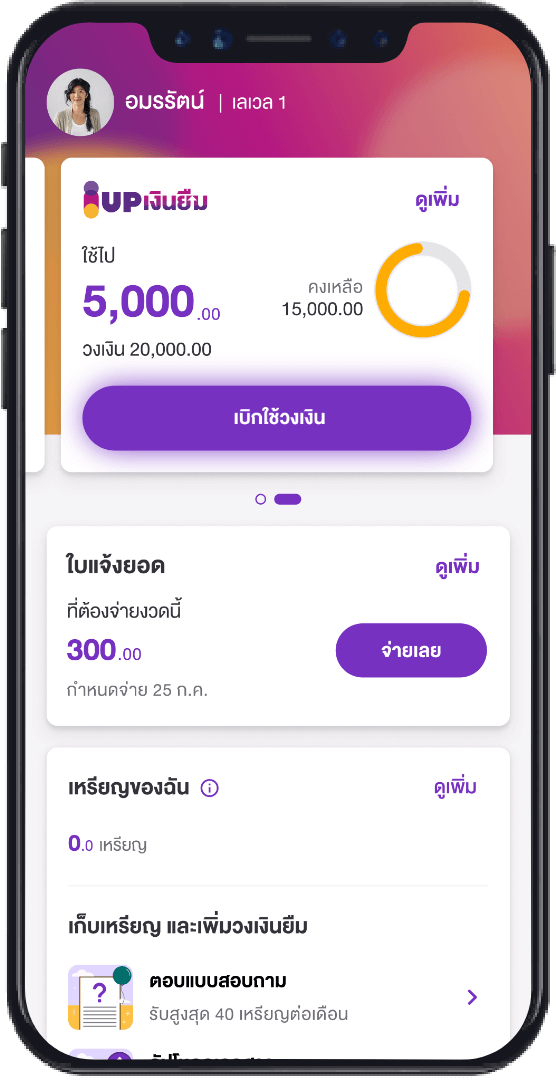

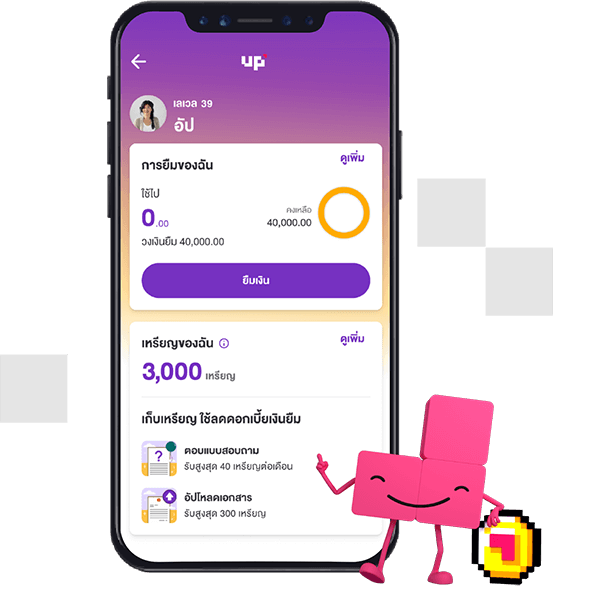

What are UP coins?

UP coins are coins earned from activities to help you save on interest (0% interest).

UP coins can be used for a maximum of 50% of a borrowed amount.

Conditions

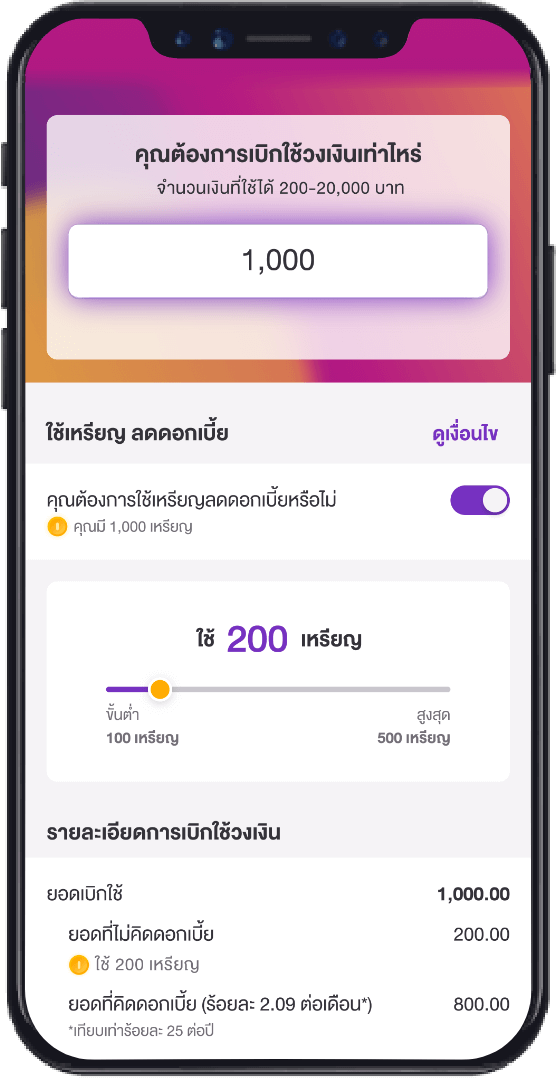

- With an UP coin, you will receive 0% interest for 1 baht borrowed.

- UP coin redemption is possible for between 100 – 20,000 UP coins and each redemption must not exceed 50% of that borrowed amount.

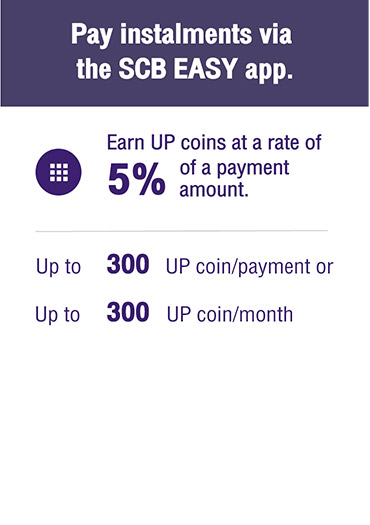

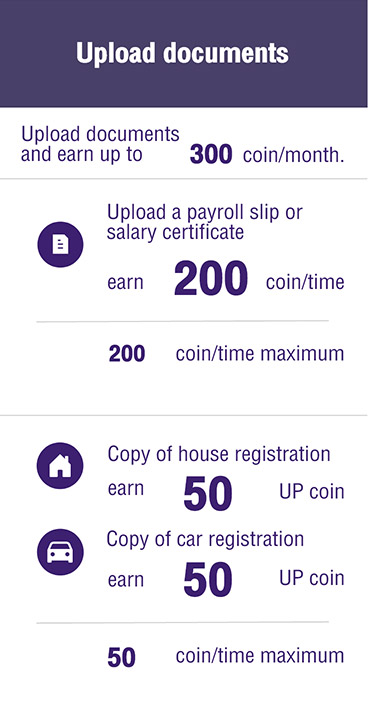

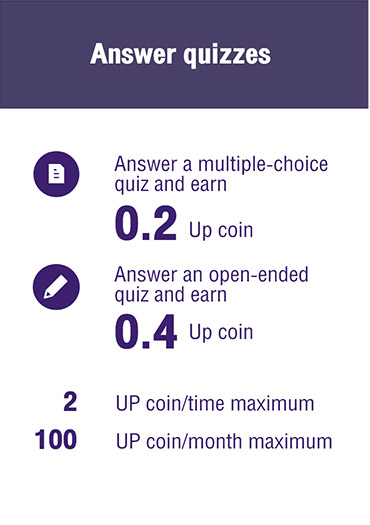

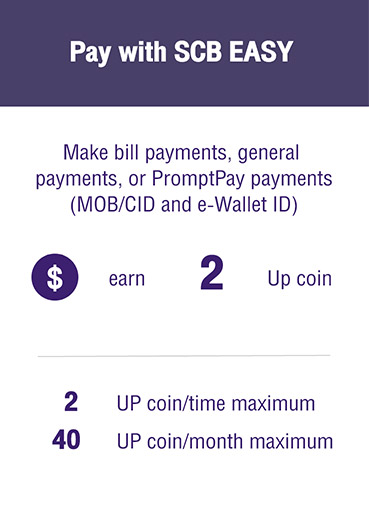

- You can collect up to 1,000 UP coins per month.

- Conditions are as specified by SCB.

interest rates

interest rates

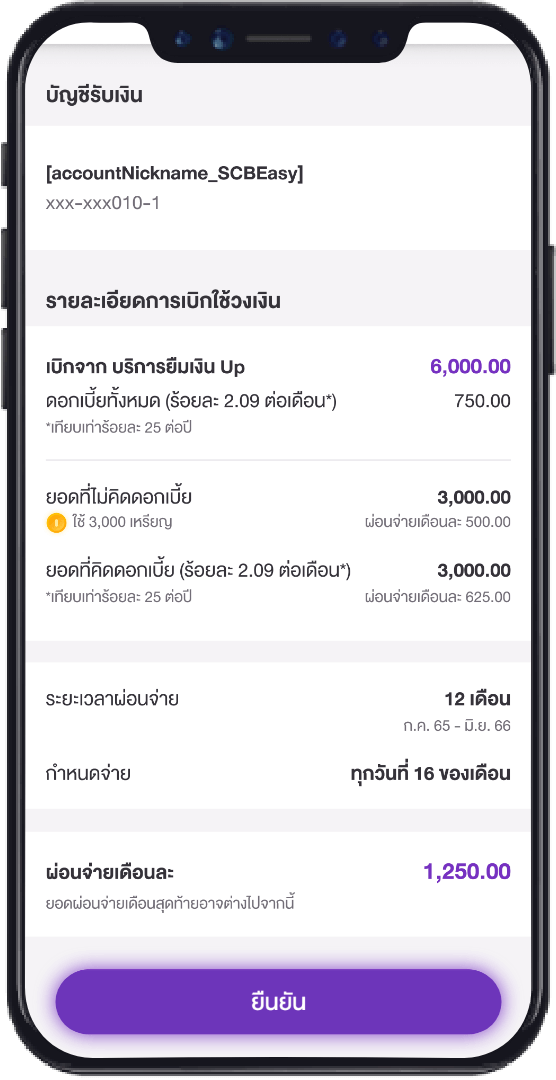

Interest rate of 25% p.a.

Special interest rate of 0% p.a. when using UP coins for interest discounts

Conditions on special  interest rates

interest rates

- With an UP coin, you will receive 0% interest per month for 1 baht borrowed.

- You can use UP coins for a maximum of up to 50% of a borrowed amount. Between 100 – 20,000 UP coins can be used for each UP coin redemption.

- You can collect up to 1,000 UP coins per month.

- Default rate is 25% p.a. maximum (the highest default rate as per the loan contract + 3% on top) for the principal amount of any default instalment.

- For more information, please call the SCB Call Center at 02-7777777.