I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- FAQ

- Insurance FAQs

- Personal Banking

- ...

- Insurance FAQs

Insurance

What is Unit Linked insurance?

Unit Linked is a life insurance product that offers both life protection and investment opportunites in mutual funds. The policy value is not guaranteed as the the policy value depends on the investment unit value which may be higher or lower based on the performance of mutual funds.

Which types of insurance are tax deduction?

- Ordinary life insurance: the life insurance policy must have at least 10-year coverage period and total life insurance actual premium paid can be tax deductible up to 100,000 Baht.

- Annuity life insurance: Actual premium paid in each year can be used for tax deduction more than ordinary life insurance up to 200,000 Baht but not exceeding 15% of income. However, when combined with all other retirement savings funds (such as Provident Funds, Government Pension Funds (GPF), Private School Teacher’s Welfare Fund, National Pension Fund, Retirement Mutual Funds (RMF), Super Savings Funds (SSF)) must not exceed 500,000 Baht.

- Health insurance premiums: Actual premium paid can be used for tax deduction up to 25,000 Baht, and when combined with life insurance premiums must not exceed 100,000 Baht.

What is “Waiting Period” in Health Insurance?

The Insured has the right to cancel the policy within the freelook period (15 days from the date of receiving it) which the Insured will receive a refund of any premium paid after deducting the expense 500 Baht per policy and the actual medical check-up expense (if any). In the case of buying insurance via Telemarketing, the policy can be canceled within 30 days (freelook period) after receiving the policy and the Insured will receive a full refund of premium paid. All conditions can be found in the policy.

What is "Waiting Period" in Health Insurance?

The waiting period in health insurance refers to the period that the Company will not cover, and still unable to claim. No benefits will be paid for illnesses arising or treatments carried out during the waiting period. For example

- Health insurance and hospital income benefit, waiting period is 30 days for common illnesses and 120 days for some specific illnesses such as Tumors, Cataracts, Hemorrhoids, etc.

- Critical illness insurance, waiting period is 90 days

What are the principal types of life insurance?

There are 4 types of life insurance i.e.

1. Term life insurance: mostly are short coverage term, cheap premiums but high life protection

2. Whole life insurance: premium is higher than term life insurance but coverage term is longer up to age 90 or 99. Premium payment period varies and depends on each insurance plan.

3. Endowment insurance: This is the most popular type of insurance. It is a life insurance that pays the sum assured to the Insured either at the end of the contract period or upon the Insured's death.

4. Annuity insurance: This is a type of life insurance policy that the Company will pay fixed annuity payments to the Insured at regular intervals (e.g. by monthly) since the Insured retires or reachs the age of 55 or 60 years onwards, depending on the conditions in each insurance plan which the Insured selects.

Non Life insurance

What is Residential Fire Insurance policy?

A residential fire insurance policy provides coverage for damage caused by

1. Fires include forest fires, bushes, undergrowth, and forest burning to subdue areas.

2. Lightning (including damage to electrical appliances and electrical equipment caused by short circuits by lightning)

3. All kinds of explosions.

4. Danger of snatching and or collision of vehicles or animals such as elephants, horses, cattle, buffaloes etc.

- From collisions of various vehicles.

- Not the vehicle of insured.

5. Aircraft disaster and or objects falling from an aircraft.

- From a collision or a fall.

- Aircraft of items that fall from Aircraft.

- Aircraft shall include rockets and spacecraft.

6. Water damage caused by

- Accidental

- Leaking overflow

- Overflow of waterpipe, tank flows through the damage building

- Not included flood and broken waterpipe outside

Buy more perils.

1. Wind Storm

2. Hail

3. Smoke

4. Earthquake

5. Water Damage

6. Riot & Strike

7. Malicious Acts

8. Spontaneous Combustion (No Fire)

9. Spontaneous Combustion

10. Electrical Injury

What is Motor Insurance?

Motor insurance is the insurance for damage caused by using the car consists of damage to the car included damage caused by the vehicle to the life, body and properties of third parties and those who are passengers in the car.

How many types of Motor Insurance?

2 types such as :

1. Compulsory Motor Insurance is known as the Insurance Act.

2. Voluntary Motor Insurance (Type 1, 2, 3, 2+ and 3+)

What is the coverage of Compulsory Motor Insurance?

Coverage includes bodily injury to driver, passengers and third party from accident that the insured car involves in.

1. Medical Expenses Pay according to the actual treatment fee, up to 80,000 baht per person.

2. Permanent Disability or Total Permanent Disability have the coverage limit 200,000 – 500,000 baht per person (In case of Dismemberment, The coverage is in accordance with the policy conditions.)

3. In case of death will receive the compensation 500,000 baht per person.

4. Compensation in case of being an inpatient 200 baht per day. (not more than 20 days in total)

Coverage for initial damages : After an accident, the company will pay the claims as part of indemnity without waiting for proof of guilt (within 7 days). Claims payment include :

1. In the event of injury, the victim will receive compensation as medical expenses and expenses related to medical treatment as actually paid, not more than 30,000 baht per person.

2. Permanent Disability If there is an event that causes the casualty to suffer bodily damage to the extent of dismemberment or permanent disability The insurance company will pay the initial damage amount of 35,000 baht per person.

3. Death The statutory heirs of the casualty will be compensated for the funeral expenses and necessary expenses related to funeral arrangements in the amount of 35,000 baht/person.

4. Damaged in many cases combined, initial damage compensation shall not exceed 65,000 baht per person

Note : In the event that the victim is a driver and as an insured will be covered not more than the initial damage only

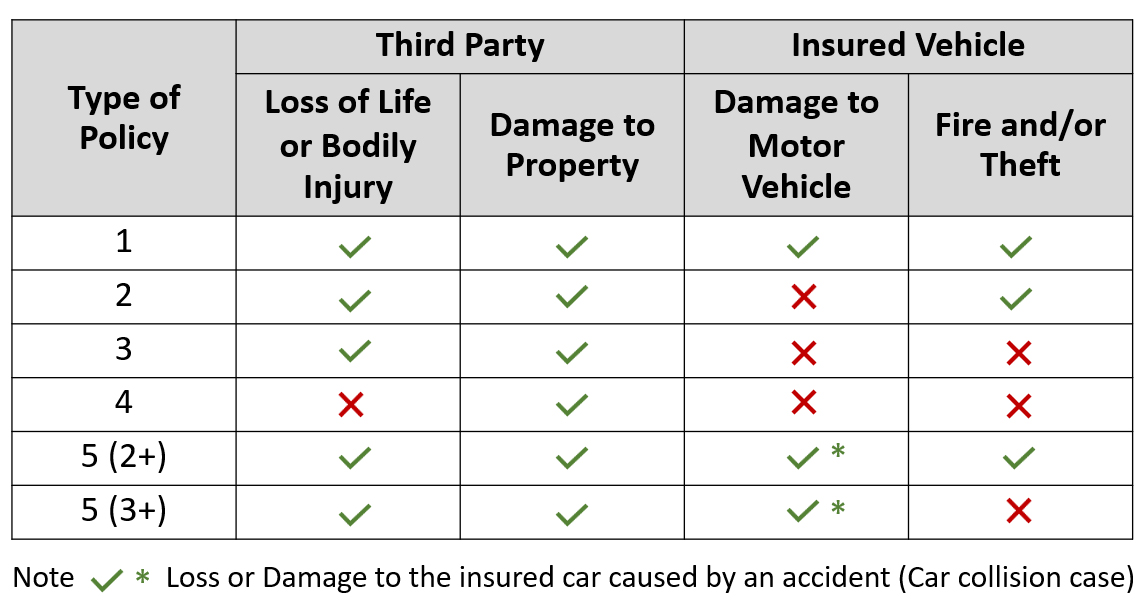

What’s the different in Motor Insurance Type 1, 2, 3, 4, 5 (2+) and 5 (3+) ?

Coverage Table Motor Voluntary Insurance