I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Grow Your Wealth

- Is it a good idea to buy stocks in the same time with mutual funds?

- Personal Banking

- ...

- Is it a good idea to buy stocks in the same time with mutual funds?

Is it a good idea to buy stocks in the same time with mutual funds?

01-09-2020

When the investment climate is bright, most investors will have more courage to invest and therefore decide to invest in high-risk assets to generate higher returns. But when the investment market is more volatile and uncertain, investors will be more careful in investing.

At present, investors use methods to reduce risks by investing in stocks simultaneously with investment through mutual funds. Many people think that this type of investment may have duplication of investment. Invest in stocks with mutual funds, such as investing in ABC stocks at the same time, mutual funds may invest in ABC stocks.

Therefore, to reduce the worry of duplication of investment, investors must clearly design the investment portfolio based on acceptable risk levels.

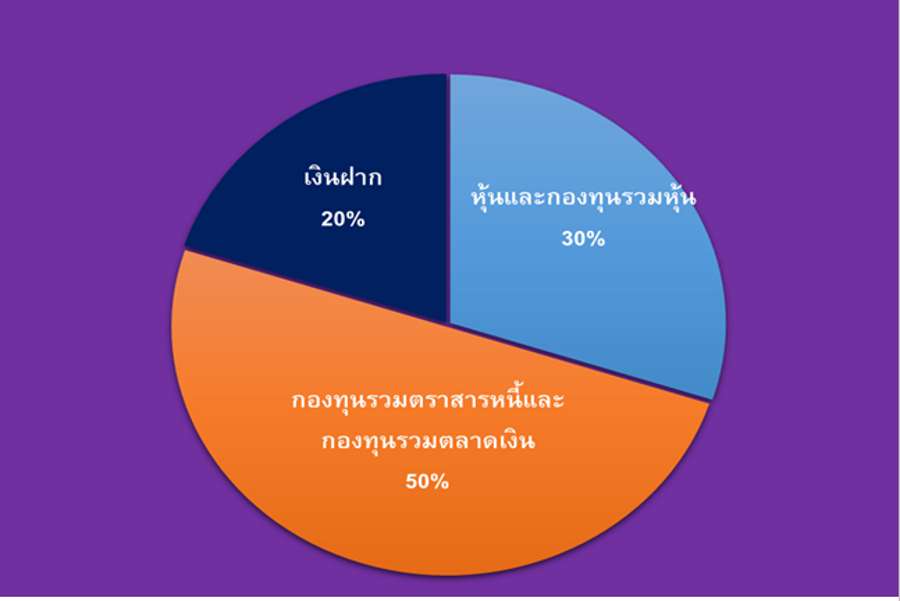

1. Conservative investment portfolio

Conservative investment port suitable for investors with low risk Does not want to lose the investment. Such as those who are near retirement age, so most of the investment portfolios are assets with relatively low-price volatility, such as fixed income funds, money market funds, and deposits, etc.

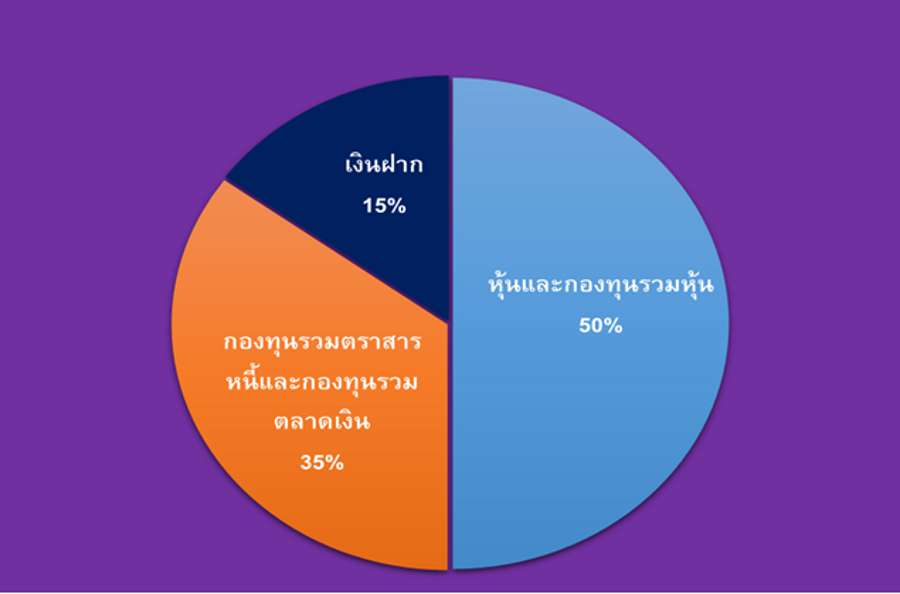

2. Moderate investment portfolio

The moderate investment portfolio is suitable for investors with moderate risk and can receive enough volatility, want to receive a return on a consistent investment. Therefore, focus on investing in assets that pay consistent dividends, such as stock dividends, mutual funds with dividend policy. Including returns in the form of interest, such as government bonds

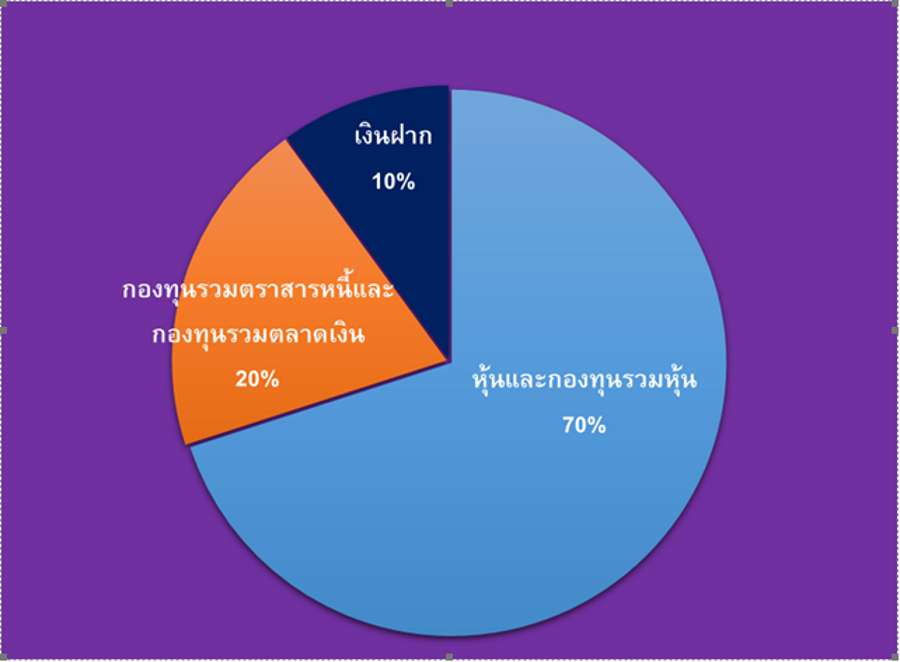

3. Aggressive investment portfolio

The aggressive investment portfolio is suitable for investors who have high risk, have a long-time investment at the same time, it requires the investment to have a high return. Therefore, focus on investing in high-risk assets such as stocks or mutual funds.

(The proportion of all three types of investment portfolios is just an example. Investors can adjust the proportion according to their own needs.)

If interested in investing in stocks and mutual funds at the same time, consider only the proportion of shares and mutual funds. (The reason for this type of view is not to affect the overall portfolio design). Then share the investment, stocks and mutual funds according to the desired proportion.

Choosing to avoid duplication is to choose to invest in different stocks, for example, if investing in a medium-sized stock market that pays a consistent dividend. Then must choose a mutual fund that has the policy to invest in large group stocks. Or choose a mutual fund that has a policy to invest in any industry, such as energy groups, should choose to invest in other groups such as banks, communications or retail, etc. The amount of investment depends on the needs of investors, for example, there are only 1-2 stocks in the portfolio. The remaining funds will be invested in mutual funds or the remaining 2 funds will focus on individual stocks.

Reasons to invest directly in stocks because it has invested in a business that he wants and creates a good return to the port. While having a stock fund will be a risk diversification because there are experts to look after and diversify investments in many stocks, helping to increase the security of the port if the stock market is highly volatile.

However, in addition to having to invest according to the plan with discipline. The main thing that cannot be ignored is to regularly check the performance of the portfolio. To adjust the investment to suit the situation and according to the goals laid out to be successful.