I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Corporate Banking

- Financial Markets

- Investment Solutions

- Corporate Banking

- ...

- Investment Solutions

Product Detail

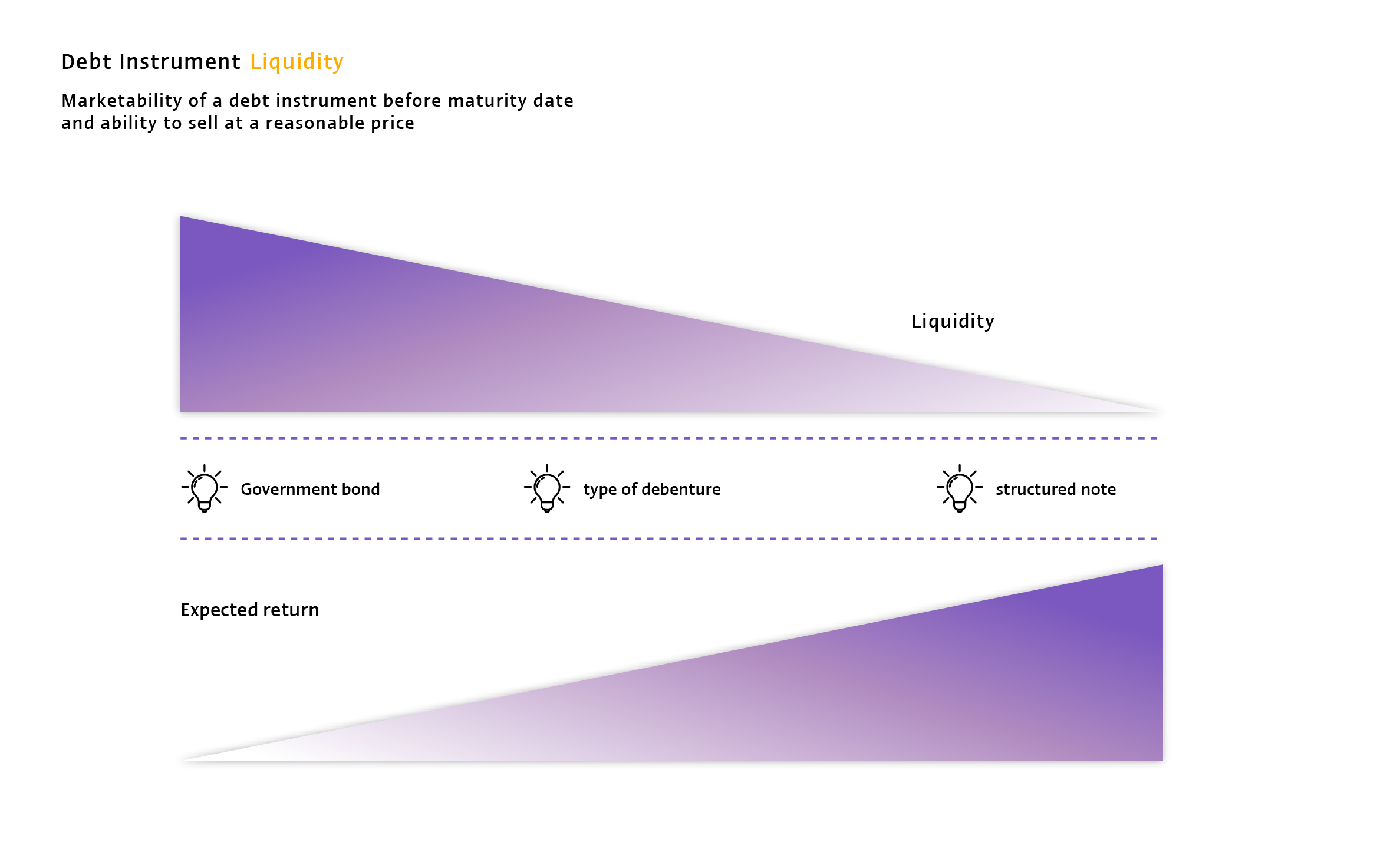

SCB offers debt instrument investment solutions for companies and investors suitable to their risk tolerance level to optimize liquidity management.

The Bank offers tools for investment portfolio management, including:

Government Bonds | Corporate Bonds | Structured Notes |

|---|---|---|

| A government bond, or sovereign bond, is a type of debt instrument issued by the Ministry of Finance. The Thai government issues bonds to raise funds from the general public and foreign investors. Government bonds are considered to be the lowest risk among the various types of debt instruments, thanks to the issuer’s credit worthiness and financial stability as a sovereign government. | A corporate bond is a type of debt instrument issued by a corporation. The buyer of a corporate bond lends the funds to the company for its business operations . This means that the credit risk and return of the bond depends upon the company's business performance. | A structured note is a type of debt instrument that provides a return on investment determined by a reference factor such as the price of a stock or group of stocks; a commodity like gold; or a currency exchange rate. The structured notes offered by SCB's Financial Markets Department are issued by either Siam Commercial Bank or Siam Commercial Bank Securities. In order to purchase a structured note, an investor must be qualified according to regulations of the Securities and Exchange Commission (SEC). For information, please visit www.sec.or.th |