RELATED LINKS

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Success Story

- From mothership strategy to landmark SCB share swap deal for SCBX

- Personal Banking

- ...

- From mothership strategy to landmark SCB share swap deal for SCBX

From mothership strategy to landmark SCB share swap deal for SCBX

02-03-2022

Manop Sangiambut, Senior Executive Vice President & Chief Financial Officer of SCB X PCL, was interviewed on The Standard Wealth's Morning Wealth program about the background to the tender offer swapping SCB shares for SCB X shares and the process for listing the new SCB X shares on the SET.

“Since SCB revealed its SCB X mothership strategy some five months ago, a major part of SCB's transition has been focused on a share swap. This involves reorganizing SCB's current operations, with banking being the core business, to the new SCB X as a mothership. SCB X shares will be listed on the SET once the share swap process is completed, replacing SCB shares. This means SCB X can expand and build new enterprises in completely unexplored areas, all thanks to the new organizational structure. It will eventually bring returns twice as much as previously. SCB X will build new, high-growth, high-yield enterprises outside of the bank's framework. SCB X 's banking operations will continue to be its primary focus, growing in line with the economy.

There are three things SCB Shareholders should know before converting shares

First, share conversion. SCB shareholders' shares will be converted to SCB X shares at a 1:1 ratio, meaning one SCB share will be converted to one SCB X share. There will be no monetary payout. If the total number of shareholders represents less than 90% of the entire number of shareholders, the conversion will be canceled. We feel that 90% is a reasonable number that accurately reflects the intention of all shareholders. Following this, SCB X will continue to trade under the SCB ticker symbol, but the securities will be represented by SCB X , not SCB.

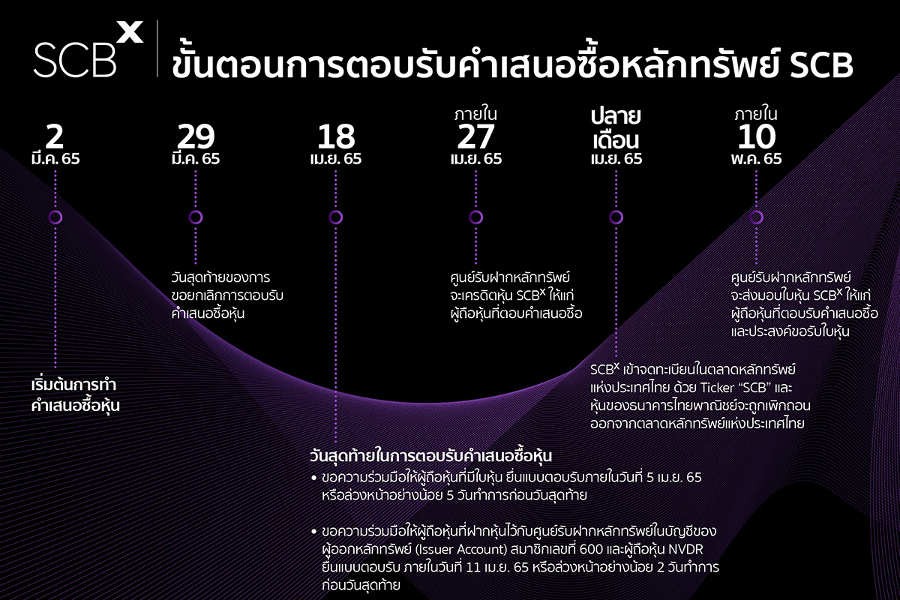

Second, the tender offer period. The tender offer will begin on 2 March 2022 when trading starts. Shareholders and investors have until 18 April 2022 or 30 business days to submit an acceptance form for the share swap, at which point the conversion procedure will begin. SCB X shares will begin trading on the SET for the first time on April 28. As a result, shareholders and investors should take action early, as SCB shareholders have been advised of the approach. We believe that by implementing a new strategy and structure centered on SCB X as the mothership, we will be able to generate significant business value. If successful, it will produce a market cap of more than one trillion baht within the next 3-5 years, more than doubling today’s value.

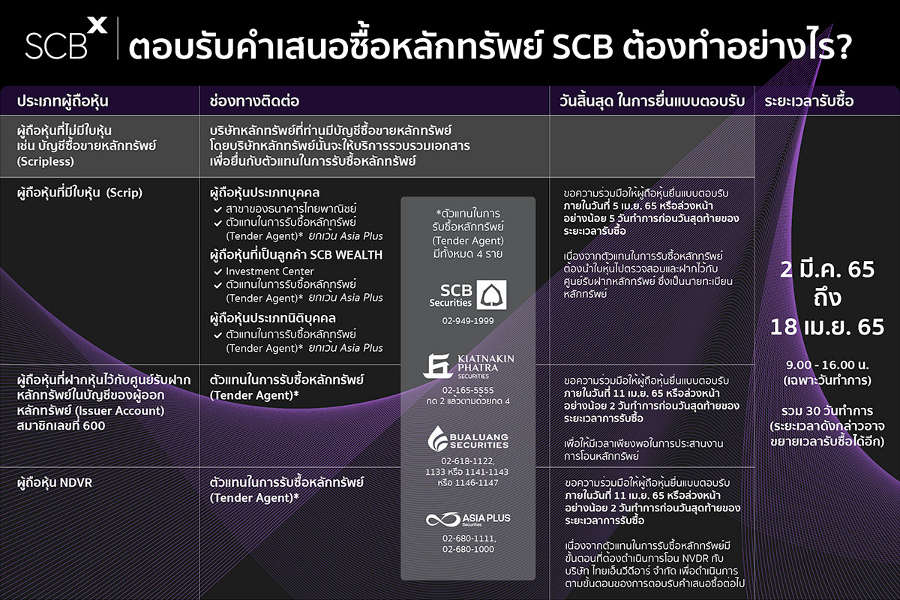

Third, the process. Within a few days, investors will receive a tender offer letter for newly issued securities, a Tender Offer Acceptance Form for SCB Shares, and a Subscription Form for Newly Issued Ordinary Shares of SCB X by mail. Shareholders without paper share certificates (Scripless) can complete the acceptance form and submit required documents at the securities company with which they maintain a stock trading account, or to one of four designated Tender Agents, namely:

1) SCB Securities Co., Ltd. (SCBS)

2) Bualuang Securities Co., Ltd. (BLS)

3) Kiatnakin Phatra Securities PCL (KKPS)

4) Asia Plus Securities Co., Ltd. (ASP)

Shareholders with paper share certificates (Scrip) can bring their acceptance form together with their share certificates to contact their securities company, stockbroker, or branches of Siam Commercial Bank and complete the process before April 5, 2022.

Shareholders holding paper share certificates or scrip may bring their acceptance form and share certificates to their securities business, stockbroker, or Siam Commercial Bank branch to finish the process before April 5, 2022. Purchasers of SCB shares between 2 March and 18 April 2022 will also be required to complete the conversion process. They will not, however, receive a tender offer letter. Shareholders may obtain documents from SCB's website or from any of the four securities brokers listed above, or by calling the SCB Call Center at 02-777-7777.

*** However, shareholders who do not submit a share swap acceptance form will not become SCB X shareholders.

What is the benefit of converting SCB shares to SCB X ? If not, what will happen?

A: SCB shareholders who do not convert their shares will remain SCB stockholders but will miss out on future growth gains. The SCB X Group's long-term aim is to at least double its enterprise value. The critical aspect is that your share certificates will have zero liquidity. While the banking industry can develop in unison with economic conditions and retain value, equities gain their value from fundamentals and liquidity. If liquidity is lost, the securities' value will also be disrupted. Additionally, their current shares will be ineligible for trading on the stock exchange. If the shares change hands and there is a profit involved, shareholders will be required to pay capital gains taxes. Finally, if shareholders want to hold SCB shares, they can convert the shares to SCB X , as SCB is part of the group and investors can enjoy opportunities to grow together with new business groups.”

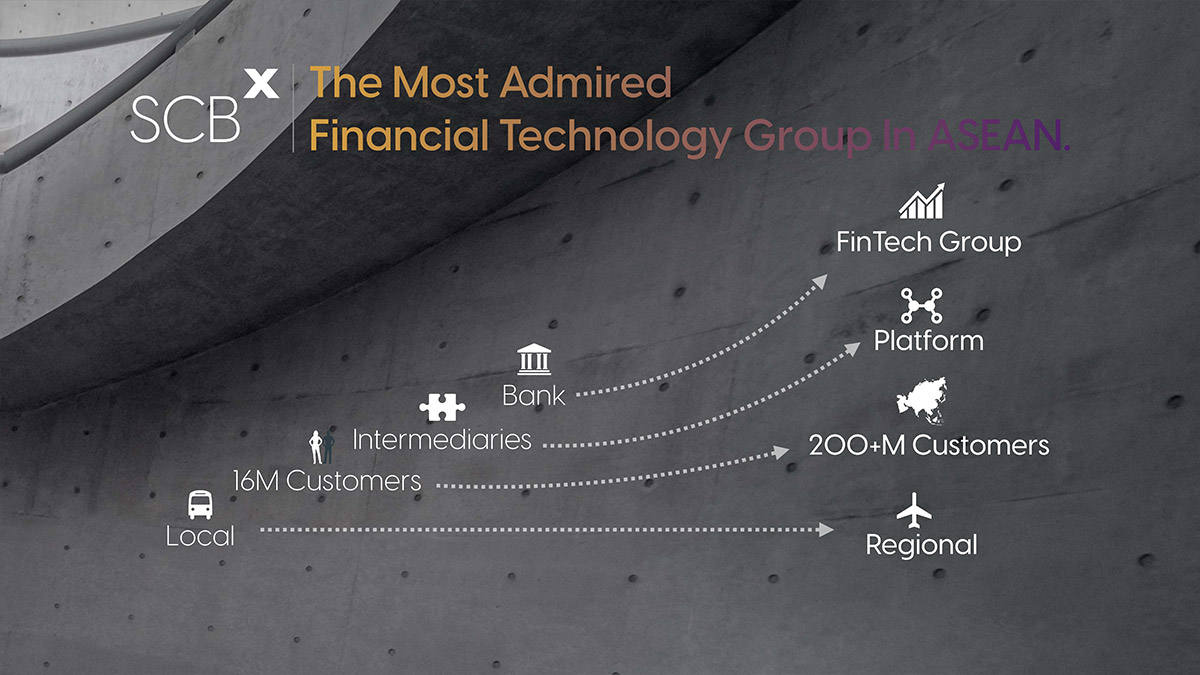

“The SCB X mothership will create long-term growth and become The Most Admired Fintech group in ASEAN.”

After the reorganization, what are SCB X 's goals?

A: On the day we unveiled our SCBX mothership plan, we introduced fourteen new businesses and subsidiaries. Several of these are new firms, while others have been spun off from our existing banking business. The concept of establishing new businesses within the banking group has existed for some time. We believe, however, that the new organization will spur growth even further. When looking ahead 12-18 months, some of those new companies have begun setting targets and developing company plans. Apart from those fourteen enterprises, there will be new ventures, joint ventures, and mergers both locally and internationally in the region, all in line with the ambition of becoming the Most Admired Fintech Group in ASEAN with a market capitalization exceeding one trillion baht in the long term.

Why are SCB shares not automatically converted?

A: The procedure must comply with Securities and Exchange Commission (SEC) guidelines, and shareholders have the right to express their intentions. We have established a requirement of at least 90% of shareholders expressing an interest to convert their shares. We want to respect the rights of shareholders.

Will shareholders be able to trade SCB shares between 2 March and 18 April 2022?

A: If shareholders submit documents confirming their intent to convert, the shares will be removed from the market. Liquidity will decline until the new securities begin trading on the market on 28 April. However, liquidity will eventually return and improve.

This shareholding reorganization procedure will assist the SCB Group in many ways, including increasing the potential and flexibility of business growth, as well as increasing the clarity of the group's business operations in order to fully expand and develop new future enterprises. There will be a clear separation between governance and business risk management, which will improve the SCB group's overall business operations. Additionally, it will enable SCB X to generate more returns on the operations of the businesses spun off to SCB X , including future new businesses in high-growth industries.

Learn more about the conversion of shares at www.scb.co.th/th/scbx.html

Source: Interview with Manop Sangiambut, Senior Executive Vice President & Chief Financial Officer of SCB X PCL on The Standard Wealth's Morning Wealth on March 2, 2022