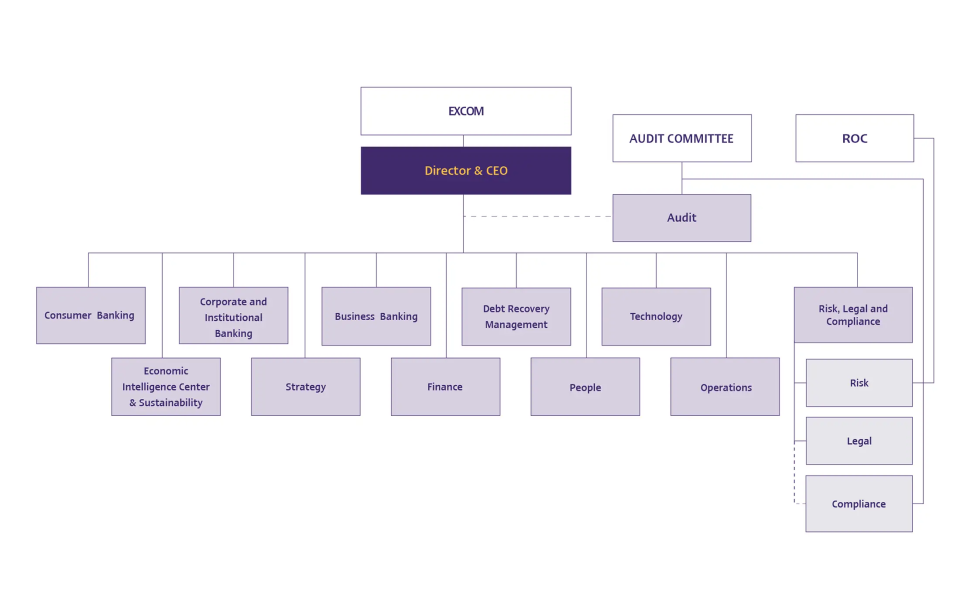

Management Structure

As of 1 September 2025

Board of Director

Board Committees

Executive Committee | |

|---|---|

| 1. Mr. Kan Trakulhoon | Chairman |

| 2. Pol.Col.Thumnithi Wanichthanom | Member |

| 3. Mr. Prasan Chuaphanich | Member |

| 4. Mr. Arthid Nanthawithaya | Member |

| 5. Mr. Surasak Khaoroptham | Member |

| 6. Mr. Arak Sutivong | Member |

| 7. Mr. Kris Chantanotoke | Member |

Functions and Responsibilities

The crucial duties and responsibilities of the Executive Committee are to ensure that the Bank's operations are in accordance with its strategies and policies and regulations. The Committee is empowered to administer and manage the Bank's business, and perform tasks assigned by the Board of Directors, with an aim to accomplish the Bank's vision and be in alignment with the Bank's mission, as well as to promote management practices that are in compliance with the Bank's core values as well as support the operations of SCB X Group.

In addition, the Executive Committee shall have authorities, duties, and responsibilities as follows:

- Deliberate on, recommend for the Board of Directors’ approval or approve matters related to business operations of the Bank in accordance with the Bank's regulations and/or policies including but not limited to:

(1) Business policies and strategies, financial goals, and plans (in short-term, medium-term, and long-term), as well as the annual budget

(2) Credit

(3) Debt Restructuring and Sale of Non-performing Assets

(4) Investment Strategy and Investments

(5) New business operations of the Bank

(6) Contingent Liabilities and Borrowing

(7) Financial Report

(8) Key policies related to the business of the Bank

(9) Policies and/or plans concerning sustainability

(10) Other crucial matters relating to the Bank’s business - To screen issues prior to their submission to the Board of Directors for consideration, except where the issues are under the responsibility and/or authority of other Board Committees, they will be screened by such related Committees prior to being directly submitted to the Board.

- To take note of issues both related to and not related to the management of the Bank, such as legal proceedings against the Bank as a defendant, which the Executive Committee members deem necessary or appropriate.

- To take note of internal audit reports concerning preventive and audit measures. Damage or possible loss which could severely affect the Bank must be immediately reported by the Audit Group to the Executive Committee.

- To consider or approve issues which are assigned by the Board of Directors.

In the case that the Executive Committee resolves or directs that a person or a group of persons be authorized to perform a task on its behalf, such authorization may not be sub-delegated to a third person unless it is allowed in the Committee's initial authorization.

Audit Committee | |

|---|---|

| 1. Mr. Chaovalit Ekabut | Chairman |

| 2. Dr. Pasu Decharin | Member |

| 3. Mrs. Prisana Praharnkhasuk | Member |

| Ms. Nipaporn Kullertprasert | Secretary |

Responsibilities

The Audit Committee is responsible for providing the Board with independent, objective advice on the adequacy of management's arrangements concerning key aspects of the SCB Group’s operations. Additionally, the Committee will promote collaboration among the SCB Group’s Audit Committees to ensure strong corporate governance, effective risk management, and the implementation of appropriate internal controls and audits. It will also monitor changes to ensure the Company is well-prepared to address any potential risks that may arise in the future.

1 Values and Ethics

To obtain reasonable assurance with respect to the SCB Group's values and ethics practices, the Audit Committee will:

- Review and assess the policies, procedures, and practices established by the governing body to monitor conformance with its code of conduct and ethical policies by all managers and staff of the SCB Group.

- Provide oversight of the mechanisms established by management to establish and maintain high ethical standards for all of the managers and staff of the SCB Group.

- Review and provide advice on the systems and practices established by management to monitor compliance with laws, regulations, policies, and standards of ethical conduct and identify and deal with any legal or ethical violations.

- Promote whistleblower channels for reporting inappropriate behavior, including ensuring the existence of policies or methods for receiving notifications and appropriately protecting whistleblowers.

2 Corporate Governance

To obtain reasonable assurance with respect to the SCB Group's governance process, the Audit Committee will review and provide advice on the governance process established and maintained within the SCB Group and the procedures in place to ensure that they are operating as intended.

3 Risk Management

To obtain reasonable assurance with respect to the SCB Group's risk management practices, the Audit Committee will:

- Review and monitor those practices to ensure that the principles of good corporate governance have been implemented adequately and assessed risk management appropriately.

- Seek consultation with the Risk Oversight Committee to ensure that financial institution risk management policies and plans include all types of risks, including emerging risks, and are implemented efficiently and effectively.

4 Fraud

To instill reasonable confidence in the prevention and detection of fraud within the SCB Group, the Audit Committee will:

- Oversee management's efforts to prevent and suppress fraud.

- Ensure that appropriate actions are taken against individuals engaged in fraudulent activities.

- Interrogate management, and internal and external auditors to verify that the SCB Group has effective fraud prevention measures and controls in place. The Committee will ensure that investigations are conducted if instances of fraud are uncovered.

- Supervise policies and measures addressing bribery and corruption to guarantee compliance with legal and ethical obligations.

5 Internal Control

To obtain reasonable assurance with respect to the adequacy and effectiveness of SCB Group's internal controls in responding to inherent risks within the SCB Group's governance, operations and information systems, the Audit Committee will:

- Review and evaluate whether the SCB Group has set an appropriate and effective internal control system, including control over the information technology system, internal audits, and guidelines for communicating the importance of internal control and risk management throughout the SCB Group.

- Consider the effectiveness of the SCB Group's internal control framework, including information technology security and control.

- Review and provide advice on the SCB Group as a whole and its individual units.

- Receive reports on all matters of significance arising from work performed by other financial advisors and internal control assurance providers to the senior management and the Board.

6 Regulatory Compliance

The Audit Committee will:

- Review the SCB Group's compliance with the Securities and Exchange regulations and the law relating to the SCB Group’s businesses.

- Review the effectiveness of the system for monitoring compliance with laws and regulations and the results of management's investigation and follow-up (including disciplinary action) of any instances of noncompliance.

- Review the observations and conclusions of internal and external auditors and the findings of any regulatory agencies.

- Review the process for communicating the Code of Conduct to the SCB Group's personnel and for monitoring compliance.

- Obtain regular updates from management of the SCB Group.

7 Internal Audit Activities

To obtain reasonable assurance with respect to work of internal audit and ensure the internal audit function has sufficient authority to fulfill its purpose, strategy, and objectives, the Audit Committee will provide oversight related to:

7.1 Internal audit charter and human resource management

- Discuss with the Head of Audit and senior management the appropriate authority, role, responsibilities, scope, and services (assurance and/or advisory) of the internal audit function.

- Ensure the Head of Audit has unrestricted access to communicate and interact directly with the Audit Committee, including in private meetings without senior management present.

- Review and approve the internal audit charter at least annually. The charter should be reviewed to ensure that it accurately reflects the internal audit activity's purpose, authority, and responsibility, consistent with the mandatory guidance of the IIA's International Professional Practices Framework and the scope and nature of assurance and consulting services, as well as changes in the financial, risk management, and governance processes of the SCB Group and reflects developments in the professional practice of internal auditing.

- Advise the Board about increases and decreases to the requested resources to achieve the internal audit plan. Evaluate whether any additional resources are needed permanently or should be provided through outsourcing.

7.2 Appointment, Performance Evaluation and Removal of Head of Audit

- Advise the Board regarding the qualifications, competencies and recruitment, appointment, and removal of the Head of Audit.

- Provide input to management related to evaluating the performance of the Head of Audit

- Recommend to management or the governing body the appropriate compensation of the Head of Audit.

7.3 Internal audit strategy and plan

- Review and provide input on the internal audit's strategic plan, objectives, performance measures, and outcomes

- Review and approve proposed risk based on the internal audit plan and make recommendations concerning internal audit projects.

- Review internal audit resources and budgets necessary to achieve the plan.

- Review the internal audit activity's performance relative to its audit plan.

7.4 Internal audit engagement and follow up

- Review internal audit reports and other communications proposed to management.

- Review and track management's action plans to address results of internal audit engagements.

- Review and advise management on the results of any special investigations.

- •Inquire with the Head of Audit whether any internal audit engagements or non-audit engagements have been completed but not reported to the committee if so, inquire whether any matters of significance arose from such work.

- Inquire with the Head of Audit whether any evidence of fraud has been identified during internal audit engagements and evaluate what additional actions, if any, should be taken.

7.5 Standards conformance

- Inquire with the Head of Audit about steps taken to ensure that the internal audit activity conforms with The IIA’s Global Internal Audit Standards.

- Ensure that internal audit activity has a quality assurance and improvement program and that the results of these periodic assessments are presented to the Audit Committee.

- Ensure that the internal audit activity has an external quality assurance review every five years.

- Review and approve the external quality assurance review and improvement action plans and timeline as well as monitoring the implementation.

- Advise the Board about any recommendations for the continuous improvement of the internal audit activity.

8 Compliance Function

To obtain reasonable assurance with respect to work of compliance function, the Audit Committee will provide oversight related to:

- Review and approve the compliance charter, annual plan, staffing, and resources required for compliance functions.

- Consider regular updates from the Audit Function and the Compliance Function regarding compliance matters affecting the SCB Group’s operations.

- Review findings/issues raised by regulators and follow up corrective actions. Report these issues to the Board.

- Review the efficiency of the system for monitoring compliance with laws and regulations and the results of follow-up of corrective actions for non-compliance issues.

- Review compliance with the anti-corruption policy and report it to the Board.

9 External Auditors

To obtain reasonable assurance with respect to work of the external assurance providers, the Audit Committee will meet with the external assurance providers during the planning phase of the engagement, the presentation of the audited financial statements, and the discussion of the results of engagements and recommendations for management. The Audit Committee will:

- Review the external auditors' proposed audit scope and approach, including coordination of audit effort with internal audit activity.

- Review the performance of the external auditors, and exercise final approval on the appointment or discharge of auditors.

- Obtain statements from the external auditors regarding their relationships with the SCB Group, including non-audit services performed in the past to validate their independence.

- In the event that the Audit Committee receives a report from the external auditor or finds irregularities in the financial statements, such as significant changes in figures and financial ratios, any change in the accounting policy, unusual and significant transactions during the year, no accounting adjustment despite the external auditor’s finding, the external auditor has not received satisfactory evidence or explanation, or the audit scope has been restricted by management, and so forth, the Audit Committee shall urgently contact concerned parties, such as the external auditor and the senior persons in charge of accounting and finance of listed companies, to seek explanations for any irregularities, the causes, and the audit scope.

- Appoint the auditor for non-assurance services in addition to annual financial statement audits. Such responsibilities shall not compromise the auditor's independence in conducting an audit of the annual financial statements. If the value per engagement exceeds the stated threshold outlined in Appendix 1, the Audit Committee's approval is required prior the appointment.

- Have regularly scheduled exclusive meetings with external auditors to discuss any sensitive matters and hold at least one annual meeting with the external auditor without management present.

- Monitor management's progress on action plans. To obtain reasonable assurance that management has acted on the results and recommendations of internal and external audit engagements, the Audit Committee will regularly review reports on the progress of implementing approved management action plans and audit recommendations resulting from completed audit engagements.

10 Financial Statements

The Audit Committee is responsible for oversight of the independent audit of the SCB Group's financial statements, including, but not limited to overseeing the resolution of audit findings in areas such as internal control, legal, regulatory compliance, and ethics. The Audit Committee will:

- Review the SCB Group's financial reporting to ensure that it is accurate and adequate. Consider the completeness of acknowledged information and the appropriateness of accounting principles applied to financial statements.

- Consider the accuracy and completeness of the SCB Group’s disclosure, especially related transactions that may involve conflicts of interest.

- Review with management and the external auditors the results of audit engagements, including any concerns encountered.

- Review significant accounting and reporting issues, including complex or unusual transactions, issues requiring discretionary judgment, and recent professional and regulatory declarations, and understand their impact on financial statements.

- Review annual financial statements, and consider whether they are complete, consistent with information known to committee members, and reflect appropriate accounting principles.

- Review other sections of the annual report and related regulatory filings and consider the accuracy and integrity of the information before it is released.

- Review with management and the external auditors all matters required to be communicated to the Audit Committee under generally accepted external auditing standards.

- Understand the strategies, assumptions, and estimates that management has made in preparing financial statements, budgets, and investment plans.

- Understand how management develops interim financial information and the nature and extent of internal and external auditor involvement in the process.

- Review interim financial reports with management and the external auditors before filing with regulators and consider whether they are complete and consistent with the information known to committee members.

11 Other responsibilities

In addition, the Audit Committee will:

- Institute and oversee special investigations as needed.

- Perform other functions as assigned by the Board of Directors with the acknowledgement of the Audit Committee.

- Review roles, responsibilities, and tenure of committee members and assess the Audit Committee charter on a regular basis. Propose changes in the charter for the Board approval.

- Conduct self-assessment at least once a year and present the results to the Board.

- The Audit Committee should discuss and investigate facts when notified by auditors about doubtful incidents related to corruption or violations of the provision of directors and executives' performances under Section 89/25 of the Securities and Exchange Act B.E. 2535 (1992). Results of such preliminary discussion and investigation shall be reported to auditors and the SEC within a period specified by the SEC.

- Monitor and follow up on material transactions (“MT”) of asset acquisition or disposal and related party transactions (“RPT”) by:

- Providing opinions on significant MT & RPT transactions requiring approval at the Board’s meetings or shareholders’ meetings.

- Monitoring the progress of significant MT & RPT transactions, considering additional information to detect abnormalities in the overall picture.

- Taking appropriate action to halt inappropriate MT & RPT transactions, along with reporting the facts to the SEC Office according to specified criteria.

- Review details related to the use of raised funds and monitor their use to ensure alignment with disclosed objectives.

- Promote the integration of GRC (Governance, Risk, and Compliance) into practical operations and collaboration between GRC-related units and internal audit. Support the integration of GRC to enhance operational efficiency.

Reporting

The Audit Committee will report to the Board annually, summarizing the committee's activities and recommendations. The report should also include:

- A summary of the work the Audit Committee performed to fulfil its responsibilities during the preceding year.

- A summary of management's progress in addressing the results of internal and external audit engagement reports.

- An overall assessment of risk management, control, and compliance processes, including details of any significant emerging risks or legislative changes impacting the SCB Group.

- Details of meetings including the number of meetings held during the relevant period and the number of meetings each member attended.

- Provide any information required in response to emerging corporate governance developments.

- The Audit Committee may report to the Board at any time regarding any other matter it deems of sufficient importance.

- Prepare the corporate governance section of the Audit Committee report as part of the Bank’s annual report.

- Define the responsibilities of the Audit Committee, including all changes in composition and significant changes in activities, in a clearly written form as approved by the Board for disclosure in the annual report for shareholders’ acknowledgment.

- Report doubtful incidents or suspicious transactions to the Board for improvement within a reasonable time, as follows:

- Conflicts of interest

- Improprieties in material transactions (“MT”) of asset acquisition or disposal and related party transactions (“RPT”)

- Inappropriate or misdirected use of raised funds

- Fraud or significant internal control failure

- Violation of Financial Institutions Businesses law, the Securities and Exchange law and regulations, the Bank of Thailand regulations, or other laws that relate to the business of financial institutions and securities and other laws. If the Board or management do not rectify within the time specified by the Audit Committee, the Audit Committee shall disclose in the annual report, and report to the Bank of Thailand.

Nomination, Compensation and Corporate Governance Committee | |

|---|---|

| 1. Dr. Prasong Vinaiphat | Chairman |

| 2. Mr. Kan Trakulhoon | Member |

| 3. Mr. Chakkrit Parapuntakul | Member |

| 4. Mrs. Prisana Praharnkhasuk | Member |

Duties and Responsibilities

The NCCG Committee is responsible for the nomination and remuneration of directors and persons with power of management, human resources policies and corporate culture, corporate governance practices of the Bank, and any other undertakings assigned by the Board which include the following:

1. Nomination

1.1 Director Nomination

- Formulate policies, criteria and procedures governing director nomination based on the Policy for Governance of Subsidiaries of SCB X Public Company Limited to be proposed to the Board for approval.

- Select and nominate qualified candidates in accordance with relevant regulations, laws, and the Bank’s policies to the Board, the Board of Directors of SCB X Public Company Limited, the Bank of Thailand, and the meetings of shareholders (where required by law) for appointment as directors of the Bank and members of the Board committees.

- Oversee that the size and composition of the Board and the Board committees are appropriate for the organization and changing business environment. The NCCG Committee shall oversee that vetting mechanisms or tools, such as the board skills matrix, are available for and applied to the selection and nomination processes to ensure that the Board is comprised of individuals possessing knowledge, abilities and experience that are favorable to the Bank’s business strategy and directions in the short, medium and long terms. The Board and the Board committees shall consist of qualified individuals with knowledge, abilities, skills and experience in various aspects such as: 1) knowledge, expertise, or experience in macro-level management, 2) knowledge, expertise, or experience in specialized fields such as laws, accounting, finance, economics, and technology, and 3) knowledge, expertise, or experience in other fields such as risk management, corporate governance, corporate social responsibility, and sustainability. The NCCG Committee shall also foster the elements of diversity in terms of gender, race, nationality, age, educational background, professional experience, skills, knowledge and other differences with a view to promoting the diversity on the Board, the appropriateness of the Board composition, and the Bank’s sustainable growth.

1.2 Nomination of Senior Executives of the Bank and Advisors to the Bank

- Formulate policies, criteria and procedures governing the nomination of senior executives based on the Policy for Governance of Subsidiaries and Associates under SCB X Public Company Limited to be proposed to the Board for approval.

- Select and nominate qualified candidates in accordance with relevant regulations and laws, as well as the Policy for Governance of Subsidiaries and Associates under SCB X Public Company Limited, to the Board for the appointment of such candidates as directors and executives of Subsidiaries of the Bank.

1.3 Nomination of Directors and Executives of Subsidiaries of the Bank

- Formulate policies, criteria and procedures governing the nomination of directors and executives of Subsidiaries of the Bank based on the Policy for Governance of Subsidiaries and Associates under SCB X Public Company Limited to be proposed to the Board for approval.

- Select and nominate qualified candidates, in light of relevant duties, responsibilities and nature of work, and in accordance with relevant regulations and laws, as well as the Policy for Governance of Subsidiaries and Associates under SCB X Public Company Limited, to the Board for the appointment of such candidates as senior executives of the Bank and advisors to the Bank. The process of appointment and the determination of employment conditions for the Chief Executive Officer and senior executives for financial functions requires joint approval from the Board of Directors of SCB X Public Company Limited, as applicable,

The NCCG Committee is also in charge of disclosing policies and details of the nomination processes applicable to directors and senior executives in the annual report of the Bank and submitting the policies to the Bank of Thailand upon request.

2 Remuneration

2.1 Director Remuneration

- Set out the policy on and amount of remuneration and other benefits for the Board and the Board committees that are reflective of objectives, duties, responsibilities and relevant risks, the Bank’s long-term benefits, are based on clear and transparent criteria, are in line with the Bank’s objectives and goals and the director remuneration criteria applicable to companies in SCBX Group. Such policy and amount shall be proposed to the Board and the Board of Directors of SCB X Public Company Limited for endorsement and subsequently to the meetings of shareholders for approval. The policy must be submitted to the Bank of Thailand upon request.

- Oversee that the remuneration of directors is commensurate with their duties and responsibilities. Directors who are assigned additional duties and responsibilities should receive remuneration that are appropriate for such assignments and are in line with the director remuneration criteria applicable to companies in SCBX Group.

- Oversee the Bank’s disclosure of its policy on remuneration and other benefits as well as preparation of remuneration reports which enunciate overall performance evaluation factors, goals, performance, opinions of the NCCG Committee, and risk-based remuneration approaches and tools (if any). Remuneration paid to individual directors shall be disclosed in the Bank’s annual reports.

2.2 Remuneration of Senior Executives

- Define the policy on and amount of remuneration and other benefits for the Chief Executive Officer and senior executives that are reflective of relevant objectives, duties, responsibilities and relevant risks, are based on clear and transparent criteria, and are supportive of the Bank’s objectives, goals and long-term benefits. Such policy and amount shall be proposed to the Board for approval. The NCCG is responsible for considering and approving the compensation of senior executives or endorsing such matters for submission to the Bank’s Board of Directors and the Board of Directors of SCB X Public Company Limited, for consideration and approval, as applicable.

- Oversee that the remuneration of senior executives is commensurate with their duties and responsibilities.

- Establish guidelines for the evaluation of the Chief Executive Officer and senior executives to support the determination of annual remuneration by taking into consideration relevant duties, responsibilities and risks, in alignment with the policies of SCB X Public Company Limited. Contribution to the shareholder value maximization shall also be a priority in such evaluation.

- Oversee the Bank’s disclosure of its policy on remuneration and benefits applicable to directors being senior executives and executives or senior executives who are entitled to remuneration as employees which enunciates overall performance evaluation factors, goals, performance, opinions of the NCCG Committee, and risk-based remuneration approaches and tools (if any). The aggregate amount of remuneration paid to directors being senior executives and executives or senior executives who are entitled to remuneration as employees shall be disclosed in the Bank’s annual report.

- Review and propose for the Board’s approval the management’s proposals on remuneration policies, remuneration and fringe benefit plans other than salaries for employees of the Bank.

2.3 Remuneration of Directors and Senior Executives of Subsidiaries of the Bank

Oversee the formulation of policies, criteria and procedures applicable to director remuneration of subsidiaries of the Bank to ensure appropriateness and alignment with the director remuneration criteria applicable to companies in SCBX Group. The NCCG Committee shall also oversee the formulation of policies, criteria and methods applicable to remuneration and other benefits for senior executives of subsidiaries of the Bank. The remuneration criteria shall be clear, transparent, in line with key risks of companies in SCBX Group, and commensurate with duties, responsibilities and nature of work.

3. Human Resources Policies and Corporate Culture

3.1 Consider and give recommendations on human resources policies based on the Bank’s business strategy as well as on the improvement and development of the Bank’s directors and personnel to achieve appropriate levels of manpower, knowledge, skills, experience and motivation with an emphasis on the workforce diversity in terms of gender, age, race, etc.

3.2 Formulate succession planning policies and direct succession planning for the Chief Executive Officer and senior executives by identifying successors and establish successor development systems.

3.3 Consider and give recommendations on the corporate culture cultivation and development plan.

4 Corporate Governance

4.1 Formulate and propose for the Board’s consideration the Bank’s Corporate Governance Policy based on the Policy for Governance of Subsidiaries of SCB X Public Company Limited and other policies of SCBX Group, monitor the corporate governance policy implementation, and regularly review and update the Corporate Governance Policy to ensure appropriateness.

4.2 Oversee the Bank’s operations to ensure alignment with corporate governance principles stipulated by competent regulators and other internationally recognized corporate governance principles.

4.3 Oversee that the Bank implements mechanisms to honor shareholders’ legal rights.

4.4 Establish the Board performance evaluation guidelines and arrange for the Board evaluation (comprised of the performance evaluations of the Board, the Board Chairman, individual directors, and the Board committees) which involves a self-evaluation and/or a cross-evaluation on an annual basis. The NCCG Committee may engage an external consulting firm in the Board evaluation process every three years or when appropriate and shall apply the evaluation results to the enhancement of the Board’s performance.

Corporate Social Responsibility Committee | |

|---|---|

| 1. Pol.Col. Thumnithi Wanichthanom | Chairman |

| 2. ACM. Satitpong Sukvimol | Member |

| 3. Mr. Kris Chantanotoke | Member |

| 4. Dr. Kulaya Tantitemit | Member |

Functions and Responsibilities

- Develop SCB's corporate social responsibility policy and framework.

- Develop a working policy and coordinate with the Siam Commercial Bank Foundation.

- Consider and allocate resources and budget for corporate social responsibility projects and activities run by SCB and the Siam Commercial Bank Foundation.

Risk Oversight Committee | |

|---|---|

| 1. Assoc.Prof.Dr. Pasu Decharin | Chairman |

| 2. Dr. Kulaya Tantitemit | Member |

| 3. Mr. Chakkrit Parapuntakul | Member |

| 4. Mr. Kris Chantanotoke | Member |

| M.L. Chiradej Chakrabandhu | Secretary |

Functions and Responsibilities

- Provide advice to the Board of Directors regarding the SCB Group’s risk management framework.

- Ensure that senior management, including the Chief Risk Officer, strictly adhere to risk management policies, strategies, and risk tolerance.

- Ensure that the SCB Group’s capital and liquidity management strategies to cope with risk are in line with risk-approved tolerances.

- Review the adequacy and efficiency of overall risk management policies, strategies, and risk tolerance at least once a year or upon any significant change. The Risk Oversight Committee should discuss and share comments with the Audit Committee to assess the coverage of the SCB Group’s risk management policy and strategies to ensure that they cover all types of risk, as well as upcoming risks, and that the execution of such policy and strategies is effective and efficient.

- Report risk positions, risk management effectiveness, status of compliance with the corporate culture of risk awareness, significant risk factors and issues, and actions to be taken for improvement line with the SCB Group’s risk management policy and strategies to the SCB Board of Directors.

- Comment on or participate in assessment of the effectiveness and efficiency of the Chief Risk Officer’s performance.

- Provide the SCB Board of Directors with advice on cultivating a risk awareness culture throughout the organization and corporate culture compliance.

Technology Committee | |

|---|---|

| 1. Dr. Supot Tiarawut | Chairman |

| 2. Mr. Arthid Nanthawithaya | Member |

| 3. Mr. Kris Chantanotoke | Member |

| 4. Mr. Trirat Suwanprateeb | Member and Secretary |

Functions and Responsibilities

- Oversee the bank’s technology strategy and architecture to ensure alignment with the Bank’s goals and objectives, addressing the integrity of technology services and managing technology risk, while promoting technology best practice complying with the Bank’s core values.

- Review and provide guidance on technology strategies, risks, performance, and budgeting.

- Ratify major decisions with the Board of Directors in respect to technology direction and policies and advise the Board of implications and proposed outcomes.

- Understand the use of new advanced technology which may improve banking business within the risk appetite with the aim of becoming a leading technology bank through transformation.

- If the TechComm resolves or directs that a person or a group of persons be authorised to perform a task on its behalf, such authorization may not be sub-delegated to a third person unless it is allowed in the Committee's initial authorization.

- The authority to call meetings with members of the Board of Directors and Bank Management to address technology related matters.

- The TechComm will provide an annual report to the Board of Directors on the “State of Technology.” Additionally, when the TechComm considers it important, they will raise matters to be put on the agenda of the Board, Executive Committee, Audit Committee and Risk Oversight Committee as appropriate to ensure the respective boards are synchronized in respect to the technology.

- The TechComm will direct the Technology Awareness and Training program of the main board meetings.

- Co-direct with other BOD-subcommittees on transforming the governance structure suitable to becoming a technology company.

Management Committees

Management Committee | |

|---|---|

| 1. Director and Chief Executive Officer | Chairman |

| 2. Chief Corporate and Institutional Banking Officer | Member |

| 3. Chief Business Banking Officer | Member |

| 4. Chief Consumer Banking Officer | Member |

| 5. Chief Risk, Legal and Compliance Officer | Member |

| 6. Chief Technology Officer | Member |

| 7. Chief Financial Officer | Member |

| 8. Chief Strategy Officer | Member and Secretary |

Functions and Responsibilities

The Management Committee shall hold duties and responsibilities to drive the Bank’s business operations towards the achievement of its strategies, financial targets and business goals. The Committee is also tasked to promote the desired corporate culture and oversee the alignment of internal and external communication with the Bank’s strategies.

In addition, the Management Committee shall have authorities, duties and responsibilities as follows:

- To develop business and annual operating plan and set financial goals, annual budget, and performance indicators in alignment with the Bank’s strategy and propose to the Executive Committee for consideration and subsequently to the Board of Directors for approval.

- To review the Bank’s performance and determine business guidelines appropriate to the business situation and competitive environment.

- To consider the following matters:

(a) To approve the Bank’s business strategy and execution plans for key projects, as well as to approve resource allocation in accordance with the Bank’s regulations and follow up on the implementation and key decisions related to such projects to ensure their success.

(b) To approve and/or acknowledge of the launches of new products, services and work processes.

(c) To approve the Bank’s major resource allocation plan.

(d) To approve other related matter as authorized by the Banks’ regulations and/or issues assigned by the Board of Director or the Executive Committee.

(e) To screen all matters that are not screened by any other committees or the Chief Executive Officer prior to the proposal to the Executive Committee. - To report and provide opinions on key matters of the Bank.

Assets And Liabilities Management Committee (ALCO) | |

|---|---|

| 1. Director and Chief Executive Officer | Chairman |

| 2. Chief Financial Officer | Member |

| 3. Chief Strategy Officer | Member |

| 4. Chief Risk, Legal and Compliance Officer | Member |

| 5. Chief Corporate and Institutional Banking Officer | Member |

| 6. Chief Business Banking Officer | Member |

| 7. Chief Consumer Banking Officer | Member |

| 8. Chief Economist and Sustainability Officer | Member |

| 9. EVP, Group Treasury Function | Member and Secretary |

Functions and Responsibilities

- Liquidity Policy

- Define a liquidity policy to suit business and regulatory requirements

- Monitor domestic and international market conditions that may affect liquidity, interest rates, and exchange rates.

- Define a policy and risk limits for liquidity management.

- Approve and review contingency funding plan.

- Endorse self-recovery plan.

- Interest Rate Risk and Foreign Exchange Risk Policy

- Define a policy and risk limits for interest rates and exchange rates.

- Approve announcements of reference lending rates such as MLR and MOR, and deposit rates such as savings and fixed deposit rates in standard terms.

- Endorse investment limits for government bonds, private bonds, and debt instruments, including structured notes in the Trading Book and the Banking Book, in Thai baht and foreign currencies.

- Asset and Liability Structure

- Define a policy for asset and liability structure for risk/return optimization and risk diversification.

- Endorse fund raising through issuance of debt instruments with maturity over 1 year for SCB, such as bonds, structured notes, and subordinated bonds countable as SCB’s capital, etc.

- Approve management tools such as fund transfer pricing and economic profit.

- Capital Management

- Define a capital requirement policy to suit business and regulatory requirements.

- Endorse SCB’s fund raising plans through different instruments, including hybrid bonds and any other instruments countable as SCB’s capital.

- Monitor and control the effectiveness of SCB’s capital utilization.

- Monitor and follow up the above actions to ensure their policy compliance.

Risk Management Committee | |

|---|---|

| 1. Chief Executive Officer | Chairman |

| 2. President 3 ท่าน | Member |

| 3. Chief Risk Officer | กรรมการ |

| 4. Chief Financial Officer | Member |

| 5. Chief Legal and Control Officer | Member |

| 6. Chief Technology Officer | Member |

| 7. Chief Strategy Officer | Member |

| 8. Advisor to CEO - Special Business | Member |

| 9. Head of Special Business | Member |

| 10. Chief Credit Officer | Member and Secretary |

Functions and Responsibilities

- Develop risk management strategies in line with the SCB Group’s risk management framework as endorsed by the SCB Board of Directors.

- Screen the SCB Group’s risk management policy and guidelines to ensure that they cover key types of risk, including strategic risk, credit risk, market risk, liquidity risk, and operational risk, and propose them for consideration by the Risk Compliance Committee or other sub committees/the SCB Board of Directors.

- Oversee the SCB Group’s compliance with its risk management policy and strategies, ensure that risk levels are within acceptable risk tolerances, and approve operational risk acceptance for any issue raised.

- Consider and approve the Charter of Model Risk Management Committee (MRMC) (as a sub-committee of the RMC), including roles and responsibilities of MRMC member. And also approval of MRMC Member.

- Present reviews of the adequacy and efficiency of overall risk management policy and strategies and acceptable risk tolerance at least once a year or upon any significant change to the Risk Compliance Committee. The Risk Management Committee should discuss and share comments with the SCB Group’s audit teams to assess the coverage of the SCB Group’s risk management policy and strategies to ensure that they cover all types of risk, as well as upcoming risks, and that the execution of such policy and strategies is effective and efficient.

- Report risk position, risk management effectiveness, status of compliance with the corporate culture of risk awareness, significant risk factors and issues, and actions to be taken for improvement to be in line with the SCB Group’s risk management policy and strategies to the Risk Compliance Committee.

- Cultivate a risk awareness culture throughout the organization and ensure corporate culture compliance.

Equity Investment Management Committee | |

|---|---|

| 1. Chief Executive Officer | Chairman |

| 2. Chief Risk, Legal and Compliance Officer | Member |

| 3. Chief Financial Officer | Member |

| 4. Head of Risk | Member |

| 5. Head of Financial Risk Management Function | Member and Secretary |

Functions and Responsibilities

- Consider, review, and approve equity investments, investment policy, risk status, investment-related process and people.

- Regularly review and assess investment results to ensure that operations are transparent and auditable.

- Update, revise investment policy prior to proposing to the Board of Directors.

Corporate Governance Policy

Memorandum & Articles of Association

Charter & Independent Director Definition

The Siam Commercial Bank Public Company Limited has defined the meaning of “independent director” to be more stringent than that of the Notification of the Capital Market Supervisory Board No. Tor Jor. 39/2559, Re: Application for and Approval of Offering for Sale of Newly Issued Shares, which contains the following criteria:

| (a) | Must not hold shares in excess of 0.5% (one-half of one percent) of the total number of voting shares of the Bank, or the Bank’s parent company, subsidiary company, associated company, major shareholder, or controlling person, whilst the number of shares held by any related person of such independent director must also be counted. |

| (b) | Is not and has not been a director participating in management role, or an employee, an officer, an advisor who receives regular salary, or a person having controlling power, of the Bank or the Bank’s parent company, subsidiary company, associated company, a subsidiary company in the same level, major shareholder, or controlling person, unless such an independent director has not possessed the characteristics referred to above for at least two years prior to the date on which such an independent director is appointed as independent director, provided always that such prohibited characteristics shall not apply to an independent director who used to be a government officer or an advisor to a government authority, which is a major shareholder or the controlling person of the Bank. |

| (c) | Is not a person having blood relationship or relationship through legal registration as a father, mother, spouse, sibling, and child, including as a spouse of a child of other directors, management person, major shareholder, controlling person, or the person being nominated to be a director, management person or a controlling person of the Bank or the Bank’s subsidiary company. |

| (d) | Does not have and has not had any business relationship with the Bank or the Bank’s parent company, subsidiary company, associated company, major shareholder, or controlling person in the manner in which his/her independent discretion might be affected, and is not and has not been a significant shareholder or a controlling person of the person that has business relationship with the Bank, or the Bank’s parent company, subsidiary company, associated company, major shareholder, or controlling person, unless such an independent director has not possessed the characteristics referred to above for at least two years prior to the date on which such an independent director is appointed as independent director. A business relationship referred to in (d) above shall include any trading transaction in the ordinary course of business for any lease taking or lease out of any immovable property, any transaction relating to asset or service, or granting or accepting any financial support by way of either borrowing, lending, guaranteeing, or collateral providing, including any other act in similar manner thereto, that could result in a creation of the Bank’s obligation or the obligation of its counterparty, to repay its debt to the other party in an amount equal to three percent or more of the net tangible asset value of the Bank or Baht twenty million or more, whichever is lesser. In this regard, such business relationship shall not include deposit transaction, which is a transaction in the ordinary course of the Bank’s business. In light of this, the method for calculation of the value of the connected transaction pursuant to the Notification of the Capital Market Supervisory Board, Re: Rules on Entering into a Connected Transaction shall be applied mutatis mutandis for the purpose of calculation of such amount of debt, provided that the amount of debt incurred during the past one year prior to the date on which such business relationship with such a person exists must also be counted. |

| (e) | Is not and has not been an auditor of the Bank or the Bank’s parent company, subsidiary company, associated company, major shareholder, or controlling person, and is not a significant shareholder, a controlling person, or a partner of any auditing firm or office for which the auditor of the Bank, or the Bank’s parent company, subsidiary company, associated company, major shareholder, or controlling person is working, unless such an independent director has not possessed the characteristics referred to above for at least two years prior to the date on which such an independent director is appointed as independent director. |

| (f) | Is not and has not been any professional service provider, including legal or financial advisor who obtains fee of more than Baht two million per year from the Bank or the Bank’s parent company, subsidiary company, associated company, major shareholder, or controlling person, and not be a significant shareholder, or a controlling person, or a partner of any of such professional service provider, unless such an independent director has not possessed the characteristics referred to above for at least two years prior to the date on which such an independent director is appointed as independent director. |

| (g) | Is not a director appointed as a representative of a director of the Bank, a representative of a major shareholder of the Bank, or a representative of a shareholder of the Bank who is a related person of a major shareholder of the Bank. |

| (h) | Does not engage in any business the nature of which is the same as that of the Bank or the Bank’s subsidiary company and which, in any material respect, is competitive with the business of the Bank or the Bank’s subsidiary company, or not be a significant partner in a partnership, or a director participating in any management role, an employee, an officer, an advisor obtaining regular salary from, or a shareholder holding more than one percent of the shares with voting rights of other company engaging in any business the nature of which is the same as that of the Bank or the Bank’s subsidiary company and which, in any material respect, is competitive with the business of the Bank or the Bank’s subsidiary company. |

| (i) | Does not have any other characteristics which may restrict such person from offering independent comment or opinion on the Bank’s operations. |

After being appointed as an independent director of the Bank with the qualifications stated in (a) to (i) above, such appointed independent director may be assigned by the Bank’s Board of Directors to make decisions in respect of business operations of the Bank, or the Bank’s parent company, subsidiary company, associated company, or a subsidiary company in the same level of the Bank, the major shareholder of the Bank, or the controlling person of the Bank, provided that the decision making by such appointed independent director could be made only on a collective decision basis.

In case that the appointed independent director is the person who has or had a business relationship, or is or has been a professional service provider in exchange for fee exceeding the amount in paragraph (d) or (f), the Bank shall be exempted from such restriction, provided that a supporting opinion of the Board as considered under Section 89/7 of the Securities and Exchange Act B.E.2535 is rendered that the appointment of such person does not affect his ability to perform duties and independent judgment, and relevant information is disclosed in the notice of shareholders’ meeting under the agenda of the election of independent director.

Code of Conduct

SCB Code of Business Conduct

1. Code of Business Conduct

SCB places importance on monitoring compliance with the code of business conduct as follows:

1.1 Perform duties with integrity, fairness, and accountability. Adhere to conditions as agreed with borrowers and customers, related laws, state and corporate regulations, including the Anti-Corruption and Bribery Policy and the Anti-Money Laundering and Combating the Financing of Terrorism and Proliferation of Weapons of Mass Destruction Policy.

1.2 Perform duties as knowledgeable, capable, and expert professionals with care and prudence

1.3 Aim to generate appropriate gains for shareholders with consistently excellent performance.

1.4 Keep information confidential. Do not use inside information or confidential information to seek undue benefits for one’s self or others.

1.5 Prevent and avoid actions that may lead to conflicts of interest.

2. Service Standards

SCB shall build trust among customers and stakeholders by setting service standards as follows:

2.1 Set effective management so that good services are delivered to customers and stakeholders.

2.2 Set systems for prudent management, audit, and internal control to prevent mistakes in providing services.

2.3 Set a risk management system that is relevant to the business, so that SCB can appropriately manage and cope with potential risks.

3. Employees and Workplace Environment

SCB monitors and provides facilities to accommodate every staff member’s effective performance as follows:

3.1 Recruit and maintain capable staff members. Regularly promote, encourage, and develop them, so that they have career opportunities, advancement possibilities, and security.

3.2 Place importance on fair treatment and respect for every staff member.

3.3 Do not discriminate against staff members by reason of gender, race, age, religion, or disability.

3.4 Offer fair remuneration to staff members based on fair performance evaluation.

3.5 Arrange a safe and sound workplace environment ready to provide services to customers.

3.6 Keep staff personal information confidential and do not misuse it.

3.7 Monitor to prevent threats and harassment through verbal forms or gestures that may hurt the honor and human pride of others at the workplace.

3.8 Provide channels to submit complaints, clues, or reports on doubtful cases of integrity, unfair treatment, or non-compliance with related laws or regulations.

3.9 In case of duty-related inquiries, SCB shall care for staff members in cooperating with internal and external compliance and investigation units for fairness.

3.10 Take disciplinary action against those not complying with laws, rules, or regulations as appropriate to the impact and nature of the offense and be fair to all concerned parties without bias or discrimination.

3.11 SCB shall adhere to human rights principles as joint practice principles with every staff member, and make the staff understand human rights principles as part of performing their duties.

4. Accountability for Customers

SCB place importance on customers and accountable customer treatments as follows:

4.1 Operate businesses with a focus on providing quality and fair financial services following the Bank of Thailand’s regulations on market conduct and four basic consumer rights, as follows: the right to receive correct information, the right to freely select and buy products and services, the right to seek fairness through complaints, and the right to receive compensation in case of damage.

4.2 Maintain sustainable relationships with customers. Do not demand bribes and/or benefits, gifts, assets, or parties in any form that implies such intention would unduly favor customers.

4.3 Offer products and services that suit customers’ needs and capabilities.

4.4 Disclose information about SCB products and services, covering related conditions and risks and fee and interest rates that are correct, clear, and timely, so customers understand and have enough information for decision making. Advertising and publicizing must be transparently communicated with clear content that does not lead to misunderstanding.

4.5 Provide complaint channels and a complaint management process to clearly and appropriately manage customer complaints, such as receiving complaints via phone calls or branches providing services.

5. Conflicts of Interest

SCB provides measures to manage conflicts of interest, as follows:

5.1 Control, monitor, and prevent transactions prone to conflicts of interest, inappropriate related parties, or connected transactions. Policy, procedure, and process are defined for such transaction consideration, approval, and information disclosure in accordance with the state regulators’ requirements and regulations.

5.2 Prevention of misuse of inside information

a) SCB provides measures to control securities trading, and requires disclosure of securities trading lists of directors, executives, and staff members who may gain access to inside information, as well as their related parties to prevent misuse of inside information from their position, duty, or performance to seek unduly benefits for themselves or others.

b) SCB requires that workplaces for units of which operations may involve conflicts of interest shall be separated, to prevent information leakage.

5.3 Related party and connected transactions

a) Regulations for connected transactions and prudent consideration process are defined importantly for the best interests of SCB and its shareholders.

b) Related party transactions between SCB and directors, executives, major shareholders, and their related parties shall not involve transferring SCB benefits to related parties.

c) SCB staff members having a stake in or involved in any transaction shall not participate in the consideration process of such transactions, so that the decision made for such transactions is fully for the benefit of SCB.

5.4 Giving and Receiving Gifts, Receptions, and Other Benefits

a) In giving and receiving gifts, receptions, and other benefits, SCB’s objective is to maintain business relationships. Such actions must be prudent, reasonable, and with a value appropriate to occasions and customary courtesy.

b) Do not offer, respond to, or solicit bribes or any other inappropriate benefits directly or indirectly to/from customers, government agencies, companies, or third parties, so as to influence their neutral discretion in making decisions or performance of duty or to gain undue benefits.

6. Data management

SCB places importance on information confidentiality and data management for customer, employee, business partner, and SCB data with appropriate and careful data management as follows:

6.1 Data management

a) Protect, store, and maintain customer, employee, business partner, and SCB data that must not be disclosed as required by law, including appropriate data processing (collection, maintenance, retention and use) as required by law and SCB regulations.

b) Customer, employee, business partner, and SCB data must not be disclosed, unless consent is granted by the data owner as the case may be, or in compliance with related laws.

6.2 Communications

a) SCB aims to disclose its information to shareholders, investors, and the public in an accurate, complete, comprehensive, and timely manner, and in compliance with related laws and regulations.

b) Any communication, statement, or release of information about SCB and its businesses, customers, employees and business partners must be accurate and appropriate. Such information release to the public or any press and media must be by a person assigned to release the information on behalf of SCB only.

7. Overall Compliance

SCB is committed to operating businesses in compliance with related laws and regulations, its policies and regulations, and good corporate governance principles as follows:

7.1 SCB is committed to following good corporate governance principles set forth by the state regulators overseeing SCB as a commercial bank and a listed company, and to build trust among stakeholders. SCB aims to develop its compliance function to meet international standards for the benefit and trust of every stakeholder.

7.2 Equip staff members with knowledge and understanding about related laws and regulations and awareness of risks arising from compliance failure that may affect SCB’s business operations, image, reputation and their own duties and responsibilities.

7.3 Have a Compliance Function in place to monitor the bank’s compliance with related laws and regulations. It can perform independently from the bank’s management. Personnel and resources are appropriately and adequately allocated to such Function.

7.4 Have compliance monitoring in place to regularly review the bank’s compliance with related laws and regulations and the bank's policies and regulations. Have compliance management, corrective guidelines, and prevention measures in accordance with related laws and regulations, its policies and regulations, and good corporate governance principles.

8. Business Competition and Dispute Resolution

SCB places importance on effective and sustainable business operations as follows:

8.1 Operate businesses and treat trade partners and rivals with independence and fair competition. There shall not be mutual agreements among banks on setting unfair trading prices or service conditions for customers. Keep information confidential in accordance with related laws and regulations. Do not seek information of trade partners and rivals in a wrongful and unfair manner.

8.2 Set practice guidelines on product and service offerings that is useful and valuable for customers. Let customers choose services freely. Do not discourage customers in changing to services offered by other banks so much so that it is beyond moderation.

8.3 Do not verbally attack rivals or do anything so as to monopolize, reduce, or limit market competition.

8.4 For disputes, SCB shall provide appropriate dispute resolution or mediation.

9. Society and Environment

9.1. SCB is committed to business practices with social responsibility. The Bank is prudent when considering any action that may affect public interest. SCB is committed to constant actions and support for activities beneficial to communities and the society.

9.2 ธSCB places importance on effective safety and environment care to prevent effects on neighboring communities. The Bank promotes environmental awareness and responsibility among its staff members.

Siam Commercial Bank PCL (SCB) Code of Conduct

The SCB Code of Conduct applies to all SCB directors, executives, and staff members/employees. In this regard, the term “employees” shall cover executives and staff members at all levels regardless of the period validity of their employment contracts.

1. Good Corporate Governance

1.1 SCB directors and executives play a vital role in building good corporate governance within the organization to build trust among shareholders, customers, regulators, and all stakeholders for the ultimate benefit of the organization, the industry, and the country. A clearly written Good Corporate Governance Policy must be in place. A Code of Conduct must be developed and communicated to staff members and executives for their most effective practice.

1.2 SCB directors and executives shall follow Good Corporate Governance principles by defining business-related policies and business directions, having Good Corporate Governance compliance control in place, and overseeing SCB executives and management to effectively and efficiently follow the policies given.

1.3 SCB businesses are operated under the provision of related laws, state rules, and regulations. Therefore, SCB directors, as the shareholders’ representatives, shall define policies. SCB executives, as management, drive practical and effective policy execution and arrange an effective internal control system for proper business compliance control.

1.4 SCB directors shall ensure that the Bank has an effective risk management policy and system in place to address its key risks, and oversee the Risk Management Committee to perform its duty completely, professionally, and independently – not influenced by business units. SCB executives shall acknowledge potential risks, protect SCB interest, and limit potential loss at an acceptable level under effective risk management.

2. Protecting SCB Interest, Image, Honor, Reputation, and Virtue

SCB directors, executives, and staff members shall behave as a role model as follows:

2.1 Adhere to integrity, fairness, ethics, accountability, and business ethics. Do not offer promises or obligations on matters that cannot proceed. Perform duties with care, prudence, and determination in full capacity. Adhere to the truth, not directly or indirectly causing misunderstanding, by following the business judgment rule, for the best interest of the organization and its stakeholders. Protect and keep the best interest of the organization in mind. Pay attention to incidents taking place and activities in the organization.

2.2 Protect SCB benefits through due actions. Do not help, support, or serve as a tool to avoid compliance with laws and regulations against business governance principles.

2.3 Be careful with actions and expressions that may affect SCB's image, including communications via social media.

2.4 Communications, whether internal or external, must be accurate and forthright, and directed through appropriate channels in each situation.

3. Conflicts of Interest

Employees shall perform their duties with the Bank's interest as their top priority. You shall always realize that your performance must not involve any stake or conflict of interest, and avoid any possibly direct or indirect conflict of interest.

4. Information Integrity

All SCB information must be true and accurate.

4.1 Management, shareholders, creditors, and regulatory agencies rely upon the accuracy of SCB’s records to track its health and performance, and to make decisions. Therefore, everyone shall be cooperative in properly preparing data, by accurately and timely keeping records and reporting.

4.2 Directors, executives, and staff members shall fully cooperate with internal and external auditors whenever called upon to do so.

5. Data confidentiality

5.1 Do not disclose any non-public information about SCB, unless required to do so by law, or with the Bank’s approval. This safeguarding of confidentiality extends to information related to our customers, products, services, strategies, plans, methodologies, and systems. Regardless of employment status, all concerned persons shall not use information gained or prepared in their duties at SCB for purposes other than functions under their responsibility, or use them for personal gain or the gain of others.

5.2 Information confidentiality is an important matter that requires all concerned persons’ strict compliance. Do not disclose any customer information to other parties by any means or through any communication channels, unless required to do so by authorities by law or court order.

5.3 Information confidentiality covers the personal data of customers, employees, and other personal data owners. Personal data is data that can lead to direct or indirect identification of any person, such as name, family name, ID number, passport number, date of birth, gender, age, financial data, contact data, occupation data, income, education, electronic data, data about income and benefits, and medical records. Such personal data can be disclosed only by the data owners and concerned persons with authorized access by SCB for use in SCB business, or for a critical need. Concerned persons dealing with such personal data shall be extremely careful with this policy compliance and strictly protect data confidentiality.

6. Insider Trading

Persons having inside or non-public information are prohibited from buying or selling concerned stocks or other securities, or disclosing or taking advantage of such inside information to directly or indirectly seek personal gain and/or gain for others.

7. Anti-Money Laundering and Combating the Financing of Terrorism and Proliferation of Weapons of Mass Destruction

Adhere to laws and regulations regarding anti-money laundering and combating the financing of terrorism and the proliferation of weapons of mass destruction policy. Do not encourage or be involved in transfers or transformation of assets related to offenses. This is to prevent the use of SCB as a channel or tool to transfer, conceal, or cover up sources of assets unlawfully gained.

8. Anti-Corruption and Bribery

The SCB Group has a policy to counter all types of corruption. SCB directors, executives, and staff members have a duty to study and understand SCB's anti-corruption and bribery policy and strictly follow provided guidelines.

9. Gambling, Alcohol, and Drugs

9.1 Any means of use, possession, purchase, sale, or transfer of any narcotics or controlled substances (except drugs medically prescribed) by any employee is prohibited.

9.2 Consumption of alcohol while on duty is prohibited, except at functions or reception events under SCB regulations. Be careful with your consumption of alcohol to avoid intoxication.

9.3 Gambling is prohibited in any form, whether while being on duty or not.

10. Giving and Receiving Gifts and Receptions

10.1 Do not abuse your office position/authority to seek personal benefits from those dealing with SCB, as well as candidates or potential business partners.

10.2 Do not solicit or make direct or indirect gestures implying an intention to accept money, assets, and/or benefits in other forms from third parties that may impact business decisions on behalf of SCB, with the exception of receiving them on a formal occasion, following customary courtesy, or within the bounds of what is customary in a normal business relationship.

10.3 The occasional exchange of gifts and social amenities, i.e. business lunches, dinners, or receptions, may be allowed as appropriate, so as to maintain business relationships. Giving and receiving gifts in the form of cash or valuable assets equivalent to cash such as gold, jewelry, and negotiable financial instruments such as cashier’s cheques is prohibited.

11. Corporate Assets

11.1 Employees are responsible for corporate assets. We have a responsibility to protect our corporate assets from loss, damage, or misuse. This responsibility covers not only your own conduct but also your attentive compliance with SCB’s security procedures, and alertness to situations or incidents that could lead to the loss, theft, or misuse of SCB assets.

11.2 Corporate assets include cash, financial instruments and tools, proprietary information, intellectual properties, computer systems, software programs, electronic mail, documents, equipment, facilities, vehicles, the Bank’s name and logo, materials, and supplies.

11.3 Intellectual properties include copyrights, patents, petty patents, trademarks, trade secrets, and any other valuable information belonging to SCB. Employees are responsible for protecting the bank's intellectual properties from unauthorized use or distribution, and they shall respect the right of intellectual property owners.

12. Outside Employment or Other Commercial Activities

12.1 Any personal transaction or business shall be separated from SCB business activities. Do not use SCB’s name in making personal transactions. Operate a business at arm’s length or make a transaction that is a normal trade customary practice in the same way as making transactions with people in general with no special connection, aiming mainly for SCB benefits. Avoid potential conflicts of interest or those expected to arise. In case of a conflict of interest, it must be fairly and quickly addressed.

12.2 Employees shall perform their duties with responsibility, prudence, and integrity in compliance with related laws and regulations as well as SCB policies, rules, and procedures.

12.3 Employees shall not be an employee of organizations other than those under the SCB Group, or perform outside activities that are not related to SCB while on duty

12.4 Any employee performing as a director, a committee member, an advisor, an instructor, or performing outside activities for organizations other than those under the SCB Group must obtain approval from SCB's authorized approver in advance.

13. Harassment

SCB is committed to providing our employees with a productive and positive work environment, free of any form of harassment, be they verbal, physical, sexual, offensive messages, gestures, pictures, electronic media, etc.

14. Whistleblower

For transparent compliance with good corporate governance, SCB provides the following channels for whistleblowers to complain or report misconduct, corruption, or non-compliance with rules, regulations, and codes of conduct:

- E-mail Address : [email protected]

- Direct hotline: 02-544-2000

- P.O. Box no. 177, Chatuchak Post Office 10900

Whistleblowers can choose not to reveal themselves if they have concerns about any unsafe situations or negative impacts.

SCB considers information provided by whistleblowers confidential. It will be disclosed as deemed necessary, giving priority to any safety or negative impacts on whistleblowers, sources of information, and concerned persons. Those concerned in the inquiry or fact-finding process are responsible for strictly keeping whistleblowers' information confidential. Any violation or unfair treatments to whistleblowers or witnesses shall be deemed a serious disciplinary offense and may be considered an offense by law.

15. In Closing

While fairness, honesty, and integrity are essential to the conduct of our business, let us not forget our commitment to service excellence. This commitment must become second nature to every SCB employee and be always reflected in our words, actions, and demeanor. Whether we are engaged in face-to-face meetings with our customers and third parties, talking to them on the telephone, or contacting them in writing or online, our respect, politeness, sincerity, attentiveness, and eagerness to serve must be unwaveringly apparent.

The culture of service excellence can only be sustained and flourish in a workplace where employees exhibit these very same characteristics in treating one another. Enthusiasm, cooperation, teamwork, and responsiveness are preferred characteristics that you should learn from one another.

Your compliance with the SCB Employee Code of Conduct will promote SCB's image and corporate culture, the sustainable business operations of the SCB Group, resulting in the utmost in benefits to our customers, shareholders, peers, and society.

The Siam Commercial Bank1 conducts its business ethically and responsibility in line with principles of good corporate governance and commitment to protect, enhance and support society and environment in accordance with sustainable development approach to achieve a balance between the social, environmental and business needs, enabling them to grow alongside each other in a sustainable way.

The Siam Commercial Bank has intention to encourage this principle to its suppliers2, who are significant factors in its business, to pursue this principle and concept in practice and to share such principle with society. In order for proper and mutual understanding, The Siam Commercial Bank has developed the "SCB Supplier Code of Conduct" for its suppliers as a guideline. The Siam Commercial Bank encourages its suppliers to conduct their business with ethical behavior, with respect to the liberty and rights, with care for labor and human rights, occupational health and safety, and to pursue the achievement of the "SCB Supplier Code of Conduct" in practice. In the event that the suppliers are incompliance with the "SCB Supplier Code of Conduct", The Siam Commercial Bank reserves right to take any action considering the affect and damage occurred.

1 The Siam Commercial Bank means The Siam Commercial Bank Public Company Limited and all its affiliates both domestic and abroad.

2 suppliers mean sellers of goods, contractors and/or service providers to The Siam Commercial Bank including all their affiliates and sub- contractors of such sellers of goods, contractors and/or service providers.

1. Business Ethics

- Business Integrity

Conduct business in an ethical manner with adherence to correctness, honesty, integrity and transparency and strictly comply with applicable laws and regulations and shall not participate in any fraudulent act or corruption, shall not offer, give, promise any bribes, valuable things, gifts or any other benefits including to give any advantages to any person, nor shall improperly influence any action or decision for its own benefit or for the benefit of other person. - Fairness

Conduct business with responsibility to ensure that every party will be treated with fairness, respect to the benefits of involved persons and shall not involve in the obstruction of equitable price competition. - Information Disclosure

Disclose its information completely and accurately pursuant to the law - Confidential Undertaking

Prevent leakage of the Bank’s confidential information, do not disclose nor use any confidential information of the Bank, customers and related parties for its own benefit or for benefit of others without consent in any respect including allow to use the confidential information in any manner which violates the laws and regulations or orders of the relevant authorities. - Intellectual Property Rights

Respect intellectual property rights of the Bank and others and undertake not to allow violation of such rights.

2. Labor and Human Rights

- Non-discrimination

Respect human dignity, equality, and fairness and shall not discriminate against workers on the grounds of physical or mental differences, race, nationality, religion, gender, age, education, marital status, pregnancy, political affiliation, disability or any other matter. - Labor Protection

- Do not employ child labor younger than legally required minimum age.

- Female workers shall not engage in work which may harm their health and safety. Pregnant workers shall be protected and provided their legally mandated benefits.

- Employment of foreign workers must be duly compliant with the regulatory requirements.

- Layoff-Practice must be proceeded with each step of managing layoffs according to the labor laws. Any employment contracts must not be unfairly terminated. - Prevention of Involuntary Labor

Do not use or exploit forced labor or against labor’s own free will through the use of corporal punishment, threat, confinement at the workplace, coercion, harassment, human trafficking or any other means of violence. - Wages and Benefits

Pay workers wages, overtime pay, and holiday pay, as well as provide legally mandated benefits accurately, fairly and not less than the minimum wage according to applicable laws. The wages, overtime pay, holiday pay or other benefits shall be allocated to workers within the specified time. - Working Hours