I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Grow Your Wealth

- Where the World’s Wealthiest Invest On?

- Personal Banking

- ...

- Where the World’s Wealthiest Invest On?

Where the World’s Wealthiest Invest On?

12-07-2018

Article by: Nipapan Poonsatiansup, CFP ® Dependent Financial Planner

Wealthy people comes with affluent and let’s look how World Wealth Report turned out in the year 2016.

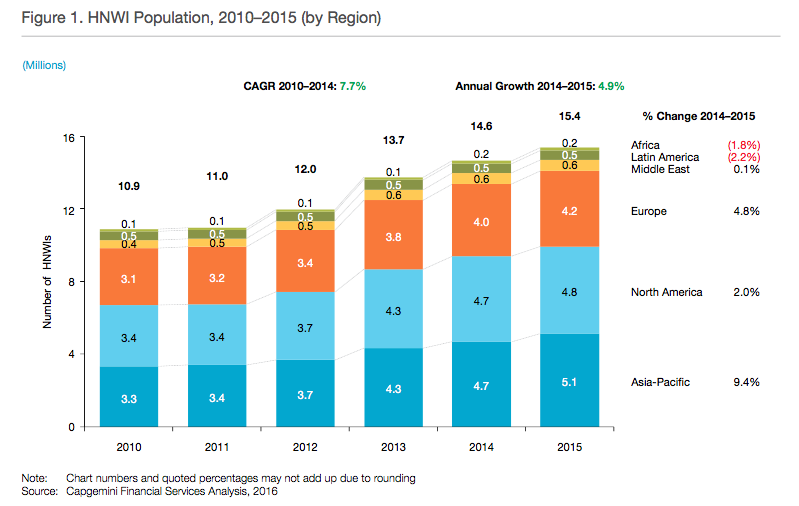

At the end of the year 2015, the number of global high net worth has increased to 15.4 million, increasing by 5.1% from 2014. High net worth is the term used for an individual with investible assets of more than 1 million USD (approx. 35 million THB). By regional distribution, the statistic indicated – for the first time, a higher number of HNWIs in Asia Pacific than in North America or 5.1 and 4.8 million people, respectively.

* HNWI = High Net Worth Individual

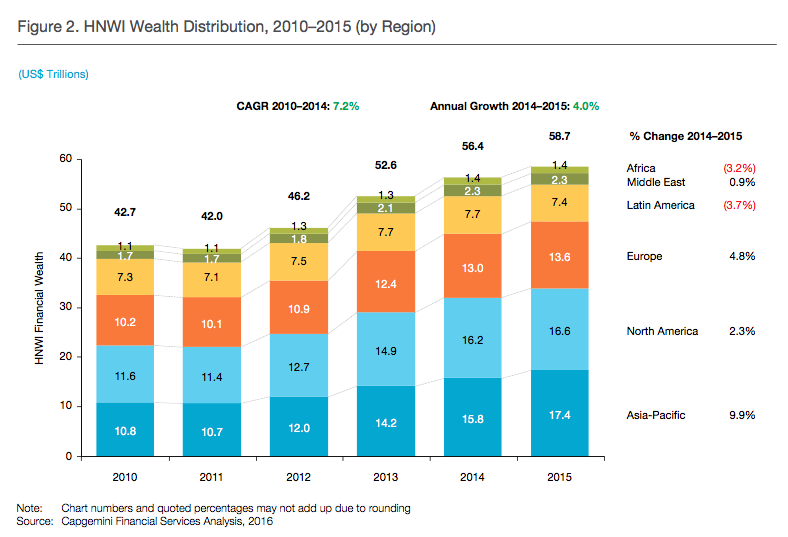

The total wealth from this segment is at 58.7 trillion USD, almost 5% increases from 2014. The growth rate of total wealth is relatively low comparing to the previous years. One of the reasons was low global interest rates and lowered rate of return from stock markets comparing to the previous years.

* The graph figures are in US$ Trillions

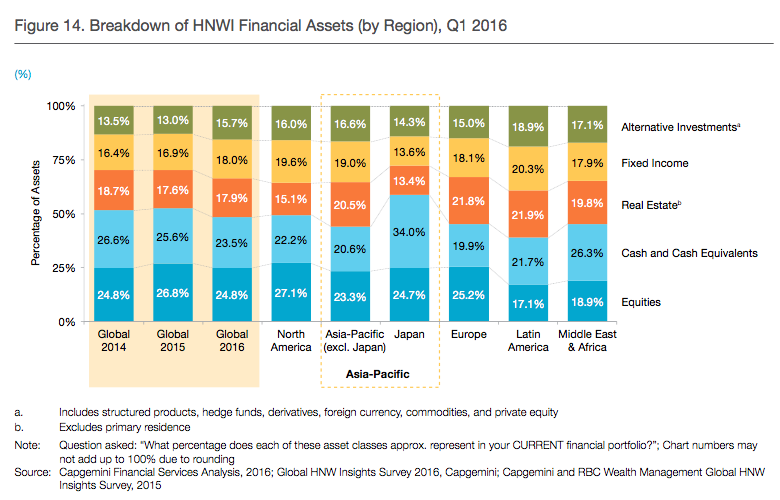

The investment allocation in 2016 consist of:

Equities | 24.8% |

Cash/Cash Equivalents and Capital Market Investment | 23.5% |

Fixed Income (Bonds) | 18.0% |

Real Estate | 17.9% |

And Alternative Investments | 15.7% |

Comparing to 2015, HNWIs has reduced cash/cash equivalent and equities investment and shifted to real estate segment, debts securities and alternative assets to diversify their investment portfolio in volatile market i.e., derivatives, foreign currencies, gold and private equities.

In term of investment channels, 38.3% of global HNWIs invested on individual stocks, 31% on mutual funds, 18.2% on the secondary market or ETF* and on other channels by 14%, respectively. We can observe how HNWIs still prefer investment on mutual funds. Mutual fund is an efficient and optimum investment choice for investors because it required low investment funds. Investors could rearrange their investment portfolio and diversify investment to other alternative assets more at ease.

*ETF is an abbreviation of Exchange Trade Fund or open-fund registered in the security exchange market. It is a marketable security and trades like common stocks which required smaller investment funds, low transaction costs and managed by Asset Management companies. ETF tracks yields and returns of its native index (Passive Fund) and it allows a combination of diversified portfolio i.e., domestic equities (i.e., TDEX investing in stocks composition of SET50 indexes), foreign equities and gold.

Once we know how wealthy people invests, use them as guidelines for investment portfolio management of your own. Do not forget to diversify your investment by asset allocation, a key successful factor for long-term investment.