I WANT

RELATED LINKS

I WANT

RELATED LINKS

RELATES LINKS

I WANT

RELATES LINKS

Services

Related Links

คำค้นหาที่แนะนำ

ผลการค้นหา "{{keyword}}" ไม่ปรากฎแต่อย่างใด

ข้อแนะนำในการค้นหา

- ตรวจสอบความถูกต้องของข้อความ

- ตรวจสอบภาษาที่ใช้ในการพิมพ์

- เปลี่ยนคำใหม่ กรณีไม่พบผลการค้นหา

Use and Management of Cookies

We use cookies and other similar technologies on our website to enhance your browsing experience. For more information, please visit our Cookies Notice.

- Personal Banking

- Stories & Tips

- Salary Man

- How to invest Provident fund during crisis

- Personal Banking

- ...

- How to invest Provident fund during crisis

How to invest Provident fund during crisis

20-04-2020

During a crisis, many people may be worried about the investment policy of the selected provident fund. That will be suitable for the economic trend that is currently slowing down or not. How should you adjust your investment plan? This article has answers.

First, before deciding to change investment policies ask yourself first how much risk you can take. Measured by answering questions in the risk assessment form that everyone must do before investing in order to truly get to know me.

If deciding to select an investment policy based on other people without knowledge and have invested heavily in shares that are considered high-risk assets after seeing the stock falls into a hundred points then the heart attack Answer is an investment that does not match the risk that you accept. Therefore, answering questions in the investment risk assessment form is straightforward as well as understanding your own feelings when seeing heavy stocks. Therefore, this is a very important first step

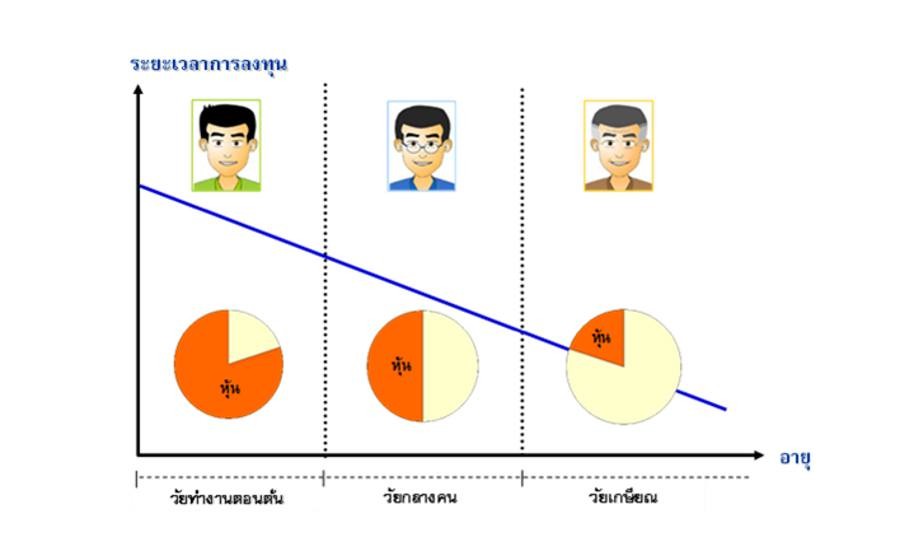

Next, aside from considering the investment proportion in stocks according to the acceptable risk level We also need to consider arranging portfolios by age range. Which if we are young and have a long investment period that we will be able to invest in high-risk assets such as stocks. And over time as our age and our investment period are shorter, we have to adjust our portfolios to reduce the proportion of risk-weighted assets as well. Since there are only a few years left to work, it is necessary to maintain the best principle. Therefore should not take risks with shares Examples of arranging investment portfolios by age and ability to take risks are as follows:

However, because of the economic crisis that came quickly and severely until may cause many of you to not adjust your portfolios Then what should be done next? We have some suggestions as follows

1. In case you are not very old There are many years of work. If there is no investment in shares at all Recommend starting to invest in a small proportion of stocks first to create an opportunity for increased return Since the yield on the current debt is low, not more than 2-3% and the trend is still around. Therefore, the total return of the provident fund is mainly from shares you also have a long investment period that can tolerate stock fluctuations.

2.In case you are not very old There are many years of work. There is already some investment in shares. Recommend to keep the proportions in shares the same You should not move out of stock at this time (in case you do not adjust your investment before the crisis or do not adjust out of the stock in time) because the move out of the stock now means that you will have to recognize the Realized Loss from the investment. In stock immediately Because moving out of stock To invest in other instruments Equal to the sale of shares at the market price (Which has fallen a lot already) and invest in other instruments instead Causing the value of your provident fund to disappear immediately While if still investing in shares The loss seen is just the unrealized loss. Or accounting losses (Unrealized Loss) and when the crisis is over the falling stock price can recover. Which, if we have a period of ten or tens of years before retiring No need to worry about the loss of stock today. Because this is not the first time the stock has fallen this much. And will not be the last time in our lives too. Please just have a long enough investment period. In addition, if anyone with the ability to take high risks Recommend adding more weight to invest in stocks To wait to reap the rewards when the economy recovers after the crisis has passed This will give the provident fund an opportunity to secure financial stability for us in the long run.

3. In the case that the remaining working period is less than 5 years, in fact, if you have less than 5 years of working time, your portfolios should have no more than 15% of your investment in the portfolio. Regularly And currently there is no more than 15% investment in shares. Believe that the result of the stock market falling strong Should not affect your portfolios very much with not much remaining investment duration You need to adjust the focus from focusing to creating rewards. To become more focused on maintaining funds, Therefore, if you assess the value of an existing port Combined with new investments coming in the next few years and found "fair", then you should reduce the risk of investment, such as reducing the proportion of shares. Even if the stock has fallen Because of making a good investment decision. We mainly look forward to the Damage that has already occurred is already considered. We can't go back and change anything. Must not forget that we are not like the 1st or 2nd group who have a lot of time To invest again For people in group 1 or 2, the damage occurred Will be only temporary damage But for you This damage It may be permanent. Therefore should not risk walking the necessity

But if assessed, the damaged port goes Make you not enough money to achieve goals. You have to fix it in another way. Not to invest in the rest of the time Other solutions, such as finding extra income Some savings in order to save more Or if necessary, the sale of certain large assets To be an important source of funds in life Is considered a plan that can be used There are many people selling big houses. Come to live in a small house To bring money from sales into expenses in retirement age Just need to think more carefully than usual. In addition, if you have money other than the retirement fund, such as life insurance Pension insurance, or compensation from employment termination under the labor law You may spend money from this section first. And keep the money in the provident fund first Keeping money is another way you can let your money continue to invest in order to improve the market. And gradually take the money out of the fund

In summary, in order to achieve the desired investment goals Regularly reviewing investment portfolios and adjust the portfolios to be in line with acceptable risk levels and the remaining investment period regularly It is important and very important as well.

By : Niphan Phunsathiensup CFP® Independent financial planners, writers and speakers