I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- BUSINESS MAKER

- Gaining insight of “Micro Lending” with a MONIX-styled New Ways of Working

- Personal Banking

- ...

- Gaining insight of “Micro Lending” with a MONIX-styled New Ways of Working

Gaining insight of “Micro Lending” with a MONIX-styled New Ways of Working

18-06-2020

From the study by the National Statistic Office, there are Thais who are not able to receive the basic monetary service. By looking closer, 25% of the population, or 17 million people cannot access the loan service provided by institutions. This fact raises the question of whether these people are really not qualified and how likely are they to be able to receive the monetary service. Thiranun Arunwattanakul (Neung), COO of Monix Co., Ltd. which is a company under SCB, shares with us about the product aiming to provide access to the formal loan to the low-income earner and the New Ways of Working with the MONIX style.

Getting to know Monix

Monix, the JV of SCB and Abakus (Chinese-leading-technological company), focuses on Digital Lending service for people with no access to the basic financial system by utilizing the needs of customers to design products and services. As the bank aims for long-term Digital Lending service growth, Monix is 60% held by SCB and 40% held by Abakus Ltd.

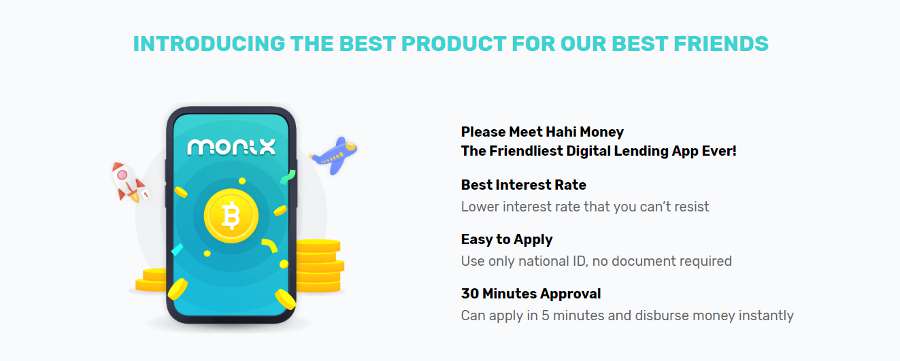

Micro Lending, the product which helps low-income earners access the loan

Monix’s main objective is to provide the solution to low-income people, freelancers, and hand-to-mount people. These people are rejected when applying for the formal loan as they fail to provide their financial statement or payslip which costs them the opportunity to access the formal loan and forces them to get the service from loan sharks which are risky and high-interest charged. These are the reasons why these people cannot escape the loan shark system. Micro Lending service is designed to provide more access to a formal loans for these people. It is a small loan that can be maximized to 100 thousand Thai Baht. Such a service can be accessed through an application called “Ha-Hi-Money”.

Easily apply for Micro-Lending through the application

For the convenience of customers, the “Ha-Hi-Money” application can be instantly downloaded, and the service can be applied. Applying for the loan is just similar to other institutions but requires fewer documents. The customer is required to fill in the information and agrees to disclose the personal information of daily income and outcome, for example, water bill, the electric bill, and telephone bill to let the company get to know the customer for the risk assessment process. The appropriate loan amount and install payment period is then identified from the customer’s paying ability. Neung mentions that “Customers can be assured that the interest charged, and the debt collectors are legally abided. Customers then will have more confidence in their financial discipline and do not have the forever-bonded debt.”

The MONIX-styled New Ways of Working

Monix works against time. Being asked what the Monix-styled New Ways of Working is, Neung answers that working at Monix is finding the fastest way to receive customer’s feedback to assure that it is truly the customer’s need. The taskforce then tries to find the quickest way to launch the product which the thinking process has to be efficient but fast, seeking the possibility and meeting with the customer to test the idea. The simplified and easily made prototype is preferred. As the idea testing can be done quickly, 50 ideas are then reduced to 10. This eliminates the meeting-room session. Then, analyzing how to make the 10 ideas happen is the Next Step.

As the work is needed to be quick and always meet new challenges, Neung mentions that the team is required to have a mindset of 1. Speed: quick, flexible, and quickly adapt 2. Changing-is-natural attitude: enjoy the changes, and eager to learn 3. Empathy: understand customers. Neung also emphasizes “When meeting customers, if they ask new questions or have a new issue which was unasked, it is important to collect the idea for the learning curve. Listening to customer’s needs and analyzing them, do not only listen to what we would like to know”.

Data is the heart of product development

Nowadays, several organizations utilize data to set their business strategy, analyze the market, and gain customer insight. At Monix, data is used in 2 dimensions. The first dimension is to assess the customer’s ability to pay back the loan. The second is to evaluate a customer's financial discipline and their daily lifestyle, for instance, bike fare, food fare, delivery price, telephone bill. Therefore, it can be seen that the Micro Lending group does not have these transactions with the banks. To be able to access such data, partnering with the business with Ecosystem plays an important role, for example, partnering with telecommunication to access the telephone bill data, either prepaid or postpaid service provide behavioral insight of the customers.

As Monix needs personal data to analyze the loan, the company is regulated by the Personal Data Protection Act (PDPA). Neung emphasizes that the PDPA forces the company to be more careful on personal data collection, 10 pieces of information were collected in the past, but with the PDPA, information collected is minimized. The usage of the data requires a clear objective that is considered to be respected. Hence, the business can be conducted with the PDPA presence as the customers still need the appropriate products and services.

Perspective on New Normal

Neung has believed since before the pandemic that changes occur continuously, however, at an unnoticeable rate. Facing the pandemic can be considered as pulling the cord forcing sudden changes. The New Normal is the change in people’s behavior. For business-wise, New Normal is different among businesses. Therefore, the behavior and location changes of the customers are required to be taken into account. It cannot be thought the same way, for example, the brick-and-mortar store is not required for the online-customer business.

Before leaving, Neung passes a good thought to other business owners during this pandemic time that everyone is facing the same problem at the same time. The encouragement can be found anywhere. Thai people are kind as we can see that many businesses have turned to sell food and people are helping to buy them. After the pandemic, preparation for the New Normal is required. Please keep in mind that discipline is what helps us get through the pandemic. Emergency saving needs to be reserved. Utilizing new Technologies could benefit in cost and expense reduction. Finally, business owners need to understand customer’s behavior, being where the customers are is the key to keep the business growing and successful.

Source: Gaining insight of “Micro Lending” with the Monix-styled New Ways of Working from Facebook: Phonlamuangdee, November 22nd 2020.