I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Deposits

- Foreign Currency Deposit Account

- Electronic Foreign Currency Deposit Account (e-FCD)

- Personal Banking

- ...

- Electronic Foreign Currency Deposit Account (e-FCD)

e-Foreign Currency Savings Account (e-FCD)

Earn an interest rate of up to 4% per year*. Start saving funds in USD via SCB EASY App.

Invest in USD TERM FUND

An opportunity to gain returns from high-quality foreign government bonds. Investment period: 3 or 6 months. Offered weekly***

You can now trade gold with e-FCD accounts!

Trade 99.99% gold in USD on Hua Seng Heng’s USD GOLD TRADE App.

Save smart. Save USD. Earn high interest.

e-FCD Account (Electronic Foreign Currency Deposit)

Save funds in USD and earn special interest rate of up to 4% per year*.

Deposit in 7 major currencies: USD, GBP, EUR, SGD, CNY, JPY and HKD.

Key benefits of e-FCD account (Electronic Foreign Currency Deposit)

Earn a special interest rate of up to 4% per year*.

Special! No account maintenance fee.** Open an account with no minimum deposit and no fixed deposit required.

Best rates, save instantly.

Exchange the rate you want at the perfect time, with 7 major foreign currencies.

Convenient, simple and accessible anywhere,

all in one App.

Open an account and buy, sell or exchange foreign currency via SCB EASY App.

Maximize investments,

seize more profits.

Invest in global mutual funds and buy, sell or save gold with Hua Seng Heng.

Spend in Foreign Currencies

with SCB PLANET Card.

Top up from your e-FCD account, instantly ready to spend worldwide.

How to open the account

Easily open e-FCD Account (Electronic Foreign Currency Deposit) via the SCB EASY App.

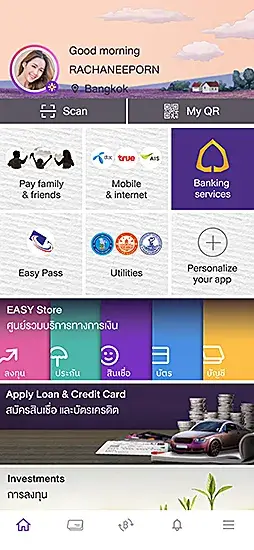

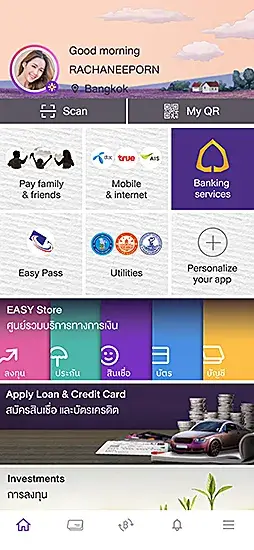

1. Select “Banking Services”

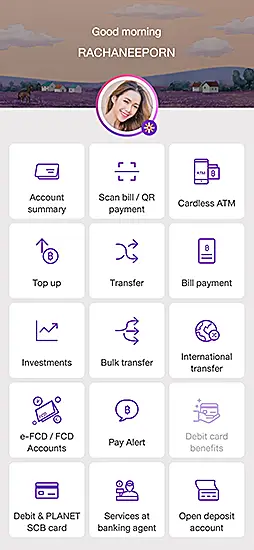

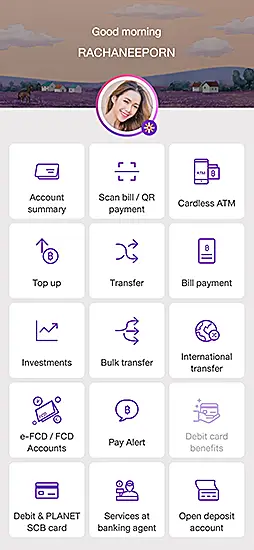

2. Select “e-FCD / FCD Accounts”

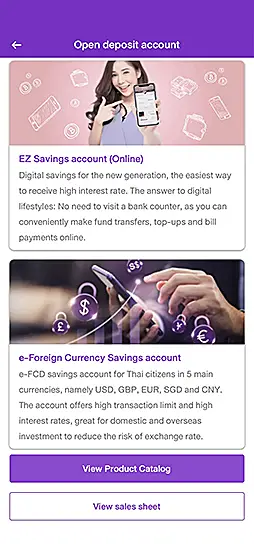

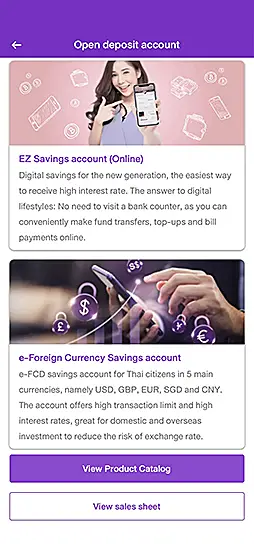

3. Select “Open Account”

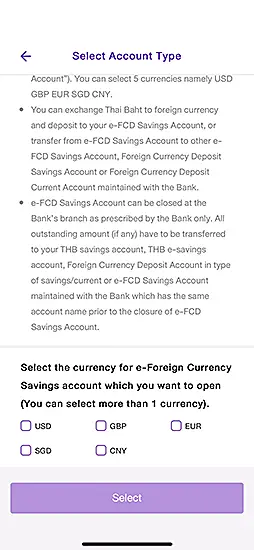

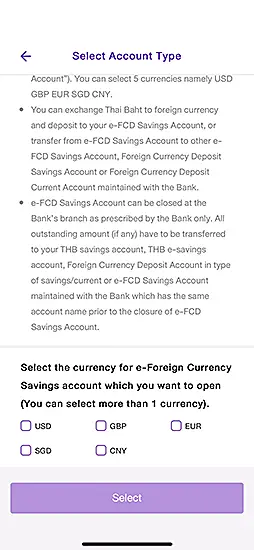

4. Select the currency (or currencies) for your account.

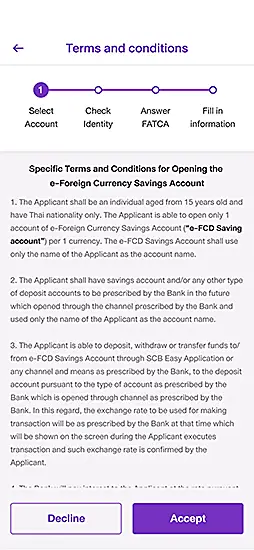

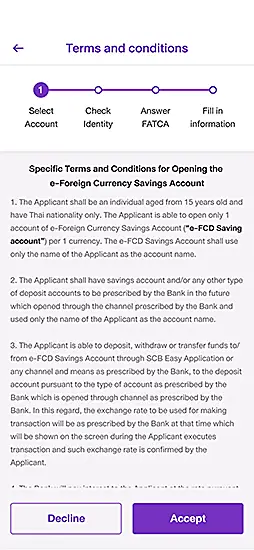

5. Read “Terms and Conditions” and tap “Accept”

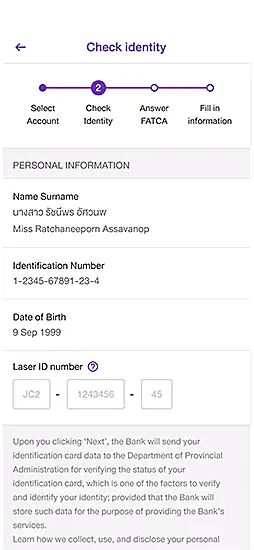

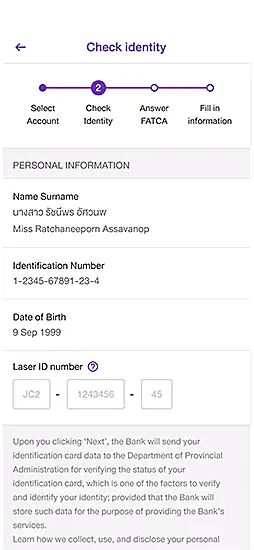

6. Enter the “Laser ID Number” and click “Next” to verify your identity

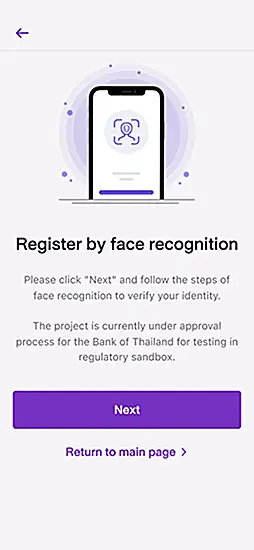

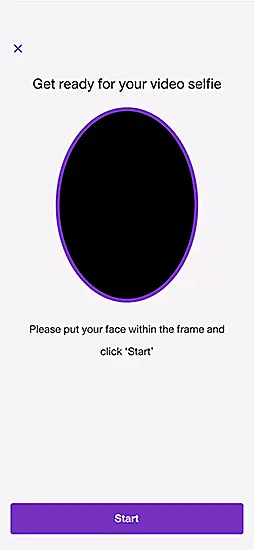

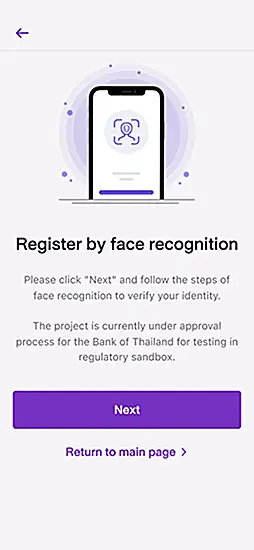

7. Press “Next” to verify your identity using a face scan.

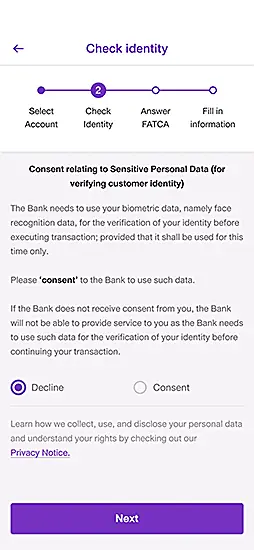

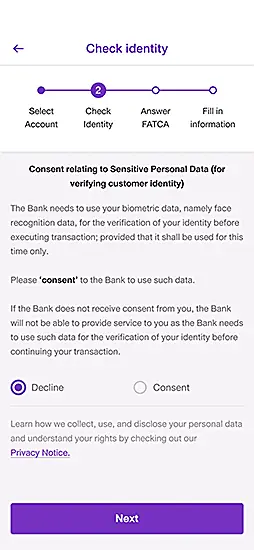

8. Provide “Consent Relating to Sensitive Personal Data”

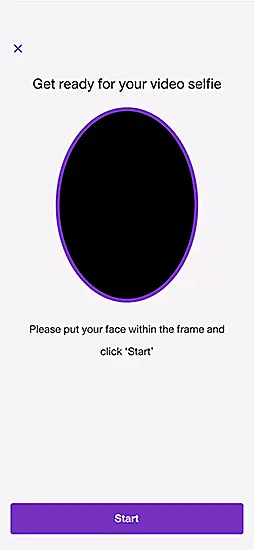

9. Proceed with a face scan to continue to the next step

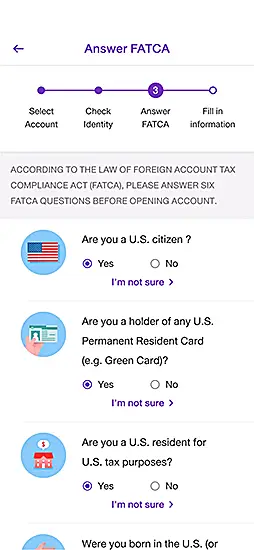

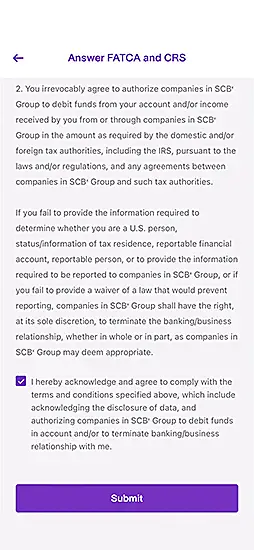

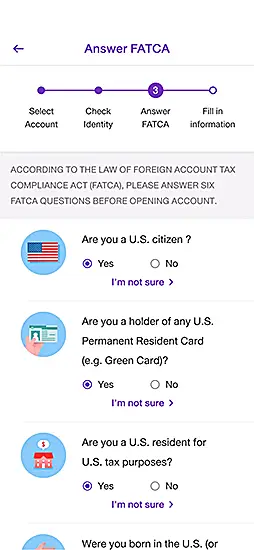

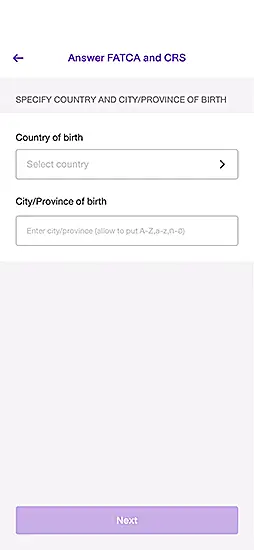

10. Tap “Next” to answer “FATCA Questions”

11. Answer “FATCA and CRS Questions”

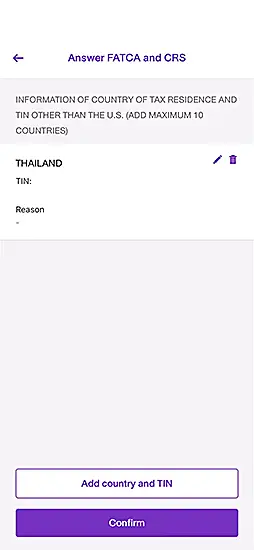

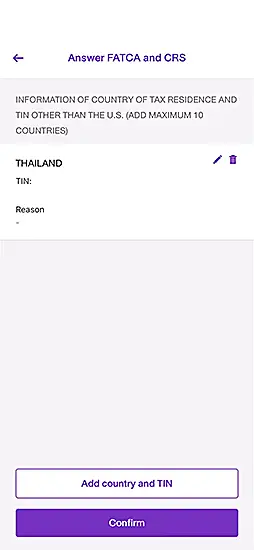

12. Review your “Taxpayer ID” and tap “Confirm”.

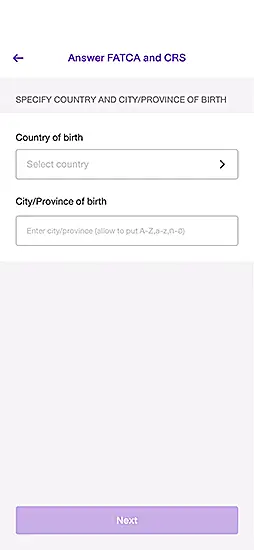

13. Enter your “Country of Birth and City/Province of Birth”, then tap “Confirm”.

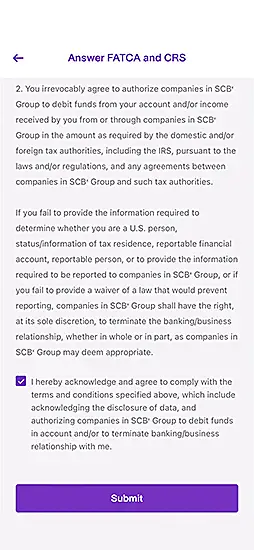

14. Read and accept “Terms and Conditions”, then tap “Confirm”.

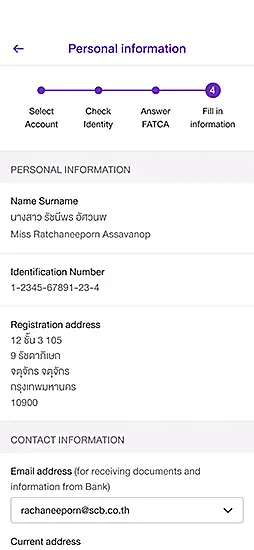

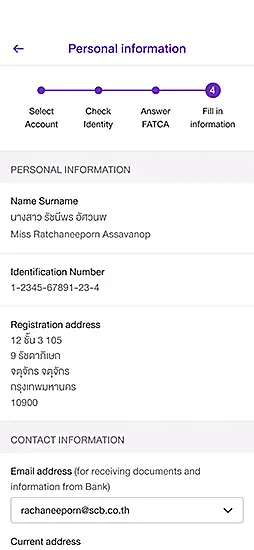

15. Fill and review “Your Personal Information” and tap confirm

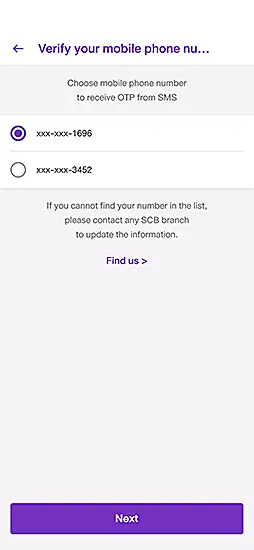

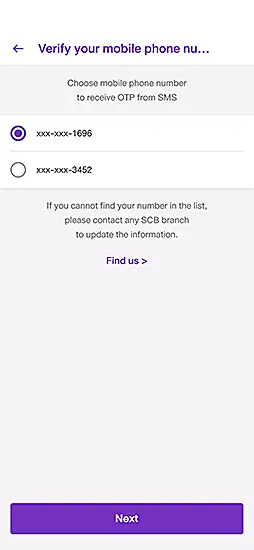

16. Select your “Phone Number” for OTP verification and enter the received OTP.

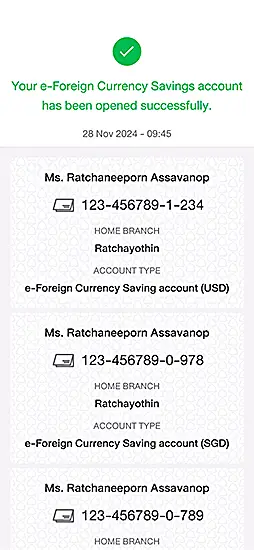

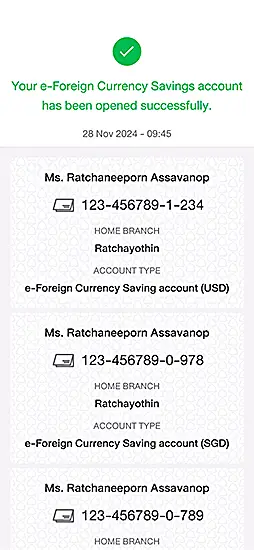

17. Your e-FCD account opening is successful. Tap “Return” to the Account Home Screen.

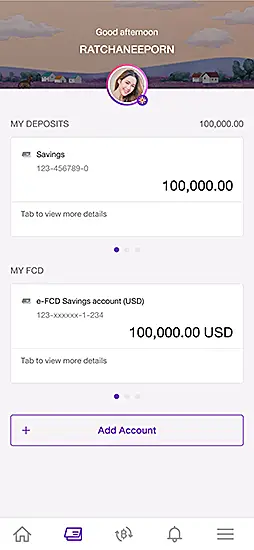

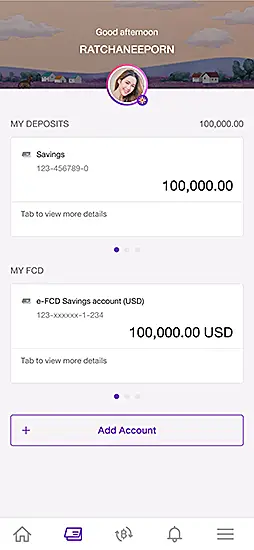

18. The e-FCD account will be automatically added to the Account Home Screen.

1. Select “Banking Services”

2. Select “e-FCD / FCD Accounts”

3. Select “Open Account”

4. Select the currency (or currencies) for your account.

5. Read “Terms and Conditions” and tap “Accept”

6. Enter the “Laser ID Number” and click “Next” to verify your identity

7. Press “Next” to verify your identity using a face scan.

8. Provide “Consent Relating to Sensitive Personal Data”

9. Proceed with a face scan to continue to the next step

10. Tap “Next” to answer “FATCA Questions”

11. Answer “FATCA and CRS Questions”

12. Review your “Taxpayer ID” and tap “Confirm”.

13. Enter your “Country of Birth and City/Province of Birth”, then tap “Confirm”.

14. Read and accept “Terms and Conditions”, then tap “Confirm”.

15. Fill and review “Your Personal Information” and tap confirm

16. Select your “Phone Number” for OTP verification and enter the received OTP.

17. Your e-FCD account opening is successful. Tap “Return” to the Account Home Screen.

18. The e-FCD account will be automatically added to the Account Home Screen.

e-FCD Account Details

- Service Type: Electronic Foreign Currency Deposit (e-FCD) Savings Account.

- Earn a special interest rate of up to 4% per year* only for USD currency deposits made between 1 January 2026 to 31 March 2026.

- Accepted Currencies: US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Singapore Dollar (SGD), Yuan (CNY), Japanese Yen (JPY) and Hong Kong Dollar (HKD).

- How to Open: Open an account and manage transactions conveniently via the SCB EASY App.

- Account maintenance fees will be waived for e-FCD accounts as follows:

- e-FCD accounts in USD, GBP, EUR, SGD, and CNY: Effective February 28, 2025, until further notice.

- e-FCD accounts in JPY and HKD: Effective October 17, 2025, until further notice.

| CURRENCIES | DEPOSIT AMOUNT | Special Interest Rate* (1 JANUARY 2026 - 31 MARCH 2026) |

|---|---|---|

| USD | Up to USD 10,000 | 0.05% |

| Over USD 10,000 - USD 50,000 | 4.00% | |

| Over USD 50,000 | 2.00% | |

| GBP | No limit | 0.20% |

| EUR | 0.00% | |

| CNY | 0.35% | |

| SGD | 0.00% | |

| JPY | 0.00% | |

| HKD | 0.00% |

Know Before You Save! e-FCD accounts are subject to foreign exchange rate risk.

Notes:

- *Special interest rate of up to 4.00% per year only for USD currency deposits made between 1 January 2026 to 31 March 2026, as follows:

- For the amount not exceeding USD 10,000, earn interest at 0.05% per year.

- For the amount exceeding USD 10,000 but not exceeding USD 50,000, earn special interest at 3.95% per year, totaling 4.00% per year.

- For the amount exceeding USD 50,000, earn special interest at 1.95% per year, totaling 2.00% per year.

- From 1 April 2026, a standard interest rate of 0.05% per year will be applied, regardless of the deposit amount.

- Average interest rates are between 0.05%- 4.00% per year. The calculation of the average interest rate depends on the customer’s deposit amount.

- Deposit interest rates for GBP, EUR, SGD, CNY, JPY and HKD vary according to the rates as prescribed by the Bank. Please study and view more details at the Bank’s website.

- **Account maintenance fee will be waived for e-FCD Account in USD, GBP, EUR, SGD and CNY from 28 February 2025 onwards and for e-FCD Account in JPY and HKD from 17 October 2025 onwards, until further notice of the Bank.

- The Bank reserves the right to change deposit interest rates and other conditions as prescribed by the Bank.

- Deposits and withdrawals of e-FCD Account are subject to risks from foreign exchange rate. Customers should review important information and conditions of the product before making a decision.

- Customer cannot use and/or make transactions through e-FCD Account for the purpose of speculating on foreign exchange rates.

- The use of e-FCD Account and/or execution of transactions through e-FCD Account shall be in accordance with the conditions prescribed by the Bank of Thailand.

USD TERM FUND

- This fund carries risks associated with foreign investments and does not fully hedge against exchange rate fluctuations. Investors may incur losses or gains from exchange rate and may receive less than their initial investment.

- Investing in mutual funds is not equivalent to depositing money and involves investment risks. Investors may not receive the full amount of their initial investment.

- Investors cannot redeem fund units within 3 or 6 months, depending on the fund’s conditions. If adverse factors affect the investment, investors may suffer significant losses.

- If the fund cannot invest as planned due to market changes, the advertised return may not be achieved.

- Investment involves risks. Investors should understand the product features, return conditions, and associated risks before making investment decisions.

- For more information about the fund, please refer to the fund prospectus available at www.scbam.com or via the SCB EASY app.

- Deposits/withdrawals in e-FCD / FCD accounts are subject to foreign exchange risk. Please review the product’s important information and terms and conditions before making a decision.

- e-FCD / FCD accounts must comply with the Bank of Thailand’s regulations.

- For inquiries, contact the SCB Call Center at 02-777-7777.

SCB PLANET CARD

- Customers must be individuals, and the e-FCD/FCD account name must match the SCB PLANET cardholder's name.

- Top-ups and transfer funds can be made in the same currency only.

Product Information

Interest Rates, Exchange Rates, and Fees

How to Use Other Features on the SCB EASY App

Solutions for partners

Smart savings with e-FCD

Payment