helps sellers and buyers to set an appropriate price which can be higher or lower than evaluating price. The market price is an actual buy and sell price which is according to market demand and supply at that time and also adjusts based on the cost of living. Therefore, the market price is often higher than evaluating price.

- Stamp duties fee is the stamp duties cost that the seller must pay in an alienation registration process which is 0.5% calculated from the higher price of either evaluating cost or selling price.

- Particular business tax ; In case seller possesses the property less than 5 years (Counting from day to day), they need to pay a particular business tax. However, it is exceptional for possessing over than 5 years or has the name in that house registration certificate. This tax is 3.3% calculated from the higher price of either evaluating cost or selling price. Also, the stamp duties fee is exceptional when you pay this particular business tax.

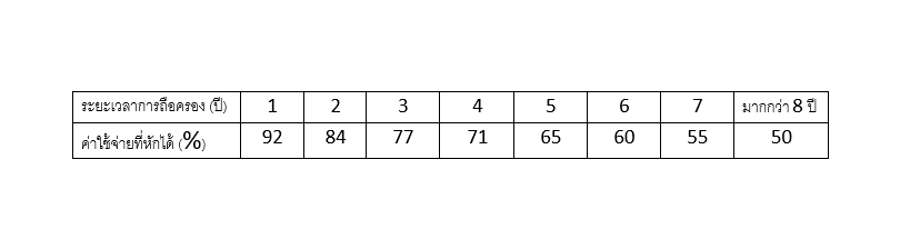

- Withholding tax; Due to selling a property is an income so, it is a must to calculate for an income tax and deduct as a withholding tax. It is calculated by evaluating cost (as of (40(8) section 49 of the Revenue Code) that it must be paid as defined in the royal decree (Revision 165 2529 BC) of the possession period as shown,

If you inherit that property or receive by affection, the deductible expenses are 50%.

Possession period (year) is counted as a fiscal year which is counted from 1st January to 31st December of that year and any buy and sell in the same year is counted as 1-year possession. Also, possessing from this December to next year March is counted as 2 years.

In the case of selling the property without aiming for profit, a maximum withholding tax is 20% of the selling price. On the other hand, there is no tax limitation for selling for profit. Moreover, property outside Bangkok, municipal district, sanitation district, and Pattaya is granted 200,000 tax exemption and the rest will be calculated for withholding tax.

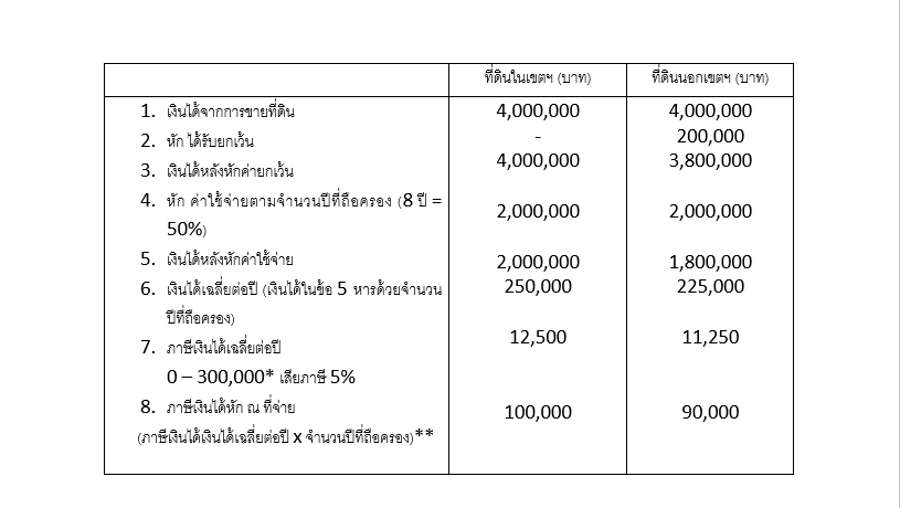

Withholding tax calculation example

Mr. Rich bought the land in June 2012 and sold in January 2019 as 4,000,000 Baht.

* Selling property tax calculation is no an exemption for the first 0 - 150,000 Baht

** Possession year count an incomplete year as 1 year and possession over 10 years is counted as 10 years. However, the seller can select tax payment as calculating by withholding tax for selling without aiming for profit and will not be added in other personal income.

From the above example, all expenses are shown as below,

- Transferring fee which is 2% of the selling price or 2% x 4,000,000 = 80,000 Baht which can be negotiated who is the payer between seller and buyer.

- Stamp duties fee which is 0.5% of the selling price or 0.5% x 4,000,000 = 20,000 Baht which is paid by seller.

- The particular business tax that Mr. Rich is exceptional because he had owned this property for over 5 years.

- 1Withholding tax which is paid by the seller as above calculation.

Nipapun Poonsateansup CFP®

Independent Finance Planner and Public Speaker