RELATED LINKS

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- BUSINESS MAKER

- Optimistic investment opportunities for retailers in Vietnam

- Personal Banking

- ...

- Optimistic investment opportunities for retailers in Vietnam

Optimistic investment opportunities for retailers in Vietnam

24-05-2021

Vietnam has increasingly gained popularity as an investment destination from investors across the globe. Its appeal is a result of continuous economic and social development. In 2020, the nation’s GDP increased by 6%, with an average increase of 6.5 -7% per year. The country has also imposed effective control over the COVID-19 pandemic. More importantly, the population structure meets the golden ratio in employment. Of the total population of 98 million in Vietnam, 44 million are of working age, making the consumer business highly competitive and with high growth potential.

The Vietnamese retail sector offers great potential worth exploring. Chalermchai Pornsiripiyakul, Head of GO! Expansion Central Retail Vietnam, and Akesak Wiwattananon, Business Development Officer, SCB International Banking Function, recently discussed investment opportunities in the Vietnamese retail market.

Akesak Wiwattananon Officer 3, Business Development Officer-IBB

Central Retail aims to dominate the premium supermarket segment

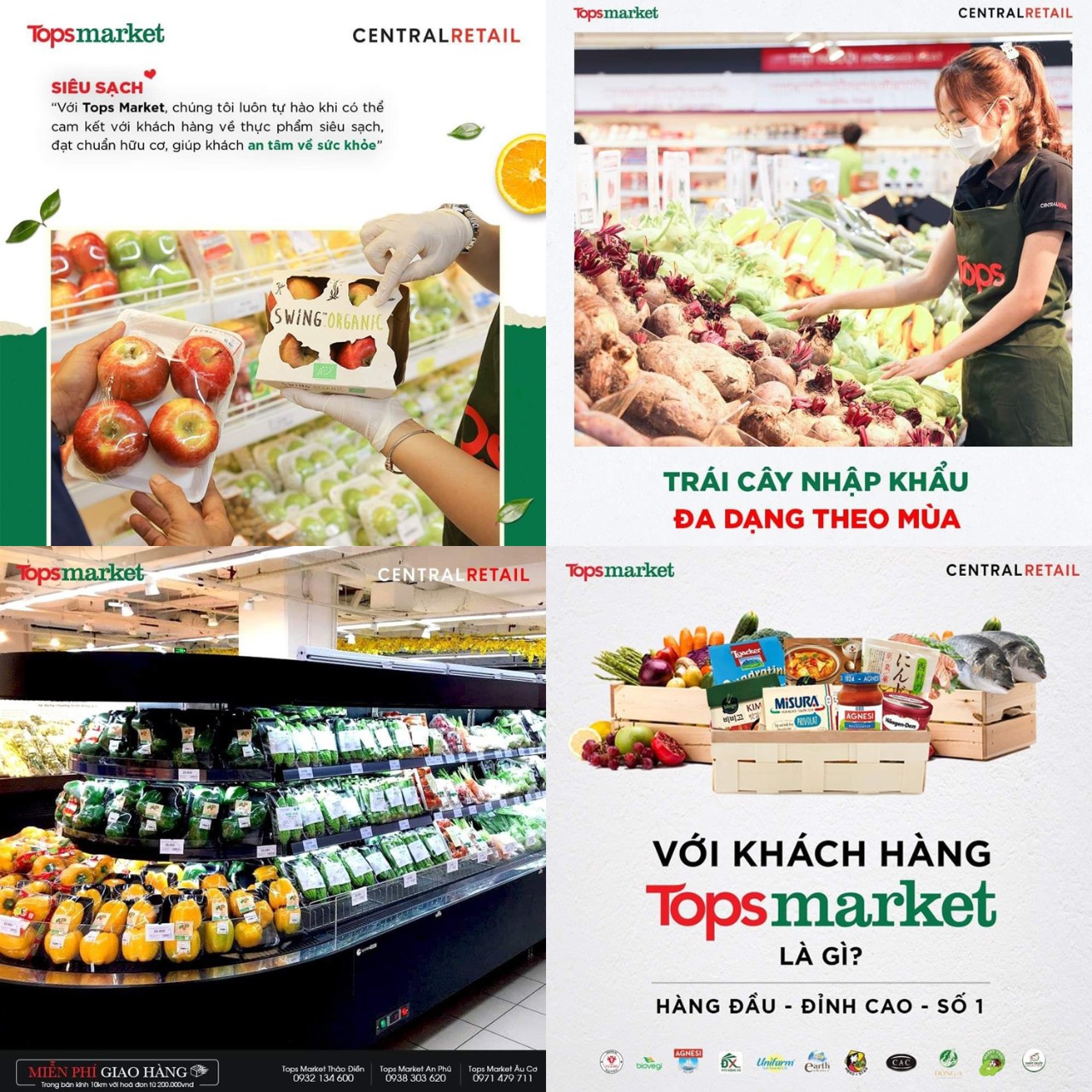

Central Retail has launched Tops Market as the first premium supermarket brand in Ho Chi Minh City, due to Vietnam’s strong market potential in the following aspects:

· Vietnam has demonstrated strong potential in terms of its politics and demography, the latter showing a golden ratio where half the population is of working age. Young people are starting families rather early and the average family has at least two children, leading to a growing population of children who are the target customers of the retail business. In addition, the FTA has paved the way for a large number of FDIs, increasing employment, growing spending, and boosting the number of those falling under the middle-class classification.

· Retail business opportunities are evident, considering statistics of modern trade stores in Vietnam. While the country has some 30 million more people than Thailand, the proportion of retail stores compared to the population is 3-4 times less than Thailand. There is still a potential segment for medium to premium customers, seeking good quality products or imported products. At present, there is no department store in Vietnam truly satisfying this group of customers.

Central Retail sees a business opportunity in this group of customers. Central operates 35 Big C branches in Vietnam, with seven branches located in the heart of major cities and well-known among this group of customers. Those seven branches are now being rebranded from Big C to Tops Markets selling premium grade products.

Opportunities versus Risk

Khun Akesak noted that Vietnam has the fastest GDP growth rate in the world at 6-7% per year. The retail market is valued at USD 170 billion and is expected to grow 10% per year during 2021-25 because Vietnamese people have high purchasing power. Wealthy people in Vietnam are growing at a fast rate of 11% per year, indicating their growth in tandem with the country's rapidly growing economy. Private consumption accounted for 67% of GDP, behind only the Philippines. In sum, the people have plenty of purchasing power and love shopping. Urban areas are expanding quickly, 3% faster than in Malaysia, Indonesia, and Thailand, giving the retail sector even more opportunities.

In terms of lifestyle and spending, most Vietnamese in suburban areas still prefer traditional trade, such as fresh markets or small grocery stores. On the other hand, in large cities, consumers have started to change their behavior and buy from modern shopping malls due to convenience and better quality. In addition, they can buy everything in one place. In 2020, supermarkets grew about 16-18% per year, and the COVID-19 pandemic has accelerated their growth because people don't want to go outside their homes frequently. They can buy everything they need at one time by going to the modern departments and grocery stores.

People have shifted to buying groceries through mobile applications during the COVID-19 lockdown, especially members of the younger generation who prefer shopping online. The Vietnamese retail market now consists of major players, including Vietnam’s Saigon Co-Op, VinMart Mobile World, and foreign-owned Central Group, AEON, and Lotte Mart.

Expansion strategies for every segment

Central Retail divides the market into three major segments, offering different products and services to answer the demands of each customer group:

1) Tops Markets for stores in big cities such as Hanoi and Ho Chi Minh City;

2) Big C hypermarkets for secondary cities; and

3) MINIGO stores for distant suburban areas.

Over the next 5 years, Central plans to spend about USD 1 billion (35 billion baht) to expand its branches to cover 55 provinces in Vietnam. For 2021 alone, they have set aside a 6.6 billion-baht budget for the expansion of four shopping malls in four provinces and MINIGO stores in one province, as well as rebranding seven Tops Market stores.

Central has developed its own platform for its online channel and collaborates with Vietnam's number one social media partner, including delivery service. It has started to experiment with the Beep-Beep platform as a click & collect service in Ho Chi Minh City by setting up fulfillment centers where customers can pick up items at their convenience. This channel has solved a pain point for customers who shop online but have nobody at home to receive shipments.

How similar or different are Tops Markets in Vietnam VS Thailand?

Tops Market in Vietnam still maintains the same “Top of the World” or “Top of Choice” concept as in Thailand, but Vietnamese products are the mainstay, with a mix of imported products based on popularity surveys of Vietnamese and foreign customers. Central has the potential to bring in a large number of imported products, allowing it to offer the best prices. Apart from being on sale in Tops Market, imported products are also sold in MINIGO stores to cater to people who can't come to city areas. Besides imported products, Tops Market also offers organic products. The goal is to allow Vietnamese customers to eat organic fruits and vegetables at affordable prices. Central has adopted a customer-centric approach to customize meat, cheese, and other items according to their popularity in each area.

Do Vietnamese people like Thai products?

Based on Khun Akesak’s direct experience talking with Vietnamese people, he discovered that Thai products, both food, and appliances, were preferred among Vietnamese people due to superior quality and taste compared to Vietnamese products. And prices are more affordable than products from Korea or Japan. Well-known consumer products include beverages, canned fish, and snacks, with tastes being adjusted to suit Vietnamese preferences. Other than that, detergent and fabric softeners are also popular. Cosmetics products are also of good quality and may be competitive with Korean or Japanese brands.

Mr. Chalermchai cited the fact that despite Thais and Vietnamese having similar eating habits and tastes, there are four significant challenges that investors must be aware of in order to succeed:

1) Business operators must be sincere. Products offered must be of good quality. Fresh products must be really fresh because the Vietnamese have a habit of touching products to check their freshness.

2) Product segmentation must be clear. Geographically, Vietnam is divided into three regions: North, Central, and South Vietnam. People in each region have different tastes and behaviors. Therefore, it is important to understand the behavior of people in each region. And although people are spending more, value for money is still a priority for many. Therefore, price is still a very important factor in the Vietnamese market.

3) Vietnamese customers like to consider products carefully. Services should communicate the quality of the product for them to understand.

4) Vietnamese people value children. Activities with children will add value and make customers love our products even more.

Recommendations for entrepreneurs interested in Vietnam

Khun Chalermchai also shared advice for entrepreneurs preparing to invest in Vietnam as follows:

1) Despite Vietnam being close to Thailand, they are not entirely similar to Thai people. Thinking that what is good in our country will be good in Vietnam is a mistake. We should learn more about their behavior.

2) Understand geographical characteristics, people’s behaviors, and their needs.

3) Adjust your mindset. Working with Vietnamese people requires a different type of communication. Vietnamese employees have high self-confidence and are concerned about their dignity.

4) Companies seeking to invest must be patient. Because Vietnam has high potential, many foreigners are seeking to invest in the country, making for a highly competitive market. Companies should bring a management team from Thailand to ensure that performance will match any policy laid down.

5) There must be constant updates on legal matters. Because the law is changing regularly, investors must ensure that they are able to comply with all the laws to avoid fines.

6) Investing as FDI is best in order to avoid the risk of irreconcilable differences with business partners in the long term.

Investment advisory with SCB in Vietnam

The SCB Ho Chi Minh Branch provides a full range of financial services, from deposits, loans, foreign trade, money transfers, to currency exchange rates. It also provides advisory services on regulatory requirements for establishing businesses at every stage. Having been granted a 99-year business license from the Central Bank of Vietnam, SCB has long experience in providing services, with an extensive network of offices in the CLMV, including Singapore and China. SCB is, therefore, ready to support business expansion in the Mekong Subregion market. Our employees have the knowledge, understanding, and investment experience to fully meet the needs of all customer groups.

Customers interested in doing business in the CLMV or Great Mekong Subregion (GMS) countries comprising Cambodia, Laos, Myanmar, and Vietnam can contact Siam Commercial Bank’s overseas network, which will be more than ready to provide services. - Here –

Source: Vietnam Insights and Update 2021: Trade Opportunities, Perspectives, and Growth Potential of Retail Business Vietnam, broadcast on SCB Thailand Facebook on April 30, 2021