I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- BUSINESS MAKER

- Continued recovery of the Vietnamese economy and stock market

- Personal Banking

- ...

- Continued recovery of the Vietnamese economy and stock market

Continued recovery of the Vietnamese economy and stock market

07-06-2021

Highlights

- The Vietnamese economy continues to recover, led by the export sector, and backed by global economic recovery and acceleration in demand for the nation’s key exports. In addition, recovery in domestic demand continued, with limited impacts from the renewed COVID-19 outbreak due to the government’s quick and effective control measures. Monetary and fiscal policies are likely to remain accommodative to support economic recovery, and we expect the economy to grow 6.5%-7.0% in 2021-22F with inflation rising gradually. External stability is stronger compared to the past as demonstrated by the surplus current account and the recuperation of Foreign Direct Investment following continued global economic recovery. These positive factors will also contribute to a stronger balance of payments. Risks to watch out for in the future include a resurgence of the COVID-19 outbreak in industrial provinces near Hanoi, slower-than-expected herd immunity prompting the delay of tourist arrivals, and faster-than-expected acceleration of the economy and inflation.

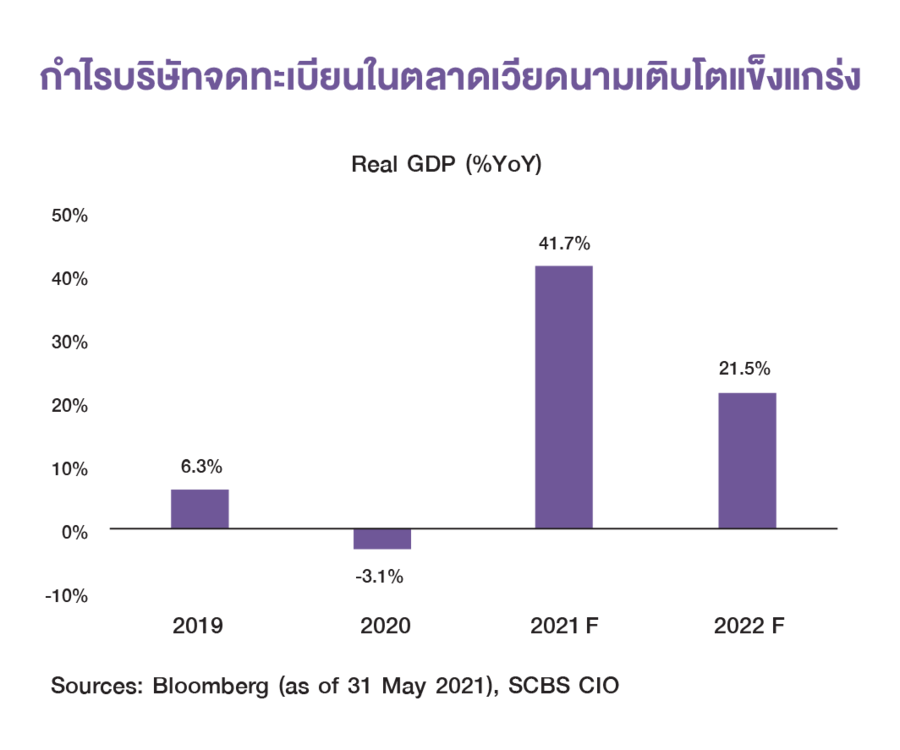

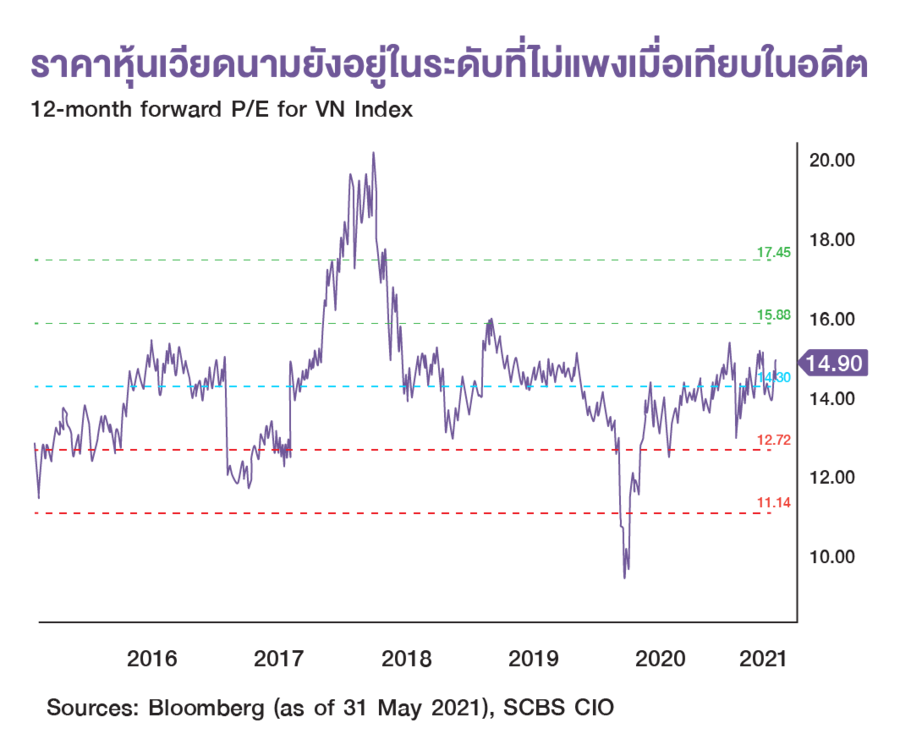

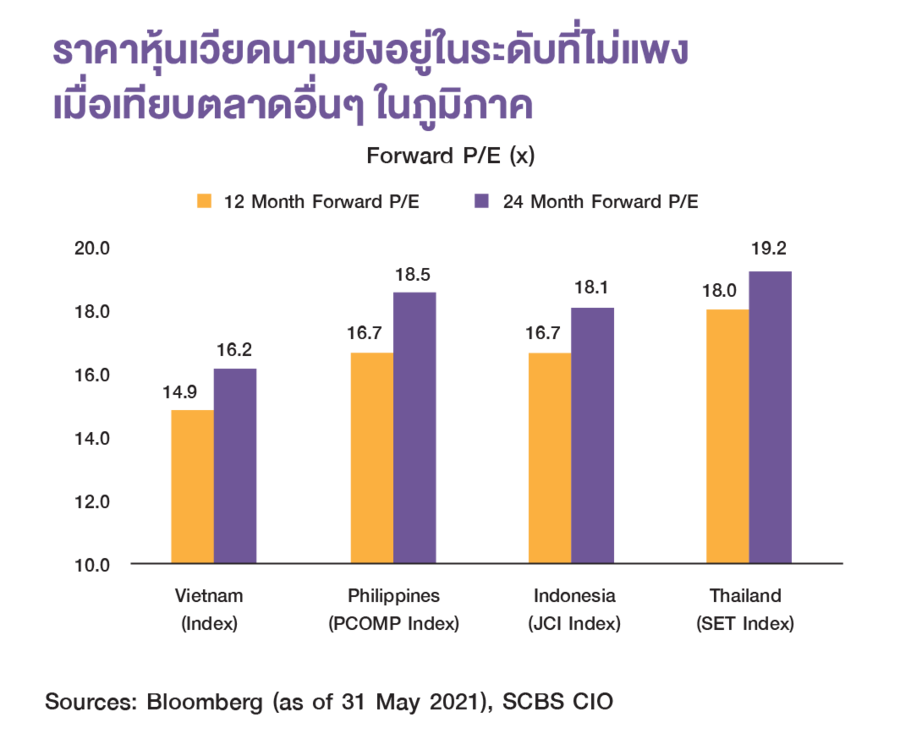

- SCBS has a positive view of the stock market. The rapid rebound of the economy could further benefit the profit growth of listed companies. SCBS expects that the earnings growth of the VN Index for 2021/2022 will increase by 41.7% / 21.5% (compared to -3.1% in 2020), which is outstanding growth compared to other markets in the region. In terms of valuation, the market has a 12-month forward P/E of approximately 14.9 and is close to the 5-year average. The outlook for Vietnam entering the MSCI EM index in the next 2-3 years should lead to a return of FDI. Net sales by foreign investors during 2020 were concentrated in a small number of large stocks. In terms of sectors, SCBS has a positive view on financial and banking, IT, and consumer discretionary groups. Toward the latter half of the year, the tourism-related sector is likely to be boosted by the gradual reopening to foreign tourists in 2022F.

Economic Outlook – Strong recovery was driven by the export sector, the success of COVID-19 control measures, and anticipated international tourist arrivals in 2H21

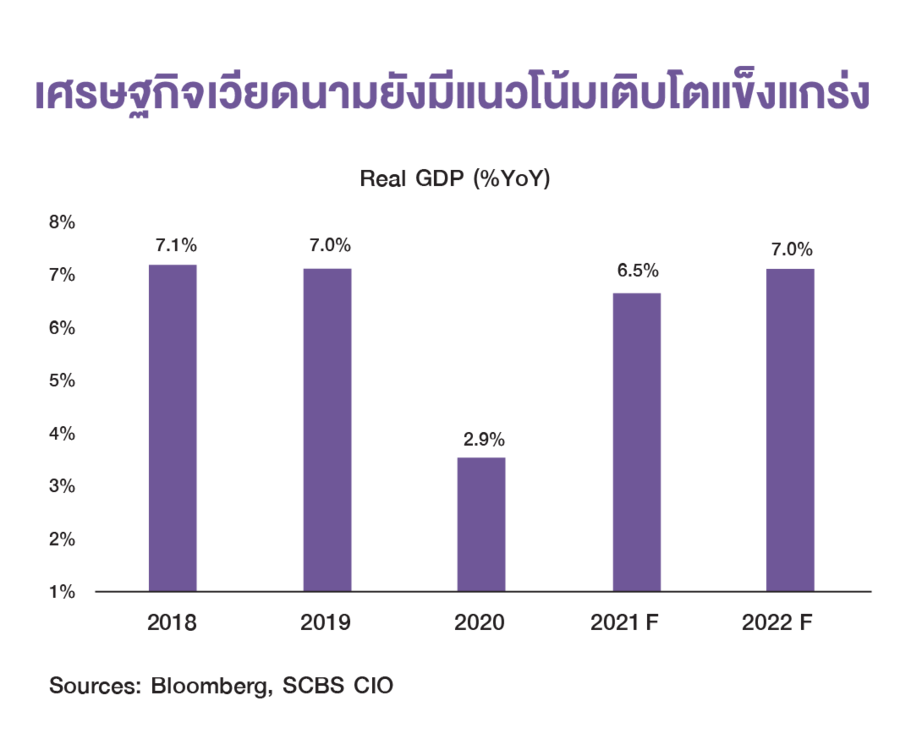

Despite the recent slowdown, Vietnam's economy in 2020 will expand by 2.9%, driven by exports and continued economic recovery.

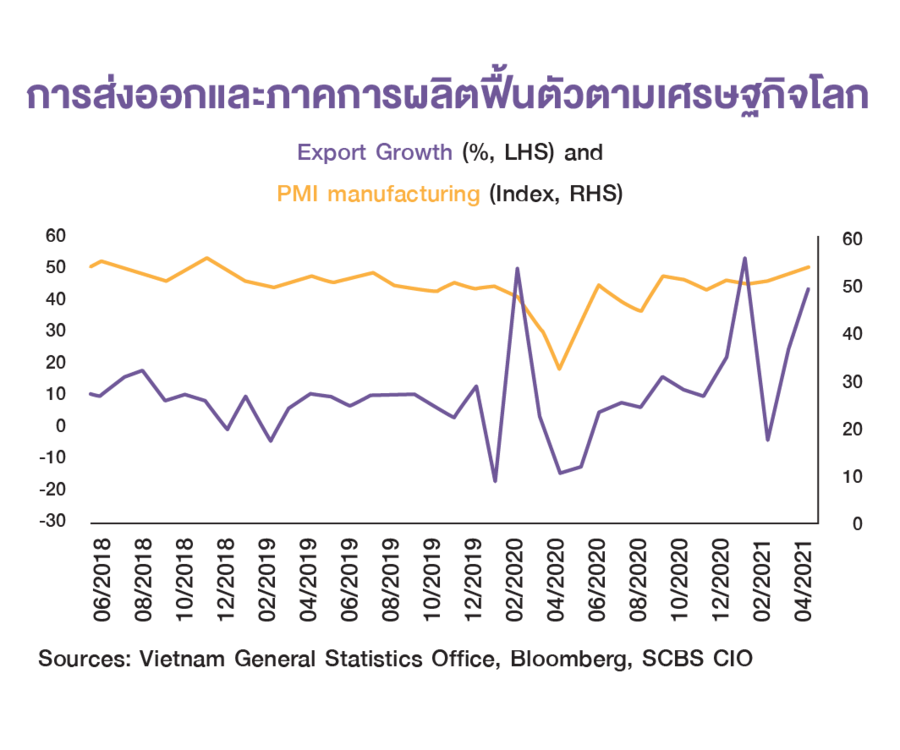

- Suffering from the global economic contraction in 2020 because of the pandemic, the economy slowed down and ended up with a growth of 2.9% YoY, compared to 7.0% in 2019. However, despite its shrinking economy Vietnam has been less affected by COVID-19 and has recovered faster than other countries in the region, with the export sector (7.0% growth YOY) as the main engine backing the economy. This was due to an acceleration in demand for work-from-home-related products, especially computers and electrical appliances, and spare parts, which are among the nation’s main export products.

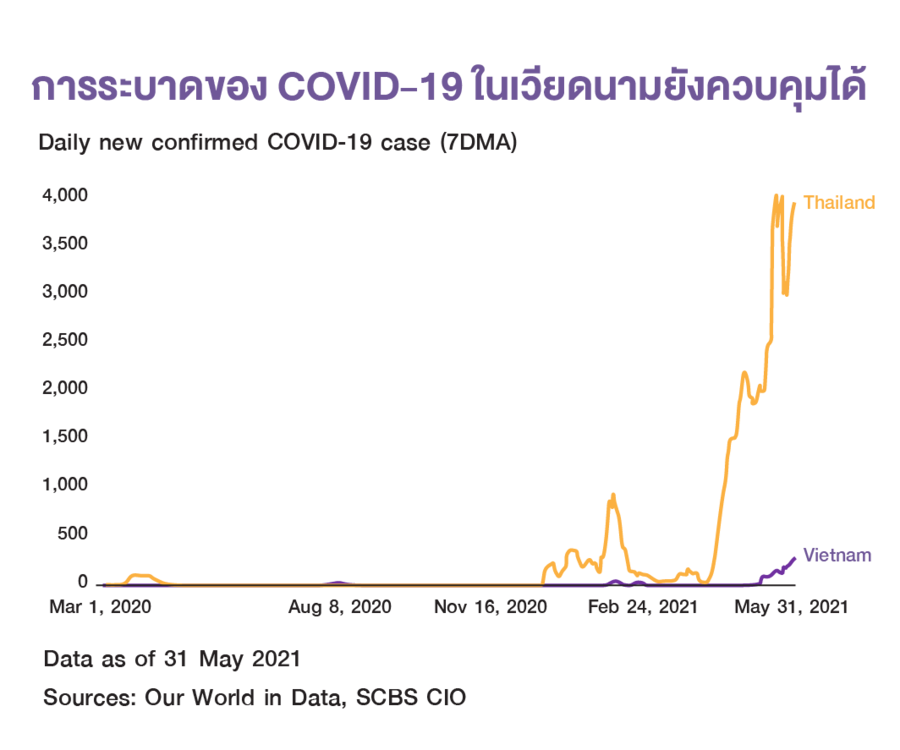

- The government's success in controlling the COVID-19 outbreak and boosting the economy, and rapid and effective measures to contain several waves of outbreaks in the country, have enabled the country to emerge with fewer impacts to its domestic economy compared to other countries in the region. In addition, the central bank issued various measures in an attempt to support the economy, such as reducing the policy interest rate (refinancing rate) from 6.0 % to a record low of 4.0%, debt restructuring, and providing soft loans to affected business sectors.

The economy is likely to continue to rebound in 2021-22F, led by exports and domestic demand. SCBS CIO estimates that the Vietnamese economy will grow 6.5%/7.0% in 2021/22F, compared to 2.9% in 2020, based on the following factors:

- The export sector is likely to resume continuously. In addition to the main export products that are growing in accordance with global demand, export markets in the three major groups, namely the United States, China, and Europe, have demonstrated clear economic recovery prospects for 2021-22. Trade agreements entered into with Vietnam’s main trading partners will be another factor further driving trade trends and foreign direct investment, which has shown a tendency to rebound further. The growth of exports in the first four months by 28.3% YoY has relieved Vietnam from accusations of being a currency manipulator, decreasing the risk of Vietnamese goods being targeted with US tax barriers.

- Vietnam’s success in containing COVID-19 has resulted in consumer and investor confidence remaining at a manageable level. Despite a fourth wave of the pandemic, vaccination progress toward achieving herd immunity may have to wait until mid-2022. However, the number of those infected and the duration of the outbreak are not particularly worrying, limiting consumer confidence, as reflected in the growth of retail sales of 10.7% YoY in the first four months of 2021.

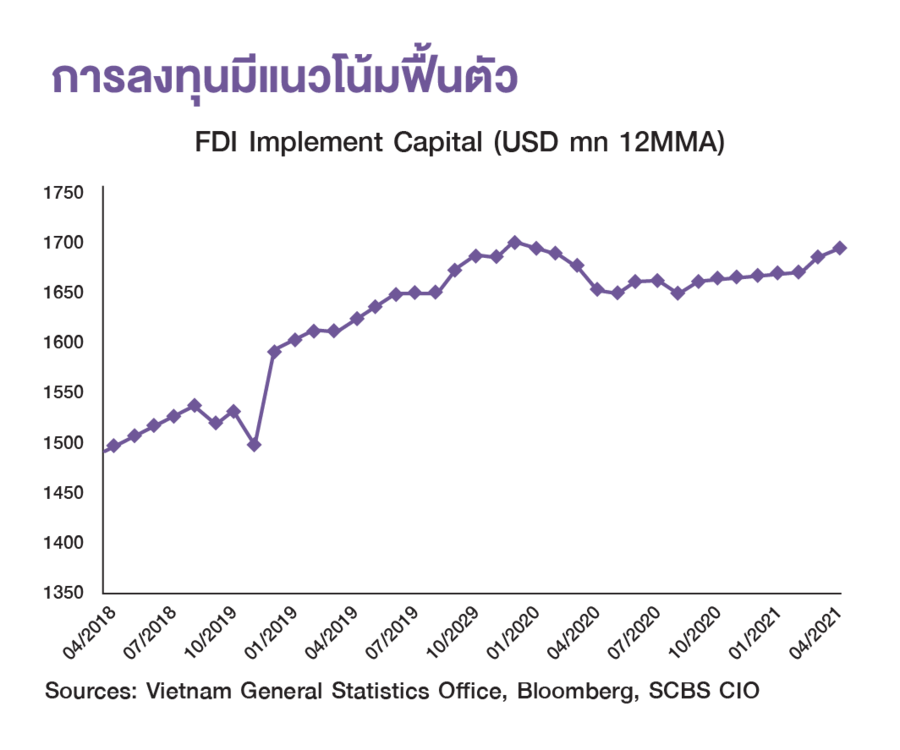

- Investment has also shown signs of recovery. Apart from the contained COVID-19 situation, recuperating exports, and lower interest rates, the government also passed a new investment law shortening the legal process for more convenience and taking effect in January 2021. These factors will help registered foreign direct investment recover even further, on top of 17.8% YoY growth in 1Q21. The growth of government investment by 34.5% YoY in 2020, partly in infrastructure such as building expressways connecting big cities, reflects the progress of Vietnam's infrastructural investment, which will help the construction business grow even further.

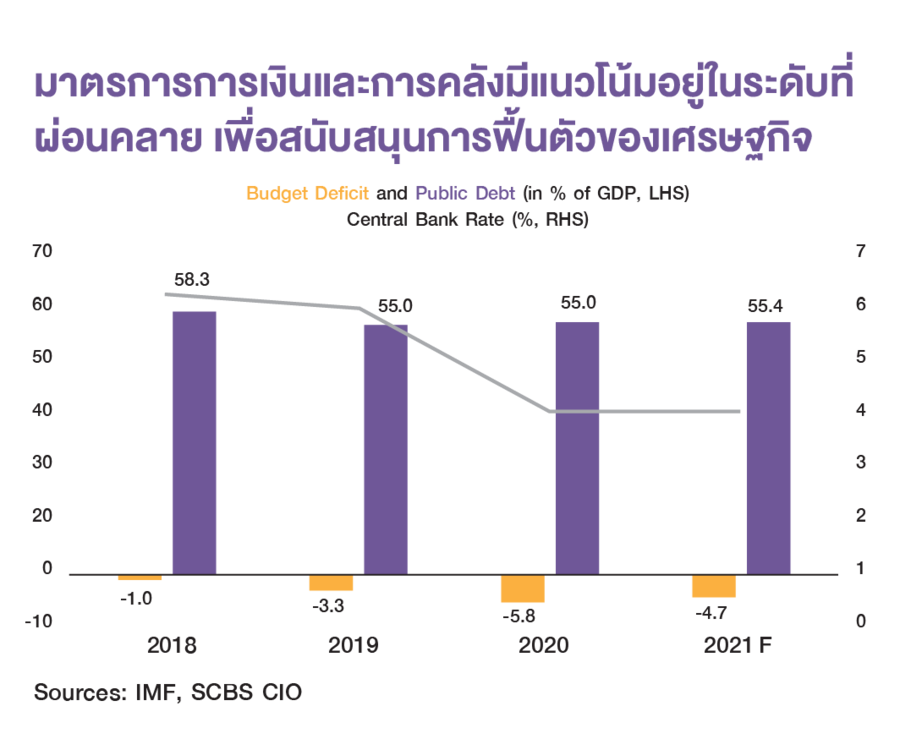

- Monetary and fiscal measures tend to be at an accommodative level to support economic recovery. In terms of monetary policy, it is unlikely that the State Bank of Vietnam will cut the policy rate further now that the economy has begun to recover. While inflation started to pick up in 2021, (The Bloomberg consensus expects headline inflation to rise to 3.4%/3.7% in 2021/22 from 3.2% in 2020), it remains below the State Bank of Vietnam’s (SBV) target of 4.0%. SBV is likely to keep its refinancing rate at 4.0% until mid-2022, an all-time low level.

- Regarding fiscal policy, the government continues to be able to stimulate the economy. In 2020, massive fiscal measures accounting for a budget deficit of 5.8% of GDP were implemented to support the economy. However, the public debt-to-GDP level is still relatively low, compared to the pre-COVID-19 crisis level (55.4% from 55.0% in 2020, according to Asian Development Bank). This would allow fiscal space for the Vietnamese government to boost the economy going forward if negative factors were to arise and affect the economy.

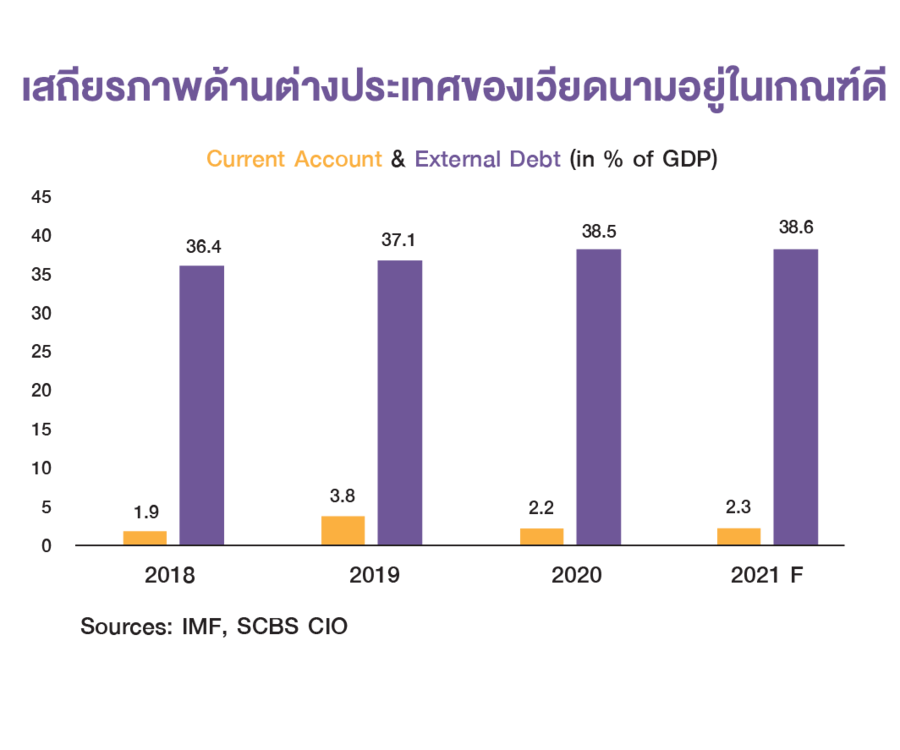

- External stability is positive, and the nation has a continuous current account surplus. The last current account deficit was in 2017 and the economy has been in surplus ever since. In 2021, the International Monetary Fund (IMF) expects a current account surplus of 2.3% of GDP, continuing from 2.2% of GDP in 2020, with external debt remaining low. At the end of 2020, the external debt-to-GDP stood at 38.5%, not much higher than the 36.7% figure for Thailand. The IMF expects external debt to GDP at 38.6% in 2021 with sufficient international reserves of USD 94.8 billion at the end of 2020, accounting for 3.7 times the average monthly import value, well above the benchmark of 3.0. External stability of emerging markets will be a key issue for 2H21 whereby it is likely that the US Federal Reserve (Fed) will begin to signal its consideration of reducing bond purchases, known as QE tapering. Countries with external stability are likely to be less affected by QE tapering, such as capital outflows from stock and bond markets, including currency depreciation.

- Credit rating agencies' confidence in Vietnam has increased. In early April, Fitch Ratings maintained Vietnam's credit rating at BB but revised its outlook from stable to positive to reflect the economy and fiscal sector, including the surplus current account and the continued increase in international reserves. In March, Moody's maintained the nation’s credit rating at Ba3, but revised its outlook from negative to positive, mainly due to a stable fiscal position despite the COVID-19 crisis and an improving outlook for Vietnam's economic growth potential.

- In terms of risk factors, despite considerable progress for Vietnam's economic outlook, certain risk factors may lead to a slower-than-expected recovery comprising: (1) the recent resurgence of COVID-19 in two provinces (Bac Ning and Bac Giang), which house industrial estates near Hanoi, resulting in the government announcing a lockdown in the areas and hastening the vaccination of workers in the industrial estates; (2) a delay in widespread COVID-19 vaccination, which may affect reopening for foreign tourists, FDI recovery, and domestic demand; (3) a significant faster-than-expected acceleration of inflation, forcing the central bank to raise interest rates sooner and more than expected; (4) significant outflow of foreign currencies due to concern over QE tapering; and (5) delays in infrastructure investments.

Slightly Positive view on the Stock Exchange: Continued earnings growth keeps valuation attractive relative to the past and regional peers.

SCBS CIO has maintained a positive view on the Vietnamese stock market due to (1) continued economic recovery, including monetary and fiscal policies remaining at an easing level; (2) The earnings growth of listed companies has helped valuation of the Vietnamese stock market avoid becoming too tight compared to the past and to regional stock markets; and (3) liquidity in the system remains high from government injections and the return of foreign investment in both direct investment and stock market investment. It is believed that the Vietnamese stock market is one of the dominant markets in the Emerging/Frontier markets group.

Continued economic recovery and accommodative monetary and fiscal policies

- As mentioned earlier, Vietnam's economy in 2020 slowed down somewhat but has yet to shrink. This should have less of an effect on the employment and business sector, known as scarring effects, compared to other countries in the region.

- Easing financial conditions has helped support continued recovery. In addition to low policy interest rates until at least 2022, government bond yields remain low. The SBV is also targeting continued accommodative loan growth at about 12% and may adjust its loan growth target during the year. This rate is close to the actual loan growth rate of 12.1% in 2020 and 13.7% in 2019. Moreover, eased credit classification and provisioning measures were also renewed, allowing banks to continue lending and borrowers to have access to loans during the ongoing impacts of the COVID-19 pandemic.

- In addition, future recovery will still be supported by easing monetary and fiscal policies. Vietnam’s strong external stability in recent years should keep any impacts from the Fed's QE tapering more manageable compared to other frontier markets.

The strong earnings growth of listed companies has helped the valuation of the Vietnamese stock market, remaining at less tight levels compared to the past and making it more appealing compared to other regional stock markets.

- Since the beginning of the year (until May 31), the Vietnam Stock Market Index (VN Index) has increased by more than 20.3%, becoming one of the frontier/emerging markets providing the highest returns. However, earnings growth of listed companies in the VN Index for 2021/2022 is expected at 41.7% / 21.5% (versus -3.1% in 2020. ) and would bring the stock market's 12-month forward P/E ratio to 14.9x, close to the five-year average of 14.3x and the 12-month forward P/E and 24-month forward P/E of countries in the region such as Thailand (18x and 19.2x), the Philippines (16.7x and 18.5x), and Indonesia (16.7x and 18.1x), making the market an interesting valuation.

- Most recently, listed companies' profits in 1Q20 have seen a gain of +90.61% YoY (versus +21.59% YoY in 4Q20 and -1.02% for the full year 2020), reflecting a continued recovery trend. In 1Q21, business segments with outstanding profit growth consisted of finance and banking, oil and gas, materials, consumer products, and power and water segments. Profits for the real estate segment dropped slightly, while earnings for the transportation segment declined considerably following the slow recovery of airlines. We believe that an accelerating economic recovery and support from government measures could allow the profit growth of listed companies in Vietnam to continue.

Liquidity in the system remains high from government liquidity injections and the rebound of foreign direct investment and stock market investment

- Foreign direct investment and net buy from foreign investors are promoting a recovery of the bottom line.

- FDI in 2020 slowed down from COVID-19 impacts on the global and Vietnamese economies, including travel restrictions. These factors led to a -61.7% decline in FDI in 2020 compared to 2019. However, 1Q21 FDI numbers signaled that the bottom line is over due to a strong recovery in Vietnam's export sector and the advantages of trade agreements with major trading partners. It is believed that Vietnam will be one of the ASEAN regions attracting FDI in the coming years.

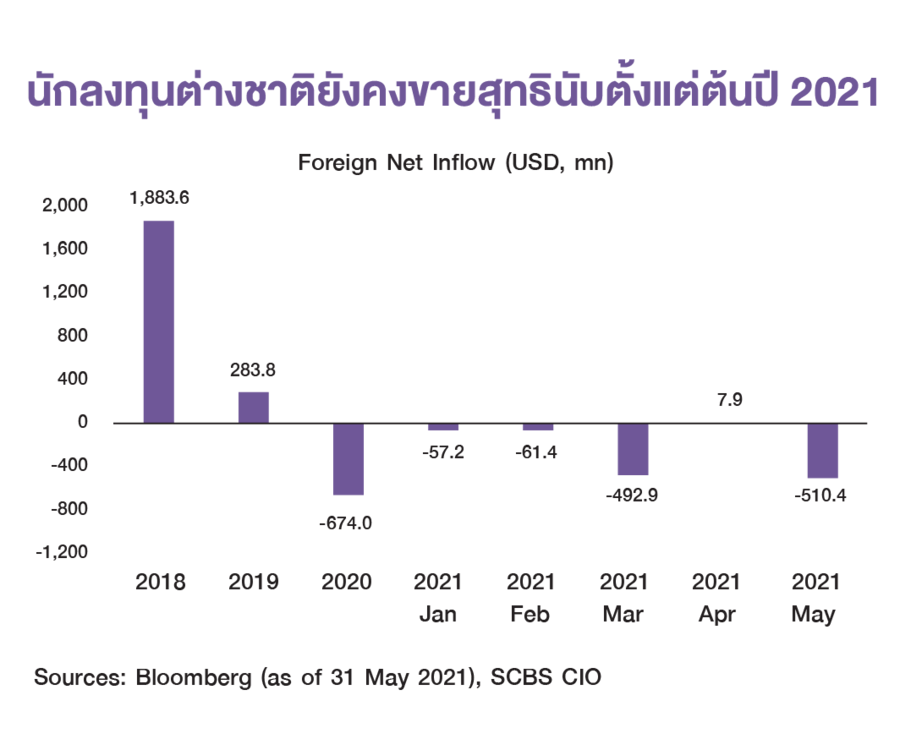

- Foreign investment in Vietnam has shown net sales for six consecutive months (October 2020 – March 2021, totaling USD 1.2 billion). In April, foreign investors started to return with a net buy in the stock market worth USD 7.9 million. However, in May, foreign investors returned to a net sale again, worth USD 510.4 million.

During 1Q21, the market saw a significant increase in participation by retail investors to 2.98 million accounts (25% YoY). In April 2021, the average daily turnover in all three Vietnamese stock markets increased to USD 888 million, an 18.8% rise compared to March 2021, with the turnover of retail investors accounting for 91.2% of total turnover.

- The dramatic increase in retail investor’s trading volume would be a risk issue if trading is driven by high leverage margins. According to the latest data, most securities firms have not had a worryingly high leverage ratio. Under the rules of the State Securities Commission of Vietnam, securities firms are allowed a margin trading limit of 200% of equity. According to data from Principal Asset Management as of the end of 1Q21, the top 25 Vietnamese securities firms with the highest margin trading to equity have reported limits of between 42%-188%, with the majority controlling this ratio to remain at about 170%.

Authors:

- Dr. Kampol Adireksombat - Deputy Managing Director, Chief Investment Office, SCB Securities Company Limited

- Ms. Kesri Ayuttaka, CFP® - Assistant Managing Director, Chief Investment Office, SCB Securities Company Limited

- Chaturapat Thanabutr - Manager, Chief Investment Office, SCB Securities Company Limited