I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Grow Your Wealth

- Simple investment strategies for managing a mutual fund portfolio

- Personal Banking

- ...

- Simple investment strategies for managing a mutual fund portfolio

Simple investment strategies for managing a mutual fund portfolio

23-08-2021

In planning your investment, you should allocate your money into different asset classes to diversify your risk exposure, keeping in mind the old adage, “Don't put all your eggs in one basket". That way you won’t lose all your money when losses occur. Knowing your own risk tolerance and understanding investment assets and the nature of the investment portfolio to suit your risk appetite is therefore very important. We have some simple tips for organizing investment portfolios to share with you:

1. Set an investment goal

Before making any investment decisions, a goal must be clearly defined for each investment portfolio. Each goal has different conditions according to your priority and the duration required to achieve the goal. This will affect the selection of fund types to suit the risk and expected return of each portfolio. For example, saving a 300,000 baht down payment to buy a house in the next three years is an important medium-term goal. If you don't want to miss the target, you should not invest in high-risk funds because there is a chance of loss.

The goal of saving 4,000,000 baht for retirement in the next thirty years is also important. However, it has a longer investment period. Therefore, you can choose to invest in funds with higher risks. When considering returns, longer investment periods can reduce investment volatility and offer more chances to earn higher returns. Therefore, setting clear investment goals will help you organize your investment portfolios more appropriately.

2. Assess your risk tolerance

Next let’s consider your risk appetite, both in terms of your investment attitude, age, financial position, investment duration, and loss tolerance. For example, young people who’ve just start working without burdens or debts and with a longer investment period can take on higher risks. On the other hand, a middle-aged investor with lots of burdens and a shorter investment period should aim for lower risk. Initially, you can assess our own risks using an appropriate investment risk assessment form which is mandatory before opening a mutual fund trading account. From the risk assessment, you will know what type of investor you are and how much risk you can absorb, which will then be applied for portfolio management.

3. Portfolio Arrangement

At this step, you will arrange your investment portfolio according to your risk appetite and investment goals:

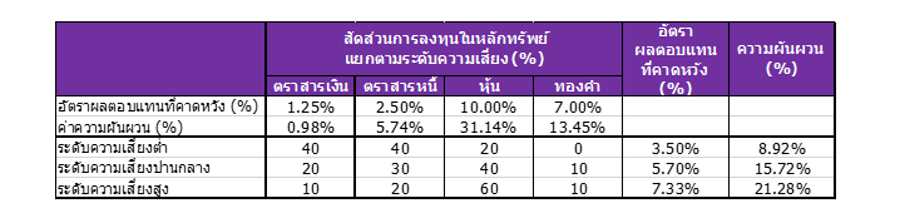

· You plan to collect a 300,000-baht down payment to buy a house in the next three years. It is evident that you will need to spend 300,000 baht in the future. As you don’t want to lose the principal amount, you must avoid any high-risk investments by adopting a more conservative approach. We recommend an investment ratio of 40% in money market funds, 40% in fixed income funds, and another 20% in equity funds, which will yield an average return of about 3.5% per year.

· You’ll have a longer investment period when saving money for your retirement. You can organize your portfolio according to age ranges, such as:

Those who are younger and have just started working with a longer investment period and less of a financial burden can assume higher risks. These people can choose a more aggressive approach, with 10% in money market funds, 20% in fixed income funds, 60% in equity funds, and another 10% in gold or alternative assets. This portfolio may yield a return of about 7.3% per annum.

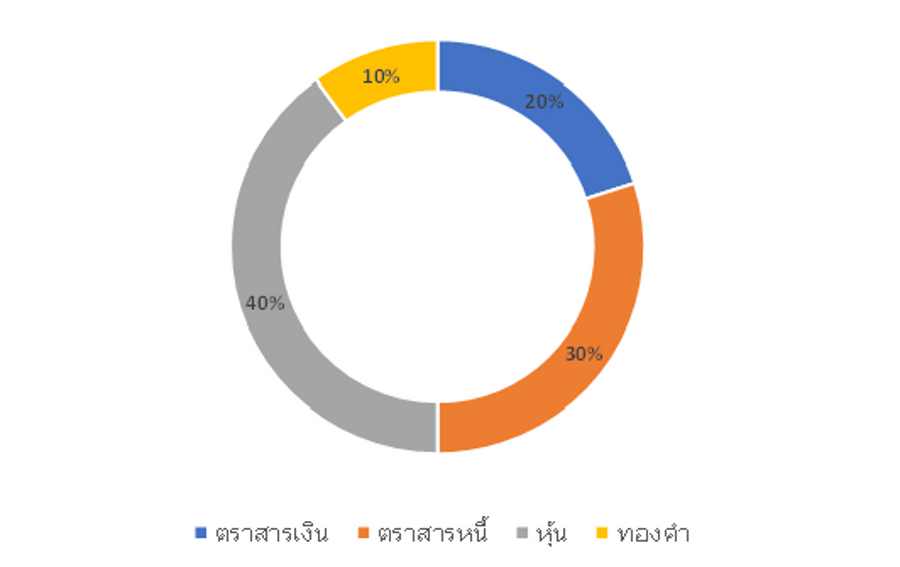

Those in middle-age who can accept moderate risk due to an increasing family burden may adopt a medium risk portfolio with 20% of their money invested in market funds, 30% in fixed income funds, 40% in equity funds, and 10% in gold funds or alternative assets. This portfolio will provide a return of approximately 5.7% per year on average.

An example of investment portfolios chosen according to the level of risk exposure is shown in the table.

Note 1. The historical compound return of the Thai stock market since the opening of the market averages about 12% per year . However, it is likely that annual returns generated by the market will be lower because the performance of listed companies will be in line with the slower growth of the Thai economy. The expected rates of return shown on the table have therefore been revised downward.

2. Due to low interest rates, return rates for money market and fixed income fund securities may be lower. The author has also adjusted the expected rate of return to reflect economic conditions.

An example of an investment portfolio for those with moderate risk tolerance:

Financial instruments can be invested via money market funds, while bonds can be invested through fixed income funds. For equities, investment will be divided between RMF and SSF for tax benefits. If you have more money, you may consider equity funds or index funds which invest in both Thai and foreign stocks. As for gold, you can invest through gold funds.

Investment in mutual funds will not require a lot of money and funds have different investment policies, allowing investors to easily diversify their portfolios, while some funds offer tax benefits. Mutual fund investment is an easier choice. However, investors should carefully study the type of mutual funds that interest them. If you don’t want to invest in multiple funds, you can invest through mixed funds with a policy of investing in different types of assets in a ratio fitting your requirements.

Information about mutual funds is available at your fingertips with the Internet. Designing your mutual fund portfolio can be easy by adjusting the proportion of your investment in accordance with your goals and the acceptable risk level you have determined. It is important to maintain your discipline by regularly checking the performance of your portfolio to make appropriate adjustments from time to time to achieve your goal.

Nipaphan Poonsathiensap CFP®, ACC

Independent Financial Planner, Writer and Speaker