I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

ประกันเพราะอุ่นใจ ยิ้มได้ยามเกษียณ 90/1 (BN03)

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

empty

- empty

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Insurance

- Endowment Insurance

- Aom Khum Mung Khung

- Personal Banking

- ...

- Aom Khum Mung Khung

SAVING INSURANCE

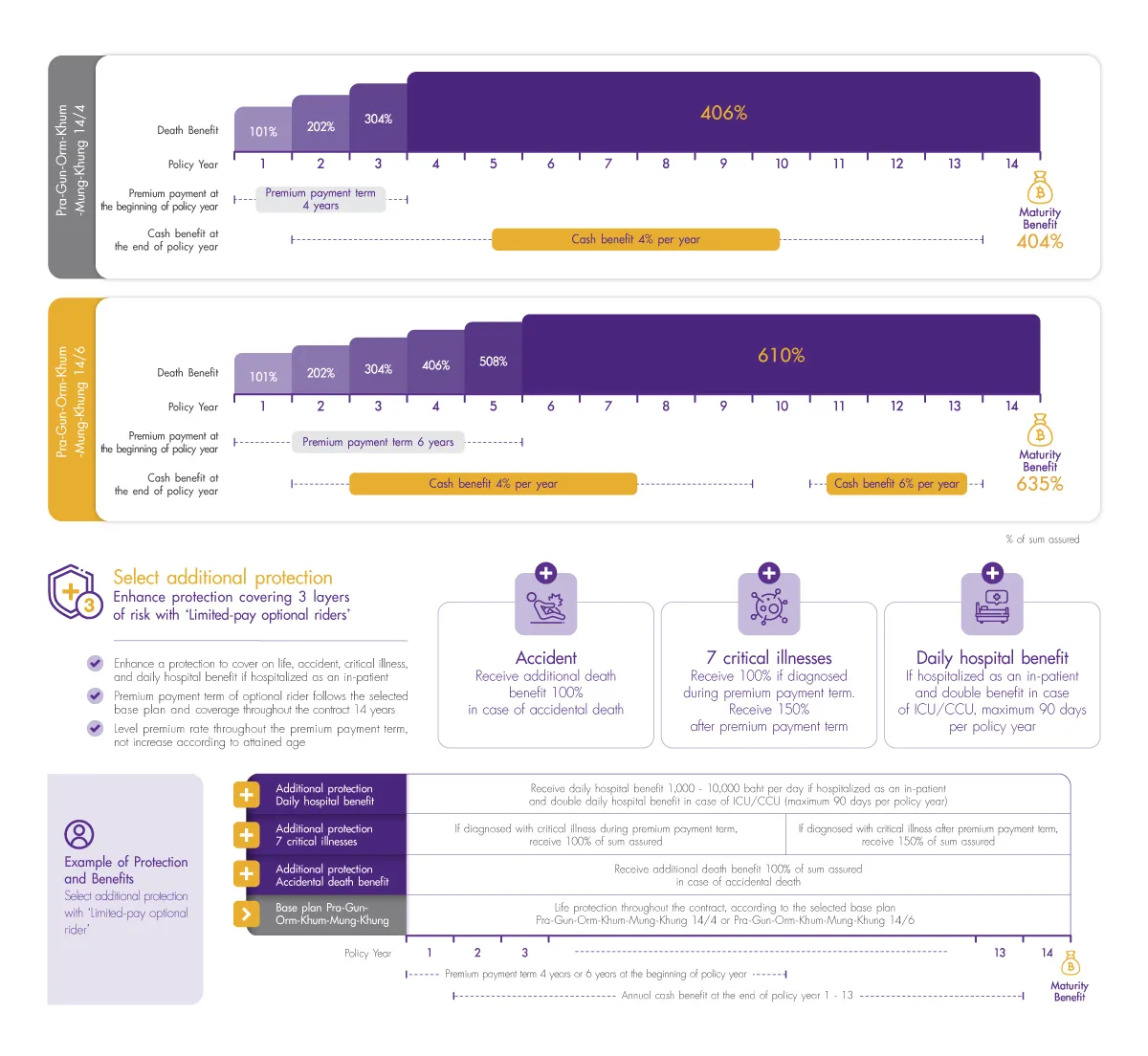

Orm-Khum-Mung-Khung 14/4 14/6

Take care of many more “what-ifs” in life as you desire

Highlights

A life insurance plan, annual cash benefit, optional riders i.e. accidental death benefit, 7 critical illnesses, and daily hospital benefit to help you manage and grow your reserves

A way to build and secure

A way to build and secure your financial planing with life protection throughout 14 years

Giving you a support

Giving you a support with a range of premium payment options 4 or 6 years.

Feel at ease

Feel at ease with annual guaranteed cash benefit at the end of policy year 1 - 13 and maturity benefit

Able to add rider

Able to add rider coverage i.e. accidental death benefit, 7 critical illnesses, and daily hospital benefit

Easy to apply

Easy to apply, no health check up and no health questions. Level premium rates and not increase according to attained age. Pay the premium according to your selected premium term (3 health questions for 7 critical illnesses rider and daily hospital benefit rider)

Insured by FWD Life Insurance Public Company Limited.

SCB is only an authorized broker.

Insurable guideline refer to Underwriting procedures of FWD Life Insurance Public Company Limited.

Buyers must understand the details of coverage and conditions before deciding to insure.

Qualification and Document Required

Pra-Gun-Orm-Khum-Mung-Khung 14/4 14/6 (Base Plan)

- Insurable age: 1 day - 80 years

- Coverage term : 14 years

- Premium payment term : Selectable 4 years or 6 years

- Minimum sum assured : 50,000 Baht

- Premium payment mode: Annually, Semi-annually, Quarterly and Monthly

Accidental death benefit rider

- Insurable age: 1 day - 70 years

- Premium payment term and coverage term follow the selected base plan

- Sum assured : Equal to sum assured of base plan but not exceed 10 MB

- No health check up and no health questions

7 critical illnesses rider

- Insurable age: 1 day - 70 years

- Premium payment term and coverage term follow the selected base plan

- Sum assured : Equal to sum assured of base plan but not exceed 5 MB

- No health check up, answer 3 health questions

- Waiting period 90 days

- 7 critical illness i.e. Invasive Cancer, Acute Heart Attack, Major Stroke, Chronic Kidney Failure, End-stage Liver disease/ Liver failure, Severe Chronic Obstructive Pulmonary Disease/ End-stage Lung disease, and Coma (According to the definition of critical illness in the insurance policy)

Daily hospital benefit rider

- Insurable age: 6 - 65 years

- Premium payment term and coverage term follow the selected base plan

- Daily hospital benefit plan : 1,000 – 10,000 baht per day

- No health check up, answer 3 health questions

- Waiting period according to the details in the insurance policy

Remark: Life insurance premium and Health insurance premium (if any) can be tax-deductible according to the Notification of the Director-General of the Revenue Department on Income Tax

Benefit and Protection