I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Insurance

- Endowment Insurance

- Pra-Gun-Support-Took-Wai*

- Personal Banking

- ...

- Pra-Gun-Support-Took-Wai*

SAVINGS INSURANCE

Pra-Gun-Support-Took-Wai*

Understand every generation. Support every saver (*Coverage from age 1 day to 88 years old)

Highlights

A life insurance plan with annual cash benefits, coverage for accidental medical expenses, an additional death benefit in case of accidental death, and a payor benefit

With 9-year premium payment term

With 9-year premium payment term, secure lifelong coverage up to age 88

For every day in the future

For every day in the future, enjoy guaranteed annual cash benefit of 10% at the end of policy years 1 - 7, 12% at the end of policy years 8 - 11, 14% at the end of policy year 12 until age 87, and a maturity benefit of 900%

Additional life protection

Additional life protection, receive death benefit 200% in case of accidental death and increase to 400% in case of death from public accident

Additional care

Additional care - receive an accidental medical expense benefit of 5% annually during the premium payment term. If no claim are made, enjoy a 10% no-claim bonus at the end of policy year 9

Easy to apply

Easy to apply, no medical check up and no health questions required

Provide peace of mind

Provide peace of mind with a special payor benefit for insured persons up to age 20

Insured by FWD Life Insurance Public Company Limited.

SCB is only an authorized broker.

Insurable guideline refer to Underwriting procedures of FWD Life Insurance Public Company Limited.

Buyers must understand the details of coverage and conditions before deciding to insure.

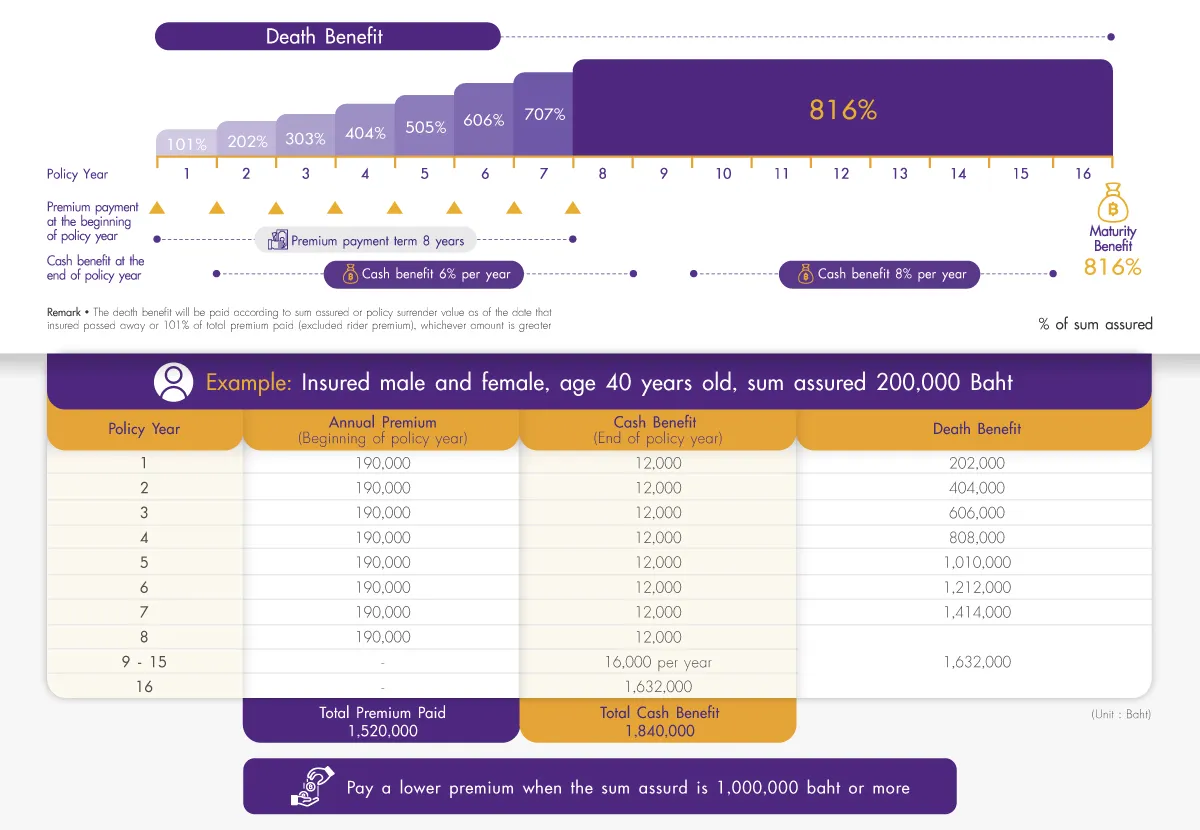

% of Sum Assured

Qualification and Document Required

For the insured

- Insurable age: 1 day – 65 years

- Coverage Term : Until age 88 years

- Premium payment term : 9 years

- Minimum sum assured : 50,000 Baht

- Maximum sum assured : 50,000,000 Baht, subject to the Company's terms and conditions in calculating total maximum sum assured

- Premium payment mode: Annually, Semi-annually, Quarterly and Monthly

- Underwriting : no health check up and no health questions

For the payor benefit

- Insurable age: 1 day – 20 years

- Payor age: 20 – 65 years

- Payor benefit - Payor must answer health-related questions as outlined in the Payor Declaration Form, upon purchase of the Payor Benefit rider (the declaration form is included as part of the application package.)

- Maximum coverage per payor: The maximum coverage amount must not exceed the sum assured of 1,000,000 Baht per person under the main policy. This includes coverage under the additional riders RPB6 and RPB7.

Special, payor benefit for the insured is not over 20 years old**

The premiums of Pra-Gun-Support-Took-Wai* (base plan) that are the payor's responsibility will be waived once the payor passes away or becomes total and permanent disability refer the definitions and conditions specified in the policy. However, the policy benefits will remain unchanged.

*Coverage from age 1 day to 88 years

**Special payor benefit is for the policies where the insured aged 1 day – 20 years and the payor must meet the underwriting conditions

- Life insurance premium and Health insurance premium (if any) can be tax-deductible according to the Notification of the Director-General of the Revenue Department on Income Tax

Benefit and Protection