I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Salary Man

- Salary man must pay attention Before you buy a house

- Personal Banking

- ...

- Salary man must pay attention Before you buy a house

Salary man must pay attention Before you buy a house

21-08-2020

Believe that having a home that answers the needs is probably the dream of many people. However, having a house that is too big may cause financial problems in the future. If there is no thorough consideration This article would like to present you with an important checklist that salarymen should pay attention to. Before deciding to buy a house as follows

1. Calculate how much you can afford to buy a house

This first step is an important step. Because the house is considered a large asset with high value. And most of the time, we must get a loan from the bank to buy a house. Which, of course, must be followed by debt and having to pay the debt for a period of at least 15 - 30 years. Therefore, it is very important to assess your ability to pay by installments. Which we will be able to calculate the ability to buy a home loan as follows:

- The ability to pay off any type of loan is no more than 40% of your monthly income. If we have no burden to pay anything Can pay the house up to 40% of the salary. For example, if we have a salary of 30,000 baht and have no burden to pay anything, will be able to pay for the house up to 12,000 baht per month. But if there are other installments such as car loan, student loan payment Assuming that there is a debt repayment obligation of 5,000 baht per month, it means that the ability to pay off the home debt per month will be only 7,000 baht.

- Reasons not to pay off debts of more than 40% of the monthly income. In order to have enough money left for other expenses. And have savings left to keep liquid and save for the future

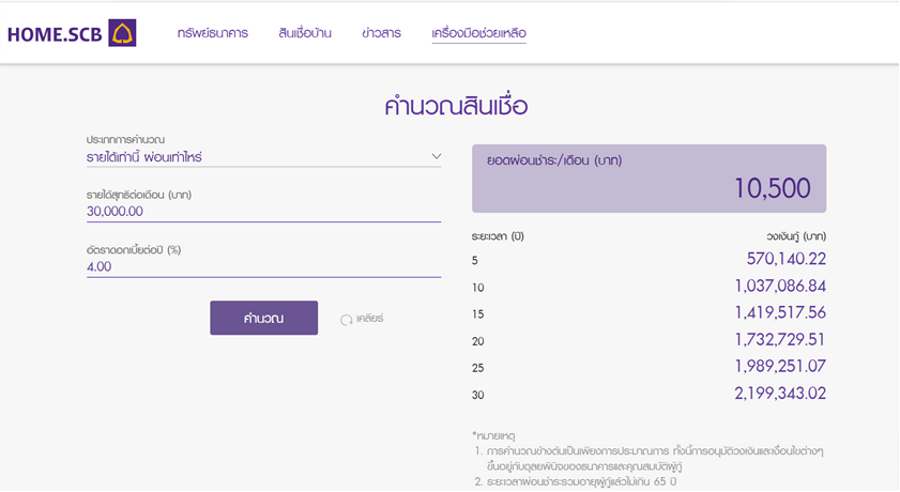

เมื่อเรารู้ความสามารถในการผ่อนชำระของตัวเอง ก็จะพอประเมินได้ว่าจะสามารถขอกู้ซื้อบ้านได้ที่วงเงินประมาณเท่าไหร่ ซึ่งสามารถใช้เว็บไซต์ของธนาคาร (เช่น https://asset.home.scb/calculate ) เป็นตัวช่วยในการคำนวณได้ โดยตัวเลขที่ต้องใส่คือ รายได้สุทธิต่อเดือน และอัตราดอกเบี้ยเงินกู้ต่อปี (ขอข้อมูลได้จากธนาคารที่เราต้องการขอสินเชื่อ) จะทำให้เราทราบจำนวนเงินที่ต้องผ่อนชำระต่อเดือน และวงเงินกู้โดยประมาณตามระยะเวลาที่เราต้องการผ่อนได้ ตามตัวอย่าง ดังนี้

2. Choose the right house In the right budget

From the example of the calculation in item 1, it will be enough to assess that If we have a 30-year installment period, the loan amount will be approximately 2.2 million baht. Therefore, we should look for a house that has a price close to the credit limit that can be borrowed. If you want a house whose value is higher than your loanable limit It may be necessary to collect some of the money first. Or consider joint borrowers. In addition, there may be other expenses. In addition to home mortgages such as insurance, mortgage, transfer, home decoration, common fees, be sure to calculate these expenses thoroughly. And prepare enough money.

3. Study the loan conditions well and comparing loan interest rates, various expenses Related

The next step is to contact your bank for a home loan. Each bank has different conditions. Should ask for detailed documents to study first to compare banks with interesting terms. And know the conditions that must be considered before applying for a loan. If buying a house from the project, some projects will have coordinated with banks that are partners. Resulting in a special interest rate loan and various promotions.

4. Prepare documents for loan application

When complete information is obtained and get the bank that you like. It is time to prepare documents for the loan. With important documents that must be prepared, such as a copy of an ID card Original house registration and a copy Bank statements for the past 6 months, salary slips for the past 6 months, salary certificate. In the case of independent contractors, must have supporting documents for receiving money from the employing company, evidence of withholding tax or evidence of personal income tax filing (To show the origin and certainty of income) Copy of a marriage certificate (If a marriage is registered) and a copy of other accounts.

5. Save money for the first down payment

As mentioned in item 2, if the house purchased has a value higher than the loan amount. Or in some cases where the bank does not lend the full amount. In addition, relevant expenses must be prepared. We may have to save a lump sum as a down payment and prepare for various expenses. Which should have a cost estimate and save money to be ready before deciding to buy a house.

Starting to save money for down payments and other expenses to buy a house can be done by try saving money to equal the debt that must be paid each month. To test whether the debt can be paid or not. For example, from the calculation in item 1, the monthly payment amount is 10,500 baht, you must try to save 10,500 baht per month to be the lump sum required. And keep saving until you get the desired lump sum. If able to save this money without any financial problems means that when we borrow the house and must pay off the house, will have the ability to pay back through.

But if there is a lack of liquidity problems, we will take another look at the borrowing capacity and the installment. In order to modify the house size or find other suitable solutions. For example, earn more money, find someone to borrow, or to find other securities for additional guarantees.

Even though the mortgage is a long-term financial burden but if we have a good plan. Both in terms of financial readiness, choosing a house to suit your needs Various information surveys, and make good decisions. Including inspection, find a source of loan that allows us to pay off the house without difficulty. Having a dream home that answers your needs isn't out of reach.

Nipapun Poonsateansup , CFP®, ACC

Independent Financial Planner Writer and speaker

Related Product Or Service

MORTGAGES

SCB Home Loans

Because life starts at home. SCB is ready to help you reach for your dream.