I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- BUSINESS MAKER

- How to effectively manage family business funds for business prosperity and strong family bonds

- Personal Banking

- ...

- How to effectively manage family business funds for business prosperity and strong family bonds

STORIES & TIPS

How to effectively manage family business funds for business prosperity and strong family bonds

How to effectively manage family business funds for business prosperity and strong family bonds

01-07-2021

A Family Charter is a family’s code of conduct and agreement on family members’ roles in the family business and society. It also sets guidelines on family business governance, the family’s core values, vision, and business commitment. Such agreements are written for clear effect among family members.

A clear Family Charter and a clear Business Management System are tools promoting transparency among family members. Every member can learn their duties and rights in their home and family business roles, which will differ according to circumstances.

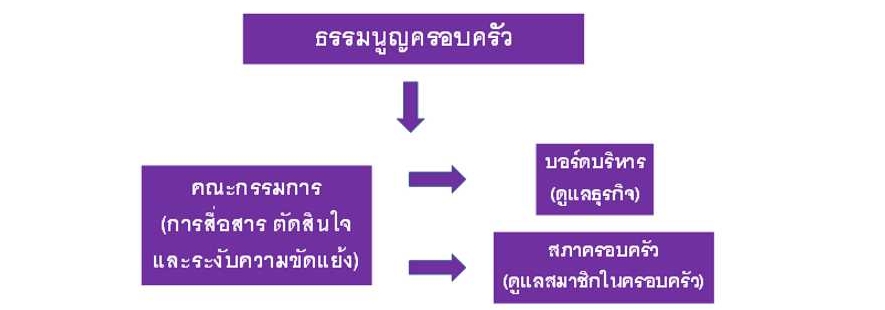

Family business management is different from other types of business. Family relationships may lead to emotions and feelings interfering in decision-making. To prevent potential conflicts, a Family Charter should be formulated. Each family can have a different Family Charter to allow the nomination of the most appropriate family member as a business successor without causing disputes among other members running the family business. Although family charters may vary, overall they consist of a Governance Committee, with an Executive Board overseeing the business and a Family Council overseeing family matters.

A Family Governance Committee consists of two parts, a Family Council and an Executive Board. Members of a Family Council are seniors, who can be stakeholders in the family business, or not, but are respected by other family members. Members of an Executive Board may include third parties such as a chief executive officer or executives accepted by family members. The numb1. Family fund management: The Family Council should be set up to manage family funds and reach an agreement on arrangements of necessary welfare for family members, such as education, medical expenses, and housing. For example, a resolution on whether a child’s education is eligible for family funds or requires the parents’ own money should be agreed upon by the Family Council.

ers of members and votes and voting rights vary by family business – some family business resolutions are based on individual votes, while others are based on shareholding percentages. However, there are similar key principles held by each family business, as follows:

- Nomination, numbers, tenure periods, qualifications, structures, and the duties of members of both business management boards and family councils are specified to take care of family members, communicate, make decisions, and settle disputes.

- They contain instructions on family business succession, business heir mentoring, business deals and agreements for in-laws, promotion and demotion, dismissal or resignation, etc. For example, when a family member in an executive position is unable to perform for any reason, it is necessary to find a capable person to replace them with at least equivalent knowledge, management attitude in the same direction, effectiveness, and readiness.

- They also contain instructions on remuneration for family members, such as bonuses for those working in the family business and dividends for those not working, market-rate salaries for working family members, bonuses as a reward for good performance, remuneration for retiring members, etc.

- Family fund management: The Family Council should be set up to manage family funds and reach an agreement on arrangements of necessary welfare for family members, such as education, medical expenses, and housing. For example, a resolution on whether a child’s education is eligible for family funds or requires the parents’ own money should be agreed upon by the Family Council.

- Family business’ share management: A common issue for a family business is wealth management, which requires proper management. A suggested solution is transparent management of common assets to reduce potential disputes among family members.

- Family relationship management: Previously, generation gaps between the first and the second generations might have been narrow as they were working together closely, learning and understanding each other through their work. However, parents running a family business while children are studying abroad may become out of touch. Frequent family gatherings and bonding can help closing generation gaps.

In short, good family business governance depends on the ability to manage the different needs of major and minor shareholders and different systems between family and business – managing the different needs of family members with professionalism, transparency, and accountability for long-term success and sustainable growth, while fostering family solidarity and happiness as well.

Nipapun Poonsateansup, CFP®, ACC

Independent financial planner, author, speaker