RELATED LINKS

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- BUSINESS MAKER

- Bicycle exports – An opportunity for Thai investors in Cambodia

- Personal Banking

- ...

- Bicycle exports – An opportunity for Thai investors in Cambodia

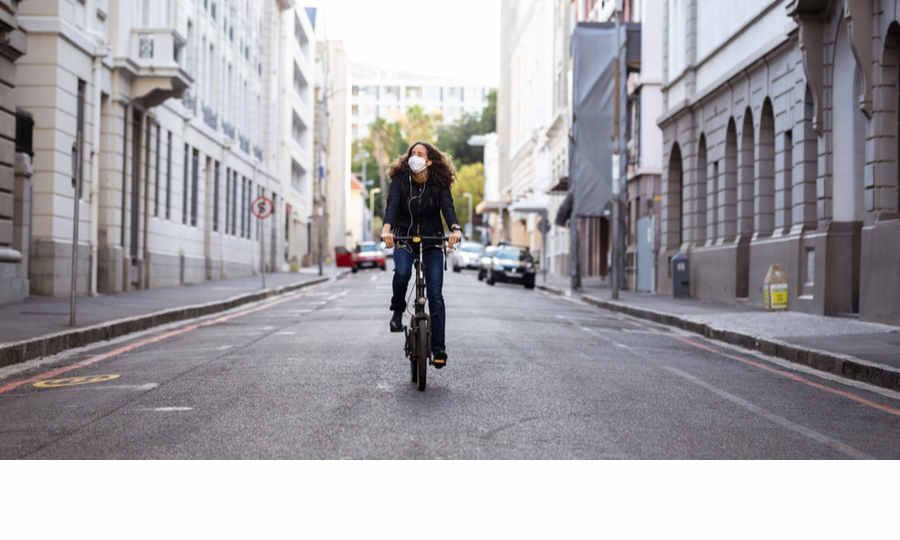

Bicycle exports – An opportunity for Thai investors in Cambodia

09-08-2021

A report by the Department of International Trade Promotion (DITP) issued in January 2021 revealed that Cambodia's bicycle exports in 2020 were worth US$ 527 million, an increase of 27% compared to 2019, driving Cambodia to become ASEAN’s number one bicycle exporter and the fifth largest bicycle exporter in the world. Important bicycle export markets include the United States, Germany, Sweden, Belgium, Canada, United Kingdom, Denmark, Australia, Austria, Netherlands, The Czech Republic, Italy, Colombia, Korea, and Spain. Meanwhile Cambodia's imports of bicycles totaled US$ 8.38 million, a decrease of 19.33% from the previous year, mainly from Japan, China, Taiwan, Vietnam, Thailand, and the United States. Currently, there are five bicycle manufacturers in Cambodia: A and J, Speedtech Industrial, Smart Tech, Xds Bicycle, and Evergrand Bicycle.

Cambodia emerged as a dominant player in the bicycle industry only a few years back. Despite such a recent beginning, the Khmer Times reported in September 2019 that Cambodia has been the largest bicycle manufacturer and distributor in the EU market since 2017, ahead of Taiwan. An important factor driving Cambodia as a destination for foreign investors such as China, the United States, and European countries is the tax privileges provided by the EU under its Everything But Arms scheme (EBA). Despite some of its products being removed from the tax incentive scheme for exports to the EU, bicycle products have remained on the exemption list.

The relatively recent worldwide popularity of bicycles has several causes, among them concerns over climate change, with most young consumers being environmentally and health-conscious. Social distancing practices to prevent the spread of the COVID-19 have also prompted people to avoid public transportation, and in the USA the pandemic has also forced most gyms to close, causing many Americans to shift to bicycles as a means of exercise. As a result of this trend, Thailand’s Knowledge Sharing Space Salika reported that in early 2020 bicycle products in the United States were in short supply. The most popular bicycle types are electric bikes, mountain bikes, BMX bikes, children’s bikes, and stationary bikes. Most bicycles sold in the USA are imported from Taiwan and China, both of which have invested in the bicycle manufacturing industry in Cambodia, sending Cambodia's bicycle exports to even further growth.

Despite having been delisted from the EU’s EBA tax privilege scheme in mid-2020, the United Kingdom has provided Cambodia with a Generalized System of Preference (GSP) exemption that will take effect from 2021. The UK is Cambodia's second most important trading partner after Germany. Moreover, on 12 October 2020, Cambodia signed a free trade agreement (FTA) with China, marking a great opportunity for Cambodia to strengthen the potential of the Cambodian workforce in various industries.

Cambodia's exports to the EU consisted mainly of clothing in the past, but bicycles are currently Cambodia’s second most important commodity exported to the EU and US. To fully take advantage of growing demand in the global market, Cambodia must increase the volume of its bicycle exports. However, such an effort will require further expertise and modern technology. This presents a good opportunity for Thai investors to bring its advancement in terms of workforce knowledge, technology, machines, and expertise to support the growing bicycle industry in Cambodia

In the long term, Cambodia is expected to produce and export a wider variety of products, embracing technology and knowledge from countries using Cambodia as a production base. Therefore, Thailand should help Cambodia adapt and upgrade its products to be of higher quality while creating uniqueness and diversity to maintain the international market

Customers interested in doing business in CLMV or Great Mekong Subregion (GMS) countries (Cambodia, Laos, Myanmar, and Vietnam) can contact Siam Commercial Bank’s overseas branches that are ready to provide the services you need. For more information, please visit https://www.scb.co.th/en/corporate-banking/international-network.html

Information courtesy of the Cambodian Commercial Bank (CCB)

References

1.DITP. “Fact Sheet - กัมพูชา ม.ค.64”. https://www.ditp.go.th/ditp_web61/article_sub_view.php?filename=contents_attach/722054/722054.pdf&title=722054&cate=947&d=0 (ค้นหาเมื่อ 2/3/64)

2. DITP. “กัมพูชาส่งออกจักรยานมากติดอันดับ 1 ใน 5 ของโลก”. https://www.ditp.go.th/ditp_web61/article_sub_view.php?filename=contents_attach/721683/721683.pdf&title=721683&cate=413&d=0 (ค้นหาเมื่อ 2/3/64)

3. Salika. “อานิสงส์โควิด-19 ยอดขายจักรยาน สหรัฐฯ พุ่งกระฉูด ขาดตลาด”. https://www.salika.co/2020/06/05/covid19-make-bicycle-order-in-usa/ (ค้นหาเมื่อ 5/3/64)

4.DITP . “สหราชอาณาจักรอนุมัติการให้สิทธิพิเศษทางการค้า GSP แก่กัมพูชา มีผลบังคับใช้ในปี 2564”. https://www.ditp.go.th/contents_attach/676648/676648.pdf (ค้นหาเมื่อ 5/3/64)

5. Khmer Times. “Kingdom to become a key manufacturing base for US bike firm”. https://www.khmertimeskh.com/639577/kingdom-to-become-a-key-manufacturing-base-for-us-bike-firm/ (Accessed 3/3/21)

6.Xinhuanet. “China, Cambodia sign bilateral free trade agreement”. http://www.xinhuanet.com/english/2020-10/12/c_139434727.htm (Accessed 5/3/21)