I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Grow Your Wealth

- The Relationship of Stock and Gold

- Personal Banking

- ...

- The Relationship of Stock and Gold

The Relationship of Stock and Gold

05-07-2019

By Nipapun Poonsathianrasap CFP, Independent Financial Advisor, Writer and Lecturer.

Diversification is one of the important investment tactics that investors should take into consideration in order for the investment to be successful. As investment returns of all financial properties always have risks and uncertainty, diversification might reduce the rate of investment return, but it will also reduce risk that could come with an investment. The popular tactic is ‘Asset Allocation’ in which the risk will be placed upon different kinds of property such as cash, debt instruments, equity instruments, properties, gold and oil. This article will, thus, explain about the relationship between stock and gold to serve as a useful piece of information for investors.

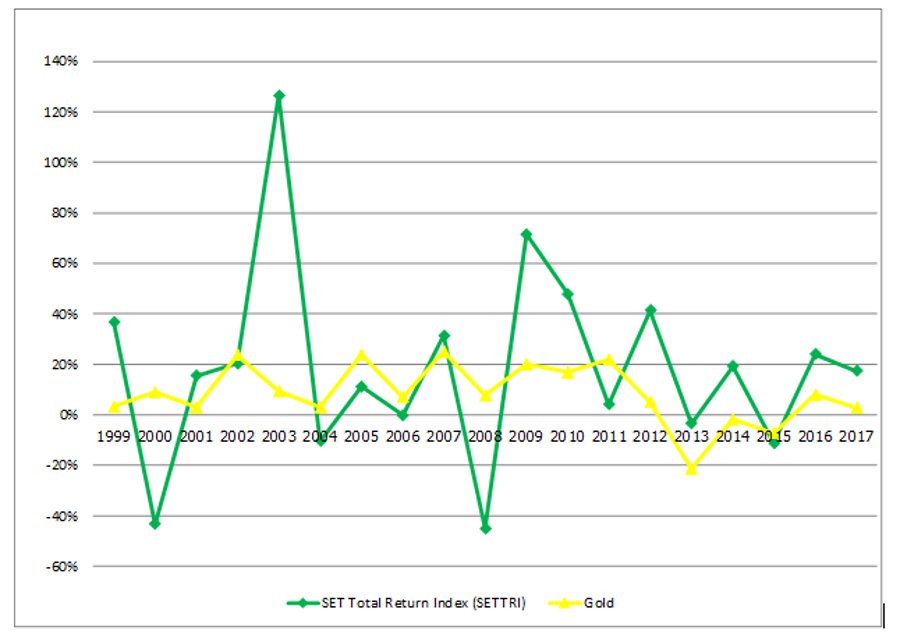

Figure: The comparison of annual investment returns between stock and gold

According to the above figure, the relationship of stock and gold can be deduced as following:

- From 2001 to the end of 2003, the economy had started to recover again after Tom Yum Kung Crisis. The stock market was likely to grow especially in 2003. As for the gold, the price increased in the same direction as the stock market, but in a lower rate.

- At the beginning of 2004 to the mid of 2008, the stock market was gradually rising. Basically, the economy was still well, but it received an impact from political movements such as coup de tat and several demonstrations. The gold price seemed to also rise at this time, but unlike in the year 2001-2003 because at this period, the gold price increased more than that of the stocks. Therefore, this shows that gold is quite a safe property to possess.

- From the mid of 2008 to the end of 2008, the stock market took a nosedive at this period. This was the result of Subprime Mortgage Crisis or what we commonly call Hamburger Crisis. However, gold had once again proven itself a safe asset because it went down less than that of the stock market.

- Besides, if we take a close look at year 2000, 2004, 2008 and 2011, we can see that the stock market really plummeted which resulted in negative investment return. However, gold could still produce positive returns and it displays the property of being a ‘Safe Haven’.

- Safe Haven is whatever asset that is safer and is less fluctuated that investors look for to place their capitals into. Gold is considered as a safe haven because investors believe that regardless of time, gold is always a valuable asset, a metal that is always needed.

- Nevertheless, after a rewarding return from 2009-2011, nightmares haunted gold investors. In 2012, there were signs that gold might not be a safe haven anymore. This was because the skyrocketing price of gold during 2009-2011 which resulted in increasing speculation of gold. Especially in 2011, the gold price changed rapidly and that was clearly a speculation, making the gold price gradually went down in the following years. Also, in 2012, investment return of gold went the opposite direction of the stock since gold had turned into a speculative asset. When stocks had become a more favourable choice, investors turned away from gold and invest on stocks instead.

- Nonetheless, from 2013-2017, gold price went to the same direction as stocks. The SET index went up, so did the gold price in a lower rate. When the SET index went down, the gold price went down as well. Gold had lost its property as a safe haven and thus, the past relationship of stock and gold might not predict the future relationship of stock and gold. Investors then need to always follow and understand their invested assets to provide suitable investment tactics for themselves.

All in all, “the past rewards do not determine the future ones” is a saying that still works in reminding people who want to invest. Despite an inability to predict the relationship of stock and gold, diversification is still an effective tactic in investment. More importantly, investors have to always be well aware of their assets and regularly revise their investment plan to adjust tactics according to the investment goals.