I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Transactions that have changed in the New Normal era in a legal perspective

- Personal Banking

- ...

- Transactions that have changed in the New Normal era in a legal perspective

Transactions that have changed in the New Normal era in a legal perspective

The arrival of New Normal due to the COVID crisis That needs to be maintained. Social distancing changes the details of our daily lives in many ways. One of them includes important business and financial transactions. Which law has approved how the transaction has been changed? Mr. Benja Suphannakun Partner, Baker & Mackenzie Company Limited, and Mr. Sukit Udomsirikul, Managing Director of Research, Siam Commercial Securities Company Limited (SCBS), came to give an answer on this issue.

The impact of COVID19 on the market

Khun Benja explains that when the epidemic of Covid-19 sent to investors from originally collecting money in money market funds, bond fund. There was concern about the stability of the fund's liquidity and therefore turned to collect cash instead. Resulting in a panic sell selling assets and investment to collect cash. Regarding financial institutions, it was affected by SME business debtors and retail customers who suffered from the inability to pay their debts. The government saw the impact of Covid-19. Broadly towards investors, SME entrepreneurs, retail customers, and financial institutions Therefore, measures have been issued to help both the capital market and the money market.

Government support measures in capital and money markets

For the capital market, the direct impact on investors is the selling of shares due to Panic Sell. Therefore, the criteria have been adjusted to Trading Suspension (Circuit Breaker). Previously, they would stop trading if the stock market closing price dropped more than 30% of the previous day's closing price. And if that day comes back to buy and sell again the price further reduced more than 15% of the previous closing price. Can break for one more round. Became a trading stop if the stock market closing price fell more than 15% of the previous day's closing price. And will be able to brake again If the price for that day drops more than 7% of the previous closing price. The Stock Exchange of Thailand will use the new Circuit Breaker criteria until June 30, 2020.

And from news about the sale of investment units in fixed income assets, causing many bond funds to close. Therefore, there is a fund to maintain liquidity in the bond market raising (BSF) is another measure that the BOT issued to help issuers to raise enough funds to bring. Money refinances, repayment of previously issued debentures due. Which the BOT requires Issuer to raise funds from traditional channels Such as issuing new debentures Loans from financial institutions Increase capital from shareholders not less than 50% of the credit limit required to refinance. And can then ask for help from the BSF Fund for the money that is still lacking by issuing only issue bonds, not over 270 days. The investment-grade was rated to be sold to the BSF. The BOT's measure on the BF was to extend the liquidity of the organization through the crisis.

As for the capital market measures, the BOT Came out due to the event that investors lack confidence and want to hold cash leading to the sale of investment units of debt until the fund must close, although the fund holds good quality assets. This includes expanding the scope of measures to assist mutual funds affected by the lack of liquidity in the financial market (Mutual Fund Liquidity Facility (MFLF). The bank can use the money to buy investment units of the Fixed Income Fund or buy investment units with a promise to repurchase in the future (Repo). This measure causes the fund to receive money from the bank to pay to investors who want to redeem the investment units. Without the need to close the pile. As for the money that the bank will use to buy these investment units, it can be repo, bring the investment units bought to the BOT, and then use the money from the BOT to pay the fund. As for the money that the bank will use to buy these investment units, it can be repo, bring the investment units bought to the BOT, and then use the money from the BOT to pay the fund.

It specifies that investment units of funds requesting repo must invest in good quality debt instruments (rating A-up) of not less than 70%. Khun Benja viewed that both the BSF and MFLF measures are effective in reducing Panic Sell, increasing market confidence. And is helping the capital markets that the government has helped through the BOT, with commercial banks acting as intermediaries.

In the money market from this year until December 31, 2021, the BOT reduced the amount of money that commercial banks must send fees to the Financial Institution Development Fund (FDIF) from 0.46% of the fund received from the public to 0.23%. Including helping the bank liquidity by easing the rules on the maintenance of liquid assets of financial institutions (Liquidity Coverage Ratio). Including helping the bank liquidity by allowing the relaxation of the liquidity. So that the commercial banks have enough power and liquidity to help the business and citizens coverage ratio of the financial institution from having to be enough for not less than 10% to be lower than 10%. So that the commercial banks have enough power and liquidity to help the business and citizens.

For the quality, SME entrepreneurs that are affected by Covid-19 Can receive the first 6 months interest-free Soft Loan and then have 2% interest per year for 2 years. This soft loan comes from the commercial bank borrowing from the BOT at the interest rate of 0.01% per year. In addition, SME entrepreneurs that have the qualifications as required by the government can request a suspension of debt both beginning and interest for a period of 6 months. By not being listed as default on debt payment that affects credibility Which is a true help to the business sector

Measures for transactions in the New Normal era

Benja explained the type of transaction methods that have changed aggressively. Due to the state of Covid-19 There are 3 important principles which are

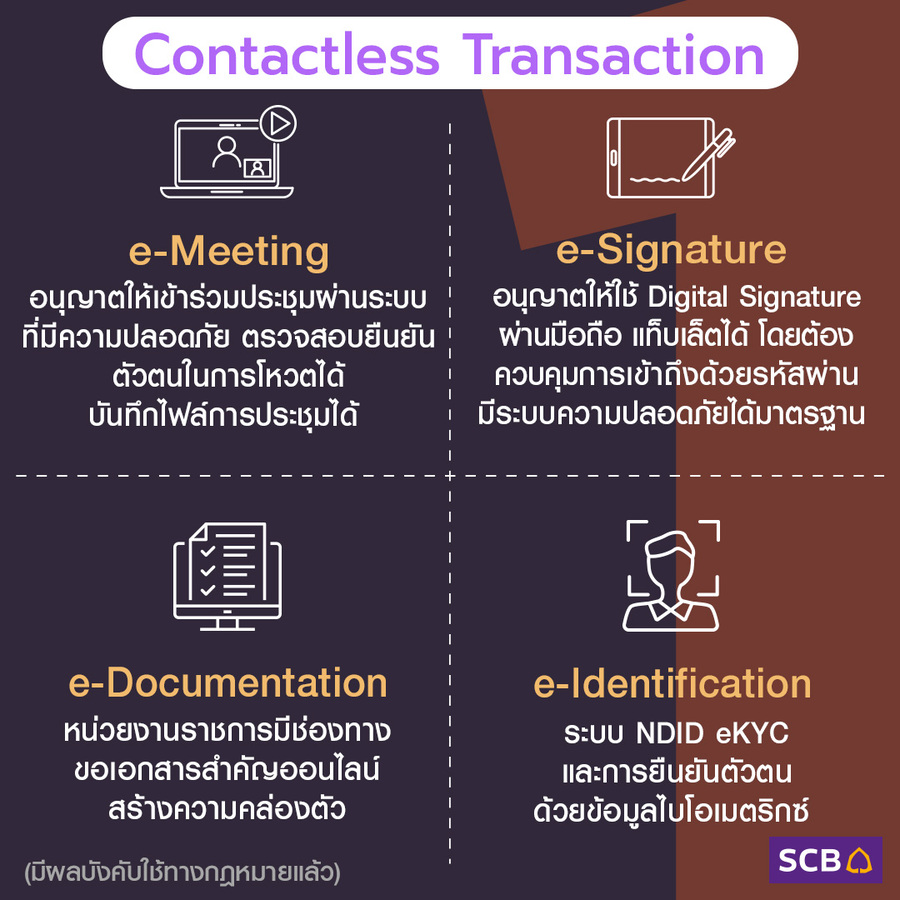

1. Contactless Transaction

-

e-Meeting

: The government has amended the law to certify online meetings (e-Meeting). Previously, there was a limitation for online meetings to become effective only if all participants had to stay in Thailand. And 1 in 3 attendees must be in the same location. The above restrictions were abolished. Require online meetings to be able to be achieved and certified through programs/applications that have enough security. With technology capable of verifying the identity of attendees and voting, including secret voting and can save files throughout the meeting.

- e-Signature : Previously, Thai law already supports e-Signature such as signing documents and scanning, sending emails back to the other party. Or using the Digital Signature function on smartphones and tablets. However, when a dispute occurs in the court, the issue that must be proven is whether the signature owner signed the document or not. Therefore, the use and creation of an e-Signature must be done in systems with reliable security technology. Control access with passwords etc.

-

e-Identification

: Digital identity verification such as Digital ID, NDID system, e-KYC with biometric data such as fingerprint, facial recognition (Facial Recognition), including reading data on ID card chips At convenient service points near home, such as 7-eleven or Thailand Post Without having to go to the office of the entrepreneur

- e-Documentation : e-Documentation In order to increase flexibility for the business sector and the public Many government agencies have provided services for requesting important documents online. Which is a transaction that reduces the use of paper (Less paper-based) such as e-Affidavit, requesting a company certificate from the Department of Business Development and e-Trade Confirmation, Bond e-Filling and Fee e-Payment of the SEC, etc.

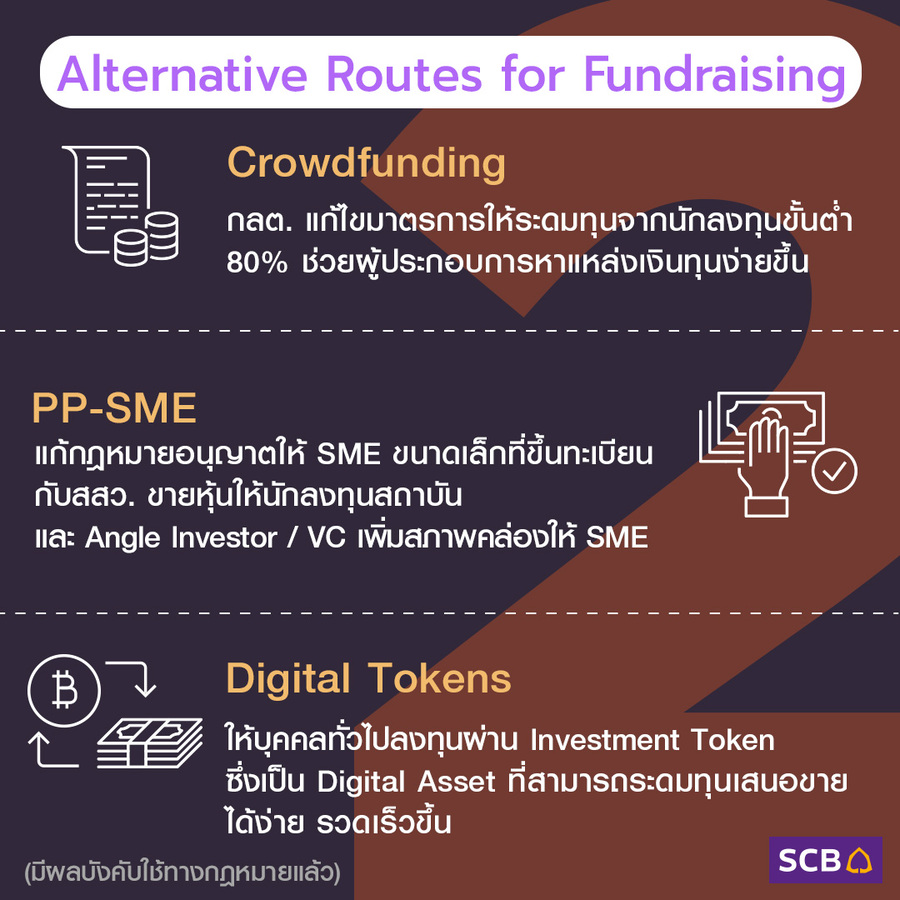

2. Alternative Routes for Fundraising

-

Crowdfunding

: Changing funding rules Previously, the SEC required entrepreneurs to raise funds from investors to meet the required amount of 100%. If not 100%, then must return the money back to investors. Which from the crisis of Covid-19 The SEC has amended this requirement to help small and medium-sized entrepreneurs have easier ways to find funding. By allowing 80% of fundraising projects to be able to finance the project.

-

PP-SME

: Previously, not allowing SME to sell shares to anyone other than the existing shareholders. Has amended the law to allow small SME registered with OSMEP. Sell shares to institutional investors and Angle Investor / Venture Capital (VC) / directors / employees / institutional investors. Medium-sized SMEs can also sell shares to retail investors (up to 20 million baht / up to 10 people) in order to increase liquidity for SMEs to make money to run a business.

- Digital Tokens : The SEC allows fundraising through the sale of the Investment Token to the general public to use the funds to invest in assets and generate returns. Investment Tokens are digital assets that funders can easily sell. Faster, more flexible than the opening for sale of securities that are traded with restrictions on the offering.

* Items 1 and 2 are in force.

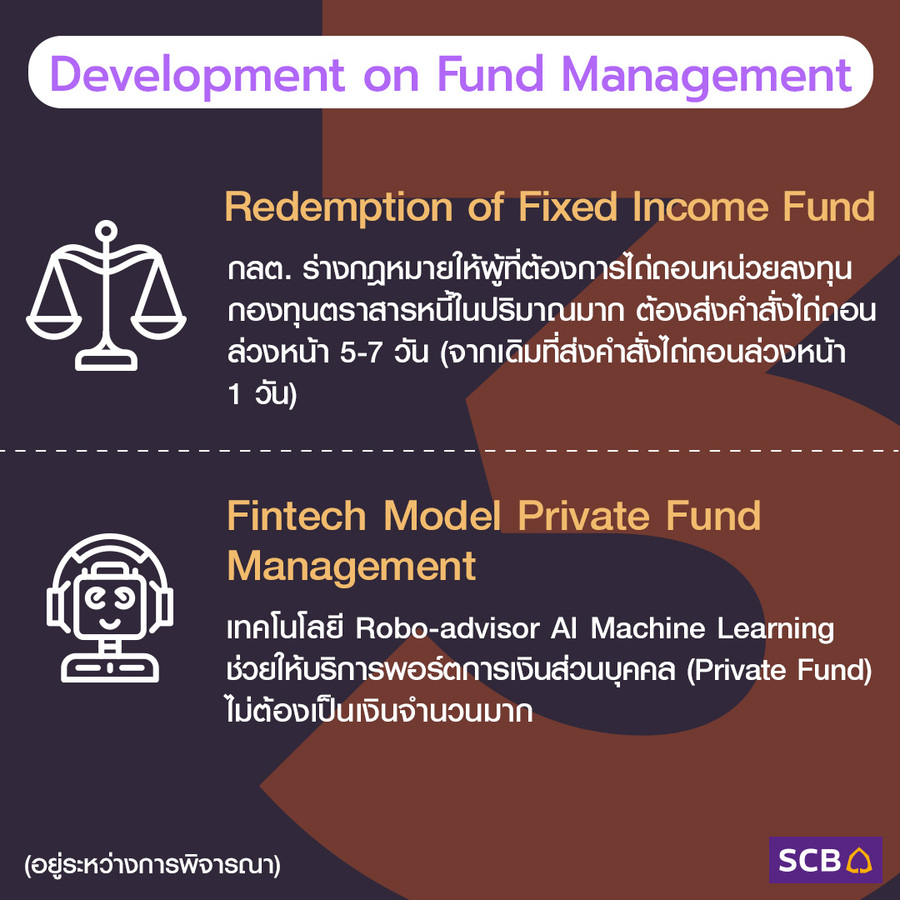

3. Development of Fund Management

-

Redemption of Fixed Income Fund

: SEC Bills Law for Those Who Want to Redeem Investment Units in Debt Fund in High Volume Must redeem the order 5-7 days in advance (from the original 1 day in advance)

- Fintech Model Private Fund Management : Robo-advisor AI Machine Learning technology helps private fund management services not have to be a lot of money like before

*Article 3 In the process of consideration

From the effects of the Covid-19 Have for the market and all sectors in society. Bring measures to help the new way of thinking that transforms transactions to be more streamlined in accordance with the changing context.

Source: LIVE SCBTV, Opportunities for the Crisis-19, Episode 4: Adapt to New Normal via a Legal Perspective Broadcast on Facebook SCB Thailand, 21 May 2020.

Related product or service

Related Stories

- Thailand after Covid-19 Prepare to get through the economist's perspective. Part 1: The impact of the economy and the Thai labor market Paste Create

- Decentralized Finance Financial services that will change the world you know

- Tools for importers to easily find new products and partners like using an application