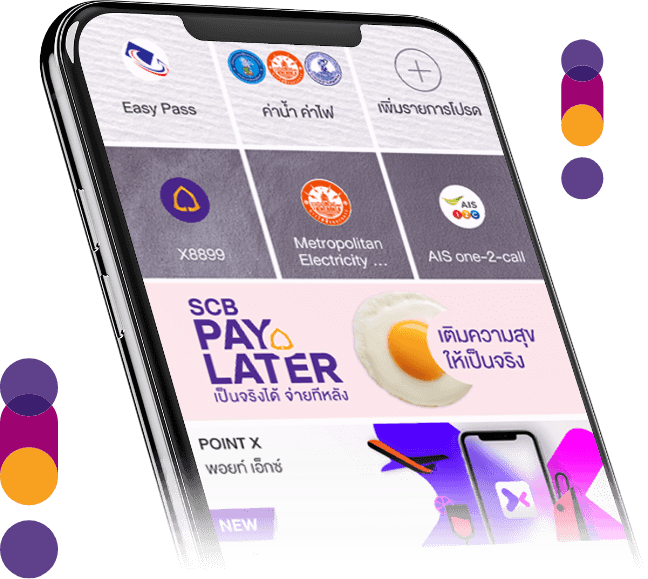

Buy now. Pay later.

No need to wait.

Buy whenever you want with SCB Pay Later.

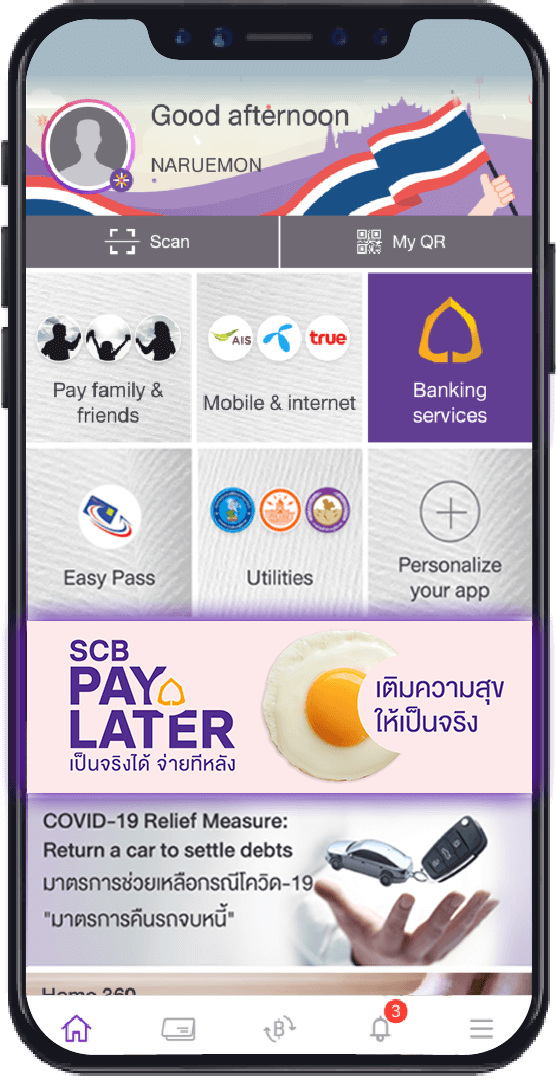

It’s easier with

SCB Pay Later.

Whenever you want, pay your shopping bills via the 24/7.

Apply for SCB Pay Later at to draw down from a credit line for shopping.

Pay your shopping bills with your credit line.

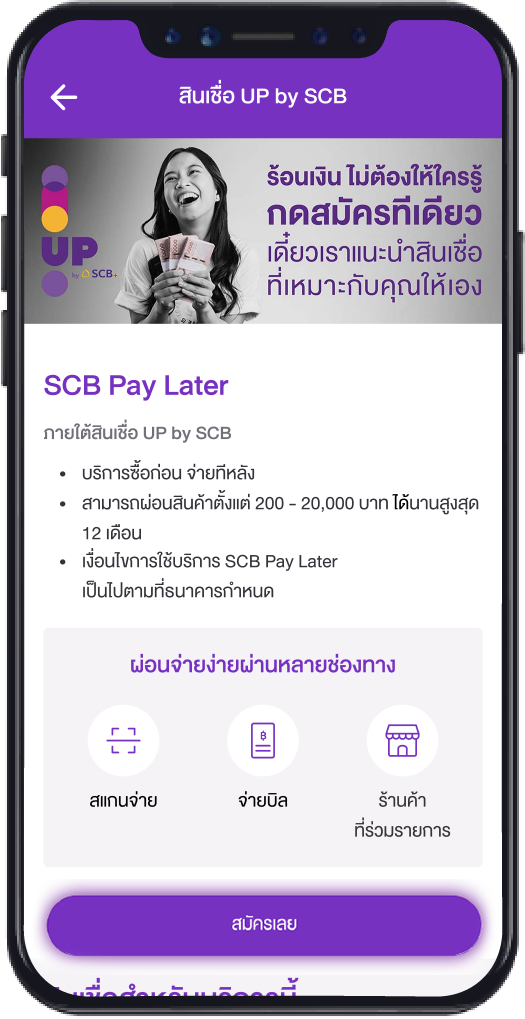

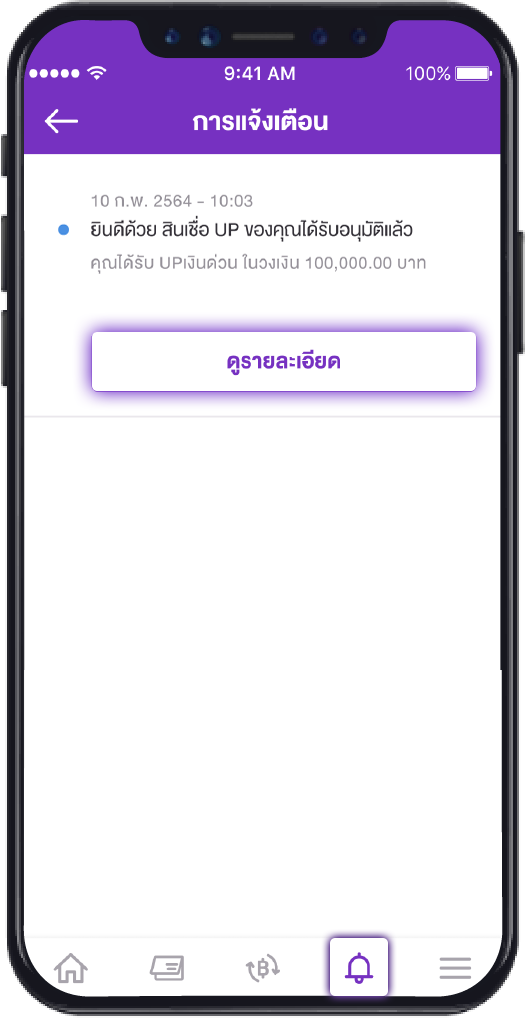

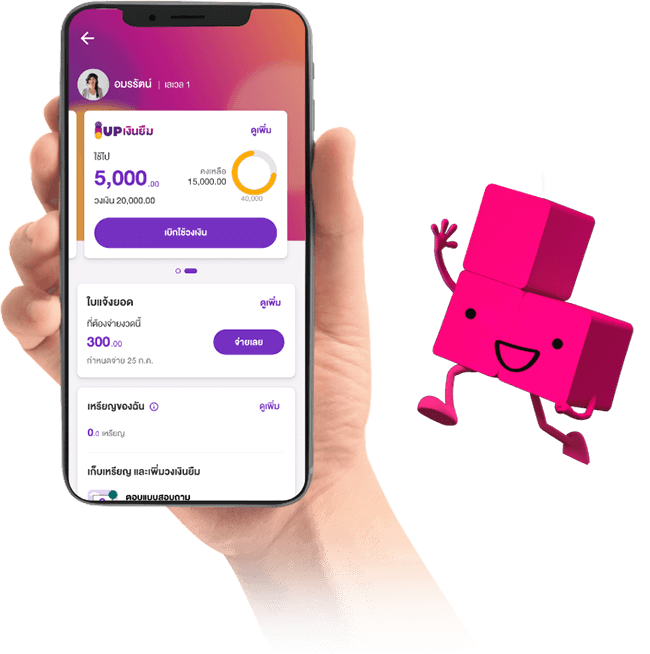

SCB Pay Later is now available for UP-Ngern-Yeum.

Instant transfers to your account when you want cash

UP-Ngern-Yeum

offers a credit line

of up to 20,000 baht*.

*Credit approval conditions for a loan tied to SCB Pay Later are as specified by SCB.

Buy what you need at ease.

Available at participating shops accepting QR code payment.

Pay via the “Bill Payment” menu on the

Available at over 200,000 participating shops nationwide.

Who can apply for

SCB PAY LATER?

*Applicants’ qualifications are as per

the type of loan tied to SCB PAY LATER.

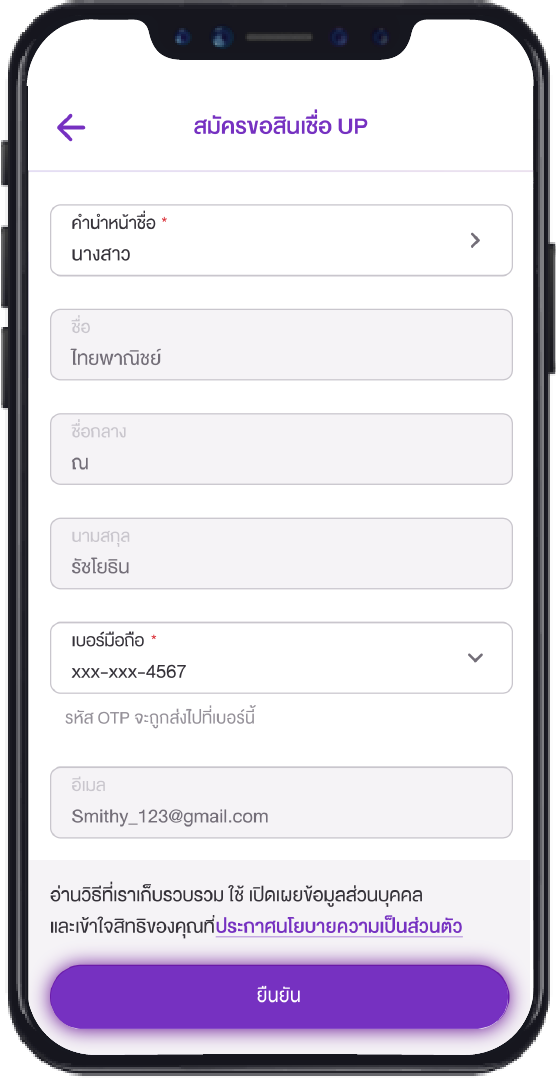

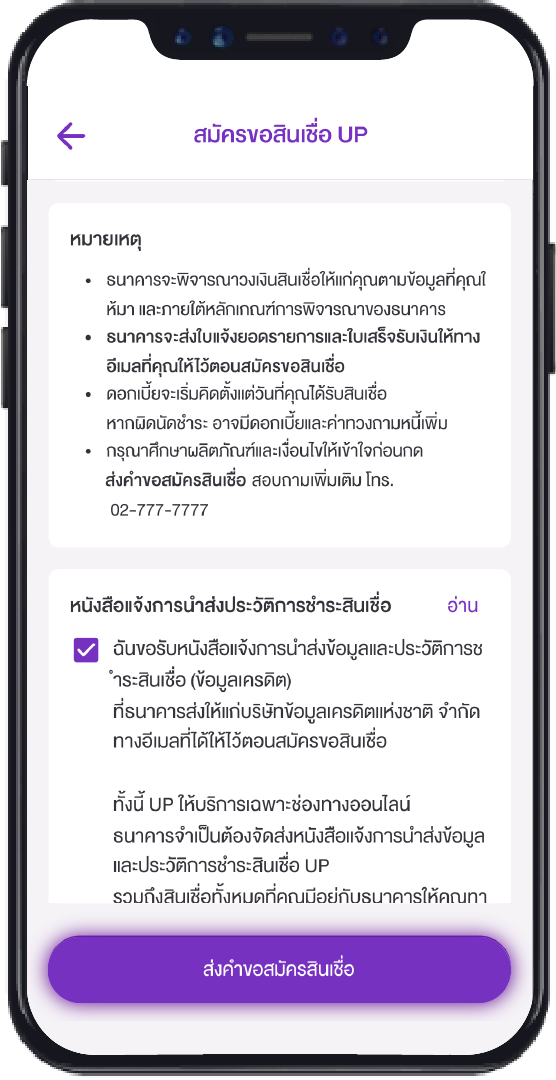

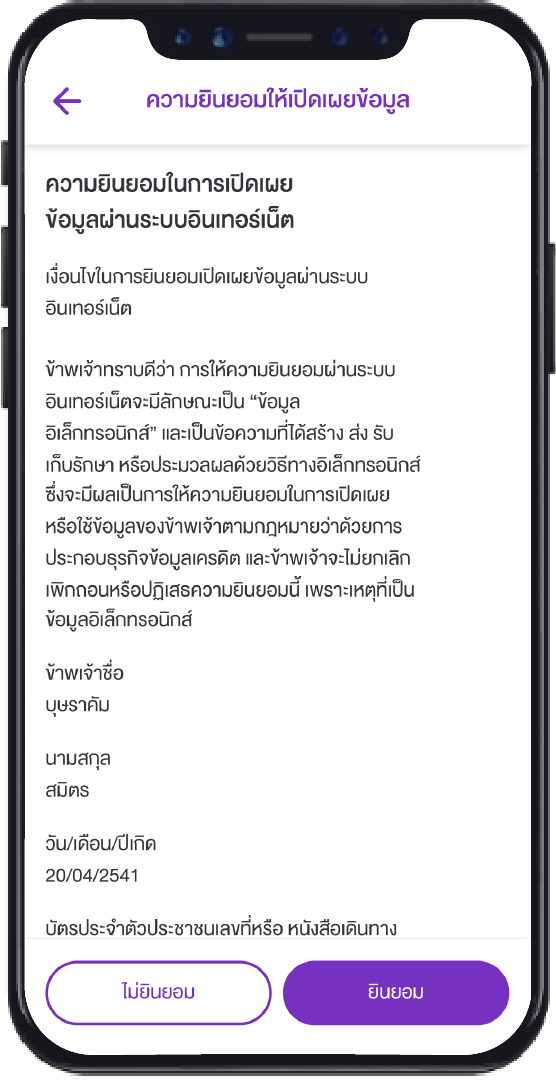

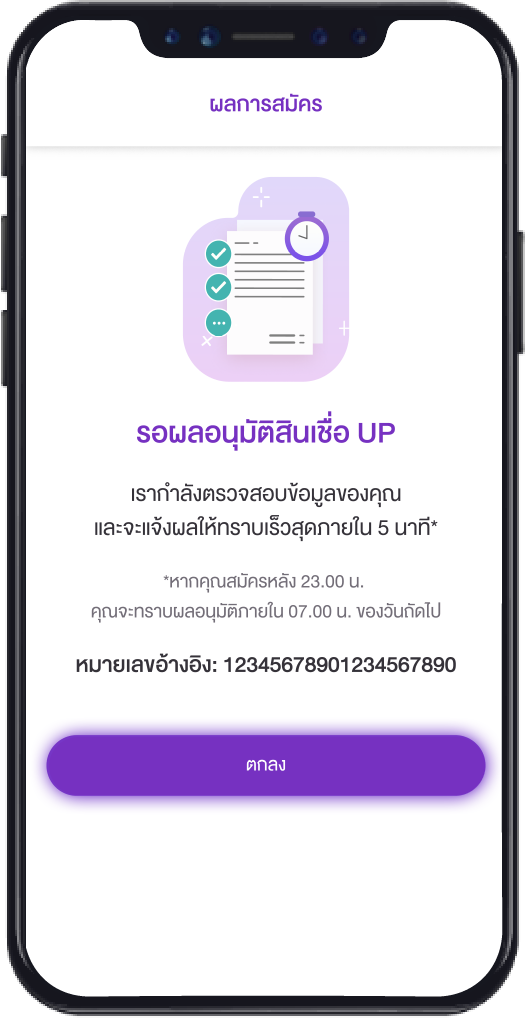

Apply for

SCB PAY LATER