I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Grow Your Wealth

- How is the opportunity after Covid-19 and lockdown situation?

- Personal Banking

- ...

- How is the opportunity after Covid-19 and lockdown situation?

How is the opportunity after Covid-19 and lockdown situation?

20-05-2020

As a result of the uncertain Covid-19 pandemic which affects the current economic situation and high fluctuation index market, how is the investment opportunity for the rest of 2020? Especially for all investors, let’s find out from the insider by Mr.Sukit Udomsirikul, Managing Director Head of Research, Siam Commercial Securities Company Limited (SCBS), Kampon Adireksombat, Ph.D., Senior Head Of Economic And Financial Market Research (SCB) and Mr.Sornchai Sunetta, Managing Director, Chief Investment Officer, Siam Commercial Securities Company Limited (SCBS).

What will the economic recovery shape be after COVID-19? Is it a V-shape, U-shape, or L-shape?

From the declining Covid-19 infections and Thailand is now starting easing lockdown. The market is already recovering from its recession from the downturn of the 2nd quarter. From now on, what will the economy look like? Will it be recovered soon? Dr.Kampon told us that there are 3 patterns of the economic recovery shape which are V-shape, U-shape, and L-shape. We have to see the rebound of economic growth compared to the loss at the crisis. For example, if +3% is a normal rate, -3% at the crisis, then recover +5% and +3% in the next year. This is called V-shape which means the return must be greater than the loss in the crisis period. If +3% is normal rate, -5% at the crisis, then +3% recovery and +3% in the next year. This is called a U-shape. And the last one, L-shape. +3% for normal, -7% for crisis, +2.8% rebound and +2.8% the next year.

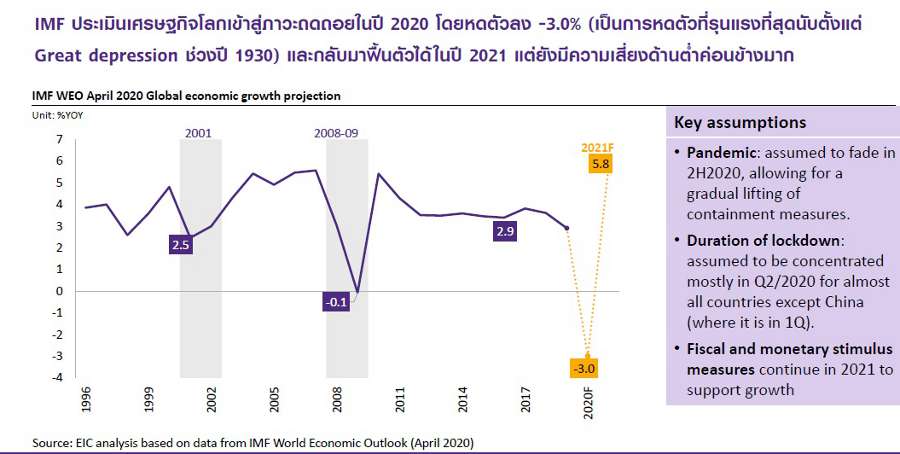

In 2020, the World economy is already in a downturn period. The IMF has predicted that the economic recession will be -3% which is nearly the same as the Great Depression era. However, it will be back around +5.8% by 2021 under 3 conditions which are 1.) Covid-19 infection spreading is controlled by the first half of 2020. 2.) Most countries must reopen theirs from the second quarter to continue their economic activities and 3.) The effective Financial economy encouragement. IMF said that the rebound will be like U-shape which gradually increases, depends on those 3 factors and consumer's and manufacturer's behavior.

How do government measures alleviate the effects of the COVID-19 on the Thai Economy?

During the virus spreading, many governments have announced financial measures that would help enhance the private sectors and make the world economy become 1) High debt from fundraising bonds announcement and causing a budget deficit, 2) Low growth economy, 3) Low globalization or became more individual state policy. However, this has happened since the trade war and how do these situations affect Thai businesses?

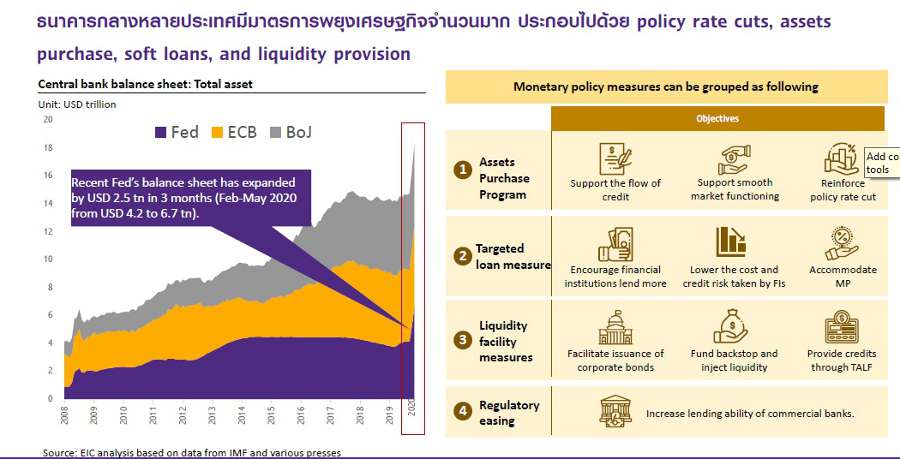

From this point, Dr.Kampon told us that the economy will regrow but it takes time because the Covid-19 pandemic is different from other crises. The government needs to control the spreading by commanding every private sector for a sudden stop which truly affects the whole economy and world market. This reduces liquidity and makes people panic. The world bank whether FED, ECB, and BOI need to announce a liquidity enhancement policy such as interest rate reduction and unlimited quantitative easing to calm the market down by injecting a quick and large amount of money as same as the finance ministry who support the economy and remedy for salaried employees and entrepreneurs by the monetary policy that has never been announced before.

The BOT and government’s policy that helps alleviate the economy to reopen according to the business-necessary levels. Since the beginning of Covid-19 spreading, there is uncertainty and low investment and then the spreading is getting worse, the tourism has stopped, the lockdown has begun, consumption and production have also stopped. Finally, the fall in numbers of infected people in Thailand and businesses have gradually recovered. The first priority business is consumable products which are necessary things, but it has been transformed into an online platform. This is the beginning of other products for export products. Therefore, the export-business to China will recover first.

When convenient transportation operates the tourism will be back, starting from domestic than international. If there is a cure or vaccines or a certainty of no second wave, then international investment will return.

Seeing through the Thai stock market from now on

From Mr.Sukit's perspective, the Thai stock market has already passed the worst point compared to the March period in which the circuit breaker occurred. At that time, the severity of investors' fear in the Covid-19 pandemic and the contraction in the economy made them want to hold cash which had led to a 950-points downturn of market share. However, support from the government and banks across the world in the lockdown period could recover the index market by gaining trust and reduce the pressure from investors. Also, as investors believe that the index price is a bit low, so the purchasing power was increasing. These are the reasons why the market has swiftly recovered. Moreover, the hope of lockdown easing is another push that helps the market reach 1,200-points.

Although the second-quarter profit tends to be not that good, the stock price is still growing. The questions are in the price too high compared to the past? Or is the worse still going? Mr.Sukit told us that we need to separate into 2 issues which are 1) Do not think about this year's profit but let’s think about next year’s. Although the first quarter of this year is a half loss and will be worse in this second quarter, it is normal that the stock market will decrease before the actual economy happens and also before the turnover comes out. For example, if you believe that the result will decline in the second quarter then the market will be in a downturn since the first quarter and will rebound in the rest half year.

For the question that is the stock price too high? Mr.Sukit told us that comparing the profit of this year to the current price, then yes, it is too expensive. If we compare to the next 12-months profit, it is still a yes that the price is high. Nonetheless, this is what the market told us today that investors believe that the turnover will be good in the next 12-months as V-shape. This is a different opinion from Mr.Sukit’s forecast that he thinks it will be a U-shape because the market will fluctuate after reaching 1,300-points.

Notwithstanding, the market-pushing factors are 1) Investors trust and the government policy, 2) The recovery expectation 3) The actual business profit which is too soon to believe because of the Covid-19 situation, and it is just the beginning of the lockdown easing.

What is the result of high public debt?

Dr.Kampon told us that because almost every country has increased an accelerated fund injection that has never been before to remedial the effect of an insufficient income in the lockdown period. Then the government needs to issue bonds that result in higher public debt and announcing the quantitative easing program. The effects of this policy are increasing the financial liquidity and low-interest rate for a while because of a high loan of the government fund. If the interest gets higher, the government also needs to pay high interest. So, if the interest rate is low, the government does not need to pay a high rate and will encourage a growth investment. So, to judge that the public debt is high or not, we have to compare it with the GDP. If the GDP can grow fast, the public debt ratio will be low respectively.

From this point, Mr.Sukit told us that a higher debt will affect the buyer and consumer power. The higher the public debt, the lower the investment from the government however, the investment from the private sector will be placed instead. Also, a low-interest rate situation can be the undertaking strategy indicator which means that the defensive indexes are more interesting which include the consumable products and services businesses and the dividend yield indexes which are the property and fundamental businesses that surely give returns in this low-interest rate and uncertainty circumstances.

Is there any QE Tapering after the Covid-19 pandemic?

Because there is too much liquidity in the system, and after the Covid-19 pandemic, the economy will certainly be better next year, thus will the government stop or reduce the financial injection or as known as QE Tapering or not? Will this point make a contraction happen? From Mr.Sukit's point of view, the pulling-money-back can be separated into 2-dimensions which are as follows, 1) A gradual change in the business side and 2) the financial side which the QE Tapering is possibly happening as same as in 2013. The money injection from 2009 - 2013 gave benefit to the emerging marketing countries, Thai market was one of them as we received around 200 billion Baht so after the QE Tapering in 2013, the Thai market dramatically declined.

Mr.Sukit said that this injection round has not yet got into the new emerging market. Since the beginning of this year, the Thai market has had a total international net sale of around 170 billion Baht and in the bond market around 100 billion Baht. Based on this data, if the QE Tapering happens, it may not affect the Thai market that much. For the question: where will the money go? For those developed countries such as Japan, or the USA, it will be in the bond market because the central bank gives importance to the rollover of the private sector as there was a panic sell in the bond market in the previous month. In the summary, there will be the QE Tapering but not this year but maybe in the next year for the developed countries and in the bond market after the better situation of the Covid-19 pandemic.

What are economic lessons from COVID-19

Mr.Sorachai said that most of the government's economic policy in many countries emphasizes increasing the GDP number but in this Covid-19 pandemic, they have to pay attention to the deficiency of consumable and medical products. They are keen on these products greater than economic growth. Dr.Kampon told us that in the past 20 - 30 years, the international trade policy has been given priority to the efficiency and the highest profit which contributes to the Global Supply Chain that changes to be more outsource the products and services to get a lower cost. This became the Globalization. However, the western countries, especially the USA during the Trump era, there is a question that should still be this Globalization or not if it affects their local industry and subsistence? Since the prior of the Covid-19 pandemic, there already was a trade war in the High-technology business. Although there is the highest production technology, it is an international outsource production, so the supply chain was stuck. In this emergency, the sanitize mask is scarce and also every medical device.

Because of the trade war and Covid-19 pandemic, turning to full globalization status may be difficult and it tends to be more regionalization and nearly regional supply chain. Also, the government may restrict some critical supplies for only their local people in case of any emergency such as the sanitize mask and medical devices. However, the most important thing for business is also to emphasize on the cost management to get the highest possible profit.

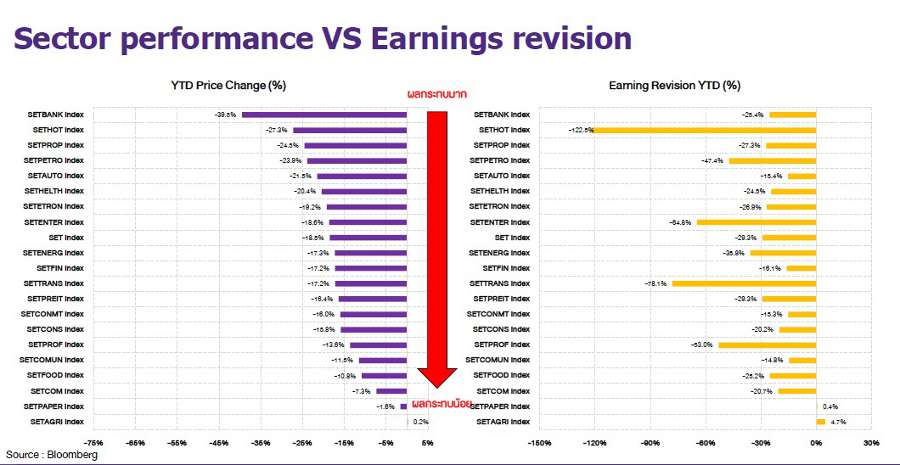

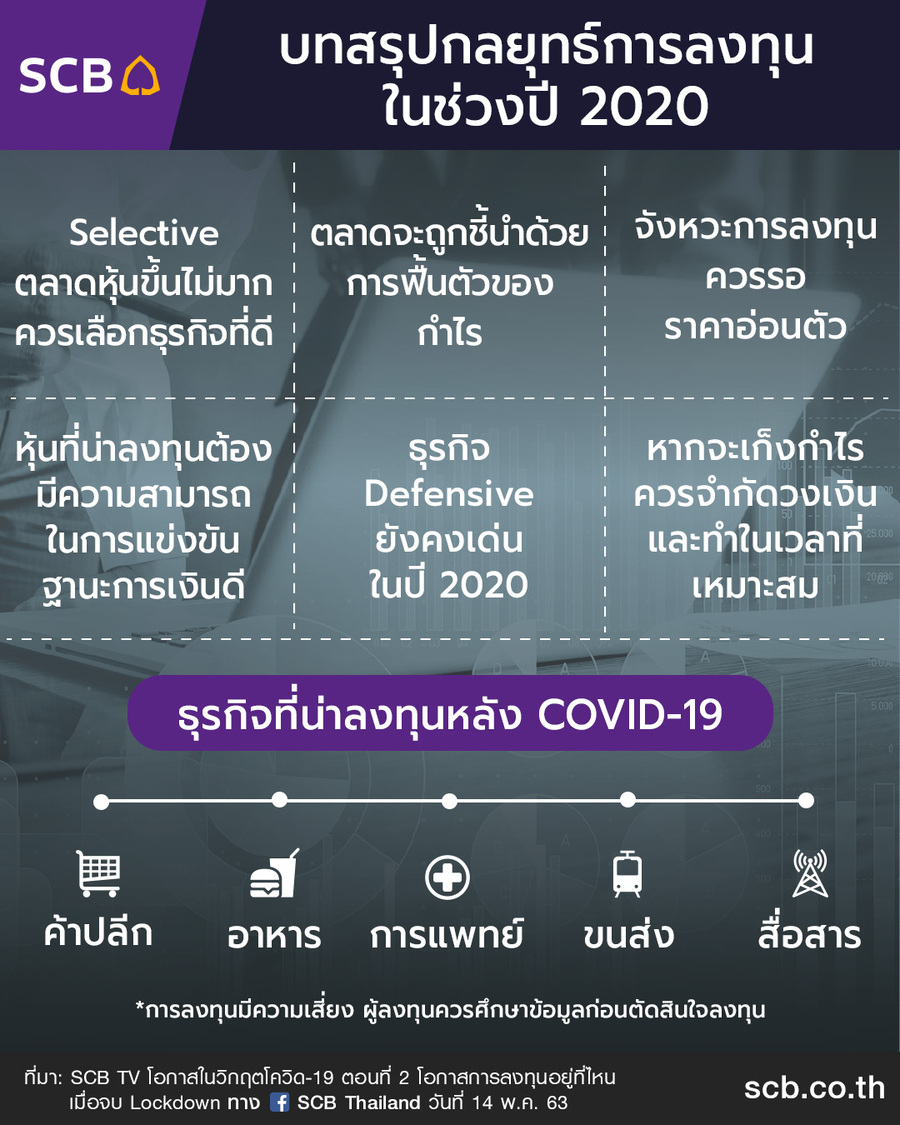

2020 Final investment strategy

From the forecast of this year SET net profit which may decrease 30% but it is still higher than the net profit in the 1997 or Tom Yum Koong crisis and the 2008 or the Hamburger crisis which means that the registered companies in the securities market fundamentals are better than those 2 crises. SCBS expects that this year's net profit will be 21% declined from 672,953 million Baht in 2019 to be 534,565 million Baht and will be back as 668,506 million Baht in 2021 which is the U-shape recovery.

Mr.Sukit told us that to consider which the interesting business after the Covid-19 pandemic will be can depend on 2 things. The first one is the low-impact businesses which are the essential public utility such as electricity, food. The second group is the moderate-impact but fast-recovery such as retail, medical, domestic transportation, and communication businesses. The last one is a high-risk businesses such as airlines, tourism, house, and cars. In this 2020 - 2021 period, the SET range will be around 1450 - 1150 points. The highlight indexes are BDMS, CPF, BEM, BTS, and MINT which are the leader in their category with a low price but higher return than the market average.

From this unpredictable Covid-19 pandemic, we should wait and see how fast the economy will return which will surely affect the investment opportunities in the market. Click LIVE SCBTV Covid-19 pandemic opportunities EP.2: Where are the investment opportunities after the lockdown?

Reference: LIVE SCBTV Covid-19 pandemic opportunities EP.2: Where are the investment opportunities after the lockdown? broadcasted on Facebook SCB Thailand on May 15, 2020

Related Product Or Service

Related Stories

- Thailand after Covid-19 Prepare to get through the economist's perspective. Part 1: The impact of the economy and the Thai labor market Paste Create

- Thailand after COVID-19 Part 2: Business opportunities and survival

- Tools for importers to easily find new products and partners like using an application