I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Home & Car

- 5 Checklists before investing on real estate and how to calculate the rent

- Personal Banking

- ...

- 5 Checklists before investing on real estate and how to calculate the rent

5 Checklists before investing on real estate and how to calculate the rent

10-10-2018

Real estate investment is another investment option that offers a variety of returns such as monthly rentals, resale difference, etc. In the current situation, there are many new townhome, home office and condominium projects. It is an opportunity for investors to invest on new real estate. The main key is to real estate investment is to study and understand of what to invest, including the type of property, financial options and ways to profit from those investments.

Let’s have a look at the 5 checklists to explore the readiness before investing on real estate.

1. Market Survey

Real estate investment is like doing any kinds of business, in which market must be surveyed, to see the demand and supply. The opportunity to have customers come to rent, must be looking at the external factors of the property investment, including location, size of the housing and convenience in travelling. Does all of this answer to the customers’ demands in term of comfort and value for money rent in customer’s perspective?

2. Who is your tenant?

Before investing on any real estate, we should know who will be our customer to rent our property. Although we might find a premium real estate such as downtown condominium that includes facilities like shopping centers, markets, hospitals, schools, etc., how do you ensure that the condominium you invest will have anyone who want to rent it. Who are your tenants? Where do they work? Who do they travel? What kind of lifestyle do they have? How much income do they need to be able to rent your property?

Why do we need to think in this way? Because when you start investing, but then no one rents your property, what is considered to be a revenue increase will become a burden to your expenses instead. In addition to having to pay the bank each month, there are also other maintenance costs that you must pay instead of having tenants pay the installment each month.

3. How is your financial health?

Did you know that when money management is wrong, the real estate you aim for may get away?

A premium real estate is obviously the target of many investors. Investment opportunity may be flawed if you have financial problem or bad financial credit. This may cause the investment to be halted. As a result, the loan approval will be delay because you have to clean up old financial problems. This means you may lose the opportunity since someone else will buy the real estate you aim for. Thus, you will lose both time and opportunity to make profit in the future.

4. Every investment is risky. Can you a

Investing on real estate is as risky as other investments, especially the need of high value investment. Mostly, you have to loan from the financial institution, repay back the loan and have a low financial health because it is not a trading asset or be able to loan in a quick time. In addition to finding customers with matching property needs, it has to go through many steps, including contracting, transferring, borrowing, and so on, which takes quite a long time to process.

Apart from the financial health, which is the main risk of property investment, we must consider whether people will come to rent our room every month or not. This is because if there is no rent that month, all expenses are push back to yourself to pay for the installment. There are also other expenses such as the deterioration that the owner will have pay to repair in the case of condominium and home.

For checklist no.4, you have to ask yourself whether you can take the risks mentioned above or not. However, these risks may not happen to everyone. It depends on the investment option, the market and the economic at that time.

5. How much will it cost?

Most real estate investment investors will use the form of bank loan to buy and leave for rent and they will use the rent from the property to pay back to the bank. Condominium with large market, especially the ones with downtown location or near the city, it is easy for renting. This rental requires the rental rate to be set to obtain the money to pay back to the bank. When the loan contract ends, you can be the owner of the property without the need to pay for the installment. However, apart from the money that needs to be paid to the bank, there will be additional profit to be accumulated as a yearly fee as well. There are two simple formulas:

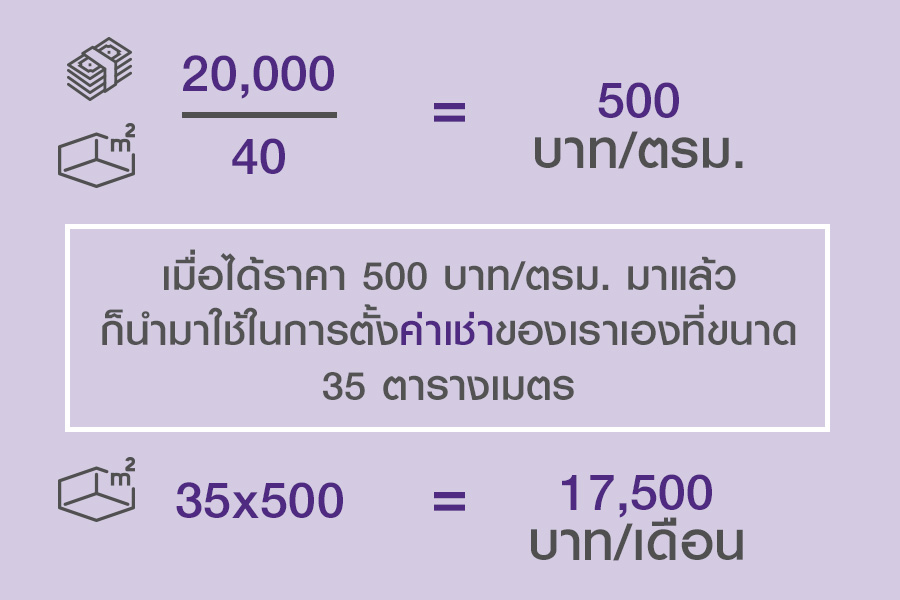

1. Calculate the rent based on square meter

To calculate the rent based on square meter, we can calculate it basing on a similar room type and location rental rate.

For example, your room is 35 square meter room with 1 bedroom, 3.5 million baht price. Compare it to a 40 square meter room with 1 bedroom, which has a monthly rental rent of 20,000 baht.

The rental price is comparable to 20,000 divided by 40 square meters room size.

20,000 / 40 = 500 baht per square meter.

When we got the price 500 baht per square meter, we use it to set our own rental rate at 35 square meters.

35 x 500 = 17,500 baht per month.

From the calculation, it may not be worth the price. We must consider whether the amount of monthly installment with the bank is sufficient or not or if we add a little more price, will it profit us or not.

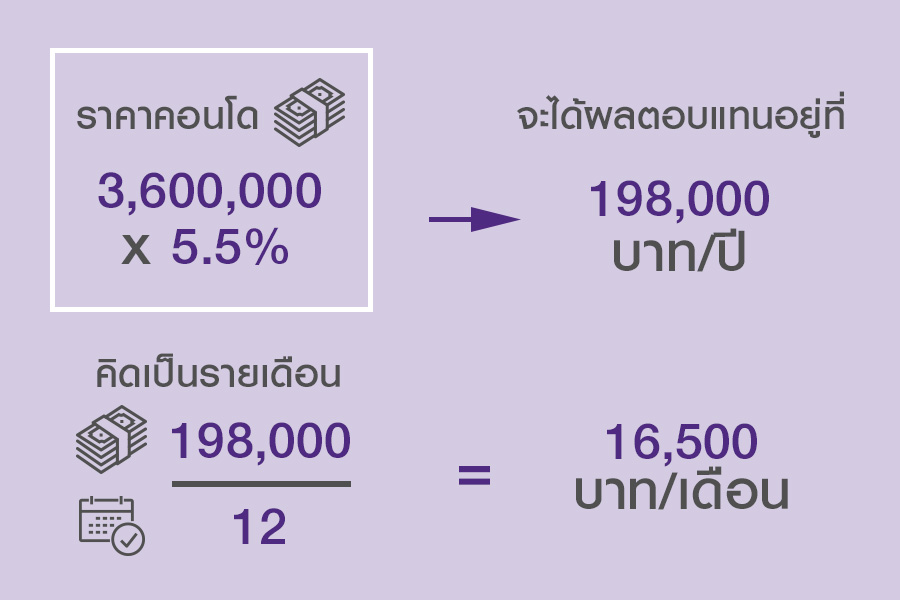

2. Calculate based on rental yield

Yield of condominium in each area will have different rates. This will come out as percentage to find out the monthly rental rate.

For example, Kawa HAUS a condominium located on Onnut T77, where it is calculated to have more than 8% rental rates (read more at Kawa HAUS Sukhumvit 77, new opportunity for investment at Sukhumvit ). If you consider the price of a condo at 3,600,000 baht and set the average rental rate at 5.5%, we will get a return of almost 200,000 baht per year or 16,500 baht per month.

From the above analysis, you will see that the monthly rental price is 16,500 baht, but there might be some additional maintenance fee which includes the commission fee for agent to find tenants, air cleaning service, etc.

Conclusion

Real estate investment is another investment option that needs to be studied and understood clearly the information since it requires large amount of funding. However, there is a method of loaning from financial institution to be used on asset, which is mostly a condominium with the current market demand. Therefore, the financial health is a significant key factor in getting a loan.

Moreover, there is also the issue of calculating the value of rent. If you have a good plan, your investment will be progress smoothly and you will be able to repay back the loans to the bank and become the true owner of the property.

Reference : www.sansiriblog.com