Sustainability Report 2021

Download

SCB SUSTAINABILITY

Established over a hundred years ago as the first Thai bank, Siam Commercial Bank (SCB) is committed to conducting business responsibly and fairly for the benefit of society, and aims to strengthen the financial and banking system of the country while helping drive the economy to stability and prosperity, uplifting the nation’s quality of life.

SCB understands that its longevity and stability is a result of dedication from employees, trust from customers, collaboration from partners and support from stakeholders. These are essential force that lead to Bank to remained committed to conducting business responsibly and continued to create values to society.

For SCB, sustainability and responsibility to society not only mean delivering satisfactory returns to shareholders, but also harnessing the ability to effectively respond to customer needs, taking care of employees, supporting partners and suppliers while improving the wellbeing of society and the environment, in hope to create inclusive growth as well as to help support the United Nations Sustainable Development Goals (SDGs).

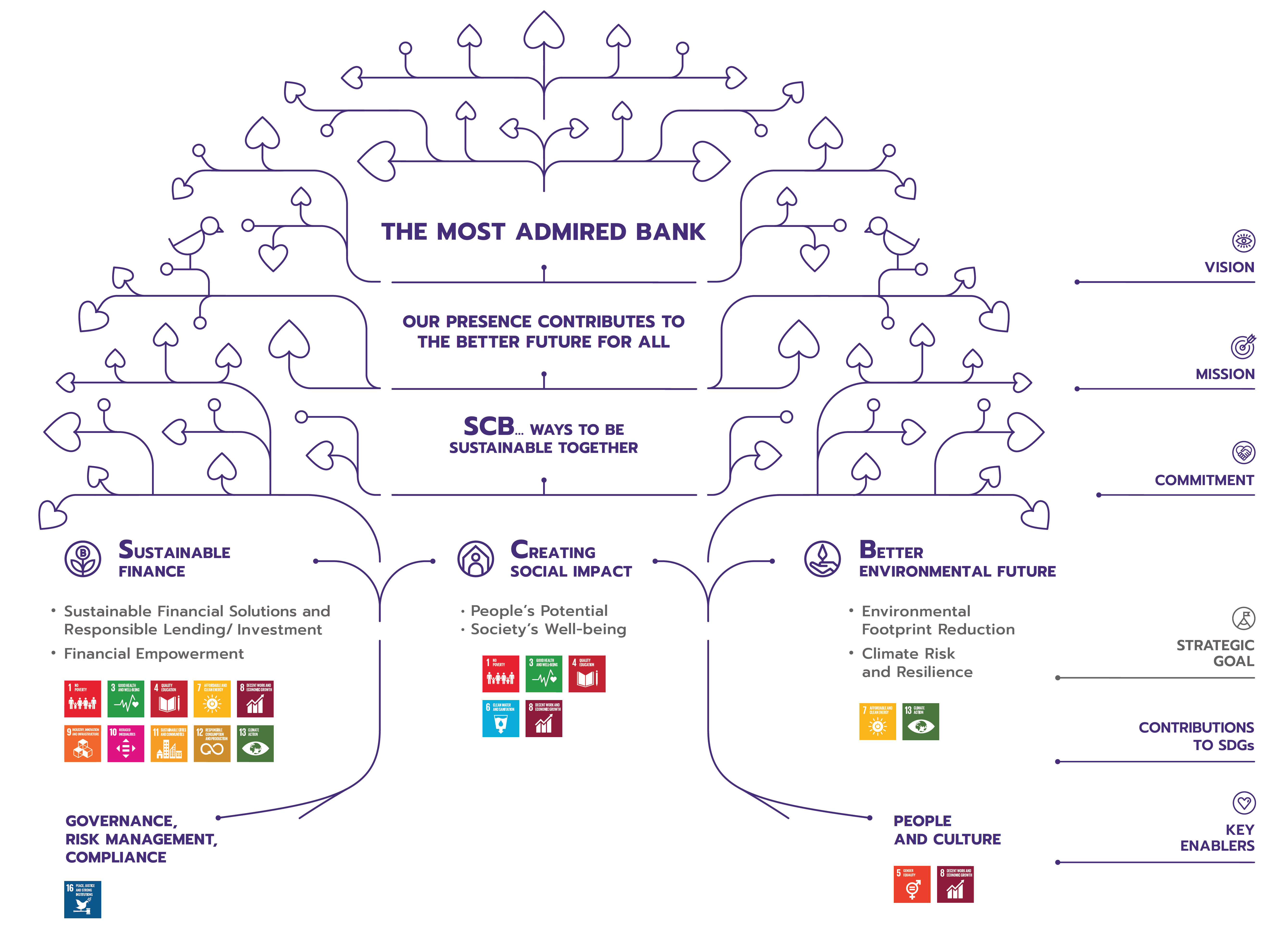

Sustainability Policy and Framework

SCB’s journey to sustainability is driven by its commitment to strengthening economic stability and creating value for society while conserving the environment. Accordingly, the Bank has established a sustainability mission under an ‘Our Presence Contributes to a Better Future for All’ concept, steered by three key pillars: Sustainable Finance, Creating Social Impact, and a Better Environmental Future. These components demonstrate that SCB is not only the name of the first Thai bank, but also the ways to be sustainable together.

SCB SUSTAINABILITY FRAMEWORK

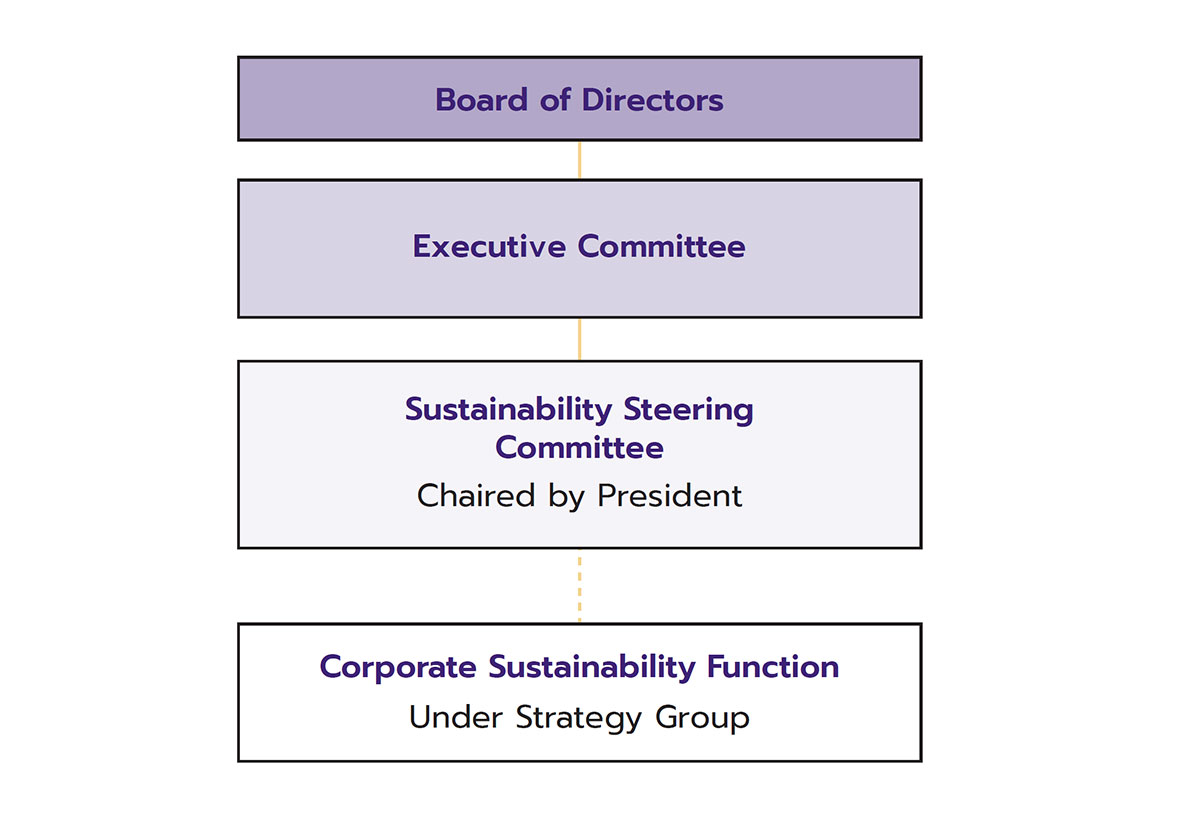

Sustainability Governance

To ensure adherence to the Sustainability Policy and framework with systematic deployment, the Bank has specified sustainability governance structure tasked with roles and responsibilities from the Board to business units in order to embed sustainability thinking as part of SCB culture and work process.

Sustainability Governance Structure

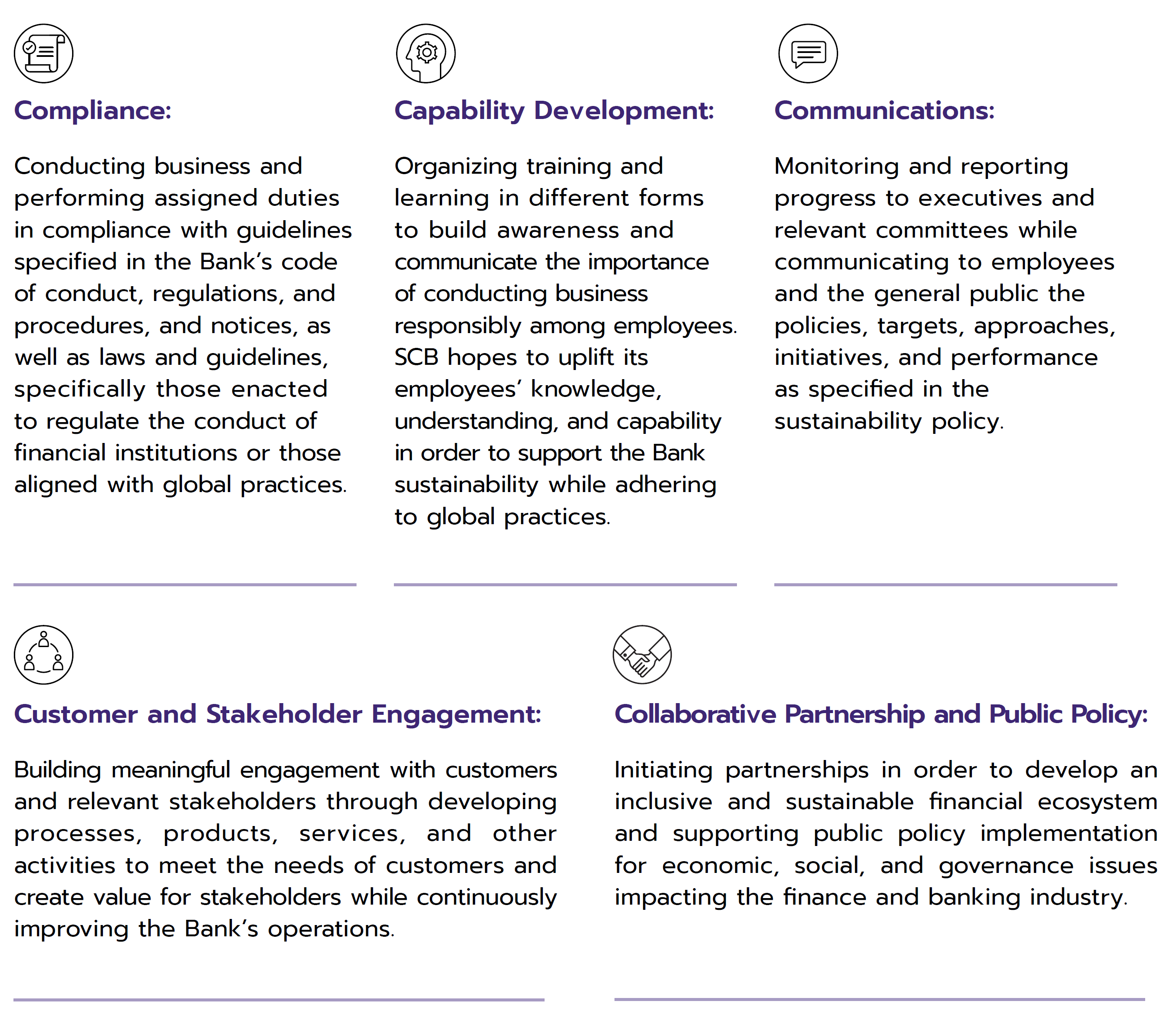

Integrated Approach

To promote and support bank-wide implementation adhering to Sustainability Policy while integrating sustainability concepts and practices into its business operations, the Bank has laid out the following ‘5C’ approach:

Stakeholder Engagement

Stakeholder engagement is at the heart of developing the business towards sustainability. Therefore, there are specified guidelines on stakeholder engagement in the Bank’s Code of Conduct. The Bank also encourages every function to continuously foster stakeholder engagement through appropriate channels and activity to understand their expectations and perspectives as well as to solicit feedback and suggestions on the Bank’s operations. This stakeholder inclusion effort also provides an opportunity for SCB to communicate sustainability aspirations and management approach to stakeholders. In addition, stakeholders’ feedbacks serve as input to the report selection process and provides guidance for the Bank to meet stakeholders’ expectations in all dimensions.

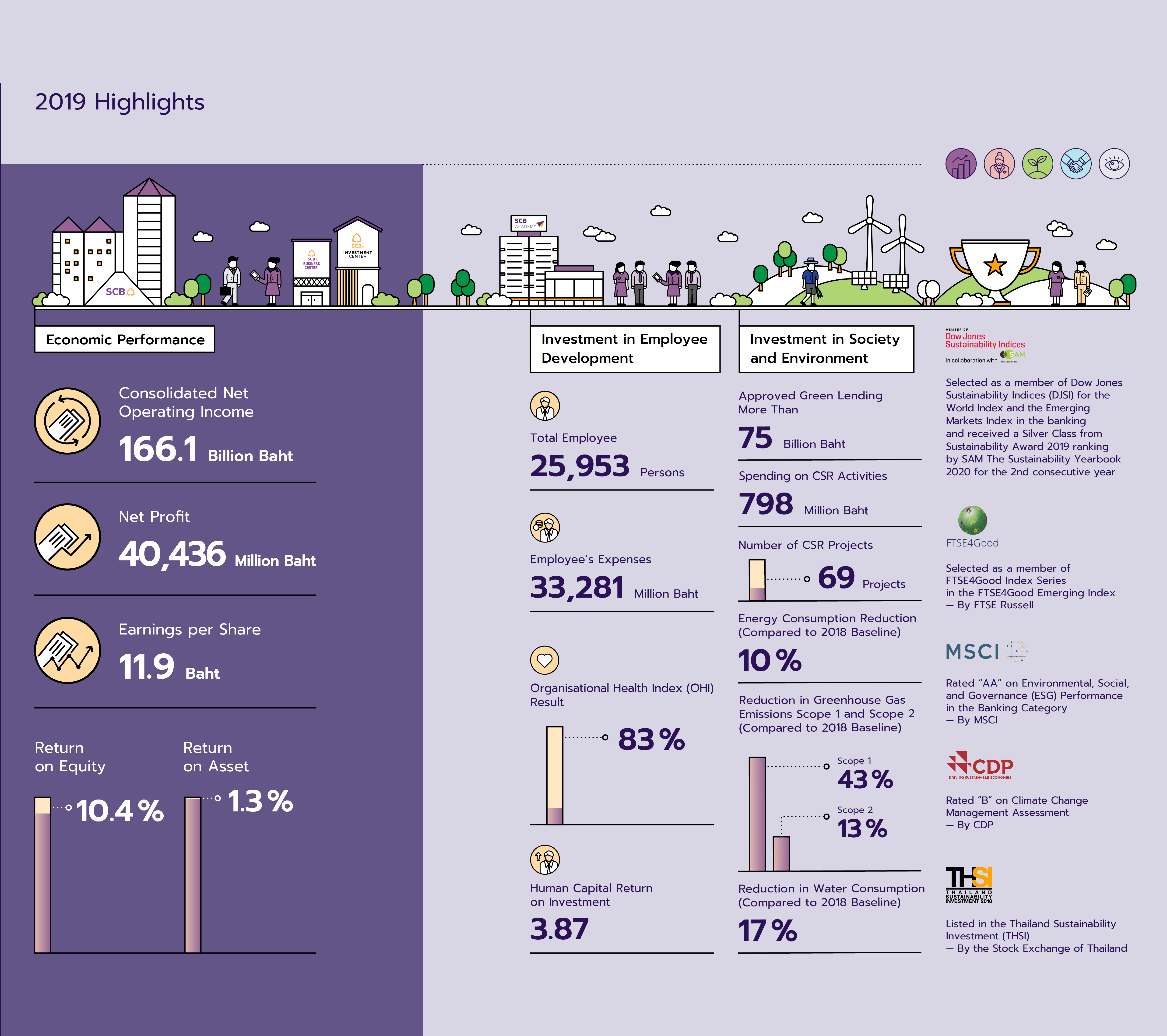

In 2019, in addition to year-round stakeholder activities and communication, the Bank also conducted in-depth interviews with selected groups of stakeholders to gather suggestions, feedback and information on material issues along economic, social and environmental dimensions. This information serves as key input into materiality prioritisation.

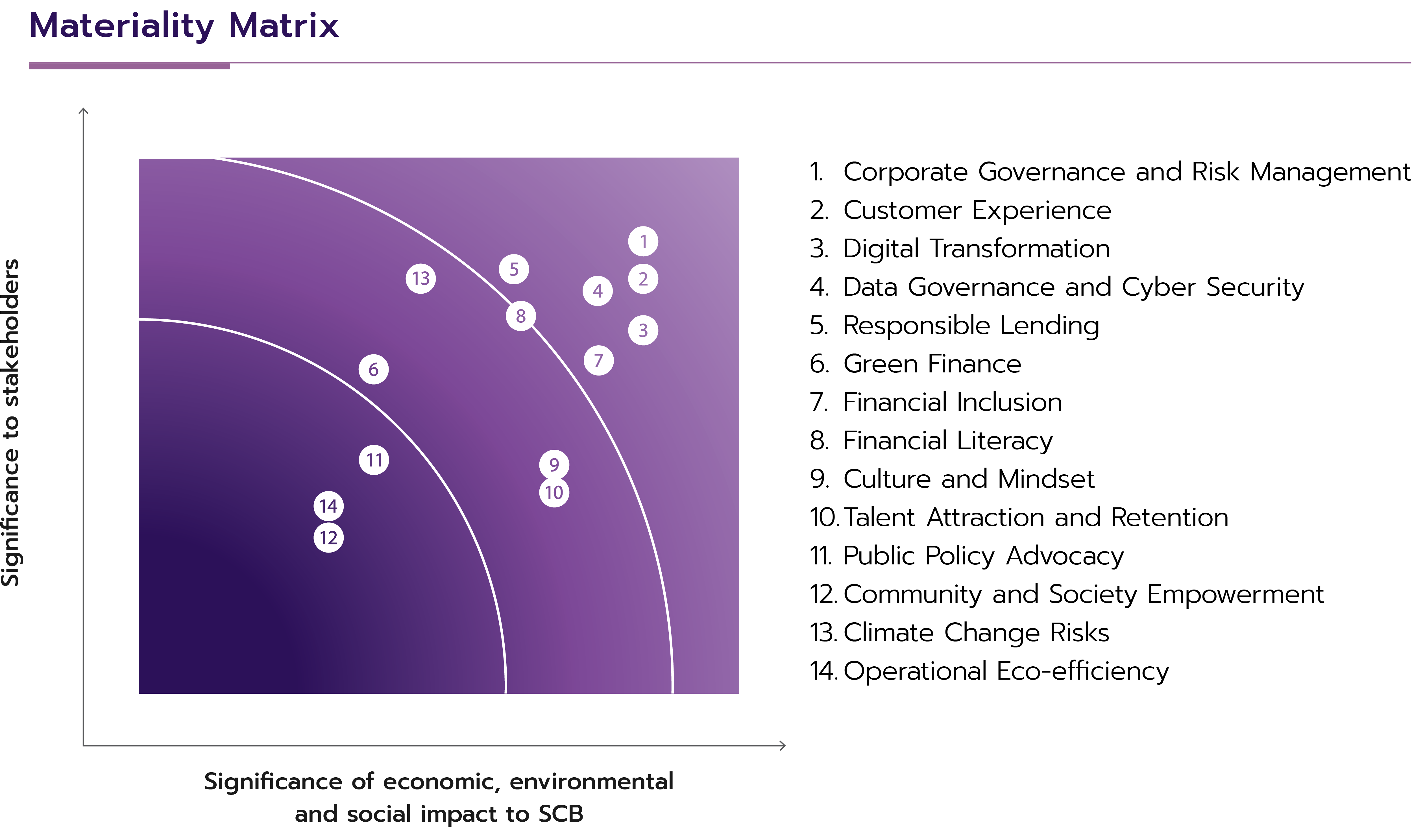

Sustainability Materiality Matrix

The Bank annually identified issues and any other relevant topics by considering both internal and external factors, such as organisational strategies, business risks and opportunities, prominent issues for the global banking industry as well as stakeholders’ interests. The Bank performs materiality assessment and prioritisation based on stakeholder interests and impact on the business.

The assessment results are reviewed and approved by the Management Committee. The Bank has also conducted stakeholders’ survey for improving SCB’s sustainability efforts and future reporting.

2019 SCB sustainability matrix is identified as followed.

Impact valuation

The Bank places an emphasis on understanding the impacts of business activities on every groups of stakeholder. The Bank introduced impact valuation methodology that examines economic,social, and environmental impacts from the Bank’s operations, both positive and negative externalities while attempting to monetises the true value of the Bank’s contribution to society. Key business factors that have been incorporated in the economic, social, and environmental impact valuation methodology are: opportunities to improve operational efficiency, preparation for future legal and regulatory changes, customer base expansion, creating environmental business opportunities through sponsorship, promoting a positive image of the Bank, and transparent disclosure of the Bank’s operating performance to stakeholders.

Since 2017, the Bank’s products and services were chosen to undergo the economic, social, and environmental impact valuation by considering stakeholders’ expectation and global trends in digital technologies. The Bank calculates positive contributions from product and service delivery on the digital platform which helps promote financial service accessibility. At the same time, the Bank also assesses environmental impacts of digital innovation by using the Natural Capital and Social Capital Protocols, which has been globally accepted, as guidelines. The resulted valuations will be incorporated in the business planning for customer base expansion.

The Bank strives to achieve strong growth, greater productivity and prudent risk management to consistently generate reasonable shareholder returns on the basis of responsible treatment of all stakeholders. The Bank’s strategy is driven by managing its existing assets to the full potential, creating new business models, as well as making investments and partnerships.

For greater productivity, the Bank focuses on developing technological and people capabilities as well as continuously improving resource efficiency to maintain its long-term competitiveness and growth potential.

The Bank also places heavy emphasis on having a systematic and comprehensive approach to risk management as well as building a strong corporate culture to embrace changes in the rapidly changing business environment.

Moreover, the Bank has incorporated social and environmental considerations into its business strategy implementation, risk management process, and corporate governance for sustainable development. In addition, the Bank also employs both financial and non-financial indicators to measure operational success and value.

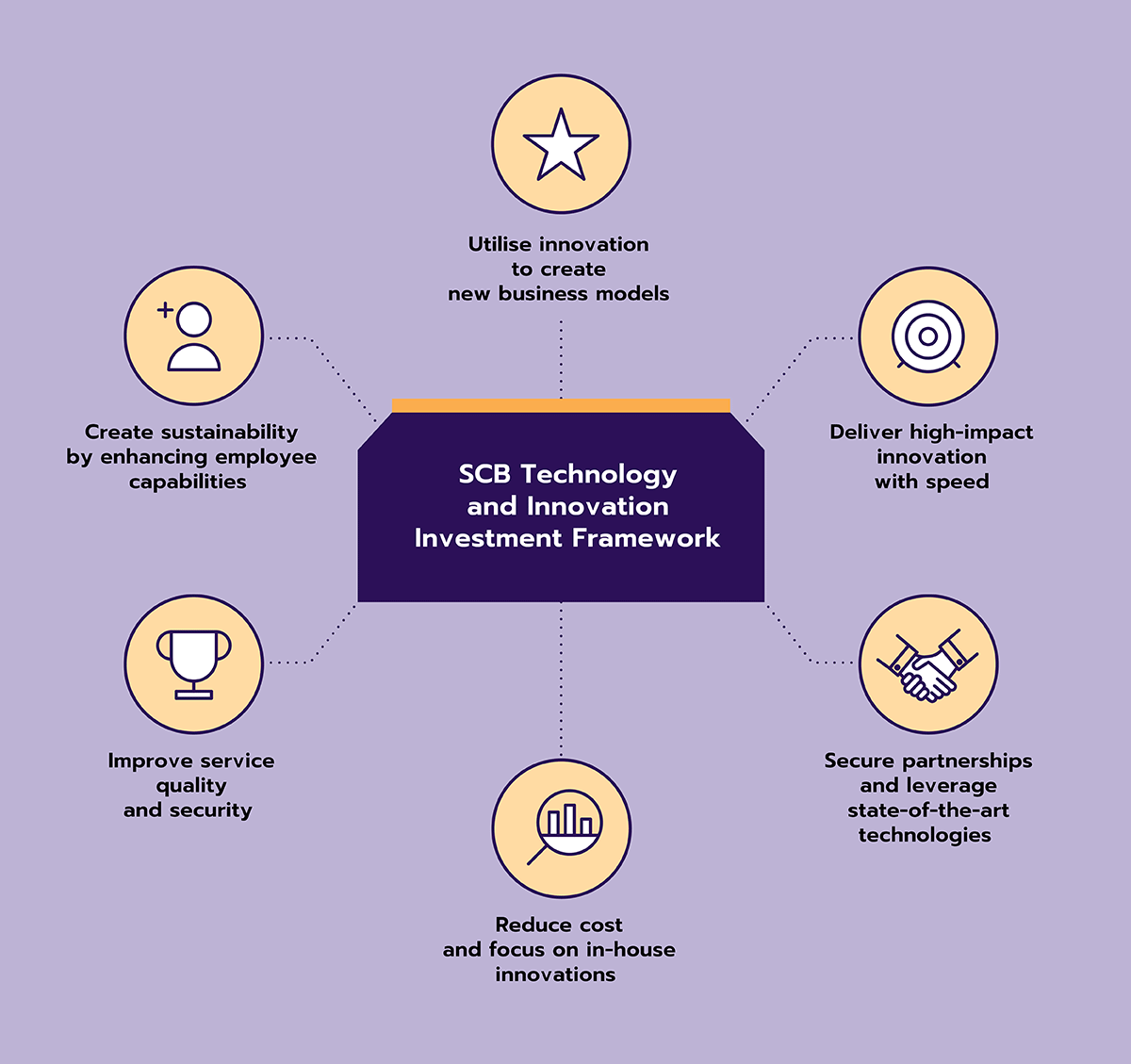

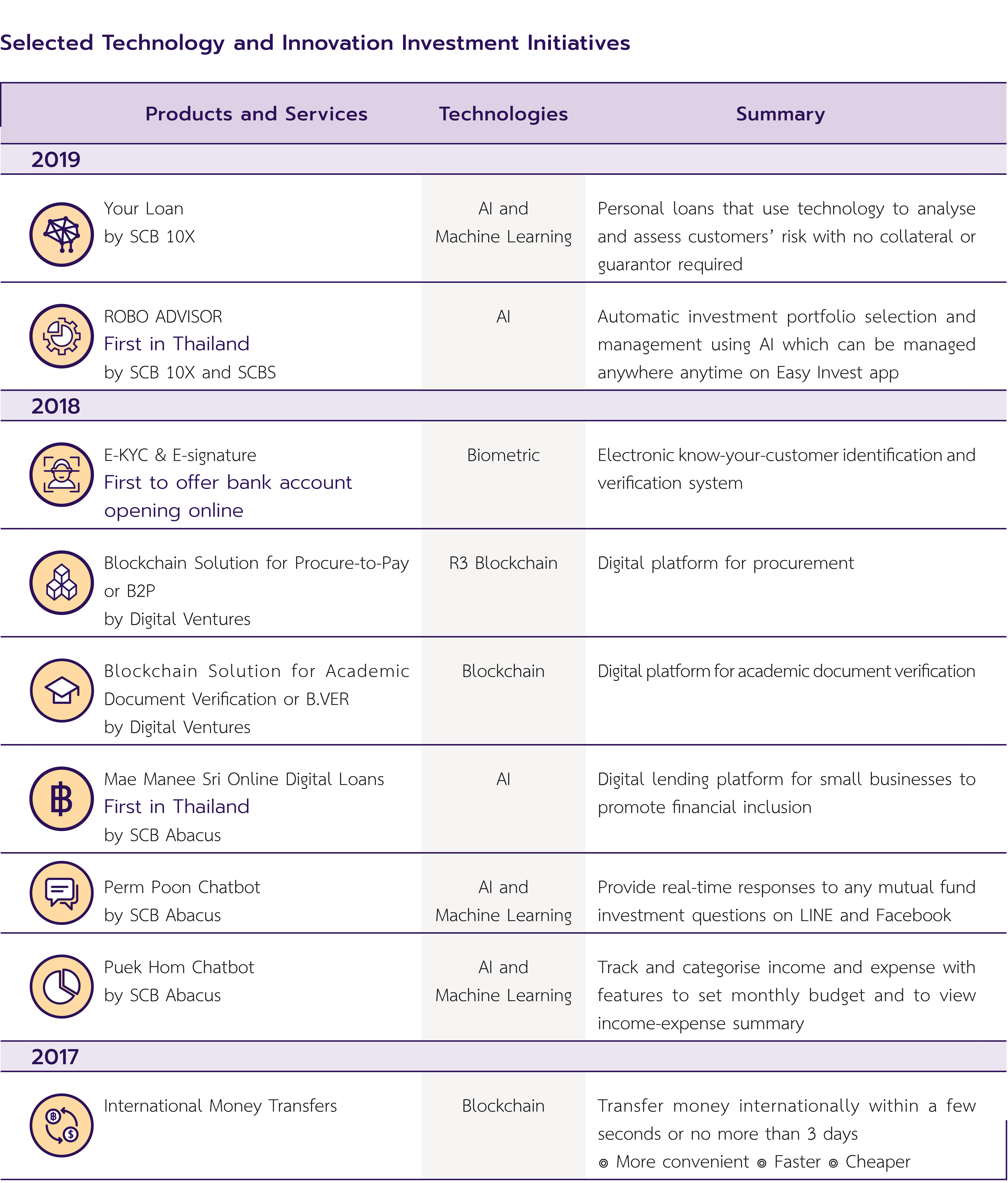

Digital Transformation

Innovation and speed are at the heart of differentiation which, in turn, increases an organisation’s competitive advantage. This requires data and digital technology as key enablers to drive core business growth and new business development with the goal of creating seamless experience for customers, promoting financial inclusion for the society, and achieving exponential growth with partnerships.

Thus, the Bank’s key priority is to become fully digitised and data-driven through investment in technology and innovation. The goal is to transition to “bank as a platform,” build a digital ecosystem, and ultimately become a tech company.

The Bank continuously identifies, implements, and enhances its product and service offerings to become a truly digital bank, meeting the evolving needs of its customers. All new product and service developments adhere to a robust and transparent process, ensuring compliance with applicable laws, regulations, and standards, thereby minimizing legal risks. Additionally, these developments incorporate relevant risk criteria to ensure that the final products and services remain within acceptable risk levels. The Bank has appropriate management procedures in place to promptly address any issues, minimizing the risk of legal violations and protecting consumer rights.

Upon mitigating potential risks through compliance with risk criteria, the products and services are presented to relevant departmental heads for acknowledgment, followed by approval from the Board of Directors.

Customer Experience

Customer Relationship Management

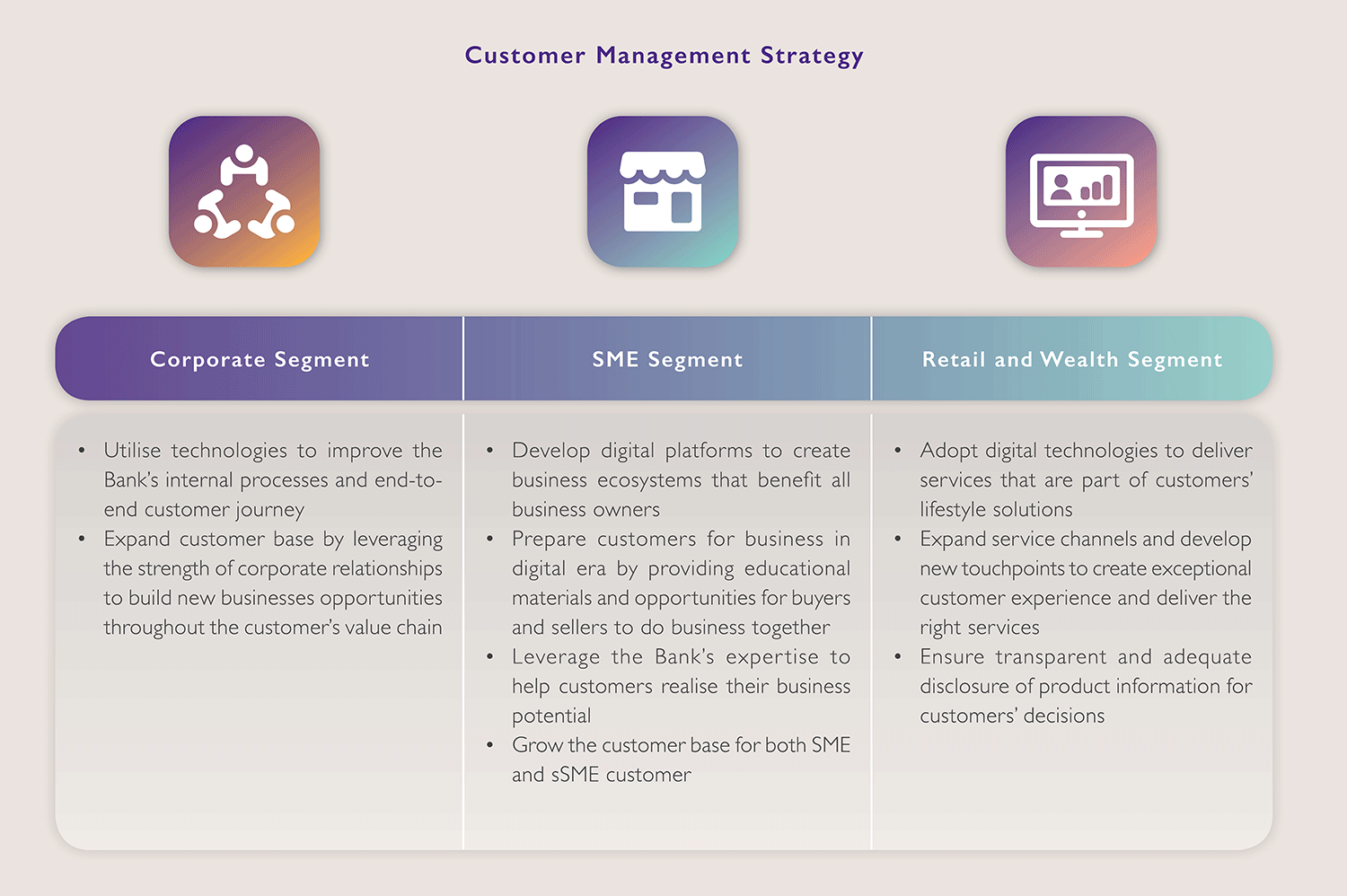

With the challenges from technological advancement, the banking industry has been revoluntionalised to the point where banks are expected to offer more than standardized financial services. Thus, it has become crucial to understand customer needs at great depth to deliver products and services that are specifically tailored to each customer segment. SCB employs advanced analytics technologies to manage and analyse customer behaviour data with the goal of delivering better customer experience and helping customers realise their full potential.

The Bank strives to be a universal financial service provider that delivers the right products and services to meet customer needs. Therefore, the Bank classifies customers into 3 main segments –Corporate segment, SME segment, and Retail and Wealth segment, with the following management strategy:

Customer Satisfaction

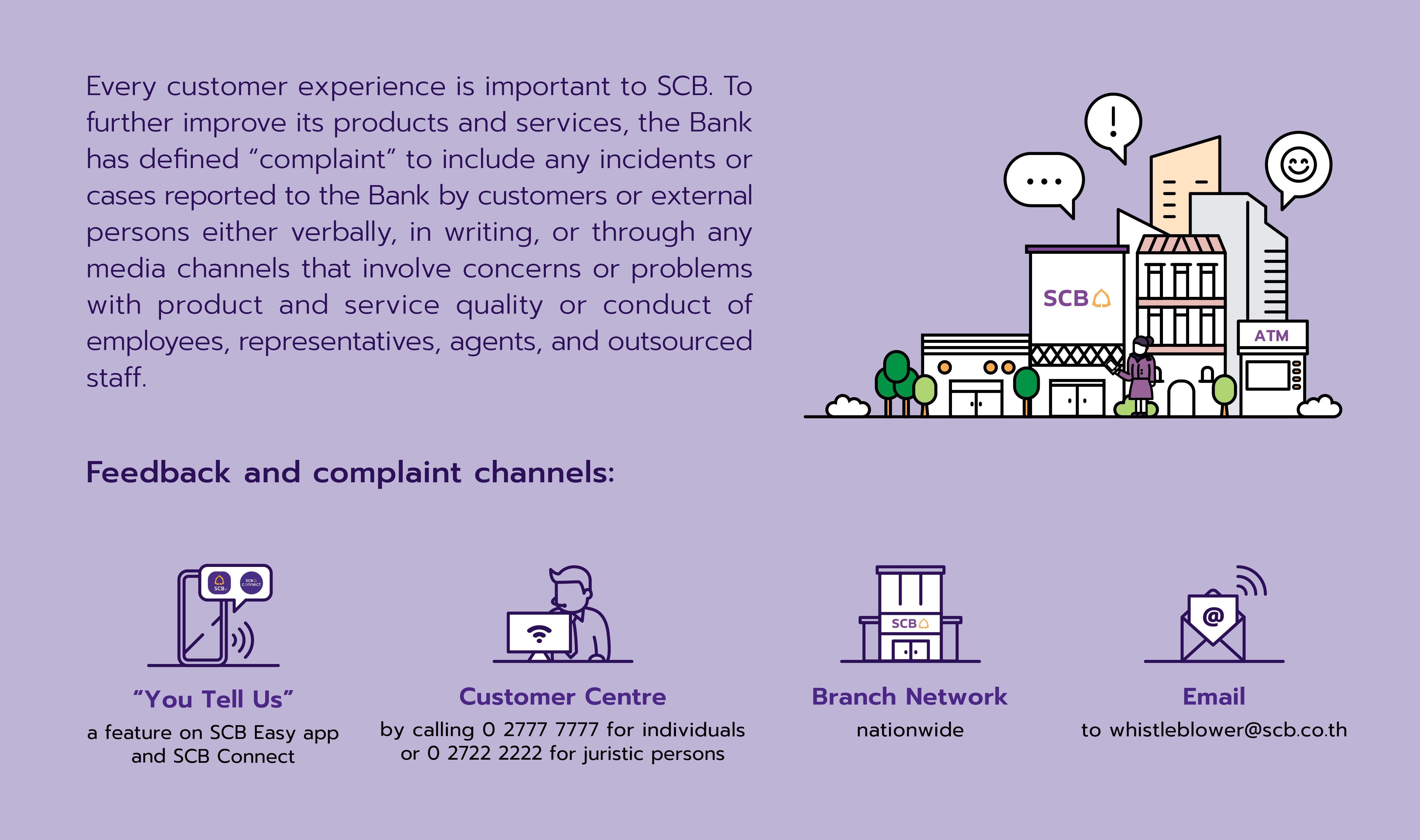

To ensure that the Bank’s products and services truly meet customer needs, the Bank conducts a customer satisfaction survey every year through a variety of channels such as SMS messaging, YouTellUs App via SCB Connect through Line app and SCB EASY. The annual survey results help the Bank understand how customers feel and get feedback to further improve the business operation.

In addition, the Bank seeks to deliver services based on transparent practice and good governance in order to ensure utmost customer satisfaction. Accordingly, the Bank has in place a procedure on customer complaints handling, assigning employees from all business units to collect customer complaints and proceed for solutions while informing customers within a specified service level agreement. Specifically, the Bank similarly has in place a procedure in taking care of customers in case of robbery, theft and fraud by scammers or external parties. Established in 2021, Financial Crime Customer Center is tasked to provide victimized customers with correct, accurate and prompt support to request and track refunds. Responsible business units are also assigned to provide necessary information, facilitating any legal actions and remedy as appropriate on a case by case basis.

People Management

Talent Attraction and Retention

“People and culture” are at the heart of business success. To attract and retain talent as well as building a strong culture under today’s intense competition and rapidly changing business environment, an organisation must constantly reassess and ensure that its workforce management approach remains effective. In addition, the organisation must seamlessly link personal development, career advancement, compensation, culture, and working environment into an integrated management approach. In 2019, the Bank reviewed and reformulated its people strategy to prepare for challenges and opportunities that may arise both at present and in the future. SCB’s people strategy consists of four key components.

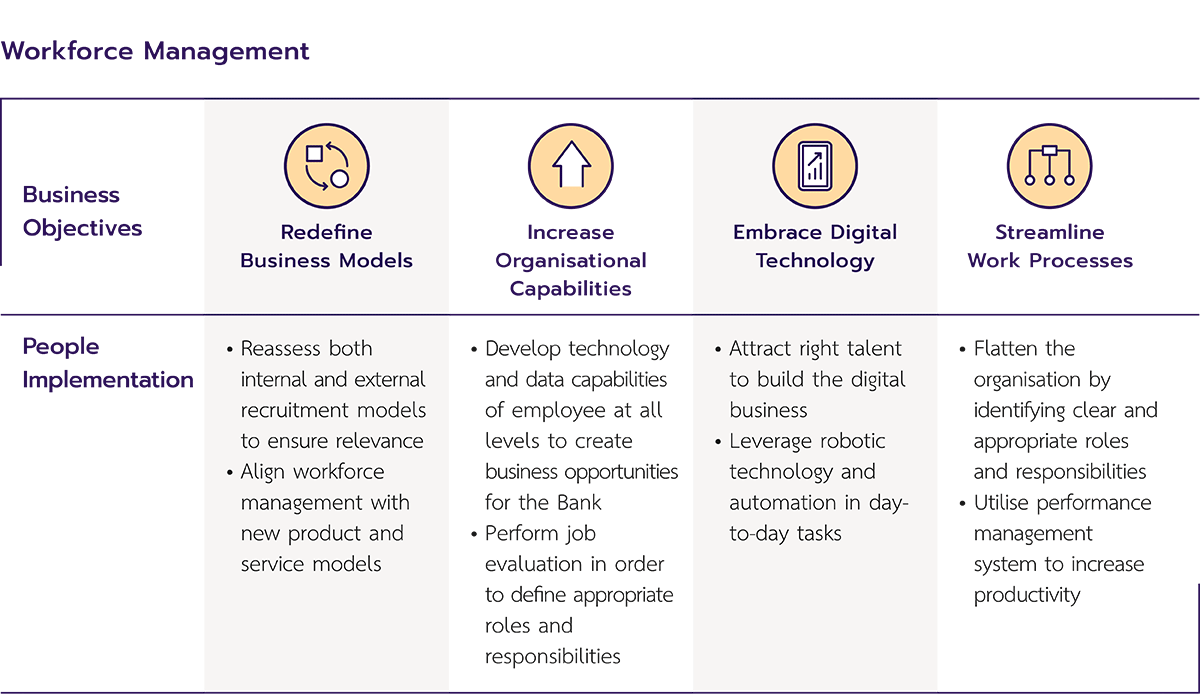

Workforce Management

To keep its workforce management approach in strategic alignment with the business direction, the Bank focuses on proactive recruitment, capability enhancement at both organisational and individual levels to uplift employees’ skill sets, as well as ensuring adequate and suitable manpower to operate in the digital age. These factors will enable the Bank and its people to grow together sustainably.

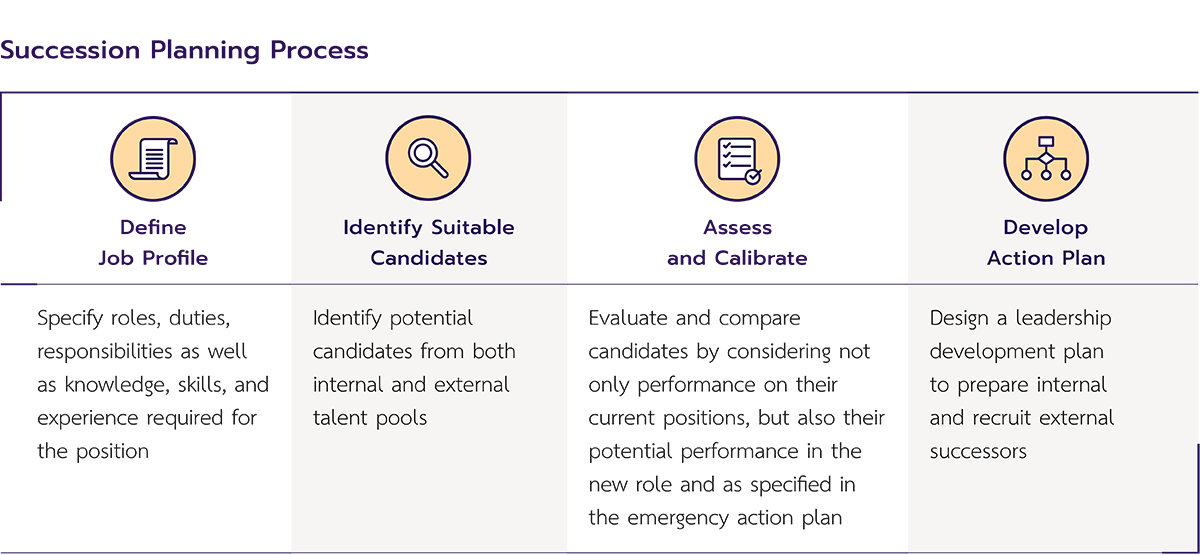

Succession Planning

Having a well-defined career path is a powerful incentive to attract and retain talent as well as enhancing productivity which creates a clear bottom-line impact to the business. Thus, the Bank pays particular attention to talent management and succession planning. A succession management framework has been put in place to fill vacancies of key positions, from both strategic and potential impact perspectives, through a systematic succession planning process. Candidates are assessed based on knowledge, capabilities, skill sets, and experiences that are required for a particular position in conjunction with leadership skills and cultural fit. In 2019, the Bank had reviewed and completed succession plans for key positions at the senior management level.

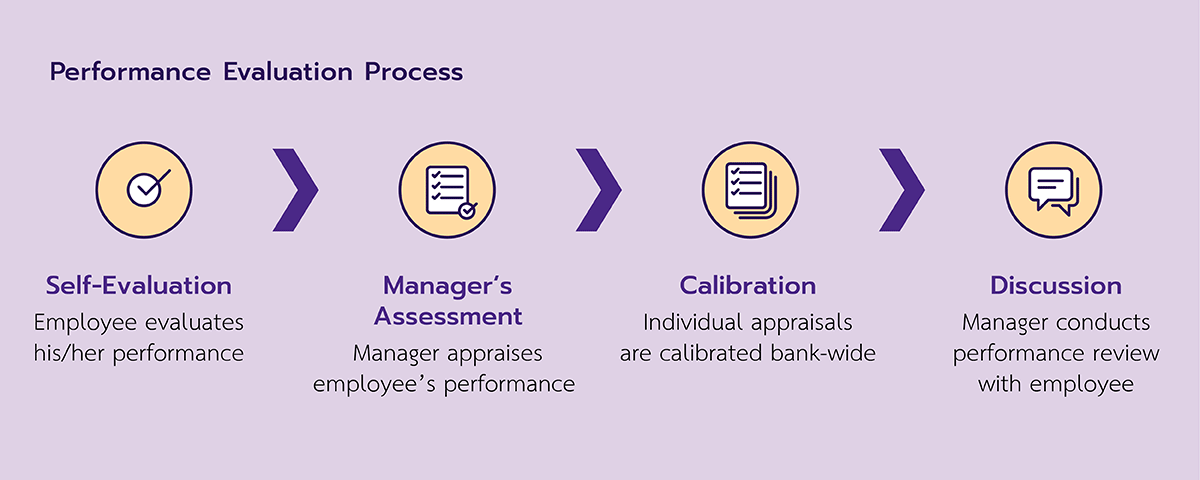

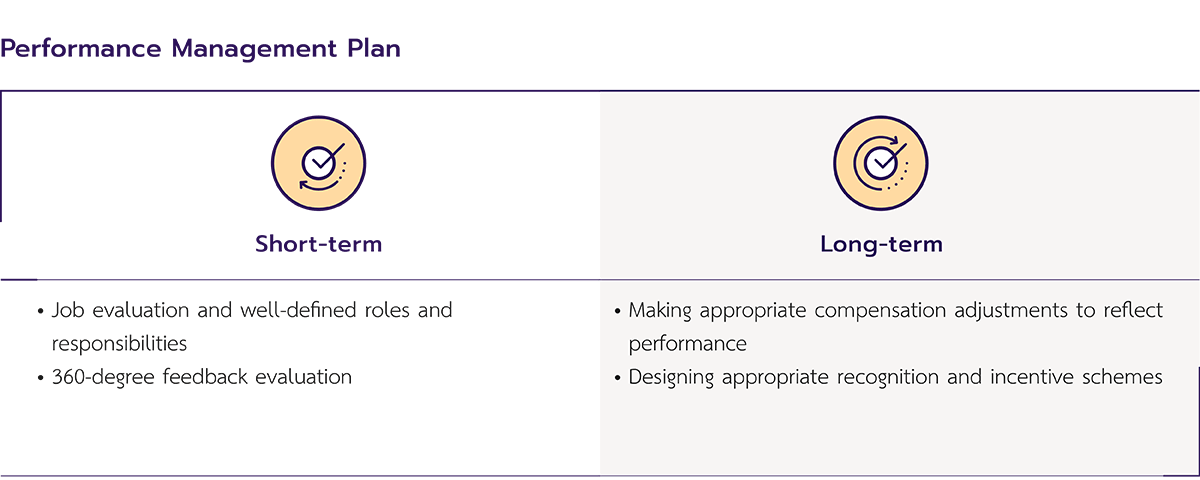

Performance Management

To manage and motivate employees to perform their best and contributes to the goals of the organization, as well as driving behaviors to align with the organization’s values, requires fair and competitive compensation, appropriate promotions, and effective personal development planning. Accordingly, the Bank has adopted a performance evaluation system in alignment with applicable sector leading programs, as part of its performance management system. This includes a four-part evaluation process as follow.

Following the discussion with relevant managers, employees are guided and are offered with applicable sector leading and job-specific development training programs relevant to individual job positions.

Moreover, to safeguard a continuous availability of skilled employees at multiple levels, the bank has also established a comprehensive succession planning & development programs for managerial and leadership positions.

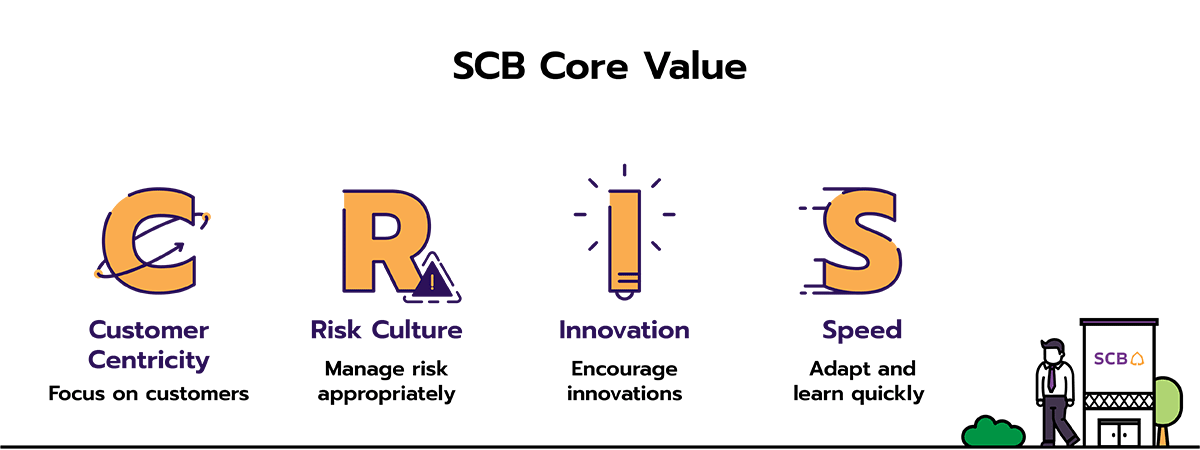

Culture and Mindset

Organisational culture is not only a set of shared values that drives the organisation forward, but also a factor that attracts candidates to join and be part of the organisation.

Amid technological advancement and rapidly changing consumer behaviour, the Bank implemented the SCB Transformation program in order to adapt to the new business environment and to create new digital experience for customers. Moreover, with its commitment to truly meeting the needs and adding value for customers, the Bank launched an initiative to build Agile Organisation culture in 2019. To become an agile organisation requires the Bank to change the organisational structure, transform work processes, and shift employee’s mindsets to revolve around the four SCB core values.

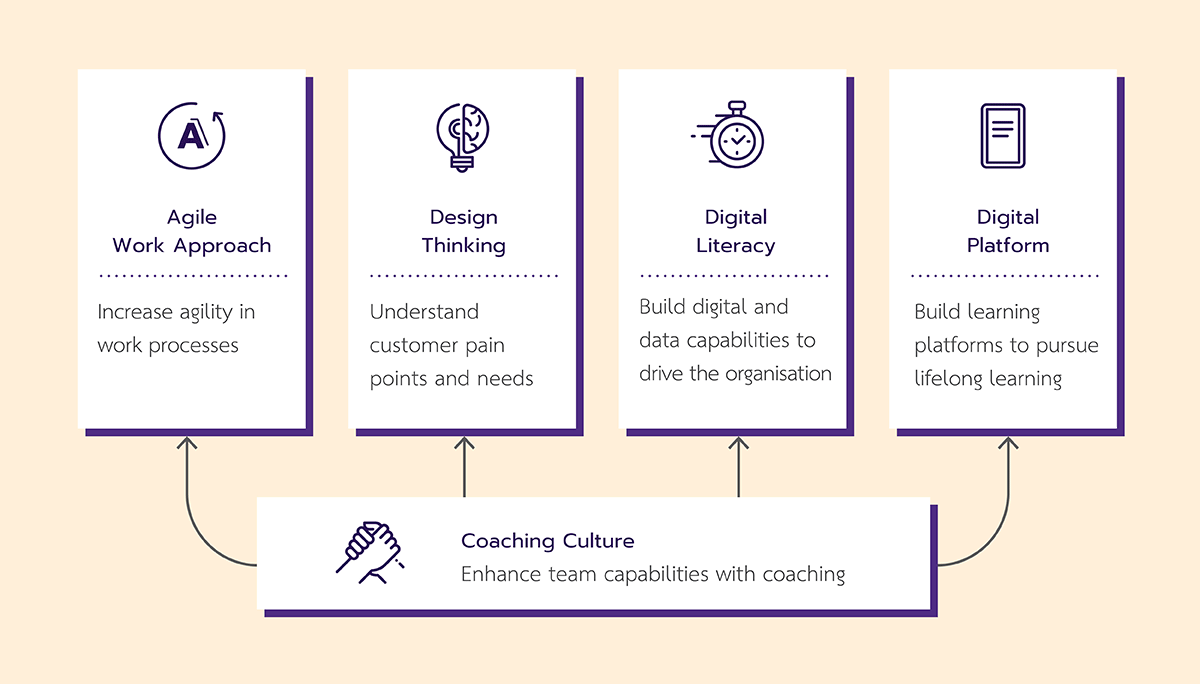

SCB and the New Ways of Work

The Bank continues to make progress in employee’s transformation to ride the wave of future changes which present a pressing need for change in employees mindset and work processes. To help employees at all levels reach their full potential in the digital age, the Bank has implemented its employee’s capabilities development strategies in 4 following areas.

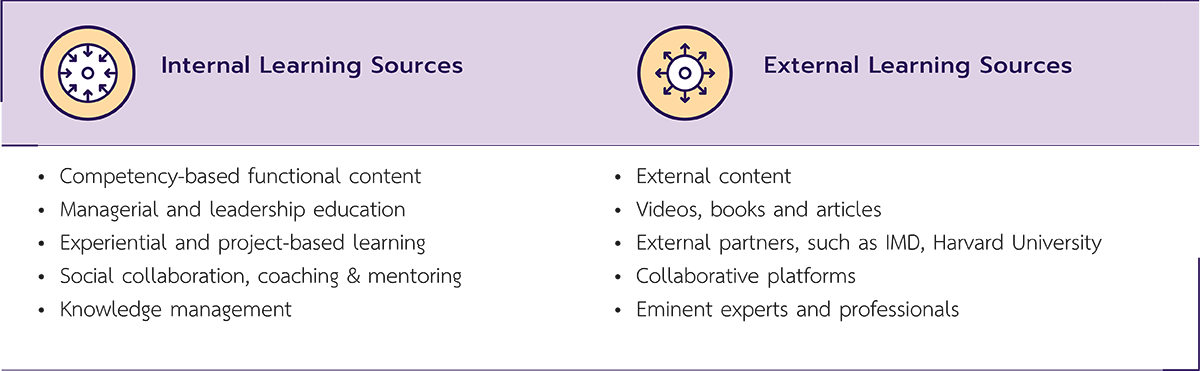

SCB and the New Ways of Learning

To become an organisation of lifelong learning, anywhere, anytime, the Bank has adopted technology to facilitate learning and training through both “push” and “pull” approach. The Bank built digital platforms that connect learning ecosystems throughout the organisation which enable employees to develop essential skills and enjoy limitless learning experience on learning platforms of the future. The Bank also has a tracking system to collect and monitor employees’ learning which can then be used for effective analysis and further improvement of the Bank’s training and learning systems.

Internal Rotation

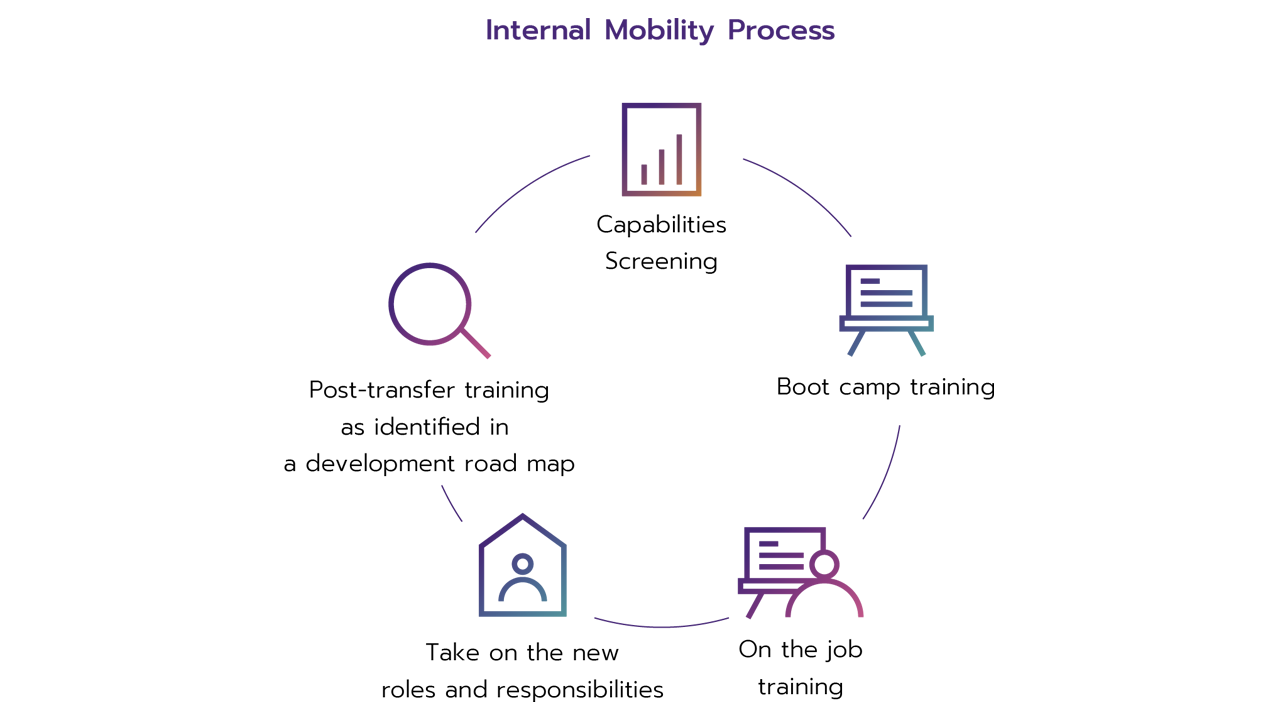

The Bank creates career advancement opportunities for employees at all levels by encouraging internal rotation to facilitate cross-functional learning and skill building. This internal rotation also ensures adequate manpower for the Bank’s future business strategy in addition to giving employees an opportunity to grow together with the Bank in a sustainable manner. For an effective employee rotation and transfer, the Bank has conducted strategic workforce planning and analysis in terms of both quantity and quality by applying a manpower model based on key manpower driver of each business unit, such as sales revenue, transaction volume, and number of customers This analysis enables business units to assess whether they have adequate manpower relative to the amount of work and can effectively plan for resources accordingly.

Communicating with employees and preparing them for internal rotation is another important matter for which the Bank has established a clear approach and procedure. The initial step is to conduct capabilities screening and then provide training necessary for the new positions through a variety of learning formats. Then, employees will receive on-the-job training prior to permanently assuming the new roles and responsibilities. Thereafter, the Bank will continue to monitor and provide additional training to ensure that employees can succeed and reach their full potential in their new roles.

Diversity and Inclusion

The Bank places an emphasis on respect for labor rights and fair treatment of employees without discrimination against gender, skin colour, race, religion, culture or education. This non-discrimination practice has been stated clearly and explicitly in the Bank’s Code of Conduct and communicated to all employees to encourage employees to treat one another fairly and respectfully. Moreover, employees are given complete freedom to join the Bank’s labor unions which are organised into three unions: management labor union, general employee labor union and service employee labor union. The objective of the labor unions is to forge strong relationships between the Bank and employees with a commitment to protecting the rights and fair benefits for members and employees by considering joint interests of all parties.

In addition, SCB respects individual differences and supports equal rights of all by providing opportunities to people with disabilities to illustrate their capabilities and creatively make contributions to oneself and to others. By the end of 2020, SCB hired and provided job opportunities to 239 people with disabilities through two types of support including directly employing 16 people with disabilities whose skills are suited to work in roles and responsibilities within the Bank. Similarly, the Bank also works with different foundations to support jobs creation of 223 people with disabilities.

Employee health, safety and well-being

The Bank treats employees like family members by ensuring their wellbeing and creating an inspiring and motivating workplace equipped with digital platform facilities. A wide range of channels have been put in place for employees to give suggestions and feedback which have been turned into concrete initiatives to enhance employee well-being at all levels such as redesigning work and recreational space at the head office and branch offices, allowing flexible work hours, providing benefits beyond legal requirements, for instance, allowing full paid maternity leave up to 90 days, full paid paternity leave up to five days, and creating various activities to provide an opportunity for employees to socialise with colleagues in other units and form strong relationships.

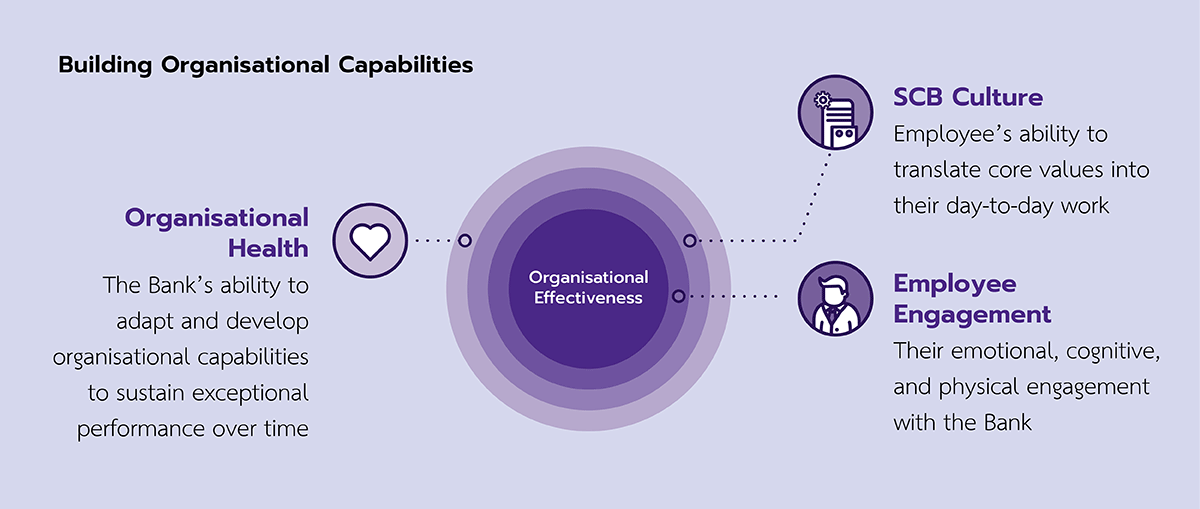

Organizational Health Measurement and Index

Although the Bank has given priority to developing employee capabilities and building positive attitudes toward change from job rotation and technology adoption, it is the Bank’s assessment on employee engagement that is the key indicator for becoming an employer of choice. Therefore, the Bank has assessed level of employee engagement by using the Organisational Health Index (OHI) as a measurement of the Bank’s current strength and readiness for future changes. In doing so, The Bank has engaged a leading global consulting firm to conduct the assessment to ensure neutrality and impartiality.

Health and Safety

A positive and safe work environment is fundamental to sustainable development of an organisation. The Bank develops and follows safety, occupational health, and environmental practices for employees, contractors and suppliers by complying with applicable laws and global standards and to prevent any incidents or accidents that may affect employees, customers, suppliers and contractors operating at the Bank’s premises as well as safeguarding the Bank’s reputation and credibility.

In 2022, the Bank reviewed and announced the latest version of the Occupational Health and Workplace Safety Management Policy which requires all employees to take ownership on safety issues as well as revising the safety, occupational health, and environmental guidelines to be in line with international standards. The Policy and guidelines have been communicated to all branches nationwide to guide workplace safety management. The Bank also assigns branch employees to perform safety self-assessment with the Bank’s Safety and Security Management Unit responsible for advising, following up on the assessment results and supervising the work to improve workplace safety. The key goal is to ensure that every employees come to work and return home safely every day at every workplace.

The Bank regards safety as the duty and responsibility of all employees. Employees must consider their own safety and that of their colleagues, as well as complying with safety and occupational health practices. The Bank places an emphasis on educating employees on safety issues by developing an online training course which offers convenience and accessibility. This safety training course is part of a mandatory training that all employees must complete before the end of their probation periods with the target of all employees successfully completing the safety training course. The Bank also runs a continuous employee safety awareness campaign through a variety of communication channels.

SUSTAINABLE FINANCE

An intermediary in mobilizing funds and resources to economy and society SCB is committed to ‘Sustainable Finance’ by integrating ESG into its credit underwriting process, financial products and services offerings as well as investment advisory to support transition to a low-carbon economy and sustainable development.

Responsible lending

Green/ESG Products and Services

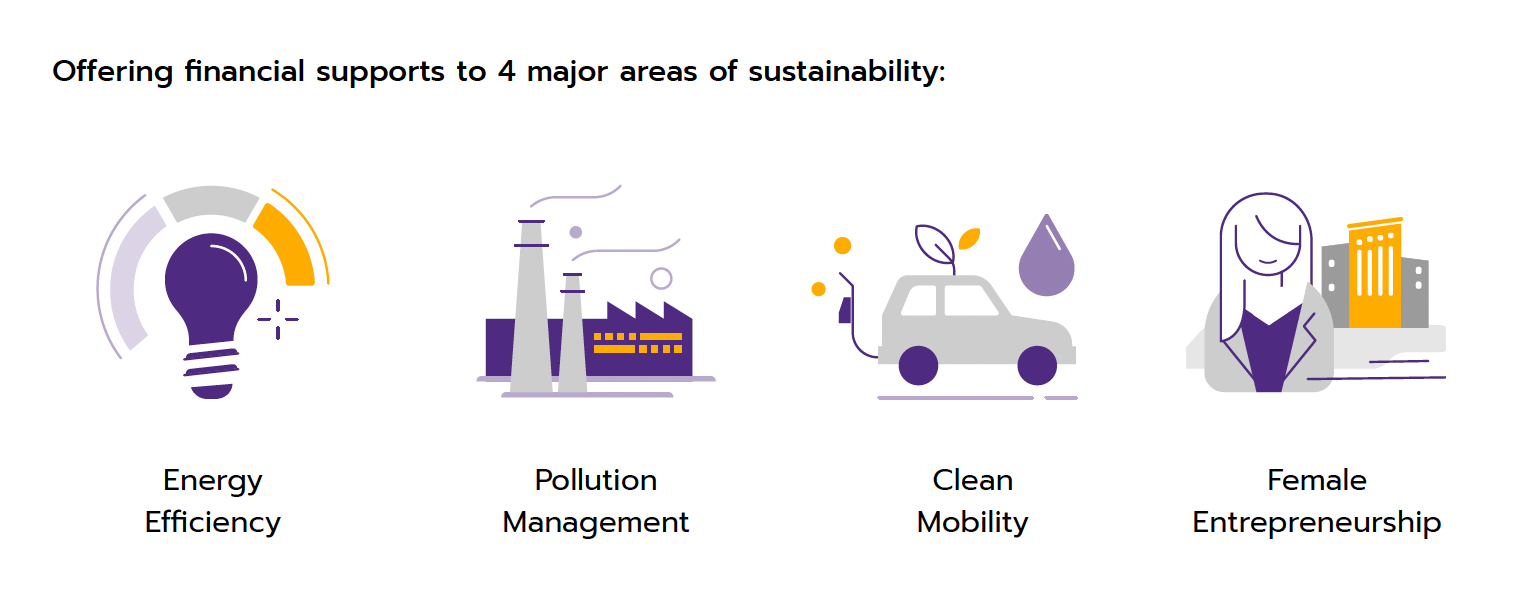

SCB seeks to offer a wide array of sustainable financial solutions that fit each client’s demand.

Corporate Customer

SCB has offered sustainable loans for corporate clients and infrastructure that rest upon the Green Loan Principles and the Sustainability-Linked Loan Principles (SLLP) guided by the Loan Market Association (LMA). The Bank has also supported the Thai financial markets to take part in protecting the environment and ecosystems by underwriting green and sustainability-linked bonds (SLB). The bond issuance proceeded in conformity with international standards, including the ICMA's Green Bond Principles and ACMF's ASEAN Green Bond Standards.

SME Customer

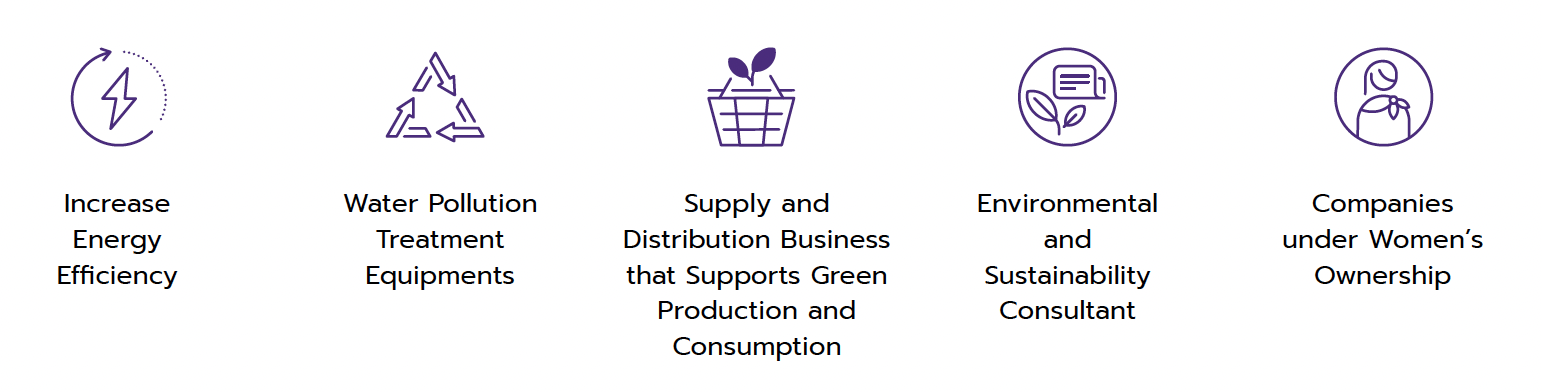

SCB has offered SME GO GREEN covering 4 main sustainable business activities to help SMEs achieve dual objectives of saving cost while also protecting the environment. In addition, the Bank has collaborated with government agencies and business partners in organizing ‘Green Seminar & Business Matching’ to uplift SME business efficiency, competitive edge, and environmental-friendly operation.

RETAIL CUSTOMER

SCB has offered retail customer the Clean Mobility loan and SCB Home Loan: Green Energy. The Bank has also offered Sustainable Business loans for sSME covering 5 main business activities.

Promoting Sustainable Investing

SCB provides investment advisory services to customers in wealth segment by offering financial investment products in accordance to customer’s investment objectives and risk appetite. Accordingly, the Bank has integrated significant environmental, social and governance consideration into its product offerings, focusing especially on the governance aspect, with the belief that a robust governance system in place will consequently generate positive environmental and social outcomes. The Bank has then applied the Investment Governance Code (I Code) as one of product selection and monitoring criteria for fund, structured note and bond. Similarly, the Bank also has in place risk assessment criteria concerning environmental and social aspects that might impact the performance of the bond issuer. If the findings are material, these are disclosed along with other important information for customer to make informed decisions.

In terms of wealth management advisory, SCB has established Chief Investment Office with responsibilities to review ESG related issues under the umbrella of Financial Management and Investment Policy. Here, preliminary review guideline for specific products are implemented to identify potential ESG concerns. The results are subsequently presented to the Investment Committee, chaired by Chief Risk Officer, responsible for reviewing the policy to ensure its appropriateness and relevance in the current business context. Apart from the comprehensive risks assessment in place, the Bank launched SCB Thai Equity CG Fund to facilitate investment in companies with good corporate governance practices based on CG Scoring ratings of the Thai Institute of Directors, including companies that are accredited members of Thailand’s Private Sector Collective Action Coalition Against Corruption with a good governance track record. This project provides a solution for customers whose objectives were to include ESG consideration in making investment as well as gaining financial return. Finally, the Bank places great importance on the Know-Your-Customer (KYC) process specified as part of SCB and its financial group’s Anti-Money Laundering and Counter-Terrorism and Proliferation of Weapon of Mass Destruction Financing Policy which requires strict compliance from all customers.

Responsibility to Environment

SCB manages our operational eco-efficiency performances of our key buildings through data governance, data collection, performance target, performance reporting and third-party assurance. SCB seeks to continuously improve our approach to data coverage, data consistency and data collection which we applies new technologies such as cloud computing to improve our process.

SCB sets up a committee chaired by a senior executive to oversee operational eco-efficiency performance and initiatives. The targets of 10% intensity reduction, by 2023, on individual operational eco-efficiency performance (total energy consumption, water consumption, waste disposal and domestic travel) the performance is also tracked on a monthly basis.

Internal Resources Management

The Bank puts an emphasis on creating the right balance between business prosperity and environmental quality by making the most efficient use of resources in conjunction with reducing impacts resulted from the Bank’s operations. Thus, resource efficiency and conservation have been integrated into the Bank’s operational and work processes to enhance operational eco-efficiency and employee engagement.

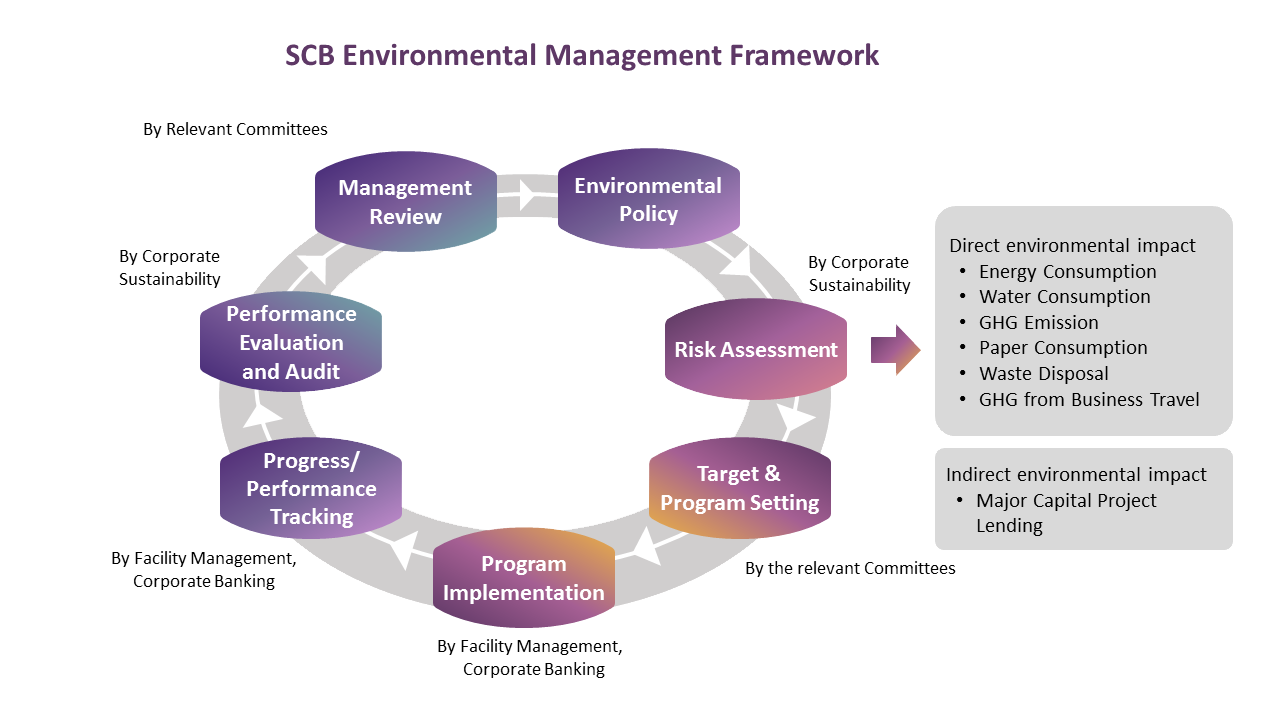

The Bank focuses on managing and mitigating environmental impact in accordance with SCB Environmental Management Policy overseen by the Environmental Committee. In addition to setting strategies and directions, the Environmental Committee, chaired by the Bank’s senior executive, is also responsible for enforcing compliance with ISO 14001 standards as well as monitoring performance to be in line with the policy framework and targets. To achieve its long-term goals, the Bank also sets targets and develops a resource management plan annually along with having systematic implementation and monitoring in place.

Sustainable Procurement

Green Procurement

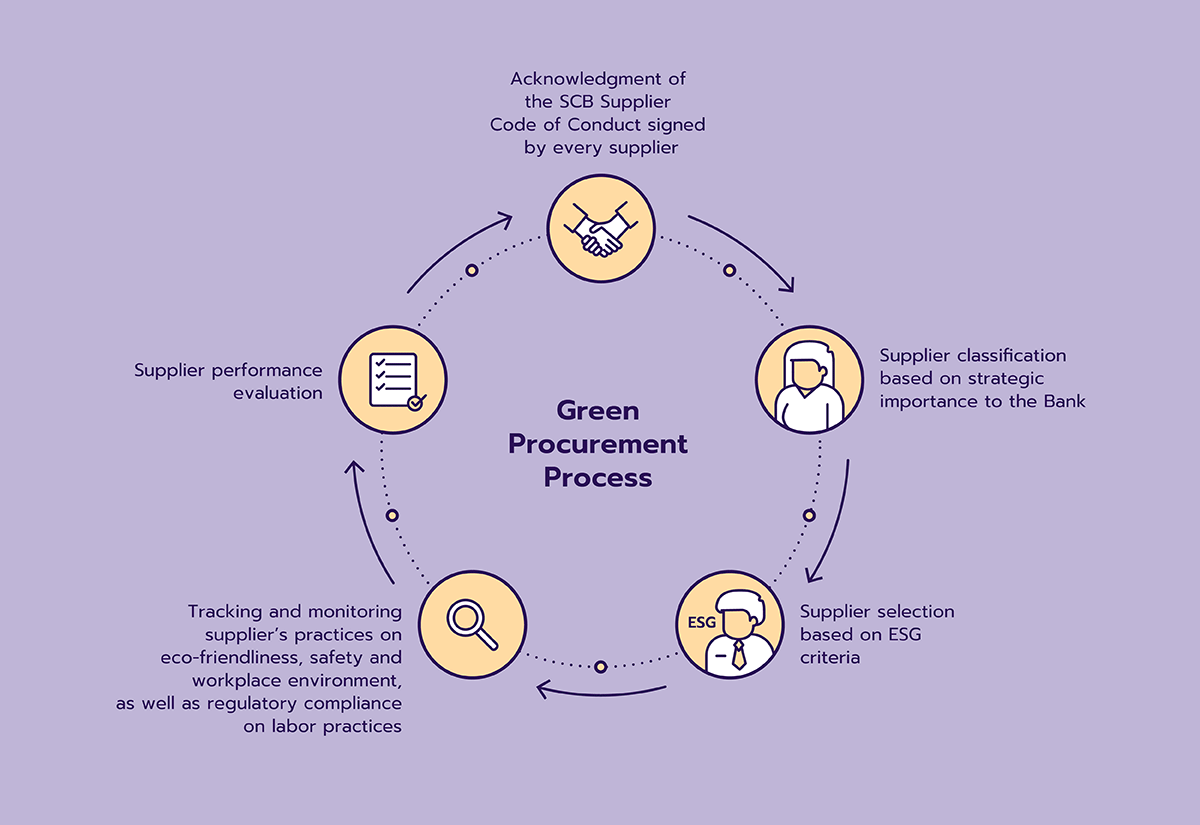

To prevent and mitigate environmental and social impact from procurement practices, the Bank established the Procurement Policy with explicit rules and procedures as well as defining roles and responsibilities of the Procurement unit. In addition, the Bank has in place the SCB Supplier Code of Conduct, for which every supplier is required to sign an acknowledgement. This document provides guidance to vendors and suppliers on good practices that meet legal and regulatory requirements with respects for human rights and consideration for environmental and social impact management.

To better understand suppliers and to effectively manage sustainability of supply chain, the Bank classifies suppliers into different groups based on their procurement value, product and service type, and strategic importance to facilitate supplier management and regulatory compliance. Moreover, the Bank has a process for selecting new suppliers that takes into account their environmental practices, e.g. existence of policy and practice guidelines, adoption of ISO 14001:2015 standards, and environmental management track records. Once selected, the Bank tracks and monitors their practices as well as assessing environmental impacts from their operations. The assessment results will be used as input into future supplier decision.

Supplier Code of Conduct

Banking operations relies on strong partnerships with suppliers in various tasks to responsibly deliver services and products that meet the Bank's needs. To emphasise integrity and fair treatment among its suppliers, SCB has established a 'SCB Supplier Code of Conduct) as a basis of supplier selection, convering business ethics, labour and human rights, occupational health and safety and environment.

The supplier code of conduct is annually communicated to suppliers via the Vendor Communication Day and suppliers are required to acknowledge and strictly follow the Supplier Code of Conduct. The Bank regularly monitors and audits the supplier compliance and reserves the right to halt the work in consideration of impact or damage. Details of the SCB Supplier Code of Conduct

Corporate Citizenship

Community and Social Empowerment

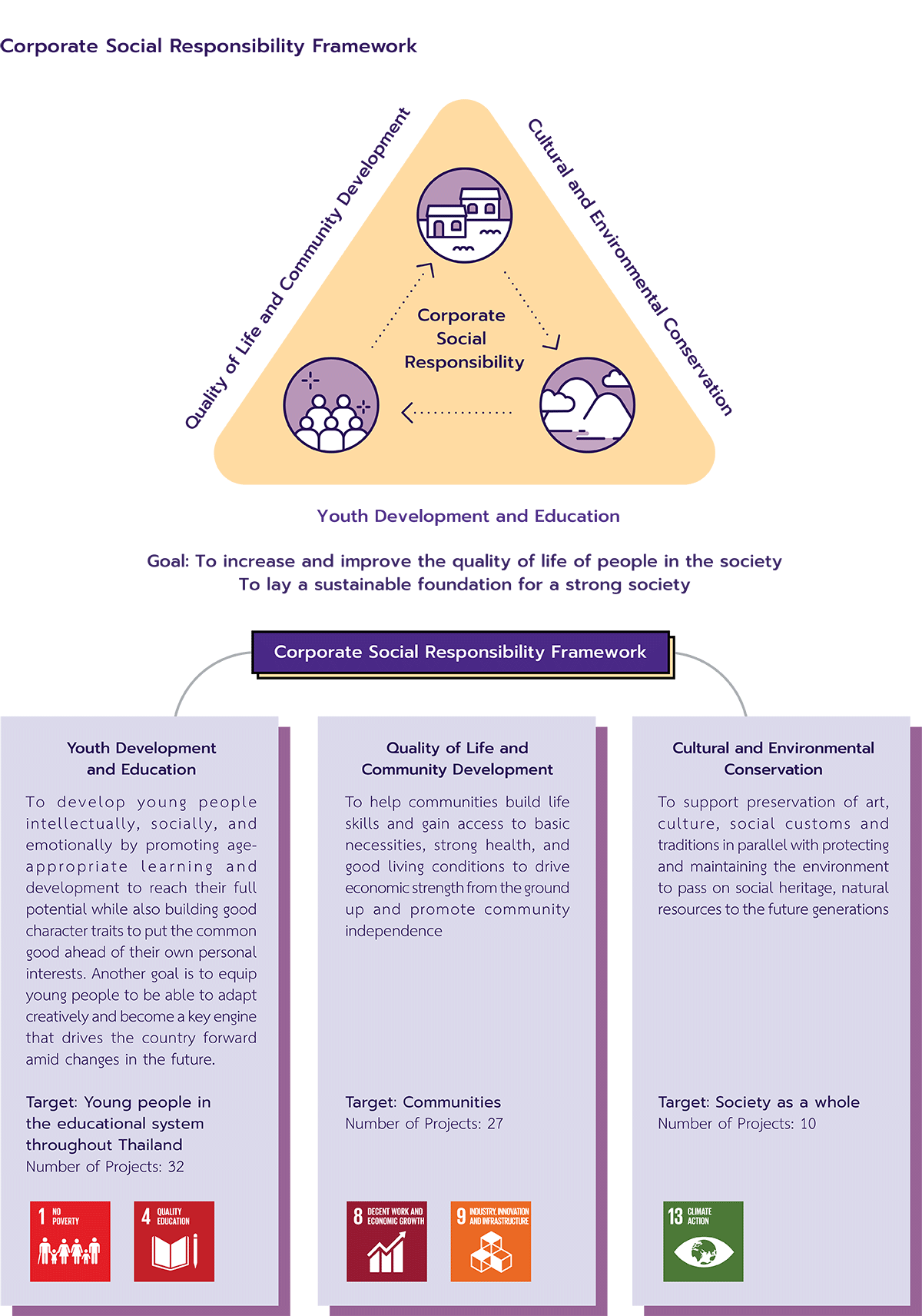

From the start of concrete CSR efforts, the Corporate Social Responsibility Committee has played a key role in formulating policies, setting operational frameworks, as well as allocating resources and budget for activities to improve the quality of life in the community and society. The Corporate Social Responsibility Function and Siam Commercial Bank Foundation are the key engines that drive each initiative to create long-term impacts, and truly address all stakeholders’ needs, in order to achieve the Bank’s vision of becoming “The Most Admired Bank.”

The primary approach of the Bank’s CSR initiatives consist of youth development and learning enhancement, quality of life and environmental development, and community arts and cultural development. The CSR activities or projects aim to address social needs, develop capabilities, and learning opportunities for youths, ensuring that they grow to become important resources for the country’s development. The Bank’s CSR activities not only contribute to better quality of life in society, but also instil the awareness of social responsibility, volunteer spirits, and the sense of civic duty for SCB people, who are the valuable resources of future CSR activities.

The Bank’s CSR practices also address five UN Sustainable Development Goals (SDGs), comprises Goal 1, Goal 4, Goal 8, Goal 9 and Goal 13; while instantaneously remain in alignment with the Bank’s aspiration and implementation to become “the Most Responsible Corporate Citizen” for society. Accordingly, the Bank has set key success indicators and monitored performance to assess whether objectives have been achieved, to what level of benefits to the general public, along with gauging the possibility of further expansion. Performance assessment outcomes are regularly reported to all relevant parties, serving as input for further improvement, and development of various initiatives to deepen and broaden benefits to the society.

Financial Inclusion and literacy

Financial Inclusion

The Bank promotes fair financial inclusion by providing a variety services in the form of both physical branches and digital platforms, such as ATMs, CDMs, virtual teller machines, SCB Easy app, and SCB Easy Net. The Bank also aims to deliver the right products for customers to provide equal opportunities for all groups of the population to access and benefit from financial services which is crucial to the country’s wealth distribution and sustainable development as supported by the Bank of Thailand’s Financial Sector Master Plan Phase III (2016-2020). In addition, the Bank supports low-income earners and small business owners by streamlining the credit underwriting process and simplifying lending terms and conditions as another route to unlevel the playing field of capital access and mitigate the informal debt problem. Furthermore, as a response to changes in the digital age, the Bank partners with a non-bank e-Wallet (or e-Money) service provider to offer digital transaction services such as online shopping and bill payment, to people without a bank account or a credit card, which helps create an ecosystem for a cashless society.

Financial literacy

By leveraging the Bank’s financial expertise and insights on customer behaviour and concerns, the Bank aims to promote financial literacy among all groups of people and entrepreneurs to equip them with practical financial management skills that can be applied to daily life or business. The Bank’s ongoing activities to build engagement in the social media sphere provide insights into the behaviour of social media users and the challenge in creating financial discipline and awareness which is often viewed as irrelevant and complicated. The Bank, therefore, uses a communication strategy that makes the content on this subject interesting by drawing connection to day-to-day events or social trends. The Bank provides information tailored to individual user groups using creative and easy-to-understand presentation techniques, such as infographics, words of wisdom, articles and short movies. These initiatives help bring customers and the Bank closer together and make SCB the leading provider of financial literacy materials on social media which was recognized at both national and international levels.

Governance

Corporate Governance

The Bank places an emphasis on having a board structure that is independent, transparent, and accountable to ensure maximum effectiveness in corporate governance and to comply with Corporate Governance Code enforced by the Securities and Exchange Commission (SEC) as well as other best practices. The Nomination, Compensation, and Corporate Governance Committee is responsible for identifying qualified director candidates to be appointed at a board meeting or a shareholder meeting by considering a wide range of factors including knowledge, expertise and experience that align with the Bank’s strategy.The Bank’s director selection process treats all candidates equally and fairly with no discrimination against gender, ethnicity, race, religion or marital status. Furthermore, the Bank has also applied the Board Skill Matrix to assess the Board’s qualifications which has been reviewed regularly to ensure that it remains current and appropriate. Details of SCB Corporate Governance Policy

Success Metrics and Executive Remuneration

At SCB, corporate performance is identified as part of an annual performance assessment of executives’ including the Chief Executive Officer, the Presidents, and senior executives at Executive Vice President level and higher. An annual compensation is proposed by the Nomination, Compensation and Corporate Governance Committee and is approved by the Board of Directors. Amount of the allotted compensation is linked to the Bank’s short and long term performance and aligned with each executive’s annual performance assessment result.

SCB Financial Group's Codes of Conduct

SCB announces the SCB Financial Group's Code of Conduct and the SCB Supplier Code of Conduct in demonstrate its commitment to operating a transparent business as well as setting ethical behavior standards for directors, management, employees and suppliers. The SCB Financial Group's Code of Conduct also serves as a direction for directors, executive, management, employees and suppliers to act cautiously and prevent any legal or regulatory violations that will tarnish the Bank’s reputation. The Audit Committee, consisted entirely of independent directors, is responsible for overseeing compliance of rules, ethical principles and the Bank’s Code of Conduct.

The Bank regularly updates both codes of conduct to maintain its relevance and stay current with today’s changing business environment. All directors, executives, managers, employees, suppliers and subsidiaries are expected to acknowledge, sign, and strictly comply with the Code of Conduct. The Bank offers training in the e-learning format for all employees and organises Vendor Communication Day to communicate the Code of Conduct to suppliers who are required to attend the session every year. Details of SCB Financial Group's Code of Conduct

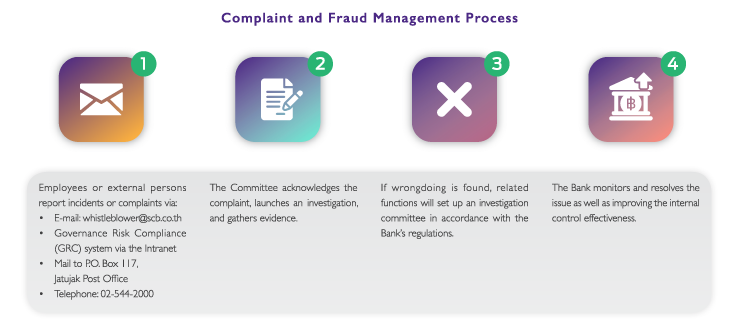

Whistleblower Policy

The Bank establishes the Whistleblower Guideline to serve as a framework for managing the process for whistleblowing and reporting on incidents of fraud, corruption, or violation of the Bank’s regulations, rules and Code of Conduct. The Bank provides diverse reporting channels and has a policy to keep whistleblowers’ identity confidential to protect whistleblowers against retaliatory actions. The Bank has appointed the Fact Finding Committee to conduct prompt investigations once complaints have been raised. The Committee reports outcomes and performance to the Disciplinary Committee and to the Audit Committee every 3 months. The Bank continues to encourage employees at all levels to report incidents or cases that may affect the Bank through the channels that have been set up which will then trigger the investigation and review process.

Anti-crime Policy and Measures

The Bank focuses on improving its operations relating to Anti-Money Laundering and Counter-Terrorism and Proliferation of Weapon of Mass Destruction to align with business context in the digital age as well as changes in laws and global practices. To this end, the Bank continues to use technologies to improves its operational systems such as Know-Your-Customer, and processes to be up-to-date and optimally efficient.

To ensure the effective establishment and implementation of an anti-money-laundering and anti-terrorism financing-supporting culture, SCB has promoted ‘Prevention, Detection, and Investigation’ as a framework and adopts Anti-Money Laundering and Counter-Terrorism and Proliferation of Weapon of Mass Destruction Financing Policy to which all employees are required to strictly adhere to. SCB has identified the procedure for customer identification. The Bank conduct Know Your Customer (KYC) and Customer Due Diligence (CDD) by requesting identification documents or relevant documents, filling and updating information for both new and existing customers, particularly high risk customers who must declare the source of fund/ revenues and specific objectives of the transaction.

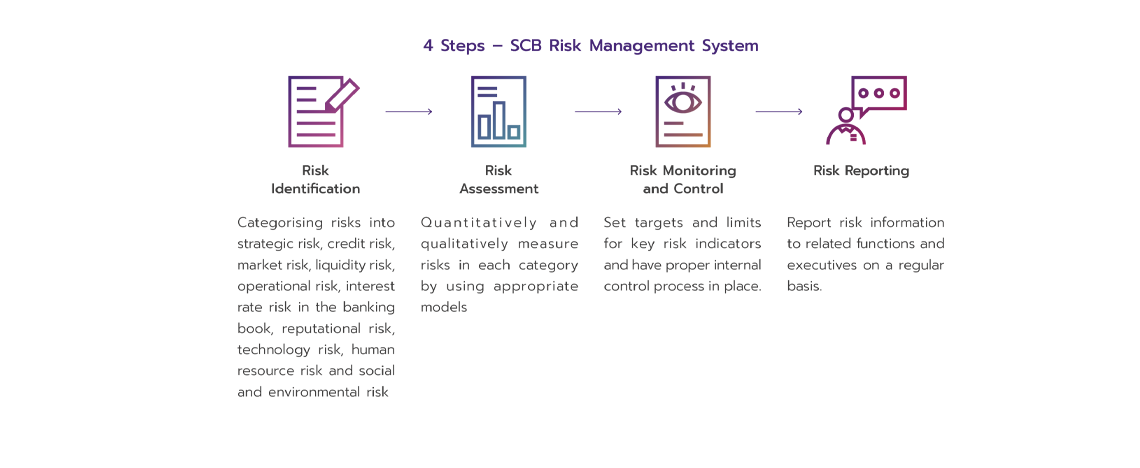

Risk Management

Risk Governance

At management level, the Bank’s Risk Management Committee is assigned with roles and responsibilities to formulate risk strategies in alignment with the Board of Directors’ given direction,while overseeing the overall risk management of the SCB Financial Group. In 2018, the Bank established the Risk Oversight Committee which is an executive committee, mostly consisting of independent and non-executive directors, with the chairperson being an independent director. The Risk Oversight Committee's roles and responsibilities are to provide recommendations to the Board of Directors regarding the direction for risk management. It is to make sure that the direction aligns with the Bank’s business strategy and complies with the risk management framework. This is to ensure that internal risks are managed and monitored at an appropriate level within the identified risk appetite. Moreover, the Risk Oversight Committee also provides reccommendation to the Board of Directors for fostering an organisational culture that constantly considers risk and operates accordingly. At the same time, Risk Management Committee at management level also has roles and responsibilities in providing recommendations on risk management policy, risk management and control framework to Risk Oversight Committee and the Board of Directors for overseeing the SCB’s Financial Group’s overall risk management.

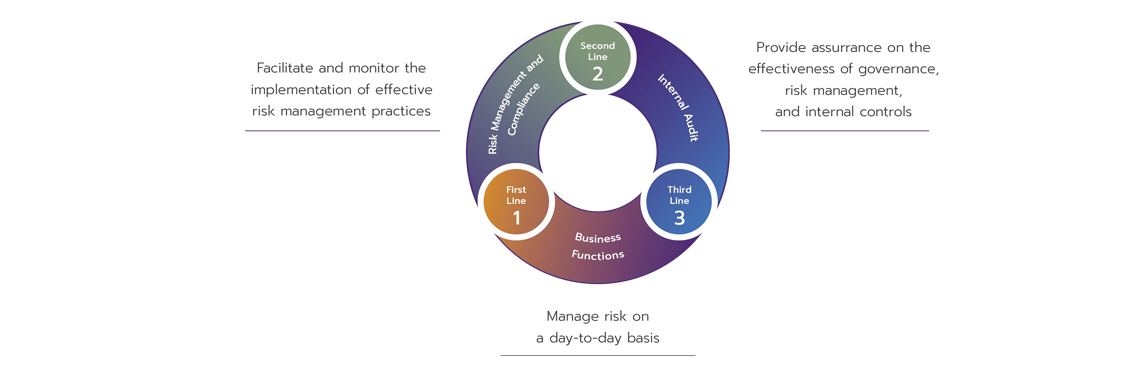

Risk Management Framework

When viewing the overall of risk management structure, the Bank has adopted the “Three Lines of Defense” governance framework to increase efficiency and accuracy in every processes. Hence, there are collaborations among internal functions, from the Board of Directors to employees. Furthermore, the Bank also applied the Risk Control Self-Assessment (RCSA) as a tool to identify the preliminary risk. The results are then presented to the Risk Oversight Committee and the Board of Directors for further consideration and conducting risk assessment at organisational level.

Data Governance and Cyber Security

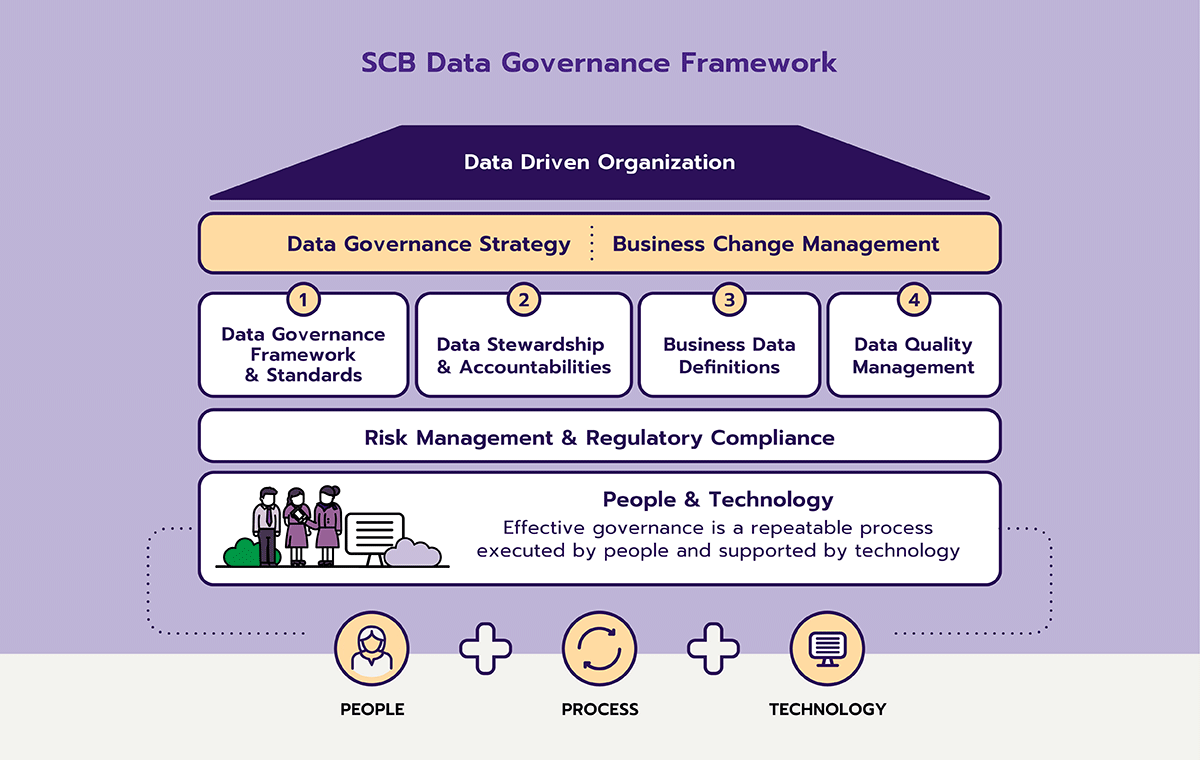

Data Governance

The Bank focuses on becoming a data-driven organisation to create distinctive customer experience by applying insights from data analytics to facilitate policy and strategy decision making as well as pushing the boundary of product and service innovation.

Because data lie at the heart of competitiveness, the Bank has developed SCB Data Governance Framework to ensure maximum efficiency and effectiveness in data management. The Bank also set up the Data Governance Office whose key responsibilities are to keep abreast of regulatory requirements and best practices in data governance and apply them to the Bank’s operations. The Data Governance Office works with relevant internal business units to ensure that the Bank’s data handling processes, procedures, and approaches effectively protect confidential information, whether relating to customers or the Bank itself.

Data Privacy Protection

The Bank respects privacy rights and places high emphasis on preventing any misuse of customer personal information, which includes releasing customer information to other parties that may constitute a privacy violation. Policies, guidelines, and systems to protect customer data security have been established to explicitly define roles and customer data access for each level of employees in accordance with the “Three Lines of Defense” practice. The Bank also ensures that such systems are secure through careful design and extensive testing in addition to ensuring that data classification, data storage and destruction, system access control, and employee access rights are kept up-to-date.

Moreover, if disclosure of customer data to a third party is needed for marketing purposes, the Bank will obtain explicit consent and give customers the rights to opt out. The consent form will be a standalone document separated from an application form with clearly stated purposes, data recipients, and channels to obtain information on data recipients. In the event that customers want to stop receiving communication from the data recipients, Customer Centre is available to assist customers 24 hours a day.

In 2019, the Bank received no complaints relating to the loss of customer data and four complaints concerning breaches of customers privacy. Accordingly, the Bank has verified the complaints and taken actions to improve relevant procedures and standards.

Cyber Security

Information security, data confidentiality and customer privacy are of utmost importance to the Bank as dictated by today’s business context where most information and data are stored in anelectronic format. Thus, the Bank has established SCB Financial Group Information Security Policy in which employees of SCB and its subsidiaries, including those in probationary periods and on temporary contracts, as well as all suppliers and consultants, must follow the IT security practices based on the concept of Confidentiality-Integrity-Availability (CIA) triad. Duties and responsibilities related to development, adoption, and compliance to the Information Security Policy are stated in the policy with the Technology Committee performing roles and responsibilities in reviewing and evaluating the Bank’s cyber security systems to ensure that the systems in place are adequate to support the Bank’s strategies. In addition, there is audit function performs audits on cyber security performance and make recommendations for further improvement.

In addition, the Bank has also taken a proactive cyber security approach, for instance, Cyber security Threat Intelligent Surveillance along with continuous improvement in technologies, employees, and processes to monitor, assess, and prevent potential cyber security threats. To prevent cyber security risks arises from internal operation, the Bank has applied machine learning technology to monitor employees’ behaviour, identify hackers, and predict events that may pose security risk to customers’ or the Bank’s data.

To manage and prevent potential risk associated with third-party service providers, the Bank has established the IT Outsourcing Policy, which also applies to cloud-computing services, to ensuredata security, integrity, and customer protection. The Bank identifies the level of approval authority for each type of IT outsourcing, performs an annual audit, and reports the results to the Bank of Thailand to ensure that services provided by vendors are held to the same standard and accountability as if the Bank were to provide the services ourselves. To prepare for emergency and ensure that, in such event, systems can be recovered within an appropriate timeframe, the Bank has developed the IT Contingency Plan in conjunction with the Business Continuity Plan. Processes, procedures, guidelines are clearly specified, along with roles and duties of business units responsible for executing, testing, and reviewing the IT Contingency Plan to ensure continuous improvement and maintain its relevance within the prevailing business context.

Market Conduct

The Bank is committed to offering products and services on basis of benefits and satisfaction to customers by continuously developing good quality products and services in accordance with the needs and capacities of customers. The Bank has in place a policy of transparent and fair disclosure of product and service information while strictly maintaining data privacy.

Market Conduct Policy of Siam Commercial Bank PCL and SCB Financial Group identifies 9 systems of responsible management of market conduct management including:

In addition, Market Conduct Policy of Siam Commercial Bank PCL and SCB Financial Group also specifies types of activities which may trigger conflicts of interest, and develop sufficient and effective policies, measures, and tools to prevent them, including disciplinary measures for those violating restrictions. Risk management and measures shall be assessed and reviewed on a regular basis.

Retail customer debt collection policy and practice

The Bank has specified a procedure on debt collection for retail customers in alignment with the Debt Collection Act B.E. 2558 and the notice on Debt Collection and Regulation Committee, Personal Data Protection Act B.E. 2562, as well as the Bank of Thailand’s guidelines, relevant laws and regulations. The Bank’s assigned debt collectors must receive training and pass debt collection assessment per the Bank’s regulations before performing assigned duties. Personnel must periodically reassess and review to keep fresh of the knowledge and understanding on debt collection.

Under this procedure, the Bank specifies explicit and appropriate guidelines on debt collection including roles and responsibilities, debt collection code of conduct, identity and information disclosure for debt collection purpose, place for debt collection, date, time, frequency and duration of debt collection, methods of debt collection, relevant fees and expenses in relations to debt collection, complaint handing from debtee as well as penalties upon debtors in case of violations as well as other key requirements. Accordingly, the Bank has specified penalties in case of violations, non-compliance or intentions to commit fraud and abuse the power beyond given authority. This is considered disciplinary actions which is punishable per the Bank’s procedure.

Human Rights

n addition to its attention on internal labor rights, the Bank is aware of the need to manage human rights issues throughout the business value chain. The risk of human rights violations can manifest itself in various forms and can happen to employees, customers, communities and suppliers such as workplace discrimination, violation of customer privacy, social risk from financing infrastructure development or real estate projects as well as human rights violations on the part of suppliers, e.g. labor disputes. Such human rights risk can lead to impact on both the overall business and the Bank’s reputation. Therefore, the Bank has issued the Human Rights Policy to respect and comply with all human rights laws and principles both at the national and global levels. In doing so, the Bank has developed and applied the Human Rights Management Framework throughout the value chain and abided by the UN Guiding Principles on Business and Human Rights (UNGP).

Moreover, to conform with global standards on human rights risk assessment, the Bank has reviewed and improved its human rights practices as well as conducting a human rights risk assessment. The objectives of this assessment are: to assess risk and set appropriate control or impact mitigation measures for human rights risk; to monitor, review, and report the implementation effectiveness; and to specify governance structure, role, and responsibilities of business units involved in the human rights management process. The Bank is committed to upholding human rights practices for all activities that may have human rights impact and preventing human rights violations. The assessment covers all of the Bank’s operations, subsidiaries, joint ventures and supply chain. Relevant stakeholders, both internal (e.g. employees) and external (e.g. suppliers, contractors, and community) as well as vulnerable groups (i.e. children, indigenous people, migrant labor) – that may be or have been impacted by its activities are included as part of the process.

The Bank is committed to upholding human rights practices for all activities that may have human rights impact and preventing human rights violations. The Bank aims to conduct human rights risk assessment once every three year in order to comprehensively assess the risks emerged from the Bank's both direct and indirect operations as well as identifying appropriate mitigation measures.

Transparency

Tax Strategy

SCB ensures strict compliance with relevant laws and regulations both at domestic or international level. The Bank has adopted Tax Policy which is applied to all SCB and all subsidiaries. The policy is aligned with SCB’s strategy in seeking to maximize shareholder value whilst demonstrating responsible tax behavior to all stakeholders.

Networks and collaborations for sustainability

Sustainable development requires multi-sectoral collaboration and efforts to achieve the common goals. SCB, therefore, seeks to play its role in helping to advocate developments of public policies, supports to organizations or activities that promote financial accessibility and literacy, low-carbon economy as well as building community capacity by creating balance in economic, social and environmental dimensions. Advocacy of public policies or supports to any organizations must align with the Bank’s principles and commitments toward governance and responsibility to the environment and society. The Bank will not lobby or work with any external organizations on lobbying issues which contradict the Bank’s ESG principles and approaches.