I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

คำค้นหาที่แนะนำ

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

ข้อแนะนำในการค้นหา

- ตรวจสอบความถูกต้องของข้อความ

- ตรวจสอบภาษาที่ใช้ในการพิมพ์

- เปลี่ยนคำใหม่ กรณีไม่พบผลการค้นหา

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Life Style

- Helping people like making merit instantly. Convenient and easy with e-Donation

- Personal Banking

- ...

- Helping people like making merit instantly. Convenient and easy with e-Donation

STORIES & TIPS

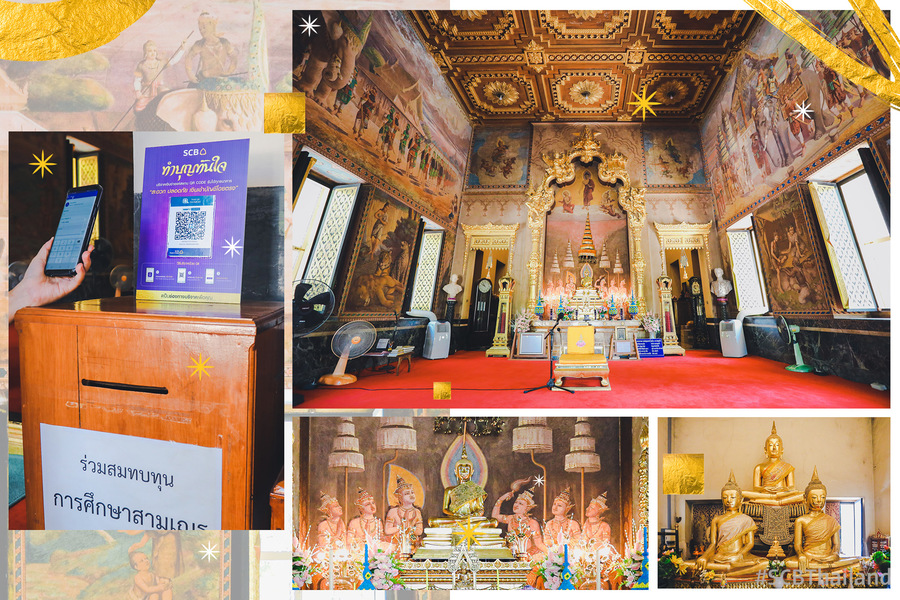

Helping people like making merit instantly. Convenient and easy with e-Donation

Helping people like making merit instantly. Convenient and easy with e-Donation

17-04-2020

The generosity of Thai people expressed by donating to help the poor, Needy people never disappeared from society. In which the era is changing to online electronic systems Which will be seen from the new system that has the leading e, such as e-Learning, e-Payment, etc. Donations also changed into e-Donation. Let's get to know more about e-Donation. And then donate via e-Donation. How is it different from normal donations? And why should we donate via e-Donation?

What is the e-Donation donation system?

Electronic donation system Also known as e-Donation, the Revenue Department has developed a system to support donation information from schools, religious places, hospitals, and other charitable organizations. And facilitates donors to be able to use tax deduction benefits without having to collect evidence of donations when filing income tax forms. Which will help donors receive tax refunds faster.

Which organization accepts e-Donation and how to donate?

As per the Revenue Department details Donation units to include educational institutions, religious places, all religions, hospitals, organizations, public charities *. There are 2 ways to donate via e-Donation:

- Donate by cash To the donation unit Which the donation unit will record the donation information on the system Electronic Donation (e-Donation) If the donor is unsure whether the donation unit uses the Revenue Department's e-Donation system or not Can be checked at http://edonation.rd.go.th/donate/Index_InfoS.jsp >รList of donation units using the e-Donation system

- Donate by using the Mobile Banking app. Scan the QR Code e-Donation of a commercial bank Which is an easy and a convenient method, both when donating and when filing for a tax deduction.

Because no matter where you see the QR Code Such as on websites in Facebook, LINE, etc. messages can be scanned for donations anytime, anywhere . And after scanning the QR Code, there will be an option showing the bank to send donation information to the Revenue Department to select 'Accept' And the bank will automatically send the donation information to the Revenue Department Donors do not have to be confused to send a money transfer slip to the donation agency to send a receipt back to keep for filing the Revenue Department later.

Advantages of e-Donation

For people who like to donate and make merit the main advantage of the e-Donation system is the convenience that donors do not need to keep donation evidence such as receipts for filing with tax forms at the beginning of next year. Because sometimes it gets lost or forgets about what has been donated. With the service that the bank sends personal donation information to the Revenue Department Information on how many organizations we have donated through e-Donation systems will automatically appear in the Revenue Department's database. Which we don't have to collect/send evidence of donations and can check donation information 24 hours a day on the Revenue Department website. ( www.rd.go.th >Electronic Services> Electronic Donation System (e-Donation)> Donors> Login using the same user ID and password as when filing income tax returns via the internet). Consider tax returns faster.

In addition to donations through the above donation units Religious support of temples By making merit, putting money into the cabinet in the temple Previously, there was no evidence for tax benefits, but with the e-Donation system, donations using the Mobile Banking app scan the QR Code at the donation box in the temple. These donations are also recorded for tax deductions.

Nowadays, various temples Both Thai temples and Chinese temples have installed QR Code signatures to support donations via e-Donation, making merit-making, instant-merit-making, and using tax-deductible privileges more convenient. Next time, if wanting to make merit Recommend picking a mobile phone and scan the QR Code. Enjoy the donation and tax privileges at the same time.

Remark:

* Public charity organization That has been declared a public charity organization under the Notification of the Ministry of Finance on Income Tax and Value Added Tax (Version 2) Subject: Establishing a charitable organization Hospitals and educational institutions under Section 47 (7) (b) of the Revenue Code and Section 3 (4) (b) of the Royal Decree issued under the Revenue Code

References

https://edonation.rd.go.th/donate/Q&A.pdf

https://www.facebook.com/TaxBugnoms/photos/a.192327474126010/3324210677604325/