I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Insurance

- Health Insurance

- SCB Multi Care Multi Claims

- Personal Banking

- ...

- SCB Multi Care Multi Claims

Highlights

Multi Claims

of Critical Illnesses

Gets return all the premium paid

if no major critical illness claim

Waiver of premium

if first diagnosed with major critical illness

Recovery Service

during Major Critical Illness

The premium is fixed

throughout the contract

Can be tax deductible

according to the notification

Suitable for

The person who concerns on Critical Illness, the plan providing you to deal with Critical Illness

The person who concerns on Critical Illness, the plan providing you to deal with Critical Illness Those looking for something that value for money, gets return all premium paid at the time of maturity (if no major critical illness claim during the policy period)

Those looking for something that value for money, gets return all premium paid at the time of maturity (if no major critical illness claim during the policy period) Insurable age 1 day – 60 year (depend on premium payment period) Coverage period until 75 years

Insurable age 1 day – 60 year (depend on premium payment period) Coverage period until 75 years You can select premium payment term for 5, 10, 15, or 20 years

You can select premium payment term for 5, 10, 15, or 20 years

*(Beginner to Intermediate maximum 3 times*and Severe level 3 times *)

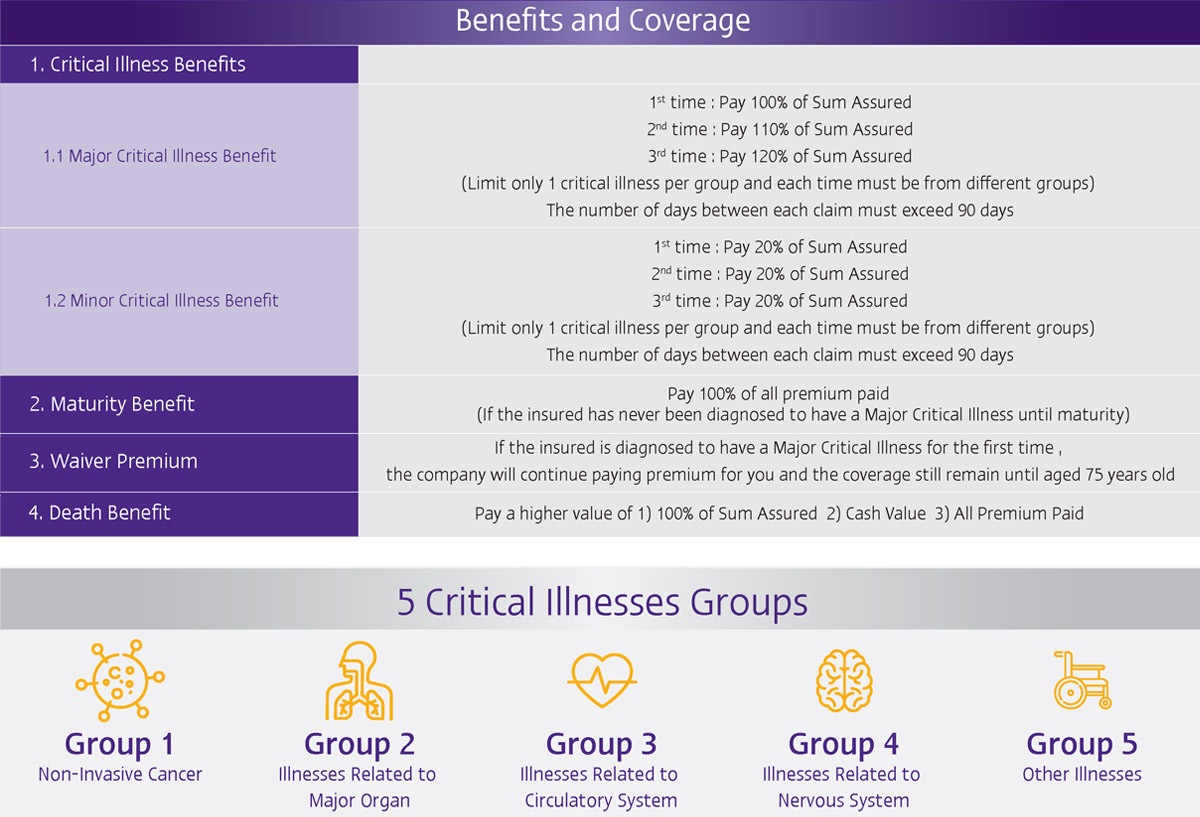

- Receive up to 3 lump sum payments* when detecting severe severe disease First time 100%

- 2nd time pay 110% 3rd time pay 120% of insurance amount

- Receive up to 3 times of sum assured* when detecting serious and moderate disease, 20% of the sum assured

Qualification and Document Required

Coverage

Qualification and Document Required

-

SCB Multi Care Multi Claims 75/5

- Eligible Age : 1 day – 60 Years old

- Policy Term : Until age 75 years old

- Minimum Sum Assured : 400,000 THB

- Maximum Sum Assured : 20,000,000 THB

- Premium Payment Mode : Annual, Semi-annual, Quarterly, Monthly mode

SCB Multi Care Multi Claims 75/10

- Eligible Age : 1 day – 55 Years old

- Policy Term : Until age 75 years old

- Minimum Sum Assured : 400,000 THB

- Maximum Sum Assured : 20,000,000 THB

- Premium Payment Mode : Annual, Semi-annual, Quarterly, Monthly mode

SCB Multi Care Multi Claims 75/15

- Eligible Age : 1 day – 50 Years old

- Policy Term : Until age 75 years old

- Minimum Sum Assured : 400,000 THB

- Maximum Sum Assured : 20,000,000 THB

- Premium Payment Mode : Annual, Semi-annual, Quarterly, Monthly mode

SCB Multi Care Multi Claims 75/20

- Eligible Age : 1 day – 45 Years old

- Policy Term : Until age 75 years old

- Minimum Sum Assured : 400,000 THB

- Maximum Sum Assured : 20,000,000 THB

- Premium Payment Mode : Annual, Semi-annual, Quarterly, Monthly mode

Coverage

SCB Multi Care Multi Claims 75/5

- Eligible Age : 1 day – 60 Years old

- Policy Term : Until age 75 years old

- Minimum Sum Assured : 400,000 THB

- Maximum Sum Assured : 20,000,000 THB

- Premium Payment Mode : Annual, Semi-annual, Quarterly, Monthly mode

SCB Multi Care Multi Claims 75/10

- Eligible Age : 1 day – 55 Years old

- Policy Term : Until age 75 years old

- Minimum Sum Assured : 400,000 THB

- Maximum Sum Assured : 20,000,000 THB

- Premium Payment Mode : Annual, Semi-annual, Quarterly, Monthly mode

SCB Multi Care Multi Claims 75/15

- Eligible Age : 1 day – 50 Years old

- Policy Term : Until age 75 years old

- Minimum Sum Assured : 400,000 THB

- Maximum Sum Assured : 20,000,000 THB

- Premium Payment Mode : Annual, Semi-annual, Quarterly, Monthly mode

SCB Multi Care Multi Claims 75/20

- Eligible Age : 1 day – 45 Years old

- Policy Term : Until age 75 years old

- Minimum Sum Assured : 400,000 THB

- Maximum Sum Assured : 20,000,000 THB

- Premium Payment Mode : Annual, Semi-annual, Quarterly, Monthly mode

- Insured by FWD Life Insurance Public Company Limited.

- SCB is only an authorized broker.

- Insurable guideline refer to Underwriting procedures of FWD Life Insurance Public Company Limited.

- Buyers must understand the details of coverage and conditions before deciding to insure.