RELATED LINKS

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

คำค้นหาที่แนะนำ

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

ข้อแนะนำในการค้นหา

- ตรวจสอบความถูกต้องของข้อความ

- ตรวจสอบภาษาที่ใช้ในการพิมพ์

- เปลี่ยนคำใหม่ กรณีไม่พบผลการค้นหา

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Retirement Plan

- Retirement Plan with Lifecycle Investment

- Personal Banking

- ...

- Retirement Plan with Lifecycle Investment

Retirement Plan with Lifecycle Investment

12-01-2022

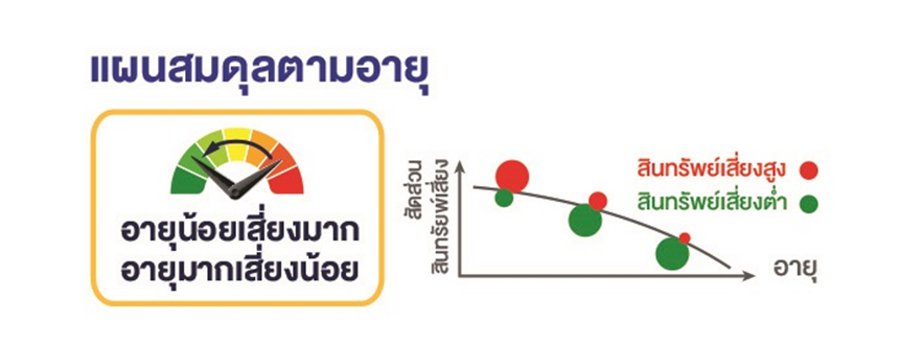

Lifecycle investment is to allocate a larger portion of long-term investment which its plan based on the total investment of investors during their lifetime. The investment portion of Equity Instruments can be high when investors are young to have a chance to gain better long-term benefits even though the annual benefits may be more unstable or be in deficit. In order to minimize investment fluctuation when investors are getting old, they can reduce their allocation in Equity Instruments and then gradually shift them to Bonds.

For Lifecycle investment during the first time working, investment should focus on “High-risk assets” to increase an opportunity to get better long-term benefits as a longstanding investment can bear a higher risk. At middle age, the focus then shifts to “Risk mitigation” to suit age changing by decreasing investment portion in risky assets, and increasing more volume of investment in safe assets. At retirement age, the most important thing is to “Maintain the principle” by adjusting the investment plan to lower risk for creating a consistent return.

Referring to the investment plan scheme, investors must rebalance investment portfolios occasionally in line with risk levels because acceptable risk levels will change as we age (Young people at high risk, Old people at lower risk). Practically, that portfolio adjustment seems difficult for some investors as they may not know when to rebalance the port and how to adjust it to reach their own investment goals. However, Target Date Fund may serve investment goals for retirement.

Target-Date Fund is designed to be long-term investments for individuals with particular retirement dates in mind which will be likely the year that investors retire. For example, at the age of 40 in 2021, investors plan to retire at the age of 60, so they’re able to select Target Date Fund whose terms will end in 2041.

Target-Date Fund will assign Fund Manager to allocate investment according to the change of members age by adjusting high-risk investment assets to lower regarding the rest of working years until retirement. For example, a Fund member who has 20 years of working left, the Fund Manager will arrange Aggressive Portfolio investment which means that the member will invest in assets with high risk and high portion for the first 5 years. And then, the investment weight will be adjusted to Balanced Portfolio for the next 5 years. After that, the investment will enter Conservative Portfolio for another 5 years. Finally, over 5 years before reaching retirement age, the investment will turn to Defensive Portfolio or safe port with emphasis on high safe assets for investors.

Why we must choose the Lifecycle Investment plan?

Mistakes tend to occur when planning for a long-term investment such as retirement. For example, young first jobbers may choose a very low-risk investment portfolio such as investing 100% in Market Money or Bond even though gaining consistent return with low fluctuation but losing a chance to get a good return for long term. On the contrary, those who are close to retirement age may choose risky investment portfolios such as 100% Thai stock or foreign stock so they tend to lose a large amount of money (loss) during the market downturn. Consequently, those investors will have little time left for investment to retrieve. The mistake derived from the one-time investment will affect their savings and they may have insufficient money to spend during the retirement period.

Good things about Lifecycle Investment

It helps relieve investors' concerns on rebalancing investment risk in line with goal and time, reduces doubts in investment and uncertainty to choose the right plan. This investment is ideal for novice investors who don’t have time to follow up market situation.

Those who are interested in Lifecycle Investment can invest through Target Date Fund by seeking advice from an investment consultant or Mutual Fund Manager. For investors who are employees at the company with Provident Fund established, you may review if your Provident Fund offers Lifecycle Investment. If it’s available, find out information and compare benefits, and pros and cons before starting an investment.

For government officials who have invested through the Government Pension Fund, that organization has already set up Lifecycle Investment to provide better long-term returns to its members. Please ask for additional detail from Customer Service officials or contact https://www.gpf.or.th/

In summary, Target Date Fund has gained more interest from investors who want to save money and invest as preparation for the retirement period. It’s the investment that a professional Fund Manager will help rebalance the investment portion to fit the age range so that investors will have enough savings to spend at retirement age. Most importantly, don’t forget to consider if savings through Provident Fund or Government Pension Fund would cover your living expense over the retirement period. If you realize that you won’t have enough money, you can hurriedly set an investment plan for other assets to ensure that you can live a happy retirement.

Nipaphan Poonsathiensap CFP®, ACC

Freelance Financial Planner, Writer, and Lecturer