I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Insurance

- Legacy Insurance

- Pra-Gun-Legacy Elite 99/5

- Personal Banking

- ...

- Pra-Gun-Legacy Elite 99/5

HERITAGE AND LIFE PROTECTION INSURANCE

Pra-Gun-Legacy Elite 99/5

Pass on your legacy... Secure lasting wealth for your loved ones at every stage of life.

Highlights

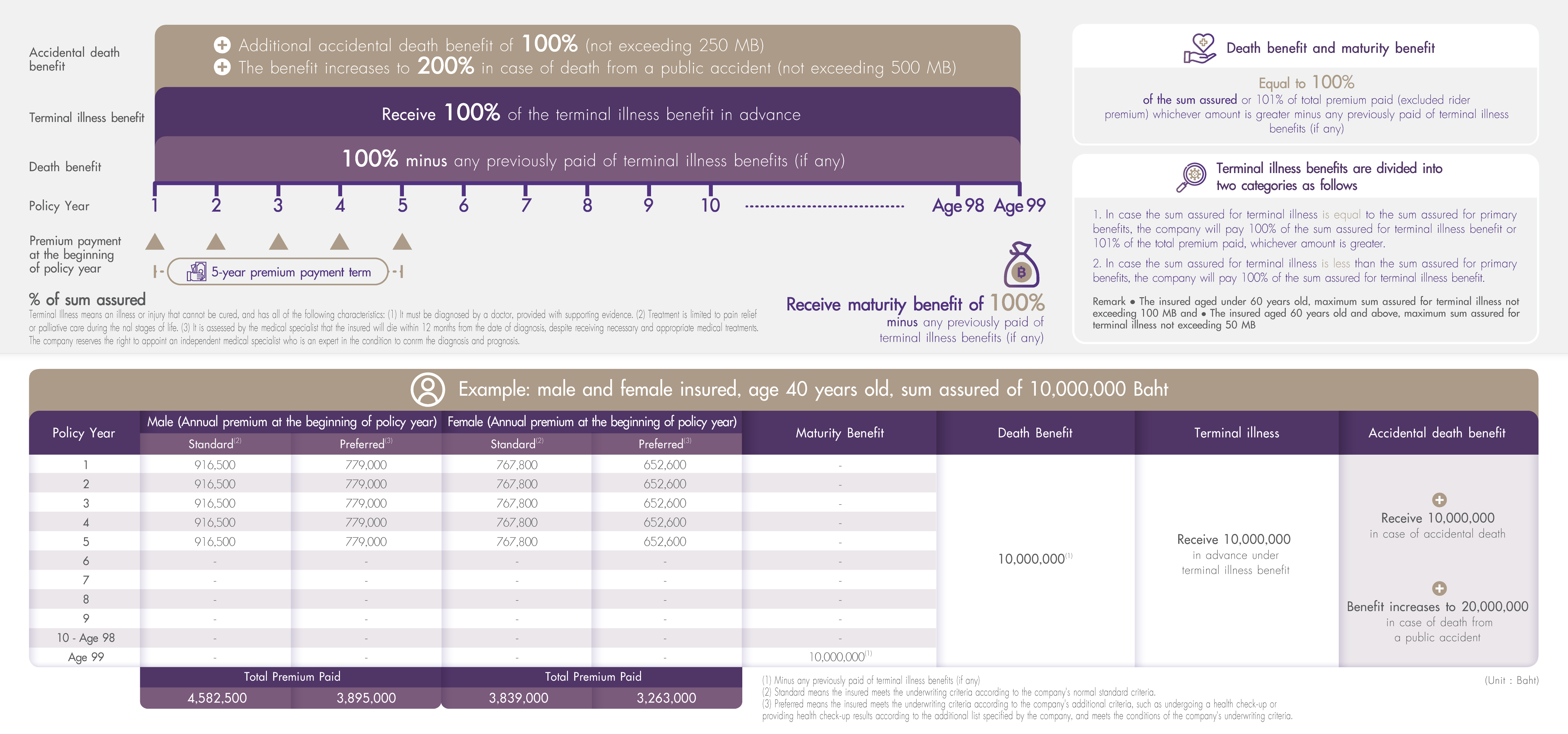

Easy planning,

complete a long-term plan within a 5-year premium payment term

Full coverage,

offering 100% life protection from the first day until age 99

Lump sum benefit,

100% at maturity or earlier in case of terminal illness

Additional life protection,

receive 100% death benefit in case of accidental death and increase to 200% in case of death from public accident*

Lower premiums,

if your health is better than the standard**

% of Sum Assured

*Get an additional accidental death benefit of 100% of the sum assured, not exceeding 250 MB, with a benefit increase to 200% of the sum assured in case of death from a public accident, at a maximum of 500 MB

**The insured must pass a health check-up according to the list and criteria specified by the company

Insured by FWD Life Insurance Public Company Limited.

SCB is only an authorized broker.

Insurable guideline refer to Underwriting procedures of FWD Life Insurance Public Company Limited.

Buyers must understand the details of coverage and conditions before deciding to apply

Qualification and Document Required for the insured Pra-Gun-Legacy Elite 99/5 Standard

- Insurable age: 15 day – 75 years

- Coverage term: Until age 99 years

- Premium payment term: 5 years

- Sum assured of base plan: 10,000,000 - 500,000,000 Baht

- Sum assured in case of terminal illness

- The insured aged under 60 years old, maximum sum assured not exceeding 100,000,000 Baht

- The insured aged 60 years old and above, maximum sum assured not exceeding 50,000,000 Baht

- Sum assured in case of accidental death

- Maximum sum assured not exceeding 250,000,000 Baht in case of an accidental death

- Maximum sum assured not exceeding 250,000,000 Baht in case of death from a public accident

For both cases, the maximum sum assured amount is capped at 500,000,000 Baht

- Premium payment mode: annually, semi-annually, quarterly and monthly

- Underwriting: Answer health questions in the application form and health check-up may also be required according to company's underwriting criteria

Qualification and Document Required for the insured Pra-Gun-Legacy Elite 99/5 Preferred

- Insurable age: 18 – 75 years

- Coverage term: Until age 99 years

- Premium payment term: 5 years

- Sum assured of base plan: 10,000,000 - 500,000,000 Baht

- Sum assured in case of terminal illness

- The insured aged under 60 years old, maximum sum assured not exceeding 100,000,000 Baht

- The insured aged 60 years old and above, maximum sum assured not exceeding 50,000,000 Baht

- Sum assured in case of accidental death

- Maximum sum assured not exceeding 250,000,000 Baht in case of an accidental death

- Maximum sum assured not exceeding 250,000,000 Baht in case of death from a public accident

For both cases, the maximum sum assured amount is capped at 500,000,000 Baht

- Premium payment mode: annually, semi-annually, quarterly and monthly

- Underwriting: Answer health questions in the application form and provide health check-up results according to the list specified by the company. The health check-up must meet the company's underwriting criteria

Privilege: No additional premium due to substandard health for sum assured amounts of 10 MB - 50 MB per individual insured, subject to the company's terms and conditions

● Life insurance premium and Health insurance premium (if any) can be tax-deductible according to the Notification of the Director-General of the Revenue Department on Income Tax

Benefit and Protection