I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Home & Car

- 10-3-10 Savings Formula for Owning a Dream Home

- Personal Banking

- ...

- 10-3-10 Savings Formula for Owning a Dream Home

10-3-10 Savings Formula for Owning a Dream Home

05-06-2021

In the current situation where people are spending more time in housing and need space for activities in accommodation, detached houses are a hot trend among people who want to own a home. When it comes to the money that will be used to buy a house most people think of applying for a home equity loan from a bank. However, there may be some limitations in applying for a loan that may prevent us from obtaining a 100% loan, so having some savings will make it easier for you to own your dream home.

Why is savings important?

General principles for the approval of a bank's home loan will look primarily from the income and burden of the loan applicant whether they will be able to pay off the desired house or not. For example, a house price of 1 million baht, 30-year installments, 6,000 baht per month, the income level should be 12,000 baht per month. If the house is priced at 2 million, installments for 30 years, 12,000 baht per month, the income threshold should be 24,000 baht/month and there are no other burdens. However, saving has become an important help in owning a dream home for 3 reasons:

1) Income is not up to the limit to be able to borrow up to 100%: For example, Somchai wants to buy a house for 2 million baht but has a salary of 20,000 baht. Somchai will not be able to borrow 100% of the 2-million-baht limit. If Somchai had savings, he would use this money to pay for a house. And for the money that is still lacking, apply for a loan from the bank. If Somchai had no savings at all and was unable to find a co-borrower. He must look at houses that are less expensive in the amount that Somchai can borrow 100%.

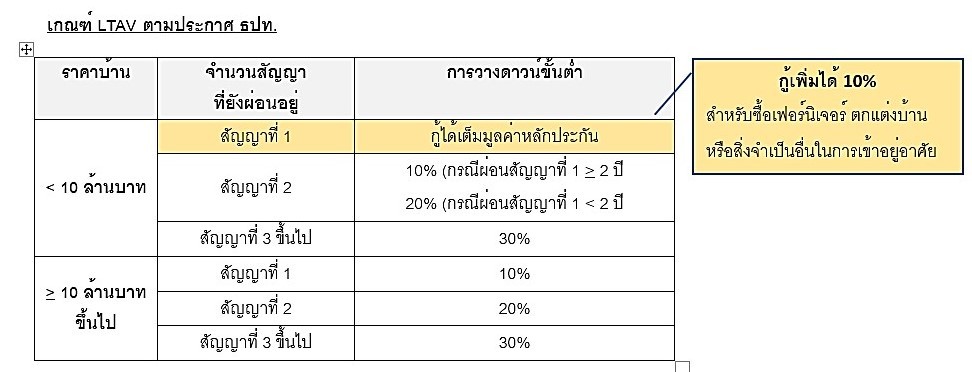

2) The case at house that want to buy is not the first house, from the Loan To Value (LTV)* measure. The Bank of Thailand enforces that commercial banks will issue home loans, stipulating that buying a house for not more than 10 million baht if it's not the first home down payment required. If the first home has been paid for more than 2 years, a down payment of 10% of the purchase price will be made. But the first home payment is less than 2 years, a 20% down payment is required. In the case of a house price of 10 million baht or more If you want to buy it for the first time, you must put down payment. Even if the income is enough to borrow the full amount of 100%. The first house put down 10% of the house price, the second house put down 20%, the third house put down 30%. The savings are involved in buying a house because of the LTV measure.

3) To buy a house in addition to the money to pay for the house, there are also other additional costs. arising from the purchase of a house. Both before purchase, such as expenses on the transfer date, mortgage, and after purchase, home decoration, furniture, electrical appliances, etc., must have a lump sum to spend.

From the above three conditions, Savings will play an important part in buying a home for many people. People who do not need to have savings before buying a house will be the case that the monthly income reaches the threshold to be able to borrow 100% and the house purchased as the first home with a price of not more than 10 million baht. Because the LTV measure allows people to buy a first home with a price of not more than 10 million, requesting a full credit of 100%, and if the income reaches the threshold, they can borrow an additional 10% to pay for decorating homes as well.

2 questions checklist whether we need to have savings before buying a house or not.

Even if we have income that meets the criteria to apply for a home loan from the bank 100%. But with the LTV measure, we may have to have savings to put down payment to buy a house. Which can check to see if the down payment is required or not. If you must save, how much should you save? Check with the following two questions:

1. If more than 10 million baht, t here must be savings for a down payment of 10%, 20%, 30% for the first house, 2nd house, 3rd house, respectively.

If not more than 10 million baht, look at question number 2.

2. Is it your first home?

o The first home no need to have savings to put down payment.

o If the first house and already paid installment > 2 years, a 10% down payment are required.

o If the first house and already paid installment < 2 years, a 20% down payment is required.

Savings Formula 10-3-10

When you have the intention of getting your dream home Then it comes to setting goals for saving money, where numbers 10-3-10 are the amount of savings that should be had before buying a house, divided into

· The first 10 is a down payment, which is 10% of the house price you want to buy.

· 3 is other expenses that must be used, such as transfer fees, mortgage fees, common expenses, representing 3% of the house price, if some projects have a promotion to pay for this expense This money is considered a reserve fund.

· The last 10 is 10% of the house price for decoration, buy furniture home electrical appliances may be depending on the conditions of each person.

As a rough idea, the 10-3-10 formula suggests saving 23% of the home's value. Assuming to buy a house for 2 million, there should be savings of about 460,000 baht to set a goal for savings. If less than this is required, it will be counted as saving for future use.

No savings, does it affect your home loan?

Even considering the loan does not primarily look at the savings of the customers. But with the LTV measure, there must be a lump sum of money to put down payment to buy a house. In the case that savings are not involved is having income reaching the 100% loan limit and being in the LTV criterion, which is the first home purchase worth less than 10 million baht. However, it is advisable to have some savings. Which saving money doesn't have to be a lot. It is important to do it regularly to create a discipline of saving. This discipline will help the bank to ensure that we will have the discipline to pay off the big burden on the house all along.

* Official name: Mortgage and other mortgage-related regulatory regulations

Source: Interview with Khun Kanokwan Jaisri, Executive Vice President Executive of Alternative Channel SCB on Facebook Live "Home Financial Clinic Clears all problems with houses" episode "How to save money to buy a house. without relying on fate” broadcast on Facebook Sansiri PLC on May 1, 2021