I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

คำค้นหาที่แนะนำ

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

ข้อแนะนำในการค้นหา

- ตรวจสอบความถูกต้องของข้อความ

- ตรวจสอบภาษาที่ใช้ในการพิมพ์

- เปลี่ยนคำใหม่ กรณีไม่พบผลการค้นหา

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Retirement Plan

- 5 Effective Retirement Plans

- Personal Banking

- ...

- 5 Effective Retirement Plans

5 Effective Retirement Plans

13-05-2021

Many people enjoy spending money in their teenage or working years without preparing for retirement or never think about the age limit for working. Once we stop earning a salary, where can we get money to spend during retirement? Most people forget to set retirement plans because they think it’s too soon to do that or there’s still plenty of time. When they realize planning, they’ll probably be close to the elderly or retirement age. We suggest that you start retirement plans as quickly as possible. Let’s find out the keys to effective planning.

5 Steps of retirement plans are as follows:

Step 1: Determine retirement age

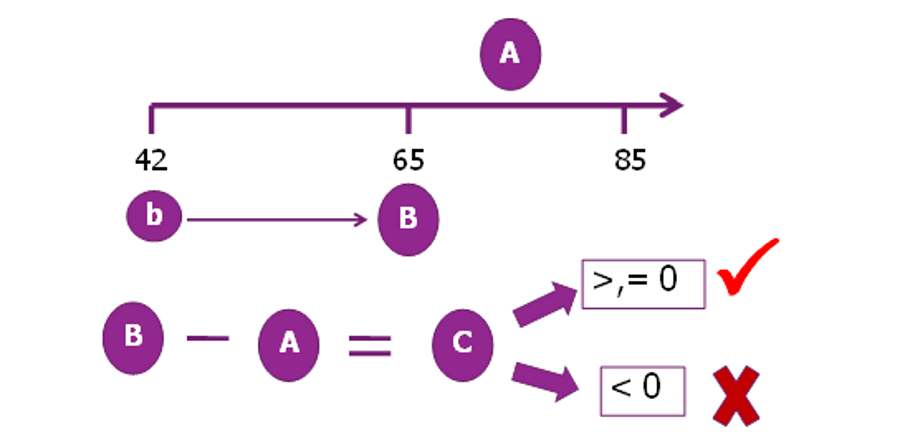

Refer to the above diagram, A wants to retire at the age of 65 and he’s now 42 years. We can evaluate that A has 23 years to work and save money to prepare for a personal retirement fund.

Step 2: Estimate post-retirement period

Refer to the above diagram, A predicts that he’ll pass away at the age of 85 so he’ll have time to spend money over the post-retirement for 20 years. In summary, A will have another 23 years to work and save money to use after retirement until 20 years.

Step 3: Estimate expenses after retirement

The need to spend money after the retirement period depends on the individual lifestyle. If we live a luxurious life, we may have to prepare a big amount of money or estimate from our current expenses (excluding any installment payment as we should have no debt after retirement) on monthly basis and then calculate by age after retirement. This sum of money is A money as seen in the diagram. The calculation is below.

Suppose A wants to spend 20,000 baht per month after retirement or 240,000 baht a year and will need to use this sum of money for 20 years. We’ll calculate with no concern about inflation. A retirement fund that A needs (A money) will be 240,000 x 20 = 4,800,000 baht. This calculation roughly shows minimum money.

How much money we should plan for retirement? Be reminded about the impact of inflation as it’s an important factor (very dangerous) that devalues our money every day.

Think about the day when A will retire about 23 years from now. How much is the true value of 20,000 baht per month at that time? The Rule of Thumb to estimate the inflation result is every 20 years, inflation will reduce to half of our buying power. That means if we want to spend 20,000 baht per month after retirement, we need to have 40,000 baht a month to survive as much as 20,000 baht in the next 20 years. In other words, the buying power of 40,000 baht per month in 20 years will be equal to 20,000 baht per month. Thus, the amount of 48,000 baht that we want, will become 9,600,000 baht.

Here is the Calculation Table of money to be spent after retirement, excluding the result of inflation.

Monthly expenses after retirement (baht) | Number of years after retirement | |||

10 years | 15 years | 20 years | 25 years | |

10,000 | 1,200,000 | 1,800,000 | 2,400,000 | 3,000,000 |

20,000 | 2,400,000 | 3,600,000 | 4,800,000 | 6,000,000 |

30,000 | 3,600,000 | 5,400,000 | 7,200,000 | 9,000,000 |

40,000 | 4,800,000 | 7,200,000 | 9,600,000 | 12,000,000 |

50,000 | 6,000,000 | 9,000,000 | 12,000,000 | 15,000,000 |

To combine the result of inflation, take the numbers in the table to multiply by 2, the number you get will be close to the money you need for the retirement period.

Step 4: Estimate all sources of money preparing for retirement.

For example, income from the Social Security Fund, Government Pension Fund, Retirement Mutual Fund, Investment Income, and Insurance. Evaluate all those sources of money whether they meet your needs. Diagram B is the value of money as of today. We need to estimate compensation that we expect to gain from each source and calculate that all money will satisfy our needs, and that’s B. And then we will compare B with A. If B is more than A, we will retire happily. But if B is less than A, we can’t retire as we need more savings as much as money we lack.

To see a clear picture, we’ll return to A’s retirement plan. From Step 3, A must-have retirement fund at 4,800,000 baht. If A hasn’t prepared for retirement, that means A still lacks retirement money at 4,800,000 baht.

Step 5: Current savings and investment plans.

According to the expense and income estimation after retirement, we’ll know how much more savings we need so that we can set a proper plan. Refer to Step 4, we know that A still needs 4,800,000 baht and he has 23 years left for work (equal to 276 months). If A has no financial investment, he needs more savings for retirement at 17,392 baht per month (= 4,800,000/276).

We can continue setting plans to consider how we can save more, increase income, or reduce expenses, or grow our savings, to achieve our retirement plan.

As the calculation of retirement funds including the result of inflation, and results of other investments are complicated, we may need calculation supports as shown on the website of The Stock Exchange of Thailand. (https://www.set.or.th/project/caltools/www/html/retirement.html)

In summary, the earlier you start setting the retirement plan, the better. “Keep saving as fast as you can” to allow good time to grow your money for the wealth of your life.

By: Nipapun Poonsateansup CFP®, ACC

Independent Finance Planner and Public Speaker