International Branch

SCB Ho Chi Minh City Branch

To make your overseas business uninterrupted SCB's international branch network is ready to support and provide services.

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

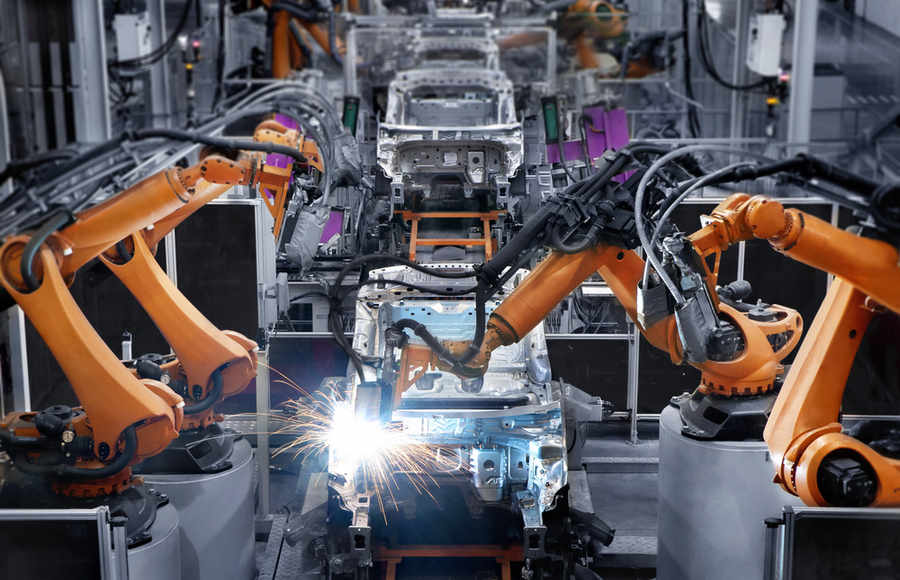

Vietnam’s growing automobile market presents export opportunities for Thai businesses

Vietnam is widely recognized for its soaring economic growth, making it appealing for investors from all over the world to relocate their production bases to the country, especially from Japan. This attractiveness is due to a variety of factors, including labor costs, increased labor efficiency in terms of labor quality and a suitable proportion of working-age workers, tax privileges, its shared border with China, one of the world's most important markets, and benefits gained from trade rifts between the United States and China.

As its economy expands, the proportion of the middle-class population has increased. Vietnamese people now enjoy higher incomes, a better quality of life, and opportunities for career growth. With a more stable status, they can spend more on high-priced products and luxury items. Vietnam has considered a high potential market and the number of cars is a good indicator of the Vietnamese people’s well-being. Car ownership is still low relative to its population, with a ratio of 23 cars per 1,000 inhabitants (data from BOT), compared to 227 cars per 1,000 inhabitants for Thailand, a major automobile exporter to Vietnam (data from the SCB EIC in 2017).

The Public Relations Department’s ASEAN News Information Center reported that in 2020, automobile sales in Vietnam stood at 283,983 units, a decline of just 7% amid the COVID-19 pandemic. Despite that figure, it is considered the region’s best performing vehicle market. At the beginning of 2021, Vietnam was recognized as the only ASEAN country to avoid falling into recession during the COVID-19 pandemic and has gained the status of an alternative production base to China.

The Ministry of Commerce’s Department of International Trade Promotion (DITP) reported that in the first nine months of 2021, the Vietnam Automobile Manufacturers Association (VAMA) recorded sales of 188,937 vehicles, an increase of 5% yoy. During April – August car sales declined continuously due to the COVID-19 situation, widespread within the country. When the situation improved, sales of VAMA members rebounded in September to 13,537 units, an increase of 52% compared to August, a time when car sales were the lowest since 2012. The increase was a sign of good growth, resulting in the growth of auto part exports from Thailand, which is one of Vietnam’s major trading partners.

The top three best-sellers in the first quarter of 2021 were:

1.

Hyundai Accent

with 4,804 units sold

Unveiling its latest model in late 2020, the Hyundai Accent is a B-size sedan. Auto import giant TC Motor assembles the new Hyundai Accent in Ninh Binh province. Vietnam has placed great importance on the development of the domestic automobile industry with several policies laid out to support entrepreneurs. This will help provide greater advantages for the domestic automobile industry, especially price competition.

2.

Mitsubishi Xpander

with 4,602 units sold

As of August 11, 2020, Mitsubishi Vietnam assembled its best-selling Xpander at a factory in Binh Duong Province, which went on sale in August 2020. The model is priced at about VND 30-40 million (or USD 1,300-1,720) lower than the imported version, prompting people to buy the domestic model.

3.

VinFast Fadil

with 4,148 units sold

The first Vietnamese car by VinFast, a subsidiary of diverse Vietnamese business conglomerate Vingroup which also owns real estate businesses, shopping centers, supermarkets, convenience stores, hotels, hospitals, schools, payment services, and mobile phone manufacturers. Being the first Vietnamese car manufacturer, the company planned an initial public offering (IPO) on the New York Stock Exchange for the past April, which was expected to raise USD 2 billion in funding. However, the listing has been delayed due to rigorous US inspection regulations. The company has also developed electric cars for sale in the US and European markets by 2022. VinFast’s continuous development in the Vietnamese car manufacturing industry has allowed it to enjoy government support in terms of zero tax privileges for the import of car parts, provided that the automaker has a minimum vehicle output of 8,500 units per year and 3,500 cars per year for each model, which will increase to 13,500 and 5,000 units, respectively, by the end of 2022.

The VinFast Fadil is a crossover style, prototyped after the Opel Karl Rocks with a mix of technology from BMW. Debuting in mid-2017, VinFast is still new to the Vietnamese market. In the beginning, it adopted nationalism to promote the brand and sales have climbed continuously. This effort was finally successful, with VinFast Fadil ranking number one in car sales in Vietnam by February 2021. However, considering car sales in Vietnam during February 2021 by the carmaker, VinFast ranked fourth behind Thaco-KIA, Hyundai, and Toyota.

While the automobile market in Vietnam has demonstrated promising growth, there are still challenges facing Thai entrepreneurs. Vietnam has focused on the development of its domestic automobile industry and has issued a number of policies to support its entrepreneurs. This will give the domestic automobile industry more advantages. As a result, exports of automobiles from Thailand to Vietnam in the future may encounter increasing price competition. As the car market in Vietnam has room for growth, there are still opportunities for Thai entrepreneurs, considering the percentage of car ownership is relatively low. Thai investors can take advantage by developing modern car products with advanced technologies such as self-driving technology or environmentally-friendly electric cars in response to the needs of today's consumers. Thailand is the center of an automobile manufacturing industry supporting its domestic market and exports in the ASEAN region. It is also an important partner in exporting finished cars to Vietnam. The fact that Vietnam has started to produce cars will be an opportunity for Thai investors to export auto parts to Vietnam.

Customers interested in doing business in CLMV or Great Mekong Subregion (GMS) countries (Cambodia, Laos, Myanmar, and Vietnam) can contact Siam Commercial Bank’s overseas branches that are ready to provide the services they need. For more information, please visit https://scb.co.th/en/corporate-banking/international-network.html

Information courtesy of the Siam Commercial Bank, Ho Chi Minh City Branch, Vietnam

Sources:

1.Manager Online. “อุตฯ ยานยนต์เวียดนามโตพุ่ง แม้นำเข้าจากไทยจะเพิ่มกว่า 46%”. https://mgronline.com/stockmarket/detail/9620000097532 (ค้นหาเมื่อ 29/4/21)

2.Vn.Express. “Vietnam market big enough for Japanese business ambitious: PM”. https://e.vnexpress.net/news/business/economy/vietnam-market-big-enough-for-japanese-business-ambitions-pm-4158587.html (Accessed 30/4/21)

3.BOT. “CLMV Weekly News Updates September 7-11,2020”. https://www.bot.or.th/Thai/AboutBOT/InternationalCooperation/Doc_CLMVNews/CLMV%20News%207%20-%2011%20Sep%202020.pdf (ค้นหาเมื่อ 30/4/21)

4. Positioning . “จับตา “VinFast” ผู้ผลิตรถยนต์รายใหญ่สุดของเวียดนาม จ่อเข้า “ระดมทุน” ในตลาดหุ้นสหรัฐฯ”. https://positioningmag.com/1327814 (ค้นหาเมื่อ 12/5/64)

5.SCB EIC “กลยุทธ์ฝ่าทางตัน อุตสาหกรรมยานยนต์ไทย”. https://www.scbeic.com/th/detail/product/3644 (ค้นหาเมื่อ 12/5/64)

6.DITP. “เวียดนามออกนโยบายส่งเสริมการผลิตและประกอบรถยนต์ในประเทศ”. https://www.ditp.go.th/contents_attach/643873/643873.pdf (ค้นหาเมื่อ 12/5/64)

7. ศูนย์ข้อมูลข่าวสารอาเซียน กรมประชาสัมพันธ์. “ยอดขายรถยนต์ในอาเซียน ปี 63 ลดลงกว่า 28% ยอดซื้อรถในอินโดฯ ลดลงกว่า 48%”. http://www.aseanthai.net/ewt_news.php?nid=11276&filename=index (ค้นหาเมื่อ 13/5/64)

8. VnEconomy. “Check out 3 good price car models coming to Vietnam”. https://vneconomy.vn/diem-mat-3-mau-xe-o-to-gia-tot-sap-ve-viet-nam.htm (Accessed 13/5/21)

9. Car Debuts. “ชาตินิยมได้ผลแล้ว! Vinfast สร้างประวัติศาสตร์เป็นครั้งแรก ดัน Fadil สู่อันดับ 1 ในด้านยอดขายที่ประเทศเวียดนาม”. https://cardebuts.com/2021/04/vietnam-best-selling-cars-sales-february-2021-vinfast-fadil-hatchback-no-1/ (13/5/64)

10. Thailand Automotive Institute. “ไทย-อินโดฯ ชิงเจ้าตลาดรถยนต์นำเข้าในเวียดนาม”. https://data.thaiauto.or.th/auto/auto-news/dailynews/9274-%E2%80%9C%E0%B9%84%E0%B8%97%E0%B8%A2-%E0%B8%AD%E0%B8%B4%E0%B8%99%E0%B9%82%E0%B8%94%E0%B8%AF%E2%80%9D-%E0%B8%8A%E0%B8%B4%E0%B8%87%E0%B9%80%E0%B8%88%E0%B9%89%E0%B8%B2%E0%B8%95%E0%B8%A5%E0%B8%B2%E0%B8%94%E0%B8%A3%E0%B8%96%E0%B8%A2%E0%B8%99%E0%B8%95%E0%B9%8C%E0%B8%99%E0%B8%B3%E0%B9%80%E0%B8%82%E0%B9%89%E0%B8%B2%E0%B9%83%E0%B8%99%E0%B9%80%E0%B8%A7%E0%B8%B5%E0%B8%A2%E0%B8%94%E0%B8%99%E0%B8%B2%E0%B8%A1.html (ค้นหาเมื่อ 17/5/64)

11. Vietnam Investment Review. “US IPO of VinFast could be delayed due to scrutiny over SPACW”. https://vir.com.vn/us-ipo-of-vinfast-could-be-delayed-due-to-scrutiny-over-spac-84494.html (Accessed 11/11/21)

12. กรุงเทพธุรกิจ. “สัญญาณบวกตลาดรถเวียดนาม ยอดขายพุ่ง “ฝ่าพิษ” โควิด”. https://www.bangkokbiznews.com/business/967316 (ค้นหาเมื่อ 12/11/64)

13. DITP. “ข่าวเด่นประจำสัปดาห์จากกรุงฮานอย ประเทศเวียดนาม”. file:///D:/Users/s62013/Downloads/752907.pdf (ค้นหาเมื่อ 12/11/64)